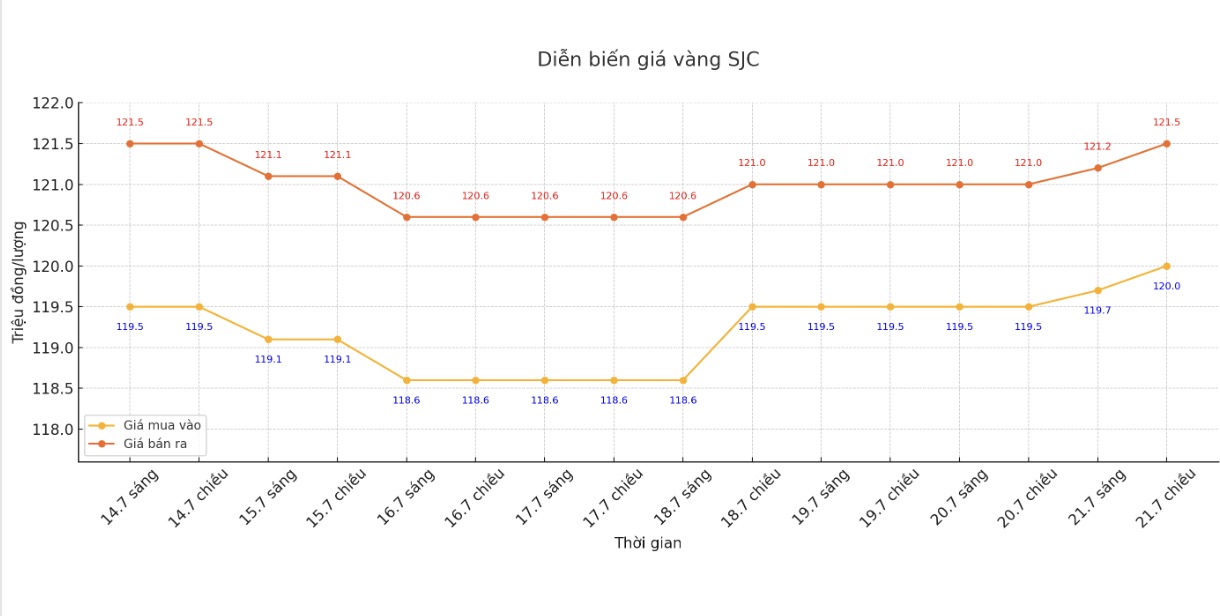

SJC gold bar price

As of 5:30 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 120-121.5 million/tael (buy in - sell out); increased by VND 500,000/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

DOJI Group listed at 120-121.5 million VND/tael (buy - sell); increased by 500,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 120-121.5 million VND/tael (buy - sell); increased by 500,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 119.2-121.2 million VND/tael (buy - sell); increased by 500,000 VND/tael for buying and kept the same for selling. The difference between buying and selling prices is at 2 million VND/tael.

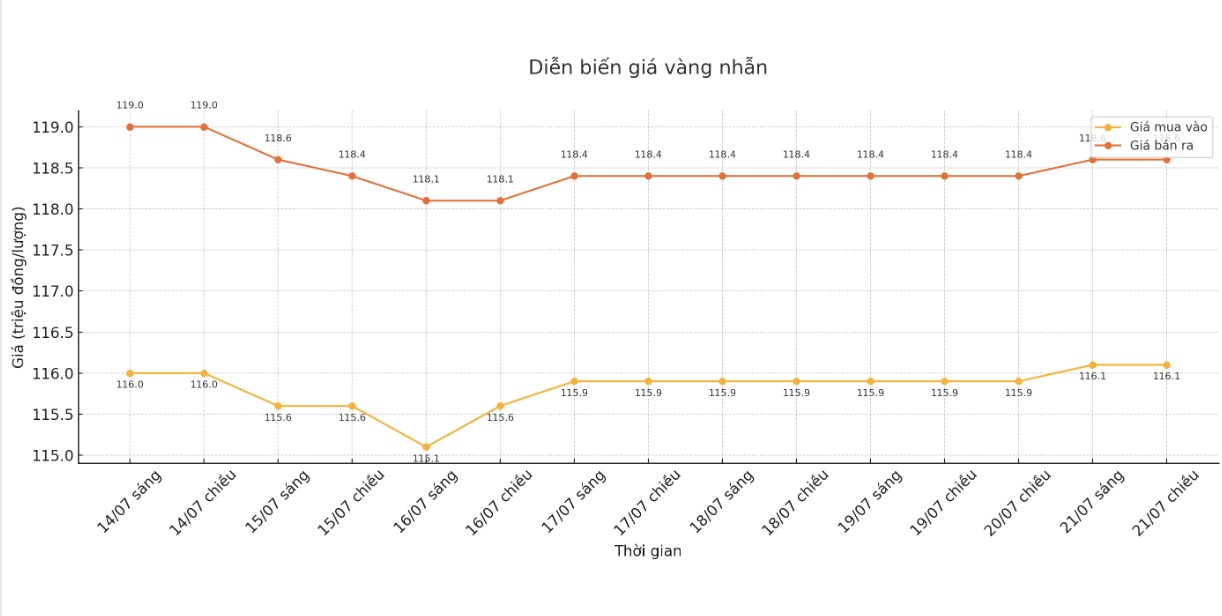

9999 gold ring price

As of 5:30 p.m., DOJI Group listed the price of gold rings at 116.1-118.6 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.3-119.19.3 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115-118 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

