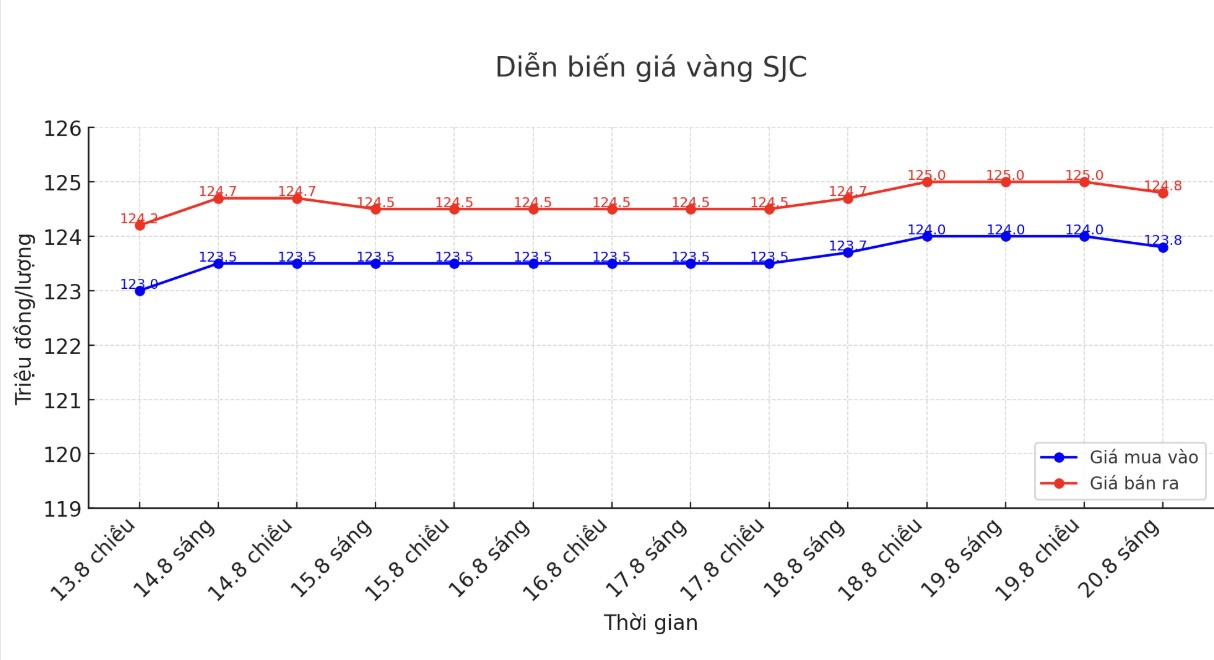

Updated SJC gold price

As of 9:00 a.m., DOJI Group listed the price of SJC gold bars at VND123.8-124.8 million/tael (buy in - sell out), down VND200,000/tael in both directions. The difference between buying and selling prices is at 1 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 123.8-124.8 million VND/tael (buy - sell), down 200,000 VND/tael in both directions. The difference between buying and selling prices is at 1 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 122.8-124.8 million VND/tael (buy in - sell out), down 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

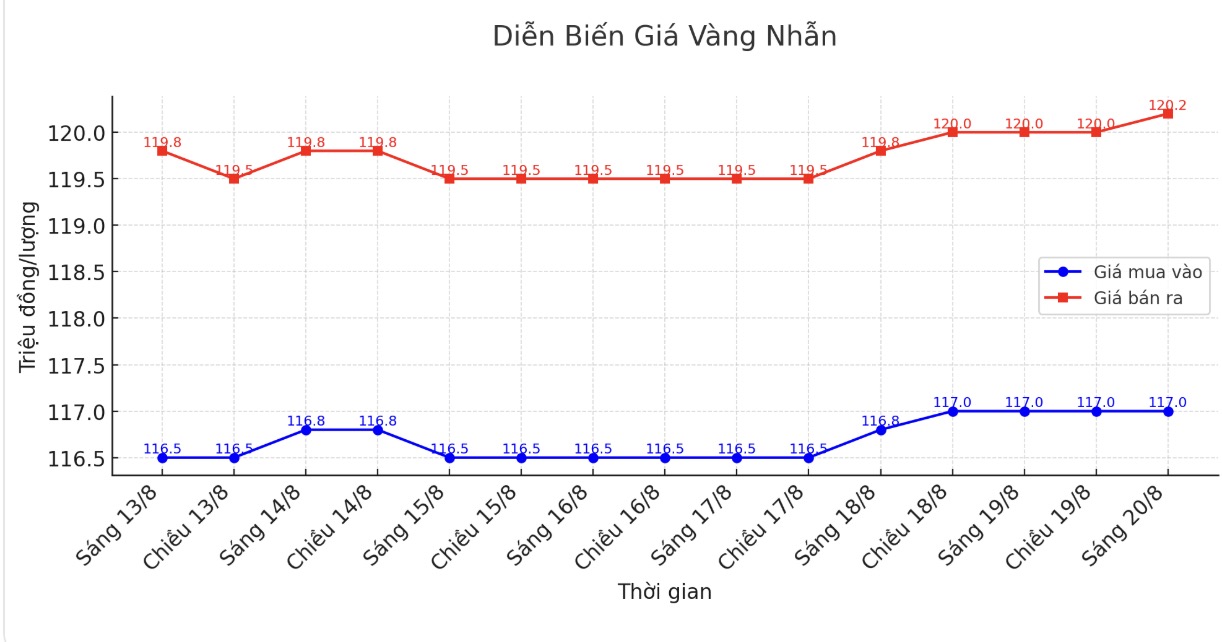

9999 round gold ring price

As of 9:00 a.m., DOJI Group listed the price of gold rings at 117-120.2 million VND/tael (buy in - sell out), unchanged for buying and increased by 200,000 VND/tael for selling. The difference between buying and selling is 3.2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117.2-120.2 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 116.5-111.5 million VND/tael (buy in - sell out), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

