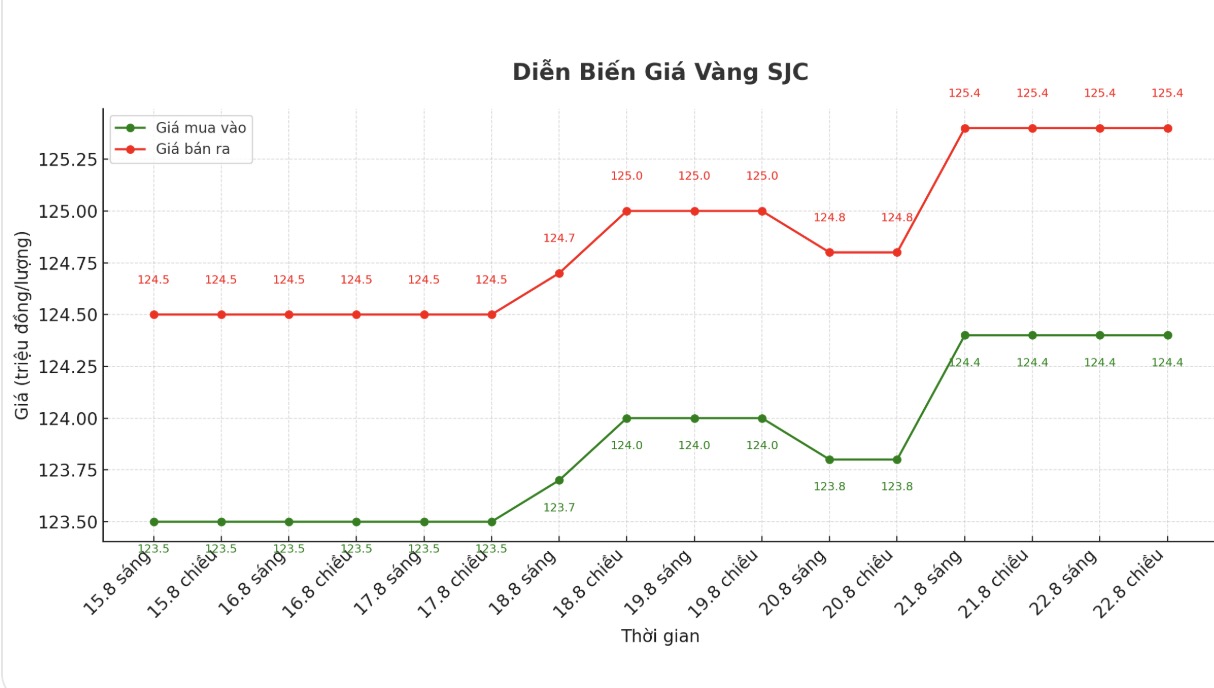

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by DOJI Group at 124.4-125.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 1 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 124.4-125.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 1 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 123.4-125.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

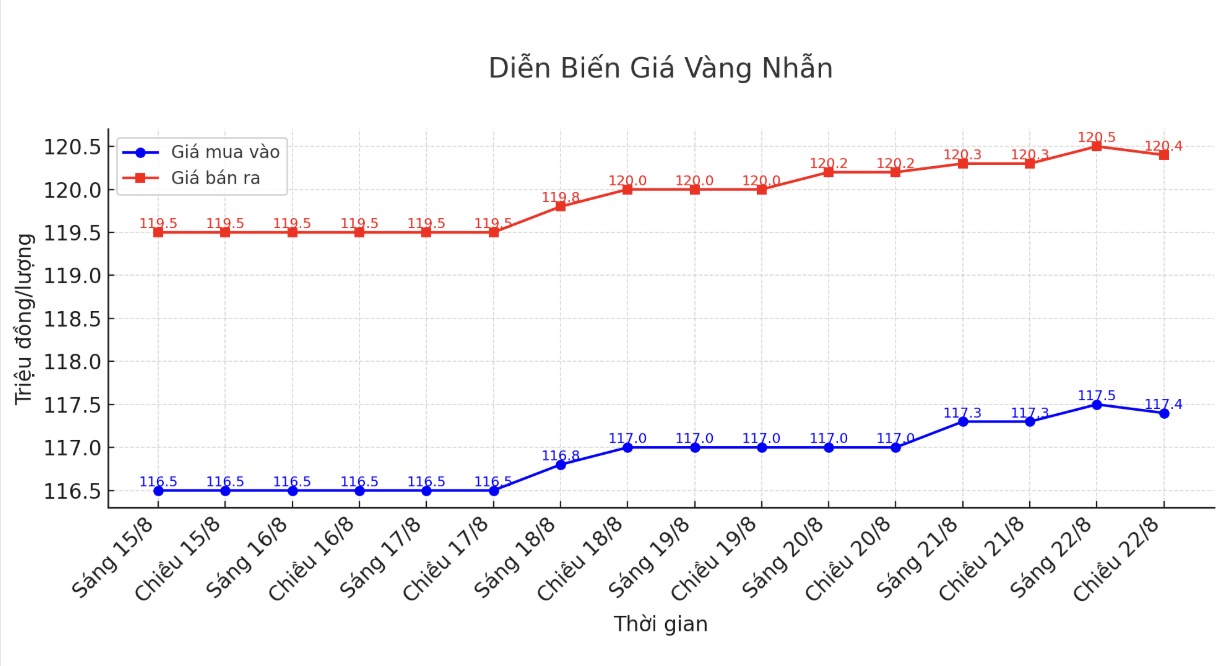

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 117.4-120.4 million VND/tael (buy - sell), an increase of 100,000 VND/tael for buying and an increase of 100,000 VND/tael for selling. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117.6-120.6 million VND/tael (buy - sell), an increase of 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 117.2-120.2 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