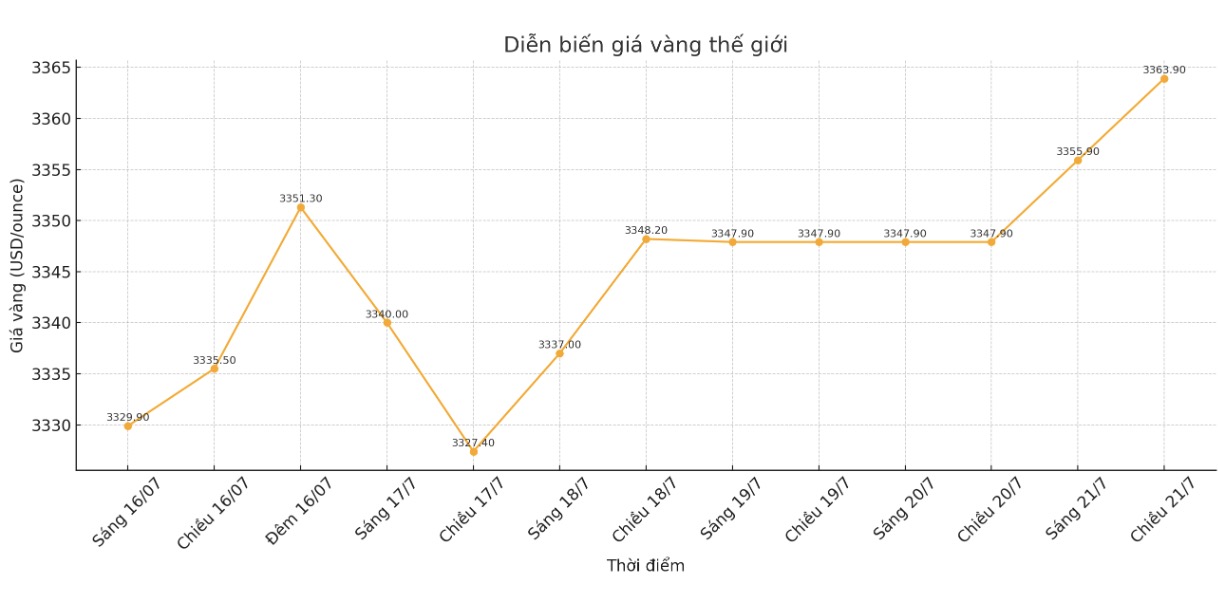

World gold price

The world gold price was listed at 5:30 p.m. at 3,363.9 USD/ounce, up 16 USD compared to 1 day ago.

Gold price forecast

World gold prices increased sharply as the USD weakened. Investors are waiting for new developments related to trade before the US tax deadline on August 1.

The slight support for gold prices comes from a weaker US dollar. As the deadline for August 1 is approaching, the market will focus on whether to reach a trade deal or the US will implement the tax, said UBS commodity analyst Giovanni Staunovo.

The USD index fell 0.2% against a basket of major currencies, making gold cheaper for holders of other currencies.

US Secretary of Commerce Howard Lutnick said on Sunday he believes the US can reach a trade deal with the European Union, but August 1 is still a tight deadline for the tariffs to come into effect.

Gold is often considered a safe haven asset in times of economic uncertainty and tends to benefit in a low interest rate environment.

The next policy meeting of the US Federal Reserve (FED) will take place on July 29-30, after the agency decided to keep interest rates unchanged last month.

High expectation inflation and strong economic data are reducing expectations for how many times the Fed will cut interest rates this year. However, the buying strategy when prices fall is still being maintained, helping to limit the downside risk for gold - ANZ experts assessed.

Notable US economic data next week

The economic calendar next week will revolve around the interest rate decision of the European Central Bank (ECB), along with a series of data on manufacturing and housing expected to be released.

Federal Reserve Chairman Jerome Powell will give an opening speech at an event in Washington, D.C. While he is uncertain to mention recent criticism from President Donald Trump, investors will still be watching closely.

There will be a report on existing US home sales in June on Wednesday. By Thursday, the market will receive a series of important information including the ECB's monetary policy decision, preliminary PMI data from S&P, US weekly jobless claims and new home sales.

The last notable data of the week is the US long-term orders report for June, released on Friday morning.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...