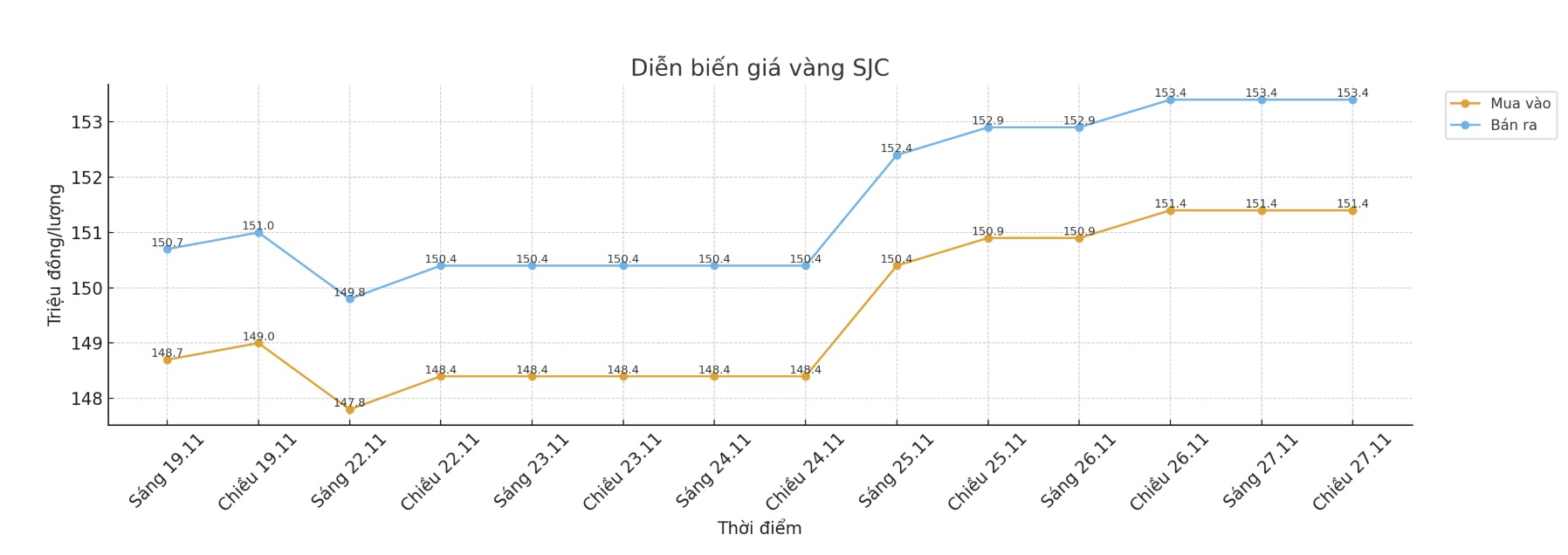

SJC gold bar price

As of 6:00 p.m., DOJI Group listed the price of SJC gold bars at VND151.4-153.4 million/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 151.9-153.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 150.9-153.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

