Although quantitative indicators show that both gold and silver are in a state of excessive increase, analysts believe that the current price movement reflects solid support from fundamental factors.

Mr. Ole Hansen - Head of Commodity Strategy at Saxo Bank - commented: "The current price increase is clearly strongly driven by market momentum, in which the fear of missing opportunities (FOMO) is very clearly shown when prices continuously conquer unprecedented milestones. However, it would be a one-sided view to consider this just a speculative fever. Considering the overall macroeconomic picture, conditions are still strongly supporting the upward momentum of precious metals.

Demand from central banks remains high, strengthening the role of gold as a diversified reserve asset, in the context of increasingly fragile confidence in fiscal discipline due to the government's continuous borrowing and lack of clarity about the long-term sustainability of public debt".

Although geopolitical tensions showed signs of easing after US President Donald Trump affirmed that he would not consider the option of using military measures related to Greenland, diplomatic disagreements surrounding this island have not completely ended.

The above developments are causing some investment institutions and pension funds in Europe to reconsider the level of allocation to US bonds. Earlier this week, the Danish pension fund AkademikerPension said it would divest about 100 million USD of bonds before the end of the month, citing concerns about the increasing trend of US public debt.

The possibility of a global order reshaping, or at least a change in the way the US participates in that order, is the reason why investors want to fill their portfolios with assets other than legal tender" - Chris Vecchio - Head of Futures and Foreign Exchange Strategy at Tastylive.com, commented - "We need something that is not tied to the legal tender world.

