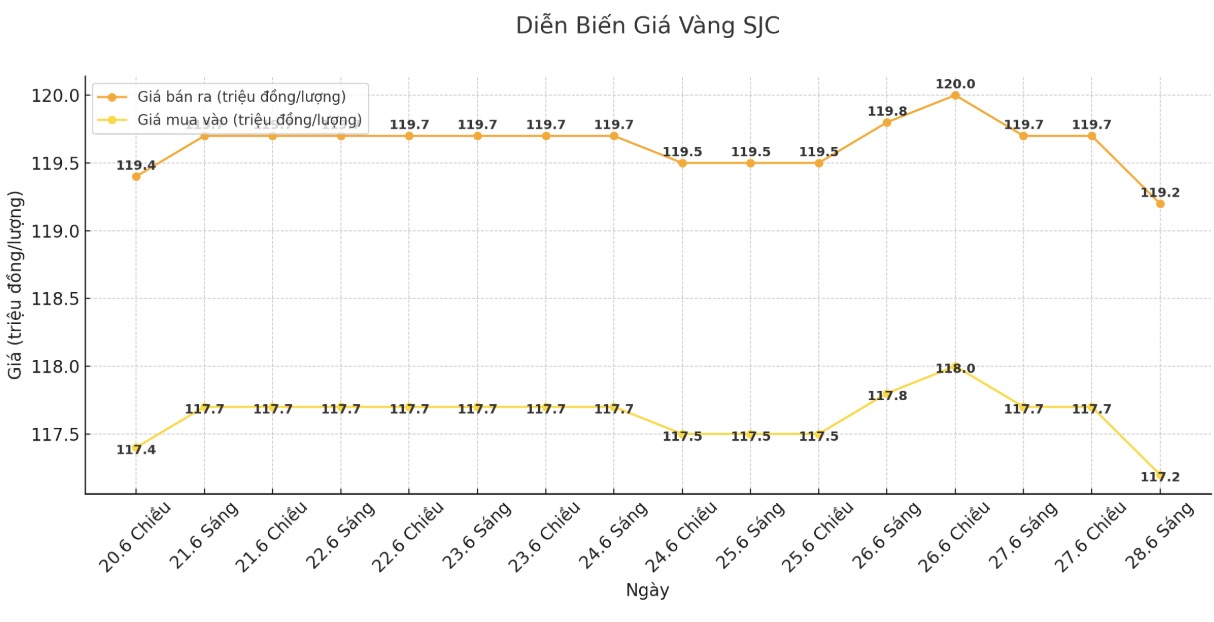

Updated SJC gold price

As of 9:30 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 117.2-119.2 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed the price of SJC gold bars at 117.2-119.2 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.2-119.2 million VND/tael (buy in - sell out), down 800,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 116.5-119.2 million VND/tael (buy - sell), down 700,000 VND/tael for buying and down 800,000 VND/tael for selling. The difference between buying and selling prices is at 2.7 million VND/tael.

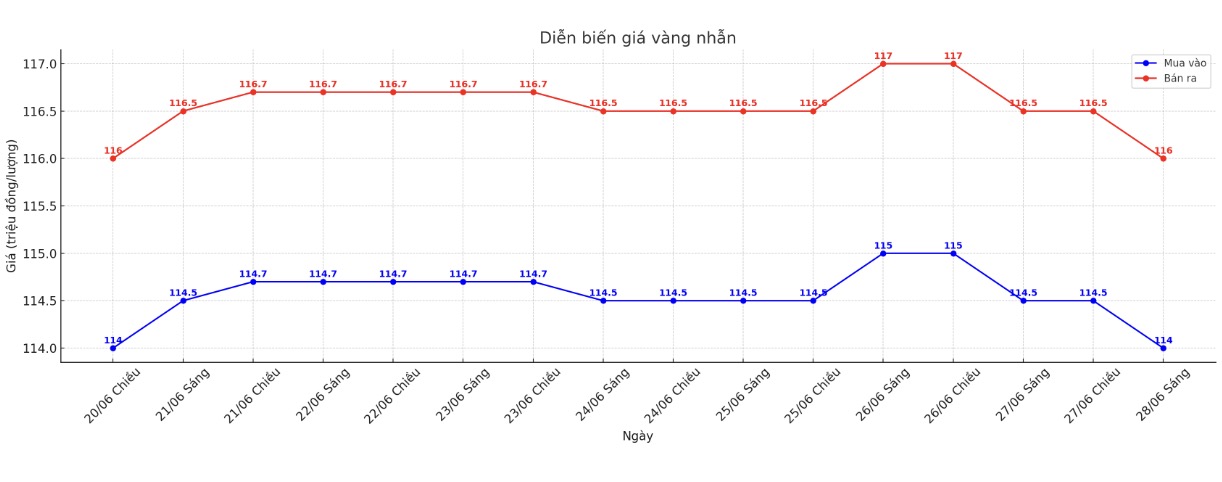

9999 round gold ring price

As of 9:30 a.m., DOJI Group listed the price of gold rings at 114-116 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114.1-117.1 million VND/tael (buy - sell), down 900,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.1-116.1 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

