According to Kitco, the instability of US public debt is causing investors to worry and contributing to supporting gold prices. However, the focus is currently the chaos in the global bond market as the "carry trade" strategy (investors borrowing money in a low-interest-bearing currency, then switching to investing in another asset or currency with higher interest rates) with the Japanese yen is showing signs of disbandment.

Japanese government bond yields for 30-years rose to a record high of 3.2% in the session on May 21, after the country's worst government bond auction in decades.

Although Japanese bond yields are still much lower than the US 30-year US Treasury note currently around 5%, according to Fawad Razaqzada - market analyst at City Index and FOREX.com, this sell-off is "a seismic shift" for the global financial market.

Inflation has finally emerged, as the Bank of Japan has begun to move towards normalizing monetary policy. The once attractive carry trade strategy - borrowing the Yen at near zero interest rates and then investing in higher-yielding assets may be breaking, as happened last summer, he said.

In this context, Mr. Razaqzada warned gold investors to "come up tight, because there could be a big shock coming".

The carry trade strategy for the Yen has appeared since 1999, when Japan began to cut interest rates sharply. Investors borrowed Yen almost for free to pour into high-yield assets.

As of 2024 - when Japan begins raising interest rates, the scale of this strategy is estimated at about 1,000 billion USD globally. Now, rising inflation and rising bond yields are reversing this strategy.

The scale of carry- trade positions is huge, said Axel Rudolph, an analyst at IG.

When these positions are released, it will lead to strong exchange rate fluctuations, the yen may increase in price compared to currencies that have previously received capital from Japan. Sudden withdrawals can cause liquidity problems and cause asset prices to plummet, even leading to widespread financial instability, said the expert.

Rudolph also believes that this could be part of the reason for the recent sharp increase in US bond yields. The 30-year US Treasury note is currently at a two-year high.

According to Razaqzada, this is a positive time for gold. Normally, the Yen and gold are in the same direction. volatility in the Japanese bond market is supporting gold. Although high yields typically reduce the appeal of non-yielding assets like gold, safe-haven demand will still prevail in this environment, he said.

Last year, gold prices increased by nearly 200 USD in August and September, from 2,400 USD/ounce to 2,600 USD/ounce when carry trade began to show signs of reversal.

Razaqzada warned that this carry trade reversal could be the first link in the Domino effect chain of the global bond market.

Japan is holding up to 1,100 billion USD worth of US bonds. If Tokyo is forced to sell off these assets to protect the domestic currency or stabilize the domestic market, US bond yields will be pushed soaring, at the same time as the US credit rating has just been downgraded, he added.

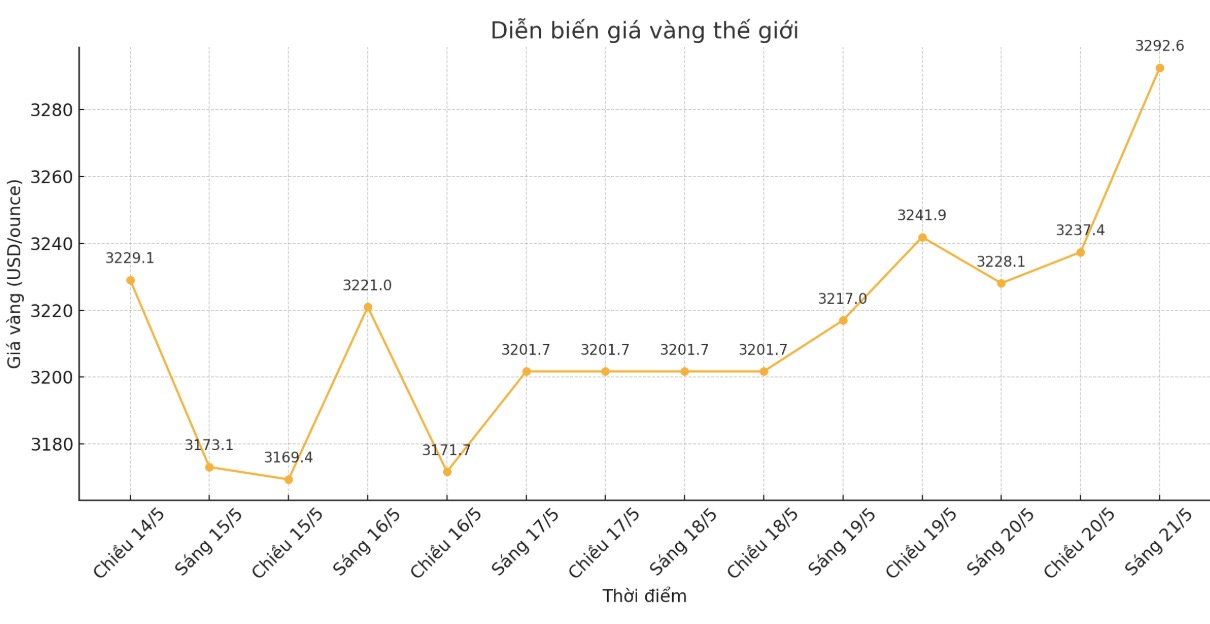

Technically, Razaqzada said that gold's first support zone is 3,245 - 3,275 USD/ounce. The nearest resistance level is 3,360 USD/ounce, if it is surpassed, the next mark will be 3,400 USD/ounce and the historical peak of 3,500 USD/ounce.