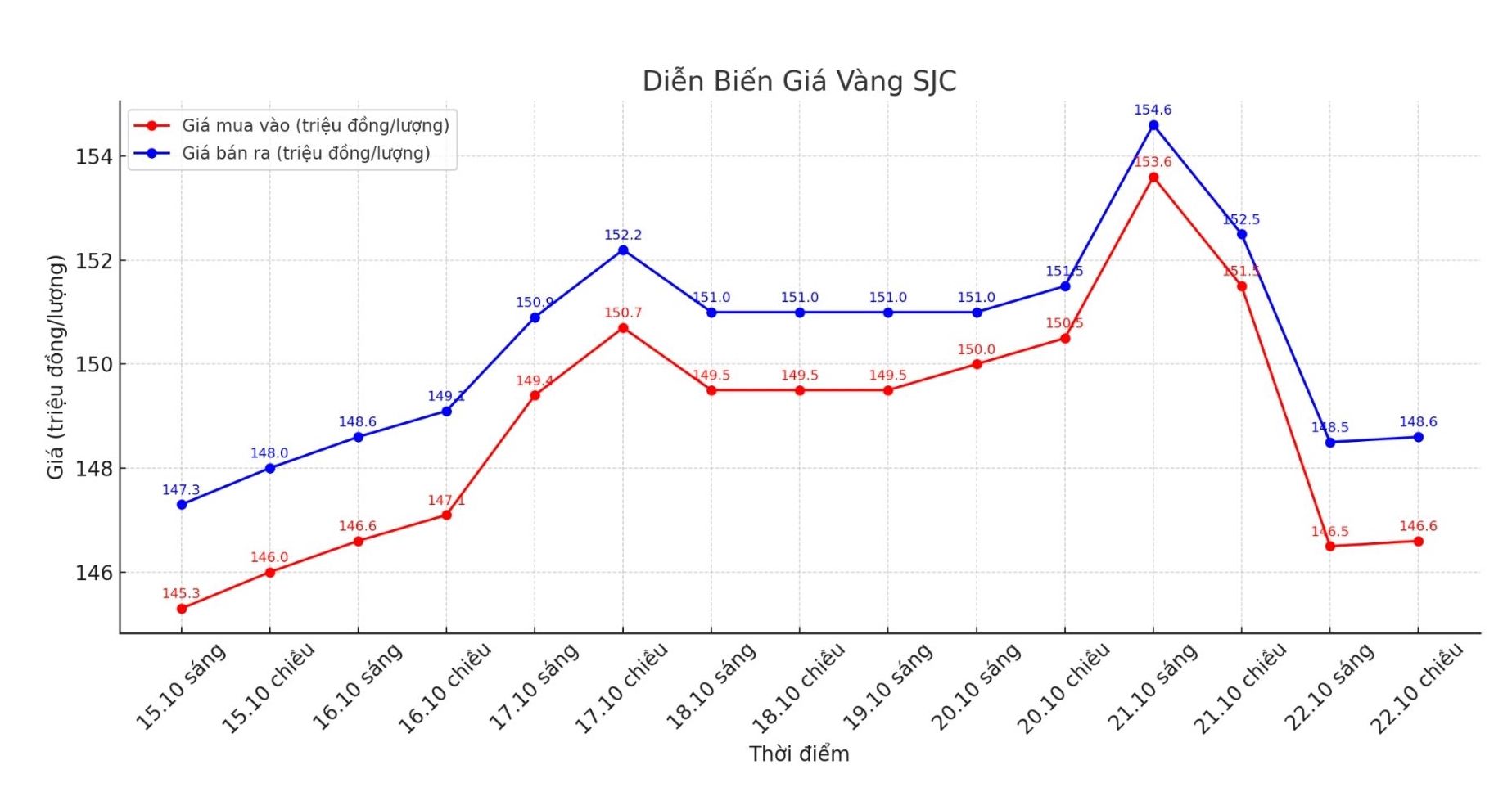

SJC gold bar price

As of 6:20 p.m., DOJI Group listed the price of SJC gold bars at 146.6 - 148.6 million VND/tael (buy - sell), down 4.9 million VND/tael for buying and down 3.9 million VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 147.6 - 148.6 million VND/tael (buy - sell), down 4.4 million VND/tael for buying and down 3.9 million VND/tael for selling. The difference between buying and selling prices is at 1 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 146.6 - 148.6 million VND/tael (buy - sell), down 4.3 million VND/tael for buying and down 3.9 million VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

