Jim Wyckoff - senior analyst of Kitco commented that gold and silver prices are under intense selling pressure, the market recorded a panic of selling to cut losses and meet deposit calls from short-term speculators on the futures exchange.

According to this expert, the more positive risk-taking sentiment this week also causes disadvantages for safe-haven metals. US stock indexes recovered strongly, approaching the recent record peak.

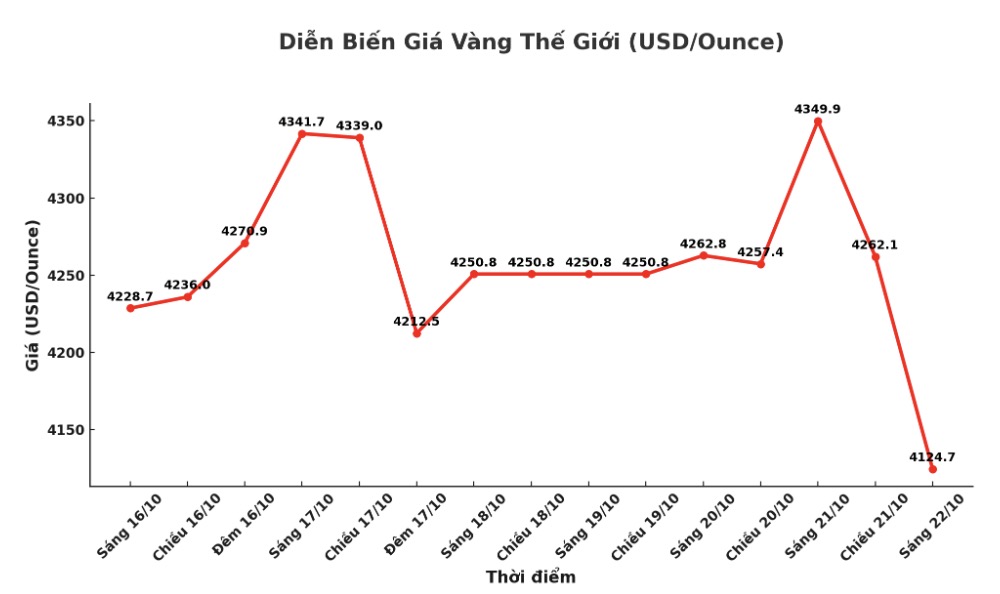

December gold futures fell $215 to $4,143 an ounce, while December futures fell $3.5 to $47.85 an ounce.

Selling pressure began when the London market opened and continued throughout the trading session in North America. Some experts say that the more optimistic sentiment surrounding US-China trade tensions and Japan's Nikkei 225 index reaching a record level have triggered a sell-off of gold and silver.

Others said that this was mainly a technical sell-off after the market's "parabol" hot spike.

This adjustment is simply a profit-taking, said TD Securities commodity analysts. In our opinion, the positions are currently at extreme levels: algorithms have stopped buying, risk balance funds and volatility control funds have all reached their limits, macro funds have almost fully disbursed, central bank purchasing power has decreased significantly quarter-on-quarter, individual investors have participated at the highest level in a decade, while China has temporarily stopped buying. The profit-taking process will continue.

Previously, in the second session, bottom-fishing buying power appeared when investors took advantage of the sharp price decrease on Friday. Gold futures then set a new record at $4,398/ounce.

However, daily price fluctuations in the gold and silver futures markets are becoming extreme. This development has a negative signal, showing that the strong price increase cycle may be entering a climax.

Commodity traders are closely monitoring the gold and silver markets because too large fluctuations in these two metals could spread to other futures markets.

An old saying in the trading world is repeated: "When you can't sell what you want, people will sell what they can". Selling pressure spread from gold and silver has also affected the agricultural product market, but to a slight extent.

Technically, December gold contracts are weakening rapidly and strongly. The next upside target for buyers is to close above the solid resistance level at the peak of the contract also a record 4,398 USD/ounce. Meanwhile, the sellers aim to pull the price below the important support level of 4,000 USD/ounce.

The nearest resistance zone is at 4,200 USD/ounce and 4,250 USD/ounce; supported at 4,093 USD/ounce and 4,000 USD/ounce respectively.

For silver, the market recorded a technical model of key reversal in the session last Friday, a signal showing the possibility of forming a price peak. The next upside target for buyers is to close above the resistance level of 53.765 USD/ounce (contract peak).

On the contrary, the downside target for the bears is to pull the price below the support level of 46.70 USD/ounce. The nearest resistance zone is at 49 USD and 50 USD; supported at 47.12 USD/ounce and 46.70 USD/ounce.

In outside markets, the USD index increased slightly. Crude oil prices edged up around $57.75/barrel. The yield on the 10-year US Treasury note is currently around 3.9%.

The international gold market operates under two main mechanisms: the spot market - where prices are listed for spot transactions; and the futures market - where prices are set for future delivery transactions.

Due to high liquidity at the end of the year, December gold futures are currently the most actively traded on the CME floor.

See more news related to gold prices HERE...