Gold price developments last week

Gold prices recorded the second consecutive week of decline as optimism returned to larger markets, causing both individual and expert investors to gradually abandon expectations of price increases for this precious metal in the short term.

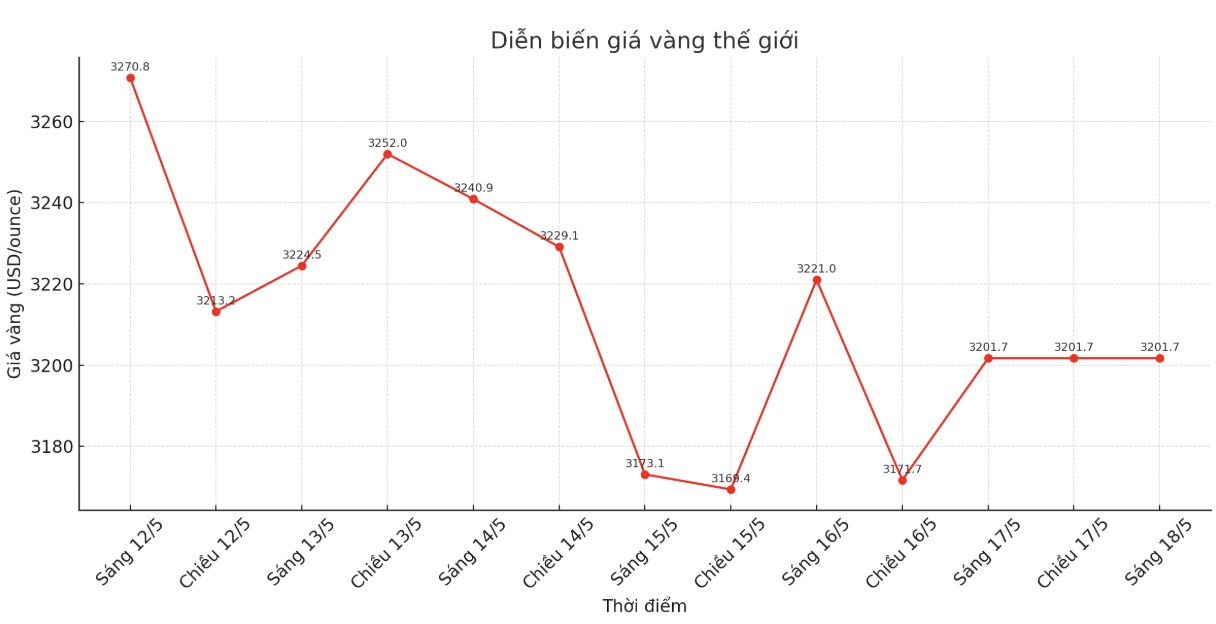

Opening the week at $3,281.36 an ounce, gold prices fluctuated in a narrow range until dawn when they suddenly plummeted at 2:45 a.m. (ET), falling rapidly from $3,277.53/ounce to $3,221.36/ounce in just 30 minutes.

At around 7am the same day, prices continued to fall to $3,208/ounce before stabilizing again and entering a sideways trend, fluctuating between $3,217/3,262/ounce.

The next sell-off took place on Wednesday morning, at 7:15 a.m., when spot gold prices fell from $3,237/ounce to below the support level of $3,200, hitting a bottom of nearly $3,180/ounce - considered an important turning point for the week.

Under selling pressure from the Asian session, gold prices continued to slide to the bottom of the week at 3,126 USD/ounce in the early morning of Thursday. However, buying momentum returned as it entered the European and North American sessions, dragging gold prices back above $3,250/ounce by the end of the day.

However, unsuccessful efforts to break the peak, along with failing to hold the near $3,220 support zone, caused gold prices to continue to plummet for the last time on Friday morning, reaching the lowest level of the day at $3,163/ounce at 7:45.

After that, the North American market tried to push prices back close to $3,200/ounce, but the increase was not strong enough to overcome this resistance zone before the weekend break.

