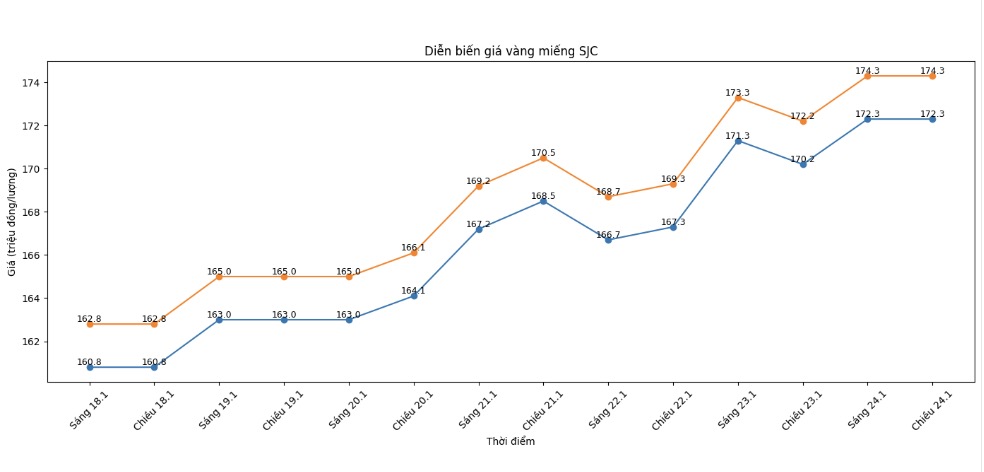

SJC gold bar price

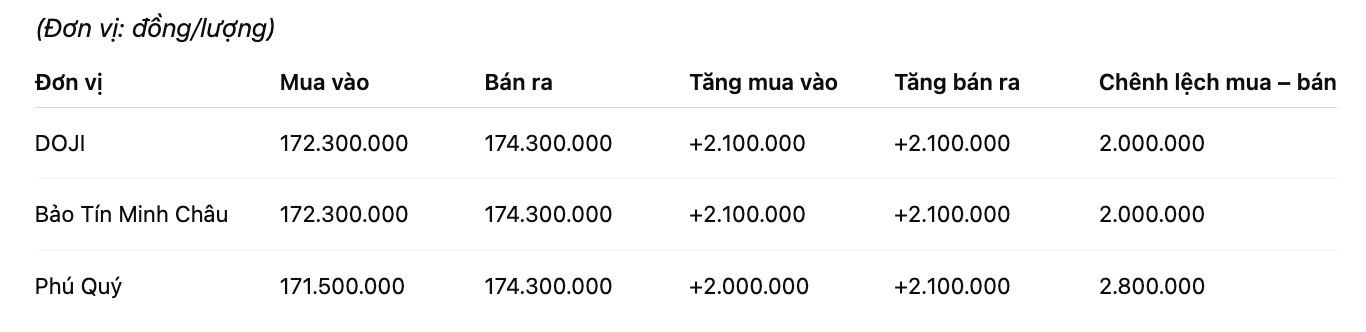

As of 6:35 PM, SJC gold bar prices were listed by DOJI Group at the threshold of 172.3-174.3 million VND/tael (buying - selling), an increase of 2.1 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 172.3-174.3 million VND/tael (buying - selling), an increase of 2.1 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at the threshold of 171.5-174.3 million VND/tael (buying - selling), an increase of 2 million VND/tael on the buying side and an increase of 2.1 million VND/tael on the selling side. The difference between buying and selling prices is at the threshold of 2.8 million VND/tael.

