According to Kitco, gold prices increased as investors searched for alternative safe-haven assets in the context of growing concerns about the reliability of the USD and US bonds.

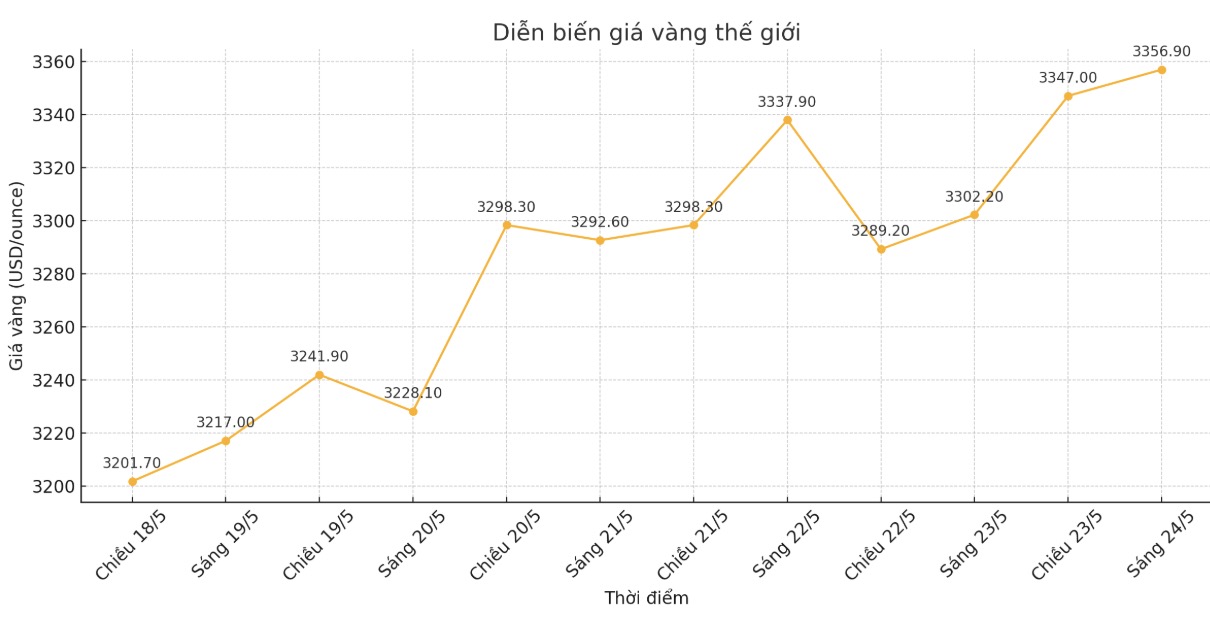

The uncertainty began late last week, after Moody's downgraded its credit rating on US debt. In the final minutes of the trading session of the week, gold prices have surpassed the initial resistance level of 3,200 USD/ounce. As of the end of this week, gold has regained its position above $3,300/ounce.

Gold prices also recorded an increase in safe-haven demand in midweek, after the US Treasury Department held a 20-year bond auction that did not meet expectations, causing a sharp decline in yield curves, with 30-year bond yields exceeding 5%.

At the same time, declining confidence in the US was also reflected in the USD, as the USD Index ended the week near the support level of 99 points - the lowest level in three weeks.

Chris Weston - Research Director of Pepperstone - wrote in a note on Friday: "Simply put, when the world is concerned about the US budget deficit, increased public debt, more bonds issued and high inflation, the increase in long-term bond interest rates and the declining yield curve are a bad signal for the USD and the US stock market. That is the reason why investors are looking for gold, even Bitcoin.

The front of the US long-term yield curve will still be the focus next week, along with some data such as PCE core inflation. However, the big focus will be demand in the auctions of 2, 5 and 7-year bonds, he said.

Not only benefiting from fluctuations in the US bond market, gold is also supported by rising Japanese bond yields, threatening to collapse "carry trade" with the yen - a factor that can cause liquidity problems globally.

Han Tan, Head of Market Analysis at FXTM, commented: The gold rally could stagnate if bond yields do not continue to increase strongly, and 30-year yields remain below 5%.

In the coming week, in addition to trade and geopolitical developments, investors will monitor signals from the FOMC meeting minutes, statements from FED officials and PCE data to adjust expectations for the rate cut roadmap. If the Fed signals more clearly about the possibility of resuming the rate cut cycle, gold prices could surpass the $3,000 - $3,500/ounce range.

Mr. Ole Hansen - Head of Commodity Strategy at Saxo Bank said that if gold breaks above the $3,355/ounce mark, this could mark the end of the short-term correction period. However, he warned that the sentiment in the bond market may be too negative.

What I am concerned about is that we have reached the peak of the negative sentiment about bonds, and that could trigger a wave of risk return, he said.

Some bond analysts believe that upcoming auctions could attract more investors, as demand for short terms remains strong.

In addition to the bond market, Hansen said gold could also attract safe-haven cash flow after US President Donald Trump threatened to increase import tariffs on European goods to 50% from June 1.

todays Trump threat to impose tariffs is a clear reminder that this trade war is not over yet, and the US will suffer economic consequences which is a positive for gold, he said.

In this context, analysts are also closely monitoring the developments of the USD, which is losing momentum.

Adam turnquist - Chief Technical Strategist at LPL Financial commented: "Cons concerns about trade, fiscal deficits and growth may be unclear in the stock market - which has recovered strongly since the bottom of April but they still affect the USD.

Over the past month, the US dollar struggled as more and more countries fell to rely on it, while the US was underperformed and forecast a rising budget deficit.

Currently, the USD is still weak. If the US dollar continues to fall and falls out of the current stable price zone, this will be a negative technical signal and could raise further concerns about the health of the US economy.