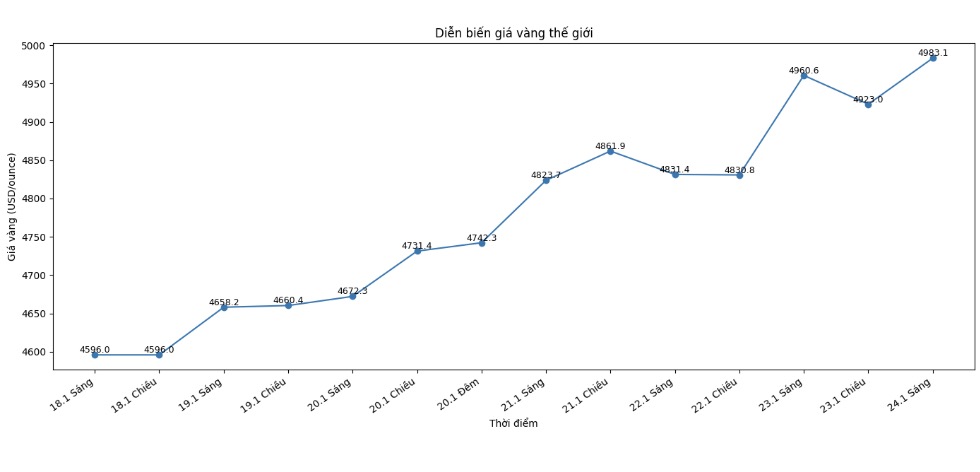

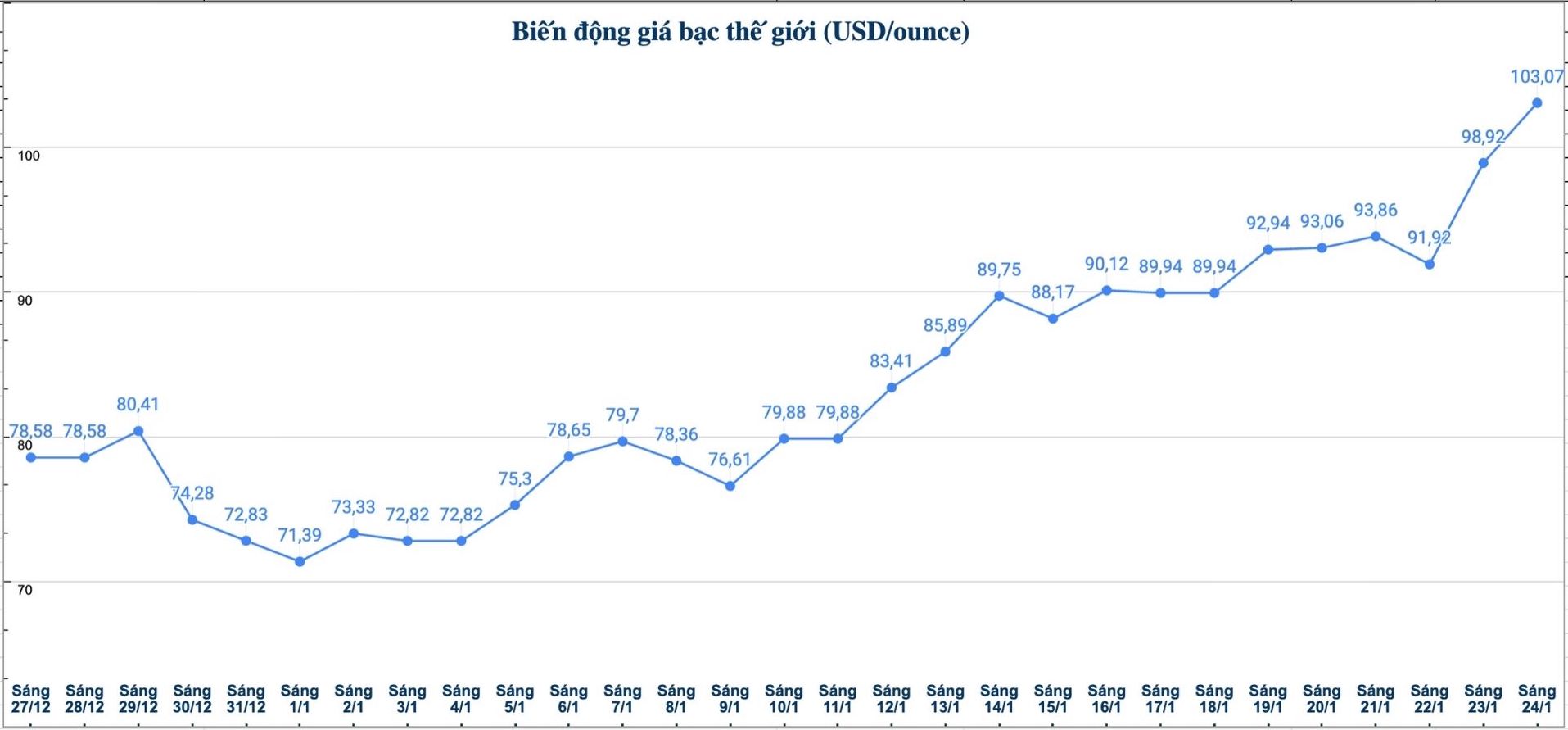

Neil Welsh - Head of Metals at Britannia Global Markets - said that although the dien bien of gold and silver prices looks like a "bubble", this is completely reasonable if placed in the overall market picture.

The current price level is reasonable considering that central banks are actively buying and geopolitical tensions are still present. This is more like a hedge against currency devaluation than a speculative bubble. Major central banks are likely to continue to buy despite price fluctuations.

It is possible that portfolio managers will continue to reallocate to gold, especially when many large analysis organizations such as Goldman Sachs, JP Morgan, Deutsche Bank... have recently announced optimistic forecasts" - he said.

The safe haven role of gold and the downward trend of the USD are overshadowing traditional market barriers, such as stable interest rates.

The monetary policy meeting of the US Federal Reserve (Fed) will be the most notable economic event next week; however, the market does not expect this central bank to make major changes.

Analysts believe that US inflation data continues to show consumer prices are still "stubborn", while economic activity and labor markets maintain sustainability, making the Fed not in a hurry to ease monetary policy.

According to CME FedWatch tool, the market currently does not expect the Fed to cut interest rates before June.

Along with the Fed, the Bank of Canada will also announce a monetary policy decision, with interest rates forecast to continue to remain unchanged.

Meanwhile, data on manufacturing and consumer confidence are expected to create more volatility for the market at the beginning of next week.

See more news related to gold prices HERE...