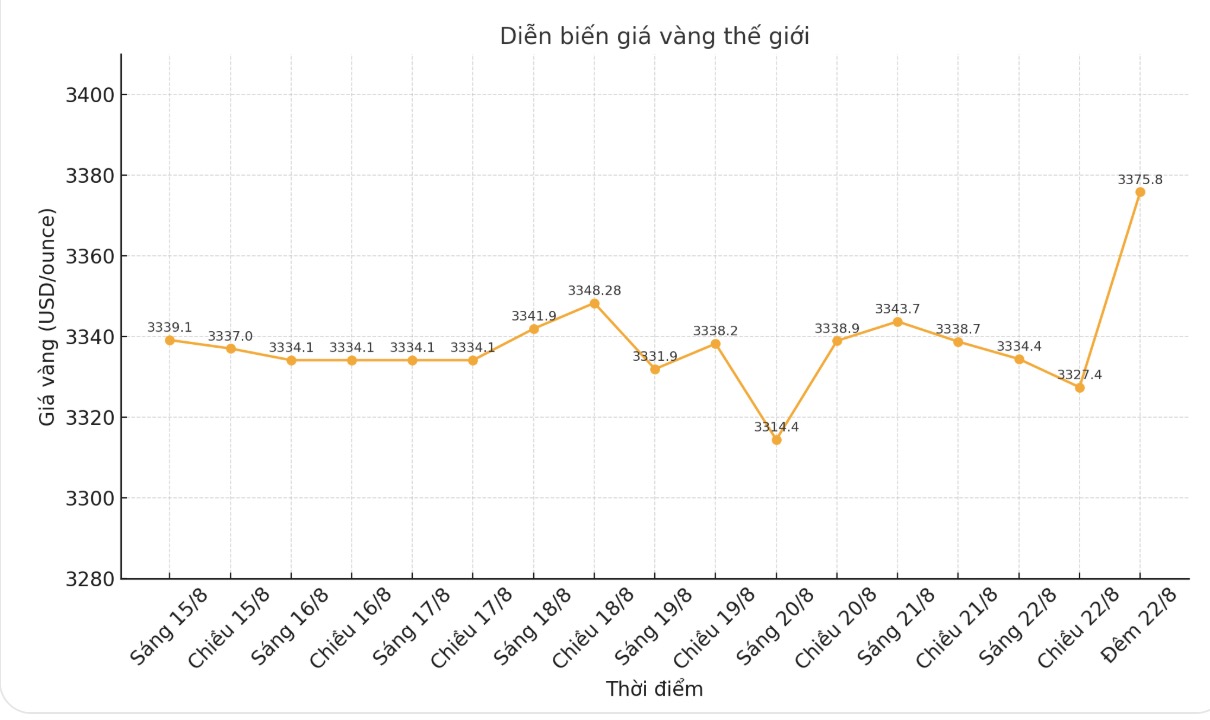

World gold price

The world gold price was listed at 22:05 on August 22 at 3,375.8 USD/ounce, a sharp increase of 37.6 USD compared to a day ago.

Gold price forecast

The market focused entirely on Fed Chairman Jerome Powell's speech in Wyoming. Gold prices have rebounded as Jerome Powell appears to be paving the way for a rate cut next month.

Mr. Powell walked a neutral line in his anticipated speech at the Fed's annual meeting. He noted the risk of rising inflation and slowing economic growth. However, he also said that while risks are in balance, US monetary policy may need to be adjusted.

In the short term, the risk for inflation is on the uptrend, while the risk for employment is on the downtrend - a challenging situation. When our goals conflict like that, the policy framework requires us to balance both sides of the double task.

Policy interest rates are now close to being neutral by more than 100 basis points compared to a year ago, and the stability of the unemployment rate and other labor market measures allow us to be cautious when considering policy changes. However, with the policy still in a limited area, the fundamental outlook and the change in the risk balance may require adjusting the policy stance, he said.

The global stock market last night had mixed developments, but overall there was an upward trend. US stock indexes are expected to open up well when the New York trading session begins.

In Europe, ECB officials are increasingly confident that they can keep Eurozone interest rates unchanged in September.

Some news agencies said that people who are knowledgeable about the problem said that the trade agreement between the EU and the US will not cause major economic concerns. Since keeping interest rates at 2% last month, growth and inflation have generally moved in line with ECB's June forecast. The ECB expects price pressure to ease in 2026 before returning to the 2% target in 2027.

In China, the Shanghai composite index increased by 1.45% to 3,826 points on Friday, while the Shenzhen Component increased by 2.07% to 12,166 points. Shanghai composite even reached a new peak in a decade, thanks to strong capital flows and purchasing power from individual investors.

China's stock market has increased sharply in recent weeks as investors withdrew from bonds to switch to stocks, with deposit trading reaching the highest level since the market grew in 2015.

Technically, December gold futures speculators are still holding a short-term advantage. Their next upside target is to close above the solid resistance level of $3,500/ounce. On the contrary, the fake sellers are aiming to push prices below the important support zone at the July low of 3,319-20 USD/ounce. The first resistance level was seen at $3,400 and then the highest level this week was $3,403.60.

The first support level at this week's lowest level was 3,353.40 USD, then 3,350 USD.

The main outside markets today showed a slight increase in the USD index, crude oil prices increased slightly and traded around 63.75 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.337%.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...