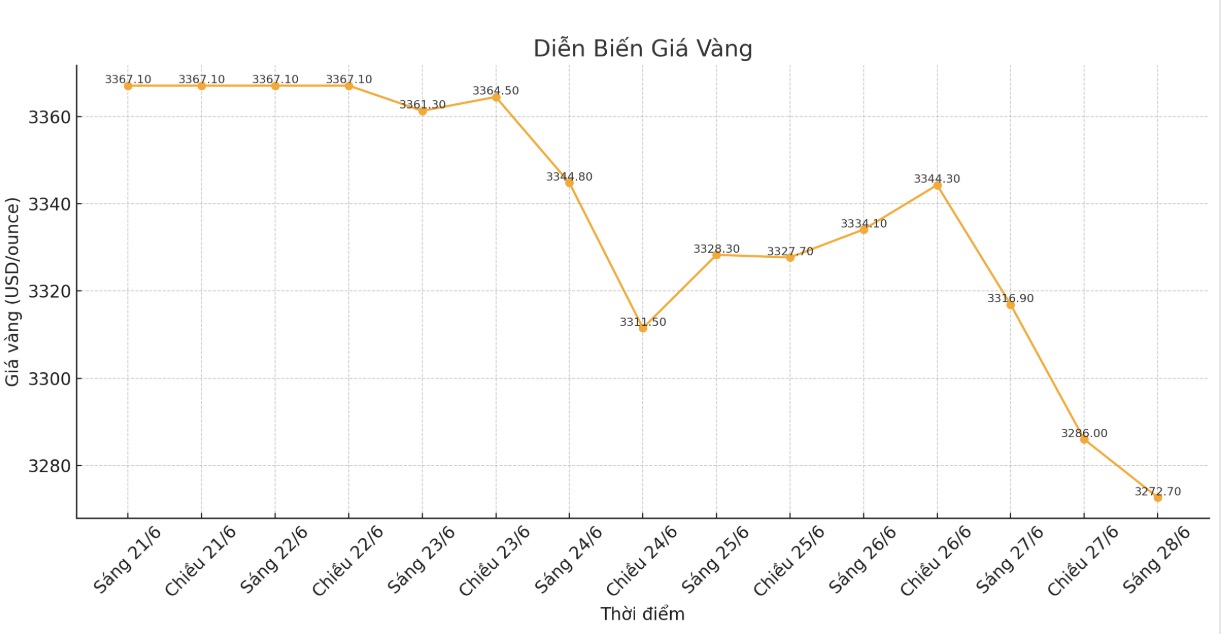

World gold price

At 9:35 a.m., the world gold price was listed around 3,272.7 USD/ounce, down 44.2 USD compared to 1 day ago.

Gold price forecast

The downward pressure on prices comes after the US announced it had signed a trade deal with China, weakening demand for safe-haven assets. In the Middle East, the ceasefire between Iran and Israel was maintained, despite some minor incidents on the first day of implementation.

Meanwhile, new data shows that US consumer spending unexpectedly decreased in May, as shopping demand evaded cooling taxes. Inflation remains under control, with the personal consumption expenditure (PCE) price index rising 2.7% over the past month.

These signals reinforce the forecast that the US Federal Reserve (FED) will only start its interest rate cut cycle from September. A low interest rate environment is often beneficial for gold - assets that do not bring fixed interest rates.

Jesse Colombo, an independent precious metals analyst and author of the Bubble Bubble report, said investors should prepare for a short-term downside scenario as the summer trading season begins next week with a long weekend on July 4.

Meanwhile, Lukman Otunuga - senior analyst at FXTM commented: With the US and China completing the trade framework and Israel/Iran respecting the ceasefire agreement, investors are rushing back on risk assets, withdrawing capital from safe havens. This market sentiment could put additional downward pressure on gold prices ahead of a new eventful week.

Notable US economic data next week

Tuesday: ISM manufacturing PMI, JOLTS number of vacant jobs

Wednesday: ADP Employment Report

Thursday: Non-agricultural employment, weekly jobless claims, ISM service PMI

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...