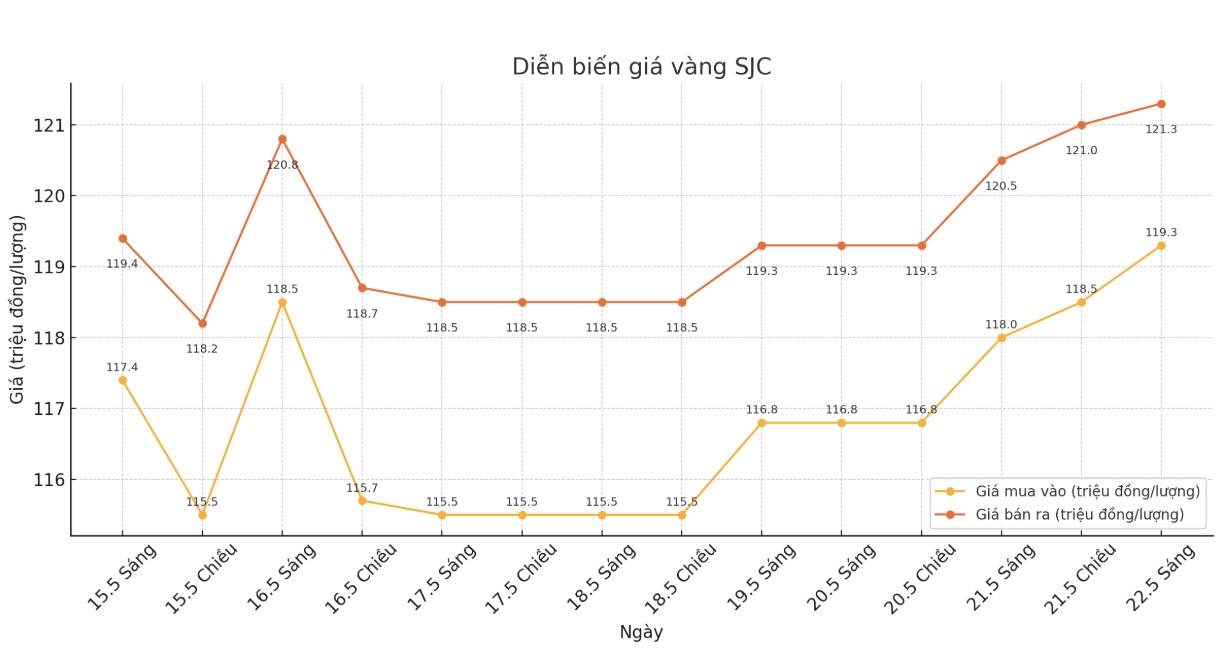

Updated SJC gold price

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 119.3-121.3 million/tael (buy - sell), an increase of VND 1.3 million/tael for buying and an increase of VND 800,000/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 119.3-121.3 million VND/tael (buy - sell), an increase of 1.3 million VND/tael for buying and an increase of 800,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119.3-121.3 million VND/tael (buy - sell), an increase of 1.3 million VND/tael for buying and an increase of 800,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 118.3-121.3 million VND/tael (buy - sell), down 200,000 VND/tael for buying and up 800,000 VND/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

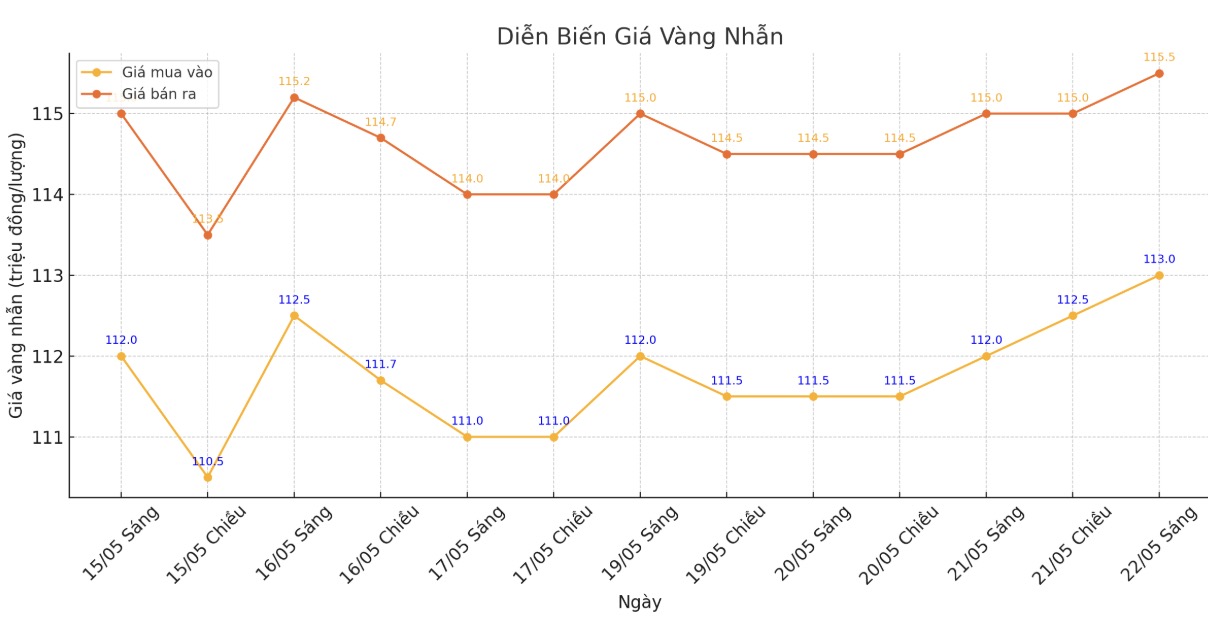

9999 round gold ring price

As of 9:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 113-125.5 million VND/tael (buy - sell), an increase of 1 million VND/tael for buying and an increase of 500,000 VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114.8-117.8 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 112.8-125.8 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

