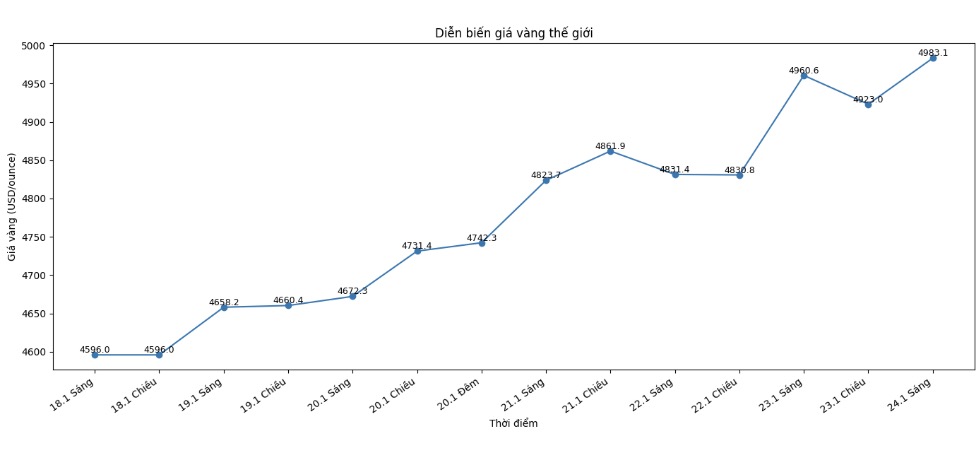

Gold price movements last week

Geopolitical concerns pushed gold prices to a new record high before US President Donald Trump's speech in Davos on Wednesday. However, even when the Greenland crisis showed signs of cooling down, it was not enough to stop this precious metal from rising sharply at the end of the week, approaching the 5,000 USD/ounce mark.

Spot gold started the week at 4,654.24 USD/ounce. After rising rapidly to 4,680 USD, gold prices entered a period of sideways movement in a narrow range when the US market closed on Martin Luther King Jr.'s Day.

The Asian trading session on Monday night recorded the first significant breakthrough, when spot gold rose from 4,671 USD/ounce at 10:00 PM to 4,714 USD right before 1:00 AM (Eastern US time), and reached a peak of 4,735 USD/ounce in the European session.

However, it was the return of US traders that really created a boost for gold's upward momentum this week. 15 minutes before the opening of the North American market on Tuesday, gold prices traded around 4,750 USD/ounce, and by 13:00, this precious metal increased to 4,763 USD/ounce.

After a few hours of fluctuating around the 4,760 USD mark, the next strong wave of increase came from Asia, when gold prices climbed from 4,758 USD/ounce at 6:00 PM to 4,837 USD at 10:00 PM, before setting a new historical high at 4,885 USD/ounce at 1:15 AM (Eastern time).

Most of the volatility, both in the precious metals market and the financial market in general, revolved around concerns about the US President's statements related to Greenland in the framework of the World Economic Forum in Davos (Switzerland) on Wednesday morning.

After the last price increase attempt failed at the 4,850 USD mark right after 2:00 PM, gold plunged to 4,766 USD/ounce just half an hour later. However, the recovery took place almost as strongly as the decline. Gold prices quickly regained the 4,835 USD/ounce mark at 4:30 PM, and overnight trading witnessed this precious metal enter a state of accumulation around the mid-week range.

On Thursday morning, a new momentum reappeared when spot gold prices soared from 4,813 USD/ounce at 8:30 am, surpassing the resistance level of 4,900 USD and heading straight to a new record high of 4,965 USD/ounce at 7:45 pm (Eastern US time).

After many attempts to break higher in the night but failed, gold turned down to retest the 4,900 USD/ounce mark as a support threshold for the first time, right after 4:15 AM. Buying power quickly appeared in this price range, and gold continued to accelerate.

In Friday's session, this precious metal made a strong breakthrough, approaching the 5,000 USD/ounce mark, peaking at 4,989.88 USD and then closing the week at 4,983.1 USD/ounce.

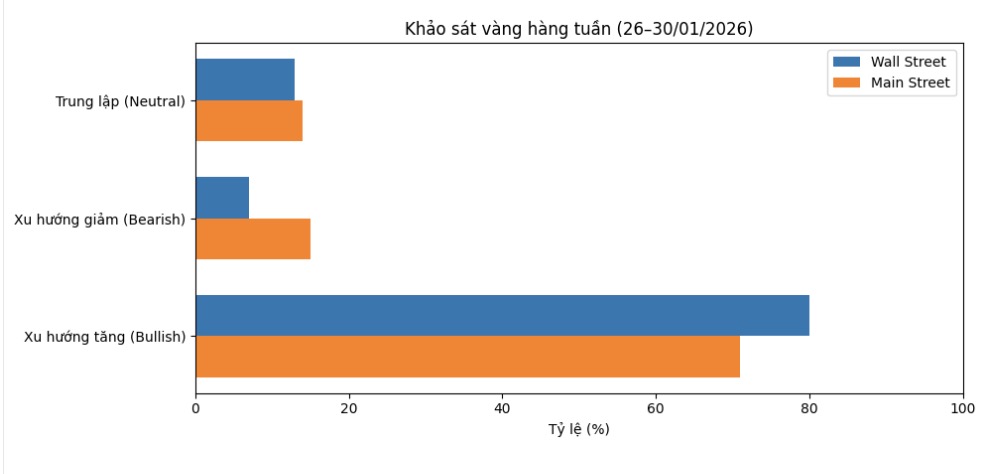

Gold price forecast for next week

The latest weekly gold survey with experts shows that Wall Street is extremely optimistic about the short-term outlook for gold prices.

This week, 15 analysts participated in the survey. Among them, 12 experts, equivalent to 80%, predicted gold prices would exceed the 5,000 USD mark next week; one expert, accounting for 7%, said prices would fall. The remaining two experts, equivalent to 13%, predicted that this precious metal will remain unchanged and accumulate next week.

Meanwhile, Kitco's online poll of 272 investors showed a more cautious sentiment appearing after the outstanding gold price increase last week.

There are 193 small traders, accounting for 71%, expecting gold prices to continue to rise next week; 40 others, equivalent to 15%, predict gold prices will weaken. The remaining 39 investors, accounting for 14% of the total votes, believe that gold prices will trade sideways next week.

Economic data to be monitored next week

The most important economic event next week will be the monetary policy meeting of the US Federal Reserve (Fed), however, the market currently does not expect the Fed to adjust interest rates before June.

However, investors will still closely monitor any signs of disagreement during the vote, as well as "challenging" or tough signals that may appear at Fed Chairman Jerome Powell's press conference.

On Monday, the market will receive US long-term goods orders in November, while the US consumer confidence index will be released on Tuesday morning.

News on Wednesday will revolve around central banks, with the monetary policy decision of the Bank of Canada being announced in the morning, followed by the policy decision of the Fed in the afternoon.

Next Thursday, traders will track the number of weekly unemployment claims. The trading week closed with the US announcing the December Manufacturing Price Index (PPI) on Friday morning.

See more news related to gold prices HERE...