Experts predict gold prices next week

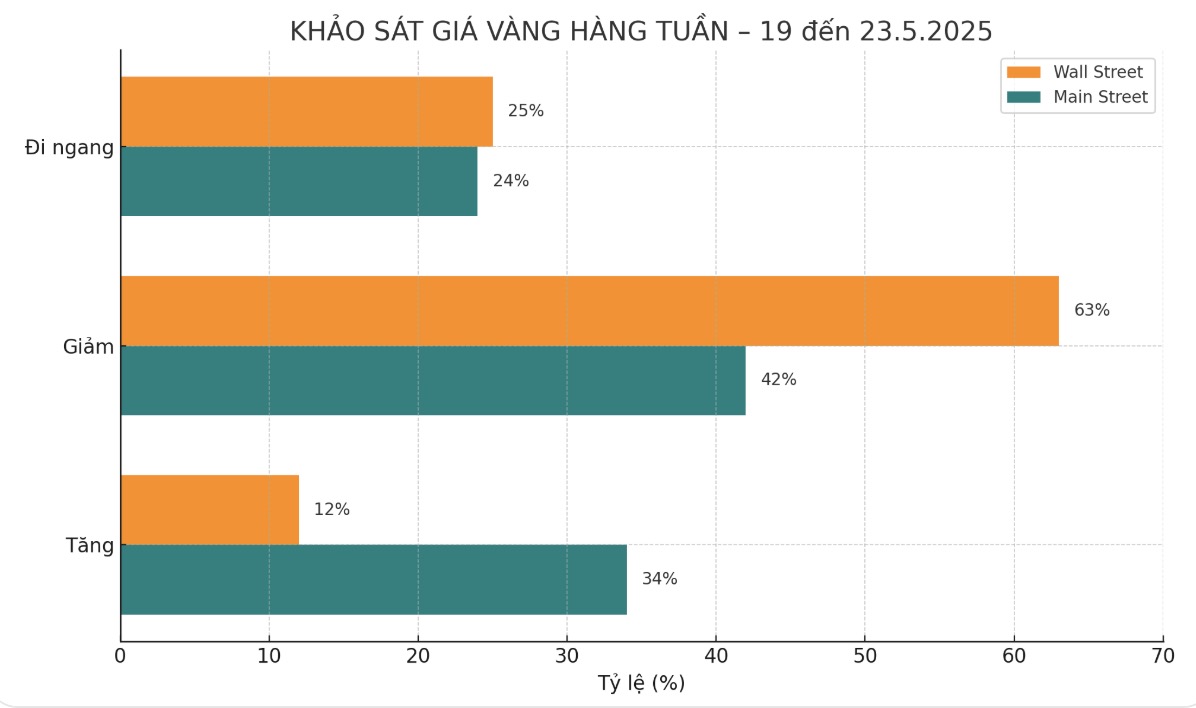

The latest weekly survey from Kitco News shows that experts are leaning towards pessimism. While individual investors are also gradually giving up the optimistic trend after a sharp decline in gold prices.

Of the 16 experts surveyed, only 2 (12) believe that gold prices will increase next week. Meanwhile, 10 people (63%) predict gold prices will continue to fall. The remaining four (25%) see prices moving sideways.

Thus, after a week of balanced opinions, Wall Street has leaning towards a negative trend towards gold's short-term prospects.

Meanwhile, 294 people participated in the online survey of Kitco. After two consecutive weeks of decline, individual investors have finally given up the optimistic assessment like many weeks ago.

There are still 100 people (34%) expecting gold prices to rise next week. 123 people (42%) predict prices will decrease. The remaining 71, or 24%, see gold prices moving sideways.

US economic calendar affects gold prices next week

After a week of rich economic data, next week will be quite quiet with only a few notable indicators released. In the first half of the week, the market will lack catalysts, but by Thursday, investors will monitor weekly jobless claims, S&P Global's preliminary PMI and existing home sales in April. There will be more data on new home sales on Friday.

In addition, the market will see a series of key statements from officials of the US Federal Reserve (FED), including Jefferson, Williams, Log logan, Kashkari, Barkin, Bostic, Collins, Musalem, Kugler, Daly and Hammack. Notably, FED Chairman Jerome Powell will speak on Sunday afternoon, which is considered the highlight of the weekend.

See more news related to gold prices HERE...