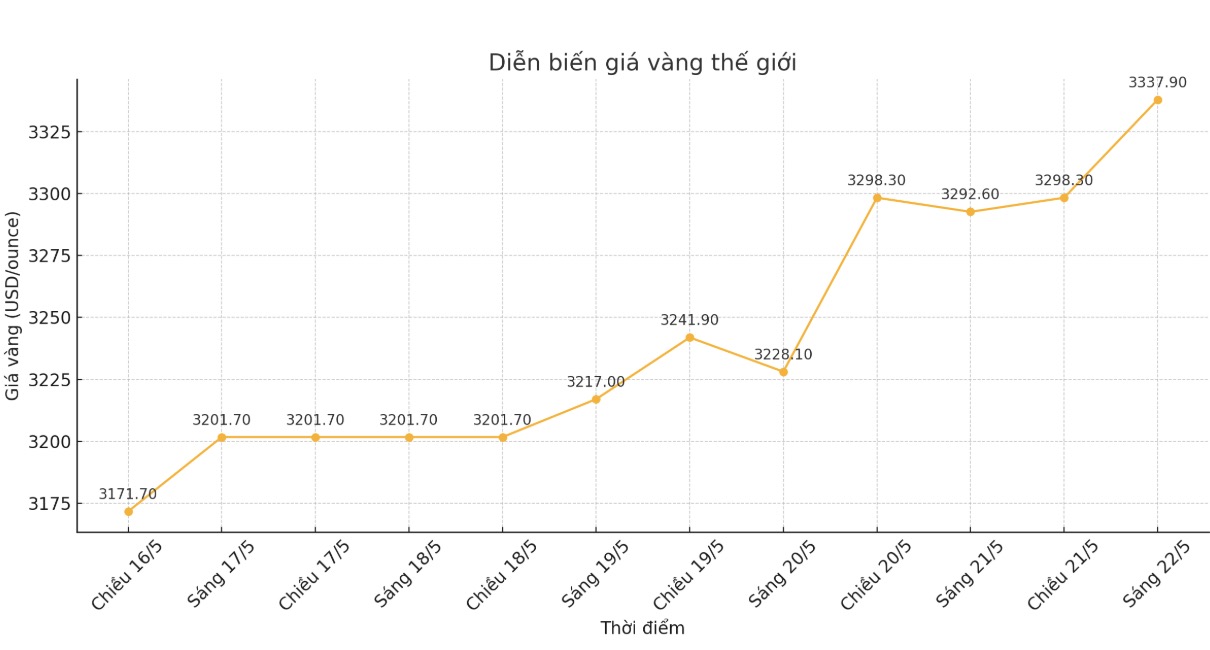

World gold price

At 9:20 a.m., the world gold price listed on Kitco was around 3,337.9 USD/ounce, up 45.3 USD/ounce.

Gold price forecast

On Kitco, Mr. Joseph Cavatoni - senior market strategist at the World Gold Council (WGC) said that demand for gold is increasing strongly in 2025, as both central banks and investors are actively buying in the context of the US facing inflation, public debt and skepticism about traditional financial assets.

The picture of gold investment is becoming clearer and stronger, he said, saying that Moodys downgrading US credit is a warning signaling pressure on the US dollar and its currency-denominated assets.

The WGC said global gold demand in the first quarter of 2025 reached 1,206 tons - the highest level since 2016, thanks to strong net buying from central banks and reversed ETF flows, especially in the US and China. In April alone, Chinas gold ETFs surpassed the first quarter in North America, Cavatoni said.

According to him, this is not short-term speculation but a trend of restructuring asset allocation, as the correlation between stocks and bonds increases, making gold stand out in its role in diversification.

In response to the European Central Bank's warning about the gold derivatives market, he said that it should be consulted for WGC research, because in the crises over the past 20 years, gold has always been a safe haven asset.

In China and India, demand for gold investment has increased despite decreased jewelry consumption due to high prices. Cash flow is only shifting from jewelry to ETFs and gold bars, not leaving the market.

Supply in the first quarter increased from mining but recycled gold fluctuated little. holders still believe in gold and are not willing to sell.

Cavatoni said central banks are still buying steadily, reacting to geopolitical risks and de-dollarization trends. While the US holds 75-80% of foreign exchange reserves in gold, emerging countries only reached 10-15%, showing great room for additional purchases.

Regarding the price of $4,000/ounce, Mr. Joseph said it was completely feasible, as gold has increased by nearly 25% since the beginning of the year. He also said that a bill being considered by the US Congress will pave the way for mutual funds to invest in gold, marking an important policy shift.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...