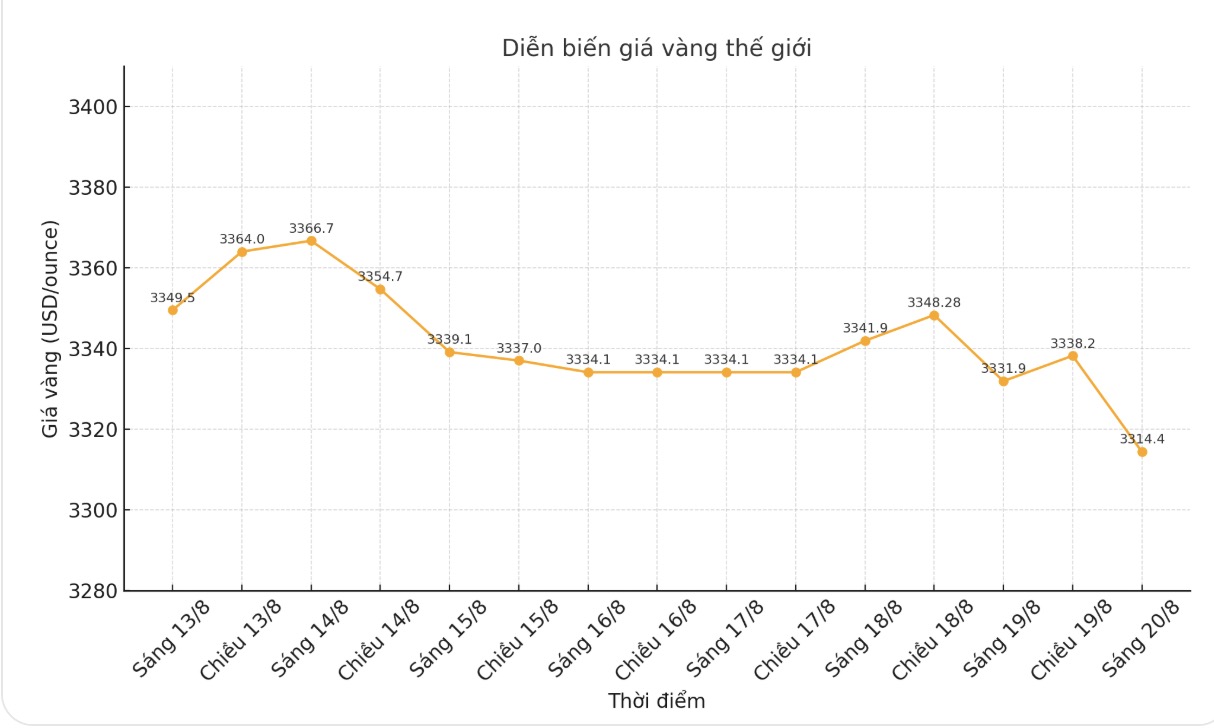

World gold price

At 9:00 a.m., the world gold price was listed around 3,314.4 USD/ounce, down 17.5 USD compared to a day ago.

Gold price forecast

Gold, silver and stock prices plummeted as cautious sentiment overwhelmed the market ahead of the Jackson Hole conference.

Today (8.20), the prices of precious metals and stocks both fell sharply. Gold futures fell below an important threshold, marking the biggest decline in many weeks.

In the stock market, technology stocks decreased the most, dragging the whole market down. The Nasdaq composite index fell 1.32%, closing at 23,408 points after losing more than 300 points. This is the lowest level since August 7 and the day's decrease is even greater than the total decrease of the previous four consecutive sessions, showing that selling pressure has increased sharply.

The parallel decline in both precious metals and technology stocks shows that risk-off sentiment is rising, as investors adjust their positions in the face of important economic data and policy orientation of the US Federal Reserve (FED).

The sell-off of gold - often seen as a safe haven asset - further highlights concerns about economic prospects and inflation. The obvious reason is cautious sentiment ahead of the Fed's Jackson Hole Annual Conference, which will open tomorrow, where investors are eagerly awaiting signals about future interest rate orientation.

According to Ole Hansen - Head of Commodity Strategy at Saxo Bank, the key speech of US Federal Reserve Chairman Jerome Powell at the Jackson Hole conference on Friday could be the next important signal.

In recent weeks, some US economic data has caused a negative surprise. While the stronger-than-expected producer price index (PPI) has reminded the market that inflationary pressures may still come from Donald Trump's tariff policies.

That data has temporarily eased expectations for a series of quick and strong rate cuts, but the market is still pricing in a possibility of a 25 basis point cut at the September FOMC meeting, although the path after that remains uncertain, Hansen said.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...