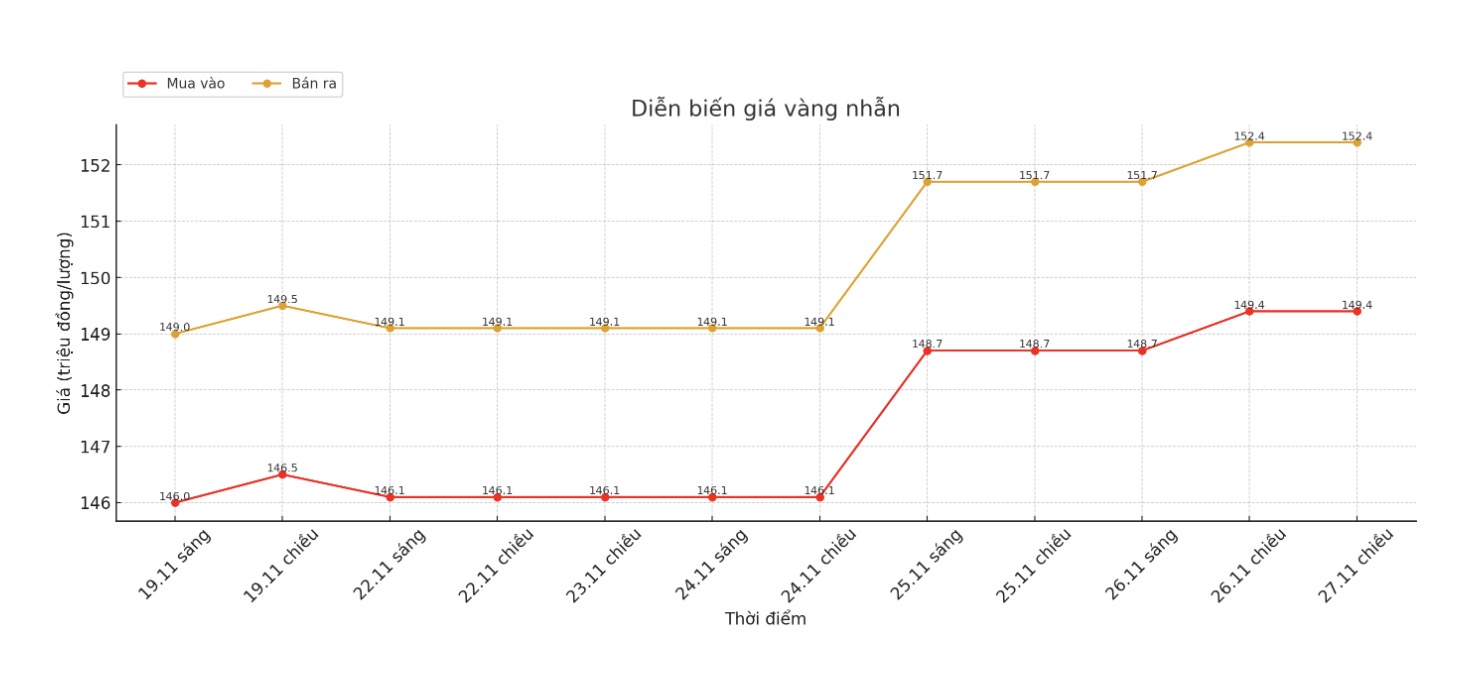

9999 gold ring price

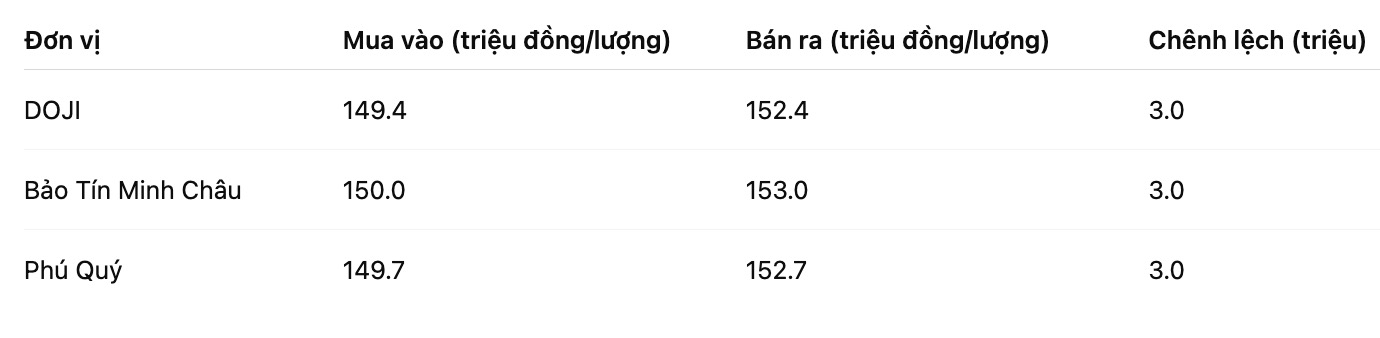

As of 6:00 p.m., DOJI Group listed the price of gold rings at 149.4-152.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 150-153 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 149.7-152.7 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

