According to Kavita Chacko - Director of Indian Research at the World Gold Council (WGC), demand for gold in India in April was generally quite gloomy as the holiday season took place in opposite directions, accompanied by large withdrawals from ETF funds, but gold imports still maintained their resilience.

In the latest update, Ms. Chacko commented that the weakening of the USD, the unstable geopolitical and economic situation in the world, and large inflows into global gold ETFs helped gold accelerate in April.

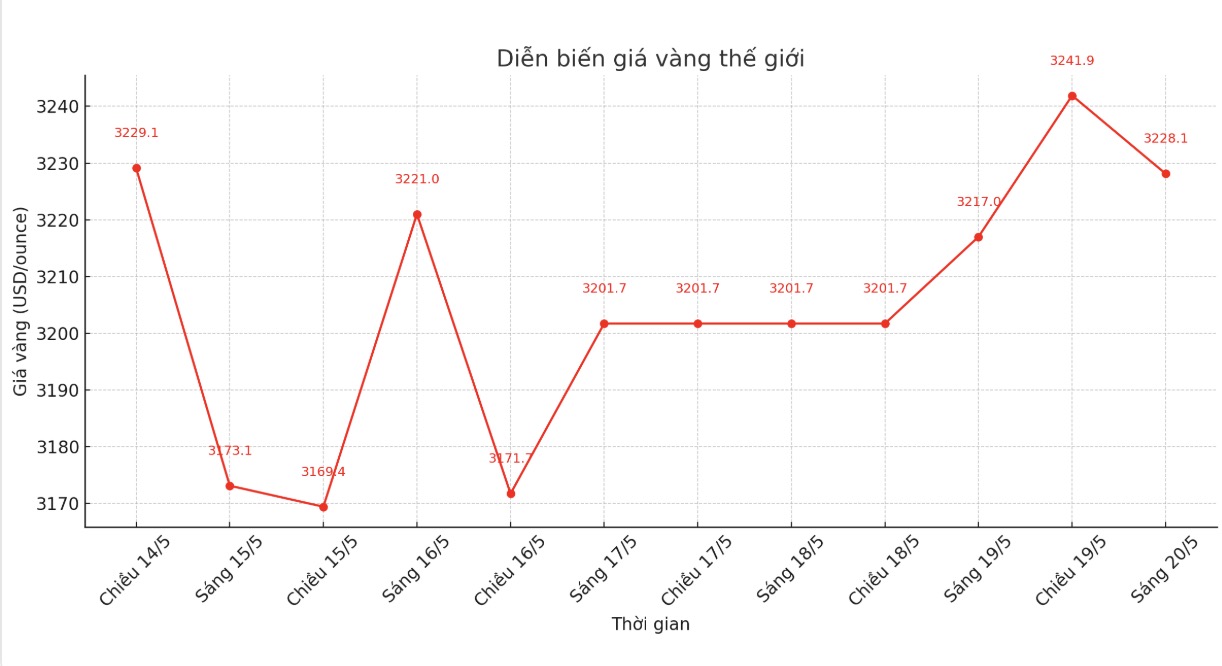

However, prices have cooled down as the London bullion Market Association (LBMA) gold price fell 8% in the afternoon in May. In India, domestic gold prices have similar developments with a slight adjustment of about 5%, thanks to the increase in the price of the rupee.

Ms. Chacko also said that although LBMA gold prices have increased by 583 USD/ounce (equivalent to 22%) in 2025, domestic gold prices have increased by 23%. Despite recent declines, gold has outperformed other major assets from year to year, Chacko said.

The demand for holiday gold in India has recently Differentiated somewhat. Due to high gold prices and strong fluctuations and economic uncertainty, gold jewelry sales in April and early May were quite weak, except for the Akshaya Tritiya holiday, she said. Consumers are expected to delay shopping, wait for stable prices or switch to buying lighter jewelry to suit fixed budgets and actual needs.

In the barley and barley segments, sales were better than jewelry, especially low-weight coins (5g) popular during the Akshaya Tritiya holiday. These transactions mainly take place on e-commerce platforms, showing the trend of consumers increasingly prioritizing investment gold products and organized distributors.

Ms. Chacko commented that although the amount of gold sold during the Akshaya Tritiya could decrease compared to the same period last year, the total trading value still increased because the gold price has increased by nearly 30% compared to last year. This shows the significant rebound of the Indian gold market. In addition, exchanging and recycling old jewelry continues to be a prominent trend".

Meanwhile, gold ETFs also saw strong withdrawals in April, but record high gold prices helped total assets under management and the number of investors continue to increase.

For the second consecutive month, Indian gold ETFs recorded a net withdrawal, with a record withdrawal of 16.69 billion INR (199 million USD) in April, reflecting profit-taking activities when prices hit a new peak, said Ms. Chacko.

However, cash flow into the fund increased by 58% compared to March, partly offsetting the withdrawal amount, helping the net withdrawal flow decrease sharply to 0.06 billion INR (0.7 million USD).

Total assets under management (AUM) of gold ETFs increased to 7.2 billion USD, up 4% over the previous month and 87% over the same period last year, thanks to high gold prices. The number of newly opened investor accounts in the month reached 180,000, bringing the total number of gold ETFs to a record 7.1 million.

The Indian reserve bank (RBI) has also slowed down the purchase rate of gold this year, although the ratio of gold reserves continues to increase. "Since the beginning of the year, RBI only bought an additional 3.4 tons of gold, much lower than 24.1 tons in the same period last year. However, RBI's gold reserves remained at a record high of 879.6 tons in late April, unchanged compared to the previous month," Chacko said.

Gold now accounts for 12% of India's total foreign exchange reserves, up 4% year-on-year and is the highest rate ever, demonstrating the growing strategic importance of gold in managing foreign exchange reserves.

In terms of imports, despite difficulties due to high prices, Indian gold imports still maintain their resilience. The import value in April reached 3.1 billion USD - down nearly a third compared to March, but still higher than the average of 2.5 billion USD in the first two months of the year and up 5% over the same period, Chacko quoted data from the Indian Ministry of Commerce.

Looking ahead, Ms. Chacko said that the stability of global gold prices could facilitate a recovery in gold demand in India. When consumers believe that gold prices are unlikely to fall sharply, gold will become more attractive as a safe and sustainable investment channel.