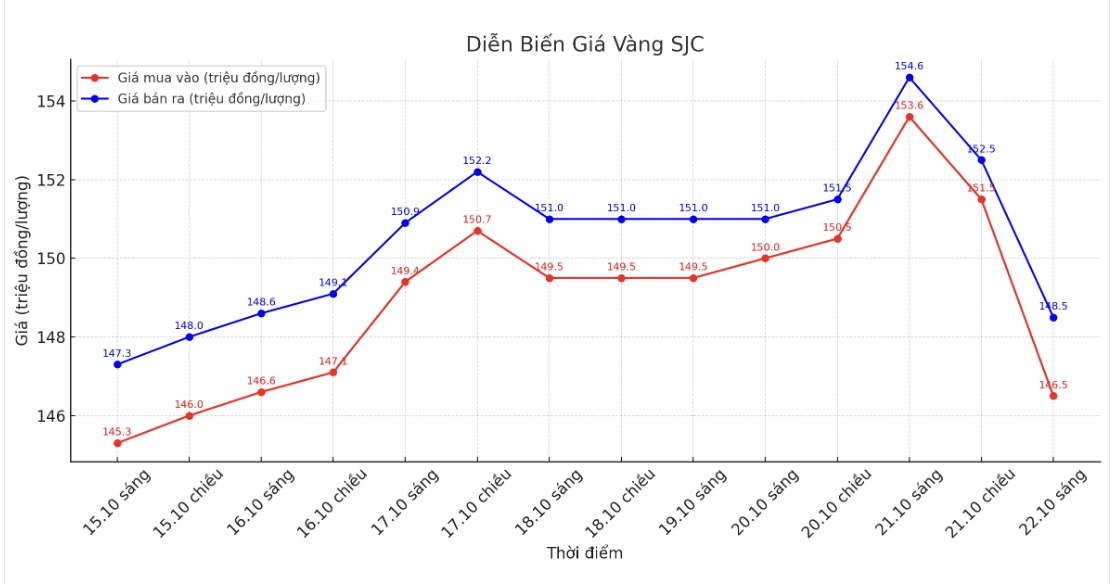

This morning (October 22), the price of SJC gold bars was listed by DOJI Group at 146.5-148.5 million VND/tael (buy - sell), down 7.1 - 6.1 million VND/tael compared to yesterday.

Bao Tin Minh Chau listed 147-148.5 million VND/tael, down 7.1 - 6.1 million VND/tael. Phu Quy also adjusted to 146-148.5 million VND/tael, down 7 - 6.1 million VND/tael.

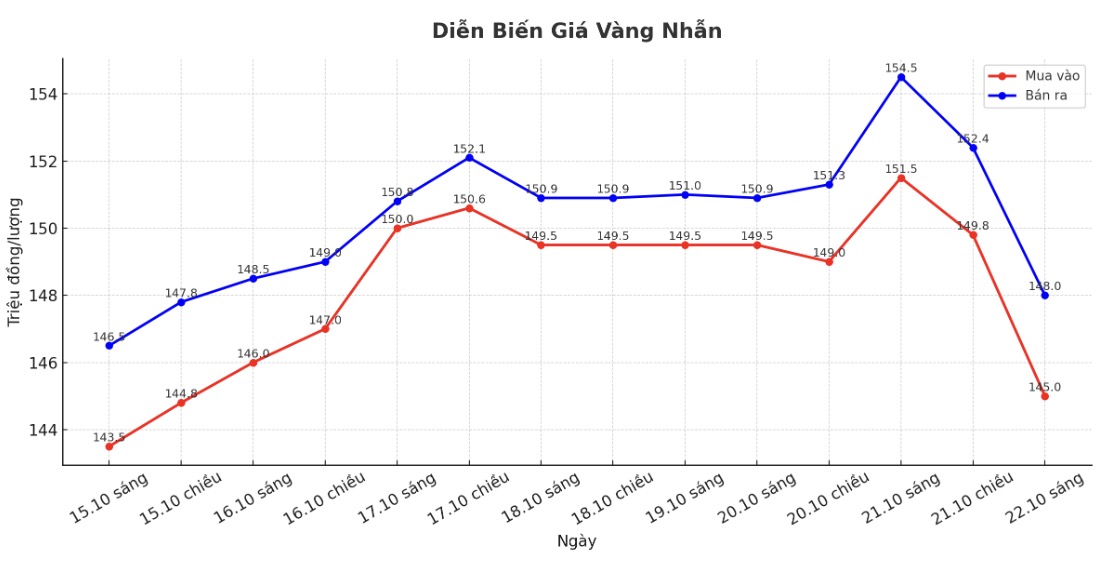

9999 smooth round gold rings also decreased sharply from 5 to 6.5 million VND/tael depending on the brand. The difference between buying and selling prices continues to remain high, at about 2-3 million VND/tael, showing great risk for short-term investors.