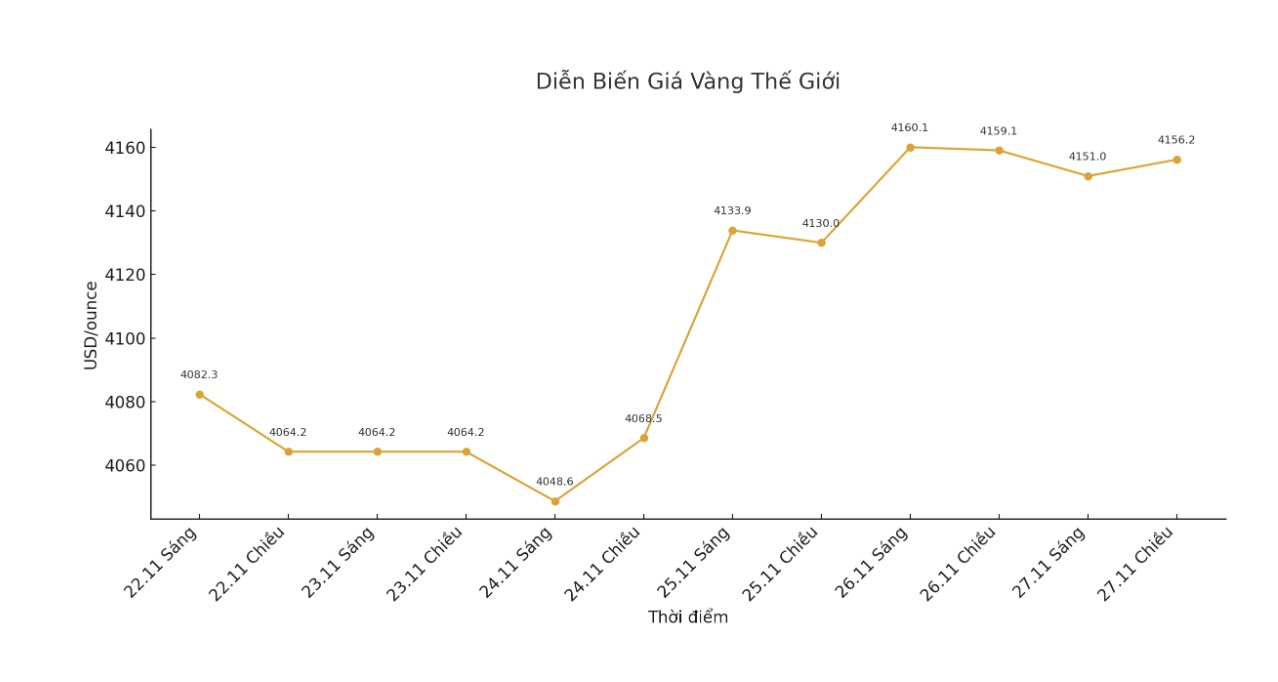

World gold price

The world gold price was listed at 6:02 p.m., at 4,156.2 USD/ounce, down 2.9 USD compared to a day ago.

Gold price forecast

Gold prices were steady in Thursday's session, remaining near a two-week high as investors assessed the possibility of the US Federal Reserve (Fed) cutting interest rates in December.

We still expect the accumulation phase that started with the October correction to continue, as the impact of that decline has not completely subsided, said Julius Baer analyst Carsten Menke.

Gold prices have fallen 5% since setting a record $4,381.21 on October 20, but are still generally trading above the $4,000/ounce mark.

Factors that support the overall gold market remain unchanged, including slowing US growth leading to lower interest rates and a weaker US dollar, stable safe-haven demand and strong gold purchases from central banks, Menke added.

Mixed signals from the Fed about the timing and scale of interest rate cuts have boosted protectionist flows into swap contracts and derivatives associated with overnight interest rates.

Kevin Hassett who emerged as the leading candidate to replace Jerome Powell as Fed Chairman has sided with former President Donald Trump in calling for a rate cut.

Meanwhile, speeches this week by San Francisco Fed President Mary Daly and Fed Governor Christopher Waller also reinforced expectations for a cut.

Traders are now pricing in an 85% chance of an Fed rate cut next month, up from 30% just a week ago, according to CME's FedWatch tool.

Gold - a non-yielding asset - often benefits in a low interest rate environment.

The US market will close on Thursday on Thanksgiving Day and operate with a shortened trading time on Friday.

For other metals, spot silver rose 0.9% to 53.82 USD/ounce, platinum rose 2.9% to 1,634.20 USD, and palladium rose 0.5% to 1,430.67 USD.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...