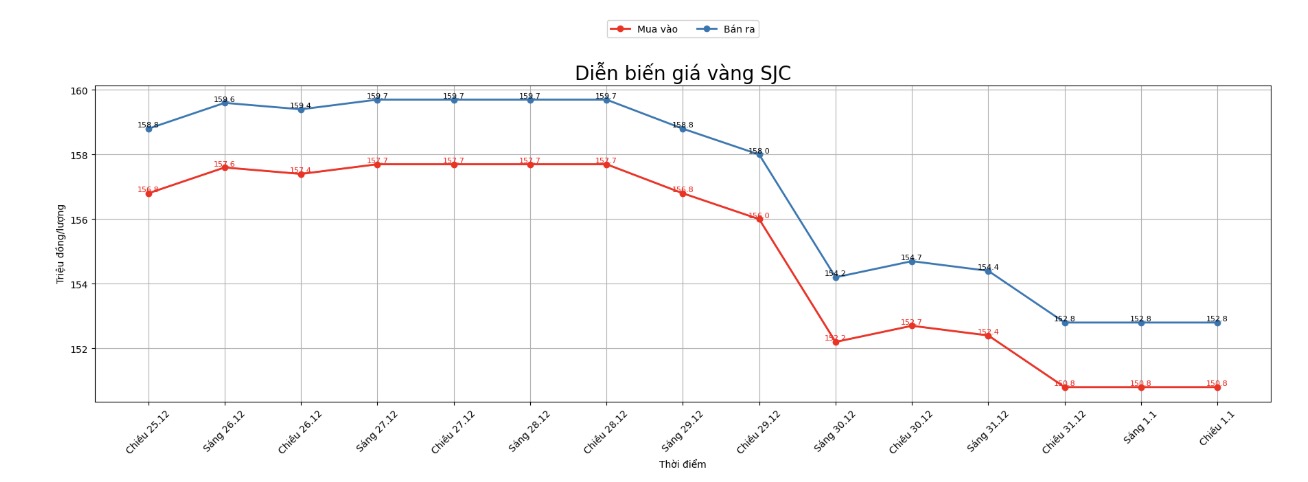

SJC gold bar price

As of 6:00 AM on January 2, 2026, SJC gold bar prices were listed by DOJI Group at the threshold of 150.8-152.8 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at the threshold of 150.8-152.8 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at the threshold of 150.3-152.8 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling prices is at the threshold of 2.5 million VND/tael.

