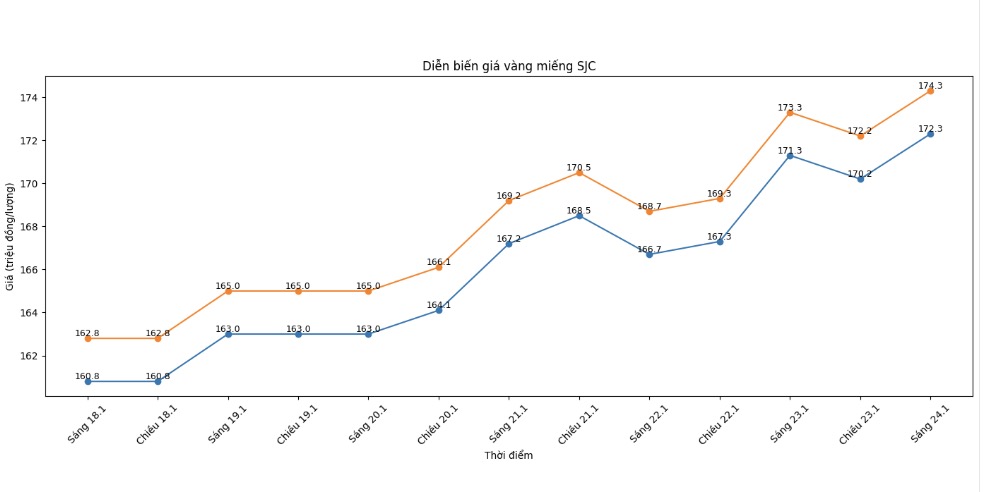

SJC gold bar price

As of 9:05 am, SJC gold bar prices were listed by DOJI Group at the threshold of 172.3-174.3 million VND/tael (buying - selling), an increase of 1 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 172.3-174.3 million VND/tael (buying - selling), an increase of 1 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at the threshold of 171.5-174.3 million VND/tael (buying - selling), an increase of 1.2 million VND/tael on the buying side and an increase of 1 million VND/tael on the selling side. The difference between buying and selling prices is at the threshold of 2.8 million VND/tael.

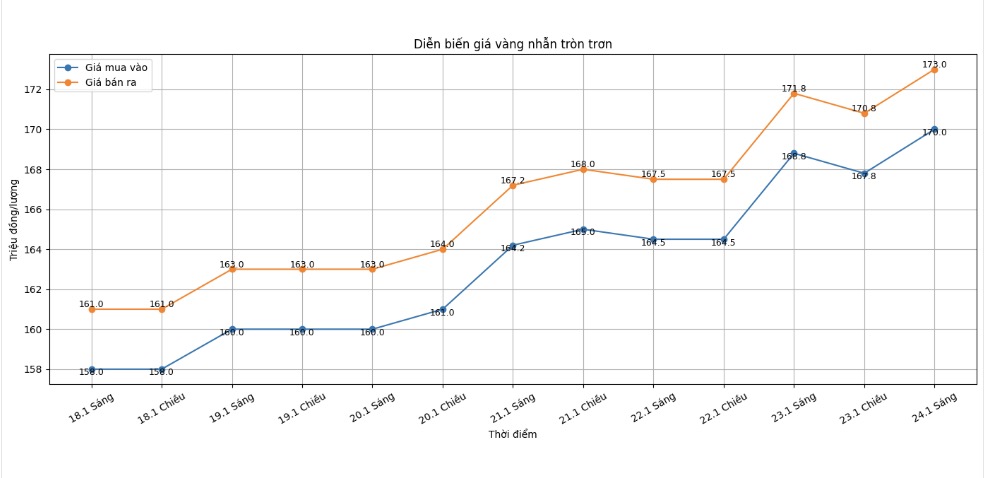

9999 gold ring price

As of 9:05 am, DOJI Group listed the price of gold rings at 170-173 million VND/tael (buying - selling), an increase of 1.2 million VND/tael in both directions compared to the previous day. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 171.3-174.3 million VND/tael (buying - selling), an increase of 1 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 170.5-173.5 million VND/tael (buying - selling), an increase of 1.2 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Currently, the buying - selling price difference of gold is at a very high level, around 2 to 3 million VND/tael, posing a risk of losses for investors.

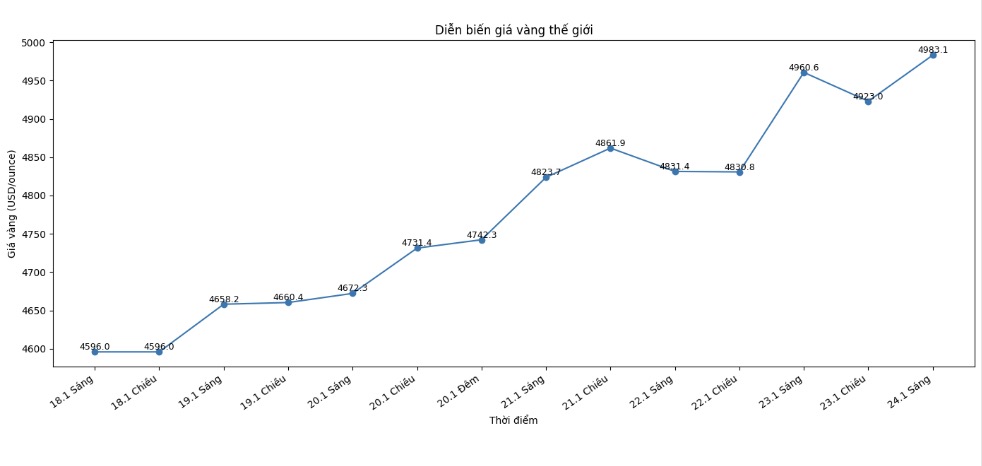

World gold price

At 9:10 am, world gold prices were listed around the threshold of 4,983.1 USD/ounce, up 22.5 USD compared to the previous day.

Gold price forecast

Domestic and world gold prices are rising, as the global market continuously receives risky information. New geopolitical developments, especially escalating tensions in the Middle East, are strongly reinforcing the safe haven role of precious metals.

On the international market, spot gold prices have repeatedly approached the psychological milestone of 5,000 USD/ounce - a threshold closely monitored by investors. US President Donald Trump's tough statements related to Iran, along with the move to deploy military forces to this region, have increased defensive sentiment in the global financial market. In that context, cash flow tends to leave risky assets to turn to gold.

Besides geopolitical factors, the outlook for US monetary policy continues to be an important driving force supporting gold prices. The USD weakened as US economic data sent mixed signals, increasing expectations that the US Federal Reserve (Fed) could cut interest rates in the second half of this year. Low interest rate environments often create favorable conditions for non-interest-generating assets such as gold.

Commenting on the short-term trend, Mr. Lukman Otunuga - senior analyst at FXTM, said that despite the appearance of technical corrections due to profit-taking activities, the level of uncertainty is still covering the market. According to him, geopolitical and trade risks that have not been thoroughly resolved will continue to keep gold in the high price range.

Meanwhile, major financial institutions also made more positive forecasts for precious metals. Goldman Sachs recently raised its gold price forecast for the end of 2026 to 5,400 USD/ounce, saying that purchasing power from the private sector is increasing sharply amid limited physical gold supply. This bank assesses that if global tensions continue to prolong, gold stockpiling demand may expand further.

However, analysts also recommend investors to be cautious about the risk of strong fluctuations in the short term. When gold prices are at historical peaks, deep corrections can appear at any time, especially if geopolitical information cools down or monetary policy has unexpected changes.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...