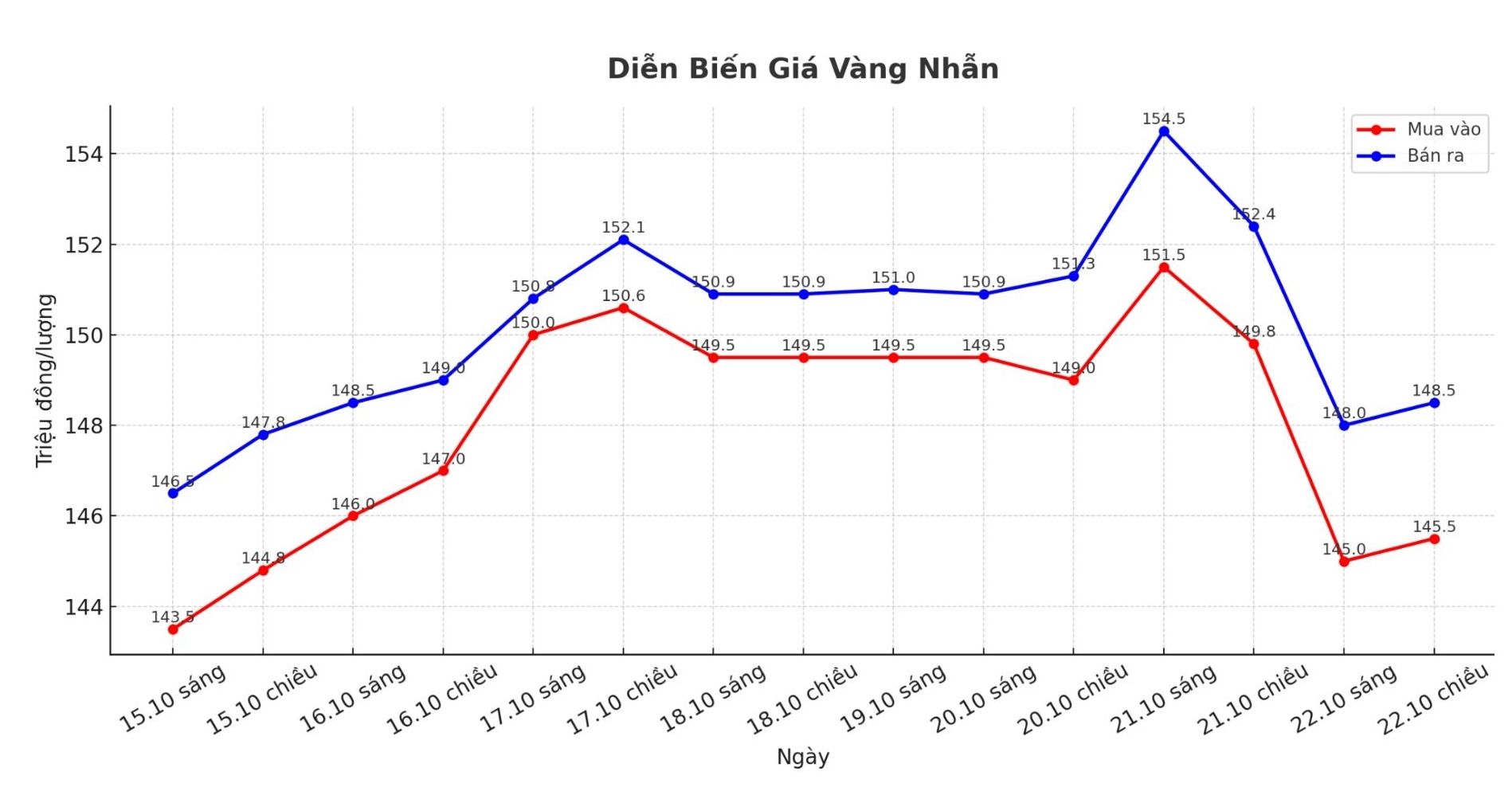

9999 gold ring price

As of 6:20 p.m., DOJI Group listed the price of gold rings at 145.5 - 148.5 million VND/tael (buy - sell), down 4.3 million VND/tael for buying and down 3.9 million VND/tael for selling. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 149.9 - 152.9 million VND/tael (buy - sell), down 6.6 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 145.6 - 148.6 million VND/tael (buy - sell), down 3.9 million VND/tael for both buying and selling. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