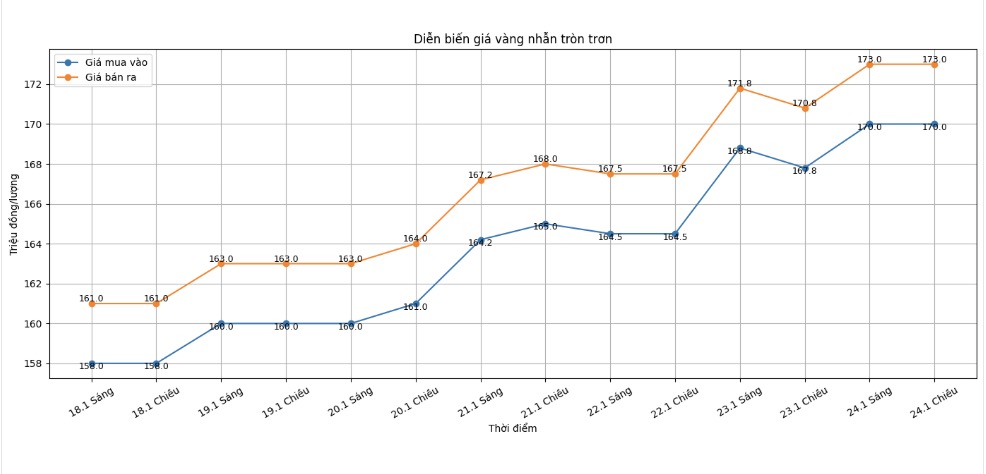

9999 gold ring price

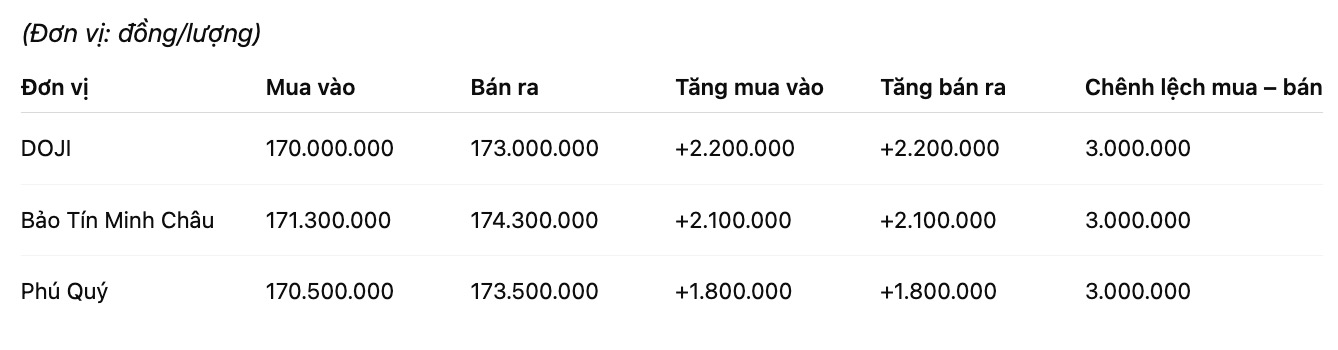

As of 9:30 PM, DOJI Group listed the price of gold rings at 170-173 million VND/tael (buying - selling), an increase of 2.2 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 171.3-174.3 million VND/tael (buying - selling), an increase of 2.1 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 170.5-173.5 million VND/tael (buying - selling), an increase of 1.8 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

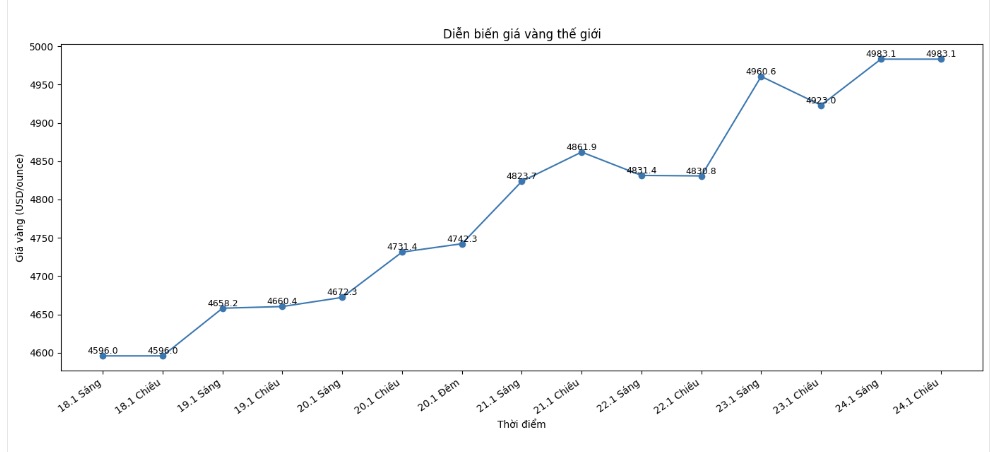

World gold price

At 9:21 PM, the world gold price was listed around the threshold of 4,983.1 USD/ounce, up 60.1 USD compared to the previous day.

Gold price forecast

World gold prices are maintaining a strong upward momentum, approaching the psychological milestone of 5,000 USD/ounce, in the context that many fundamental factors continue to support the upward trend of precious metals. Although technical indicators show that the market is in a hot upward state, analysts believe that the current developments do not only stem from short-term speculative sentiment.

According to Mr. Ole Hansen, Head of Commodity Strategy at Saxo Bank, the driving force for gold's price increase is driven by the combination of speculative cash flow and sustainable macroeconomic factors. “The fear of missing opportunities is clearly shown as prices continuously set new peaks. However, overall, the current macroeconomic conditions are still creating a solid foundation for the upward trend of gold, especially the strong buying demand from central banks,” Mr. Hansen said.

Reality shows that, in the context of increasing global public debt and declining confidence in fiscal discipline, gold continues to be seen as a tool to diversify safe deposits. Some investment funds and pension funds in Europe are also considering adjusting their asset ratios, gradually reducing dependence on US bonds, thereby indirectly supporting gold prices.

From another perspective, Mr. Chris Vecchio, Head of Futures and Foreign Exchange Strategy at Tastylive.com, believes that the demand for gold holdings reflects deeper concerns about global financial order. “When investors question the long-term role of legal tender and the stability of the current financial system, they tend to look for assets not bound by monetary policy, in which gold is the top choice,” Mr. Vecchio said.

In the short term, the market will still closely monitor the monetary policy meeting of the US Federal Reserve (Fed). Although the possibility of interest rate adjustments is assessed as low, any tough signal from the Fed may create technical fluctuations. However, many experts believe that the safe haven role of gold and the weakening trend of the USD are overshadowing traditional restraints, thereby helping gold prices maintain positive prospects in the coming time.

It's a bit of a bit of a bit of a bit of a bit of a bit.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...