If investors buy SJC gold bars on October 21 at VND154.6 million/tael (DOJI's selling price) and sell them this morning at VND146.5 million/tael (DOJI's buying price), they will lose about VND8.1 million/tael after just one day.

At Bao Tin Minh Chau, the same loss was recorded when the selling price yesterday was 154.6 million VND/tael, while the buying price this morning decreased to 147 million VND/tael, equivalent to a loss of 7.6 million VND/tael.

In Phu Quy, the damage was also about 8 million VND/tael when the buying price this morning decreased to 146 million VND/tael compared to yesterday's selling price of 154.6 million VND/tael.

For gold rings, the loss is even deeper. Buyers at DOJI on October 21 at 154.5 million VND/tael now can only sell it for 145 million VND/tael, losing 9.5 million VND/tael. At Bao Tin Minh Chau, the price decreased from 160.5 to 152.5 million VND/tael, equivalent to a loss of 8 million VND/tael.

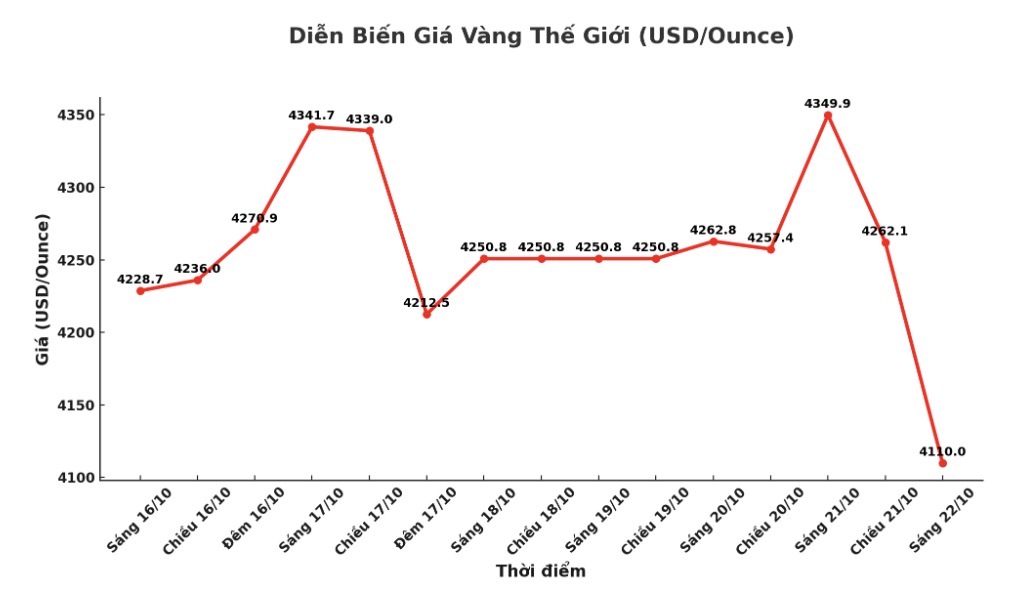

The sharp decline of the domestic precious metal was affected by the deep decline in world gold prices - which lost nearly 240 USD/ounce in the latest trading session.

Recorded at 9:15 (Vietnam time), spot gold prices were only 4,110 USD/ounce, down nearly 240 USD - the strongest decrease in many months. This is considered a strong correction after a series of increases to a record of 4,381 USD/ounce on October 20.

According to Jim Wyckoff - senior analyst of Kitco, the world gold price plummeted in the last session last night due to a wave of sell-offs cutting losses and calling for deposits on the futures exchange, when investors panicked and left the stake after a series of hot increases.

Risk-off sentiment returns as US stocks and Japan's Nikkei 225 index recover strongly, causing cash flow to leave the safe-haven metal. TD Securities experts said this is a technical profit-taking as hedge funds have disbursed the maximum, central and Chinese purchasing power has decreased.

Mr. Fawad Razaqzada - an expert at City Index - said that investors' massive profit realized after a period of erection has put gold under great selling pressure. If prices break through the support level of $4,000/ounce, the downtrend may continue.

Currently, the difference between buying and selling prices at gold enterprises is at a very high level, commonly 2-3 million VND/tael, causing the risk of losses to increase sharply if prices continue to decrease. In the context of unpredictable market fluctuations, many people still have a "bottleneck" or FOMO (fear of missing out on opportunities), but this is the time to be especially cautious.

If gold continues to fall sharply following the world trend, surfer buyers may suffer heavy losses after just a few hours of trading. Investors need to be cautious, avoid trading based on emotions to limit financial risks.

See more news related to gold prices HERE...