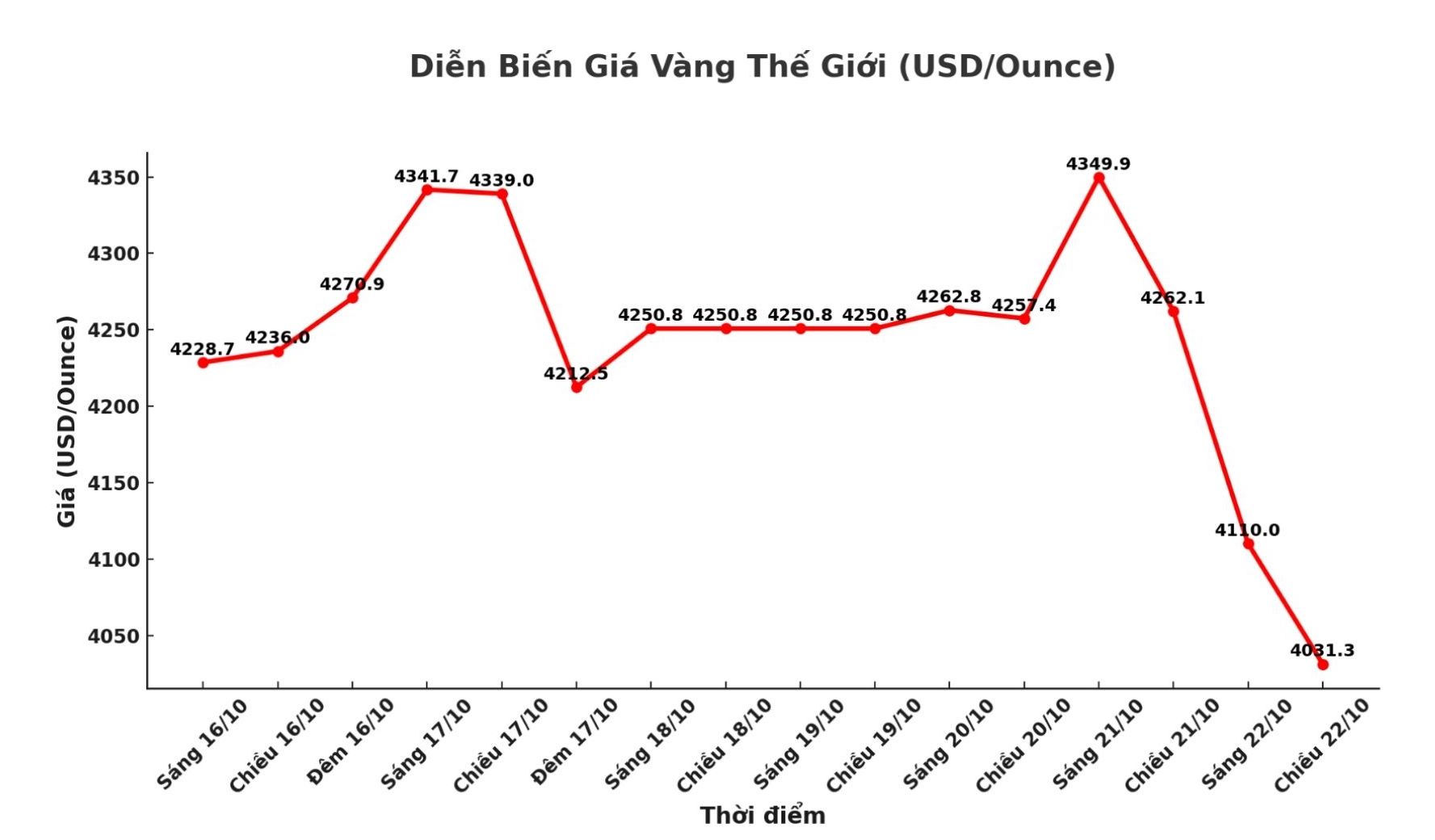

World gold price

The world gold price was listed at 6:15 p.m. at 4,031.1 USD/ounce, down 230.8 USD compared to a day ago.

Gold price forecast

Gold prices continued to decline in the fourth session, after recording the strongest decline since 2020 in the previous session. The recovery momentum at the beginning of the session was quickly replaced by a wave of profit-taking, in the context of a stronger USD, causing more pressure.

Spot gold prices fell 1.4%, to $4,067.31 an ounce at 9:41 a.m. GMT, hitting a nearly two-week low after rising to $4,161.17 an ounce earlier. December gold futures fell 0.7% to $4,081.30 an ounce.

Meanwhile, the USD Index fluctuated near a weekly high, making gold more expensive for holders of other currencies.

Since the beginning of the year, gold prices have increased by 54%, supported by geopolitical tensions, economic instability, expectations of the FED cutting interest rates and strong capital flows into ETFs.

"The strong rally in recent weeks has caused gold to enter the technical overbought zone, forcing many investors to take profits," said ActivTrades expert Ricardo Evangelista.

Currently, investors are waiting for the US Consumer Price Index (CPI) report released on Friday, which is considered the basis for predicting the interest rate policy direction of the US Federal Reserve (FED). Gold with its non-interest-bearing properties often benefits in a low-interest-rate environment.

The market expects the FED to cut key interest rates in October and again in December.

StoneX expert Rhona O'Connell commented: "We are still in a period of many fluctuations and uncertainties. Therefore, any deep decline can attract new buying power".

In other metals, spot silver fell 0.9% to $48.28 an ounce after falling 7.1% on Tuesday. platinum fell 0.1% to $1,549.53/ounce, while palladium lost 1% to $1,394.52/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...