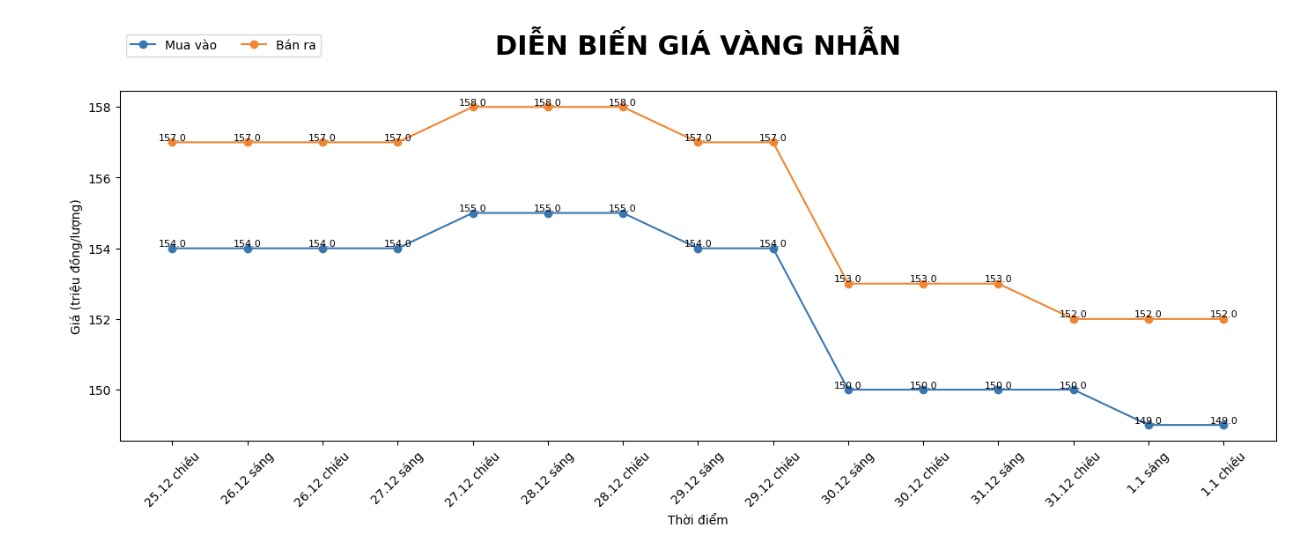

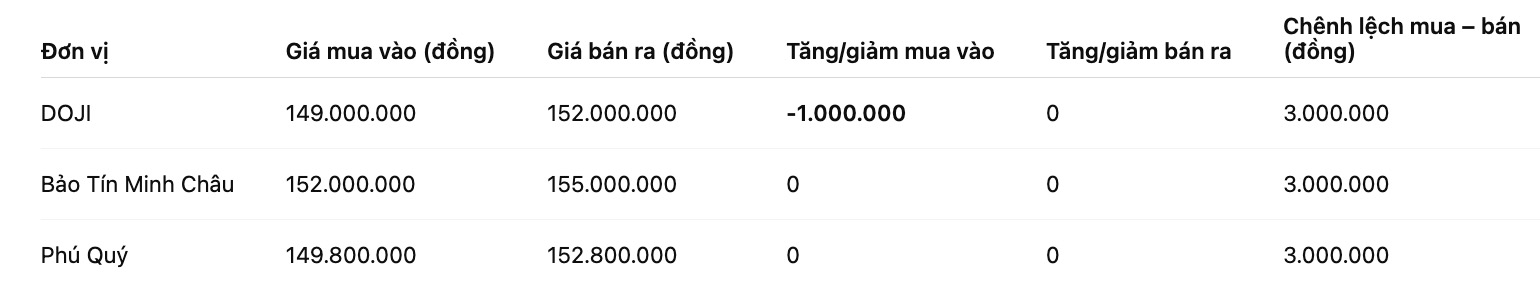

9999 gold ring price

As of 6:00 AM on January 2nd, DOJI Group listed the price of gold rings at 149-152 million VND/tael (buying - selling), down 1 million VND/tael on the buying side and unchanged on the selling side. The difference between buying and selling is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at the threshold of 152-155 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at the threshold of 149.8-152.8 million VND/tael (buying - selling), going sideways in both directions. The buying - selling difference is at 3 million VND/tael.

The high buying - selling gap increases the risk for individual investors. Individual investors, especially those with a "surfing" mentality, need to consider carefully before spending money.

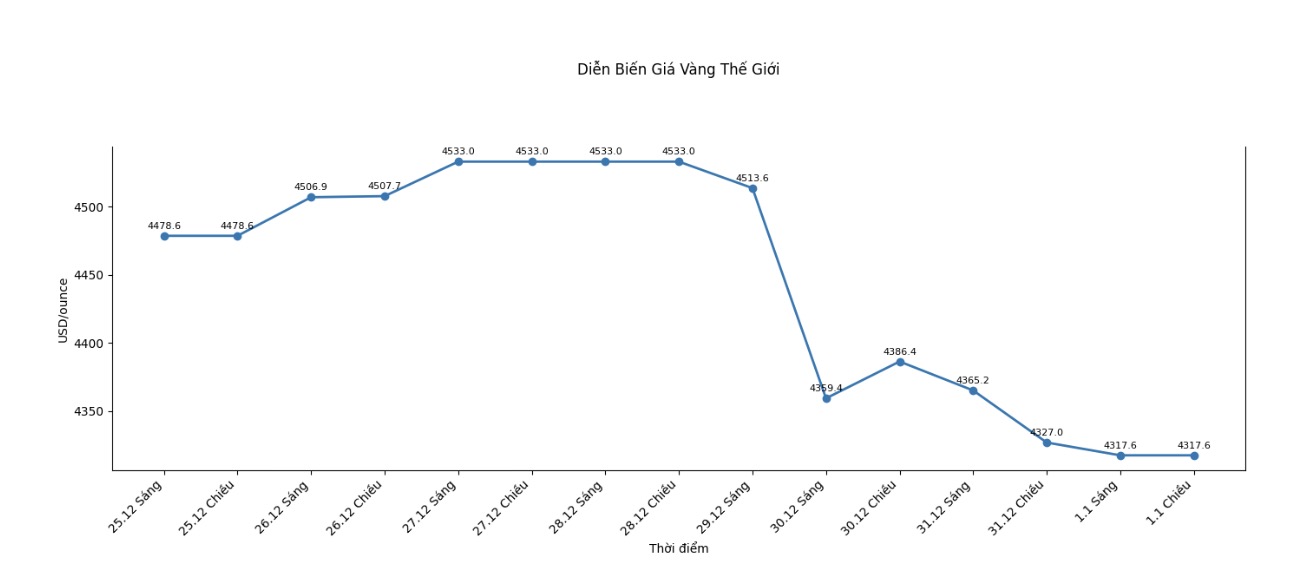

World gold price

World gold prices listed at 9:38 PM on January 1st were at the threshold of 4,317.6 USD/ounce, sideways due to the market closing on the first day of the new year.

Gold price forecast

The last trading sessions of the year are witnessing strong fluctuations in gold and precious metals prices, causing cautious sentiment to return to many investors. The Chicago Commodity Exchange (CME) continuously raising margins for futures contracts has increased short-term selling pressure, especially in the context of market liquidity decreasing due to the holidays.

According to Kevin Grady - Chairman of Phoenix Futures and Options, the current strong fluctuations need to be viewed in their true nature. He believes that the futures contract market is mainly dominated by short-term speculation, when many large traders temporarily leave the market. Thin liquidity makes even a not too large trading volume enough to push prices up sharply, forcing CME and brokerage companies to raise margins to limit systemic risks.

From this perspective, increasing margin does not mean a signal of ending the long-term increase cycle of gold, but is technical in order to stabilize the market. Very strong fluctuations during the day, especially with silver or platinum, reflect the rapid buying and selling activity of speculators more than the behavior of long-term investors or hedge organizations.

In parallel with technical factors, the fundamental factors of the gold market have not changed much. Global gold production in 2024 reached about 3,300 tons, but most focused on a few countries such as China, Russia and Australia. The increasingly concentrated supply, while new mines are difficult to detect and mining costs are high, limits the possibility of increasing supply in the medium term. On the contrary, gold demand in 2024 has exceeded 4,600 tons, with great momentum from central banks and long-term stockpiling demand.

In the short term, world gold prices are still striving to stay above the 4,300 USD/ounce mark. However, positive US economic data, especially the labor market maintaining its solidity, is weakening expectations that the US Federal Reserve will soon ease monetary policy. This makes gold lack momentum to break through in the short term and is vulnerable to technical correction pressure.

Summarizing the above factors shows that the gold market may continue to fluctuate strongly in the first sessions of the year, when speculative cash flow has not fully withdrawn and liquidity has not fully recovered. However, the fundamental factors of supply-demand and long-term storage demand are still important supports, helping the long-term trend of gold prices not to be broken.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...