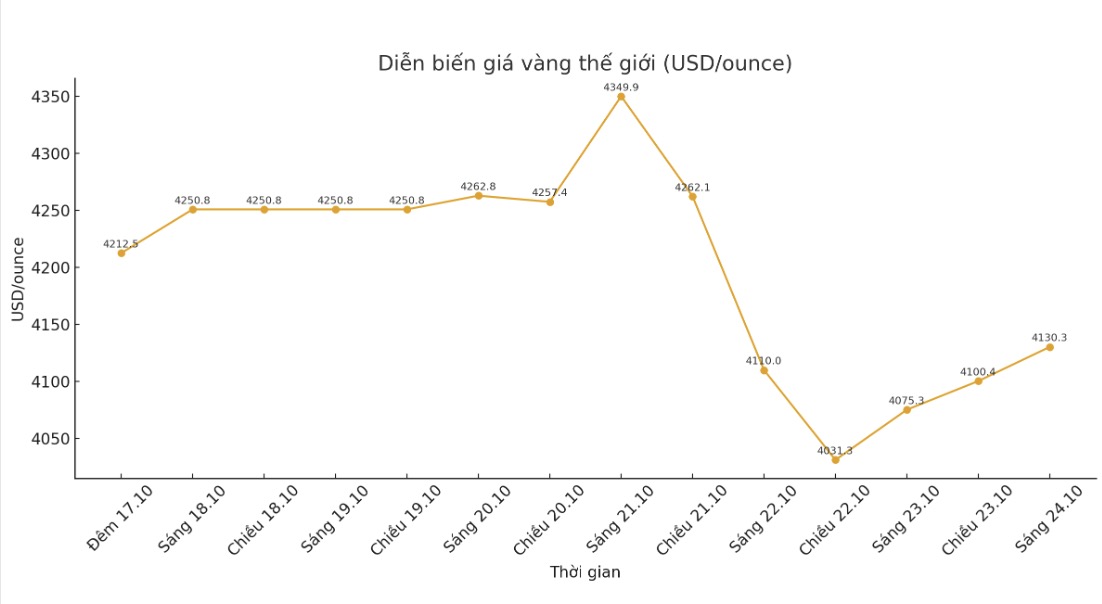

According to Jim Wyckoff - senior analyst at Kitco, world gold and silver prices rebounded as bottom-fishing buying pressure appeared after previous deep declines. The price fluctuations remain high, which if prolonged can be disadvantageous for investors expecting prices to increase.

As of noon on Thursday in the US, December gold price increased by 90.5 USD to 4,156.50 USD/ounce, while December silver price increased by 1.259 USD to 48.94 USD/ounce.

In another notable development, the platinum market saw its strongest increase since 2020. In London on the night of October 23, spot platinum prices increased by 6.4% to 1,646.03 USD/ounce at times. The gap between spot prices and futures expanded to 53.45 USD/ounce, up sharply compared to 28 USD in the previous session, showing increased demand for physical metal.

Mr. Dan Ghali - Senior Commodity Strategist at TD Securities - quoted by Bloomberg said that the platinum market is "seriously tightening with the extreme supply-demand imbalance, evoking the worry of a silver-like supply tightening scenario that once occurred".

On October 25, the US market will receive the September consumer price index (CPI) report - the first important economic data in the past three weeks. The CPI is forecast to increase by 3.1% over the same period, higher than the 2.9% increase in 8; the core CPI is expected to maintain the increase of 3.1%.

Technically, buyers still dominate the gold market in the short term. The next target is to break above the key resistance zone of $4,250/ounce, while the sellers aim to pull prices back below the psychological support level of $4,000/ounce.

The 4,175 - 4,200 USD/ounce area is a notable barrier. The levels of 4,100 USD/ounce and 4,079.6 USD/ounce played a near support role.

Silver also maintained a positive upward trend but faced great profit-taking pressure near the $50/ounce price range. The levels of 48 USD/ounce and 47.64 USD/ounce provided important support.

In the financial market, the USD index increased slightly. Crude oil prices continued to rise around $61.75/barrel, while the yield on the 10-year US Treasury note was around 4%.

The gold market is currently trading based on two parallel pricing mechanisms: spot price reflecting transactions with spot delivery, while term price reflects future delivery. Due to year-end liquidity factors, December gold contracts are the most traded product on the CME exchange.

See more news related to gold prices HERE...