Jesse Colombo, an independent precious metals analyst and author of the Bubble Bubble report, said investors should prepare for a short-term downside scenario as the summer trading season begins next week with a long weekend on July 4.

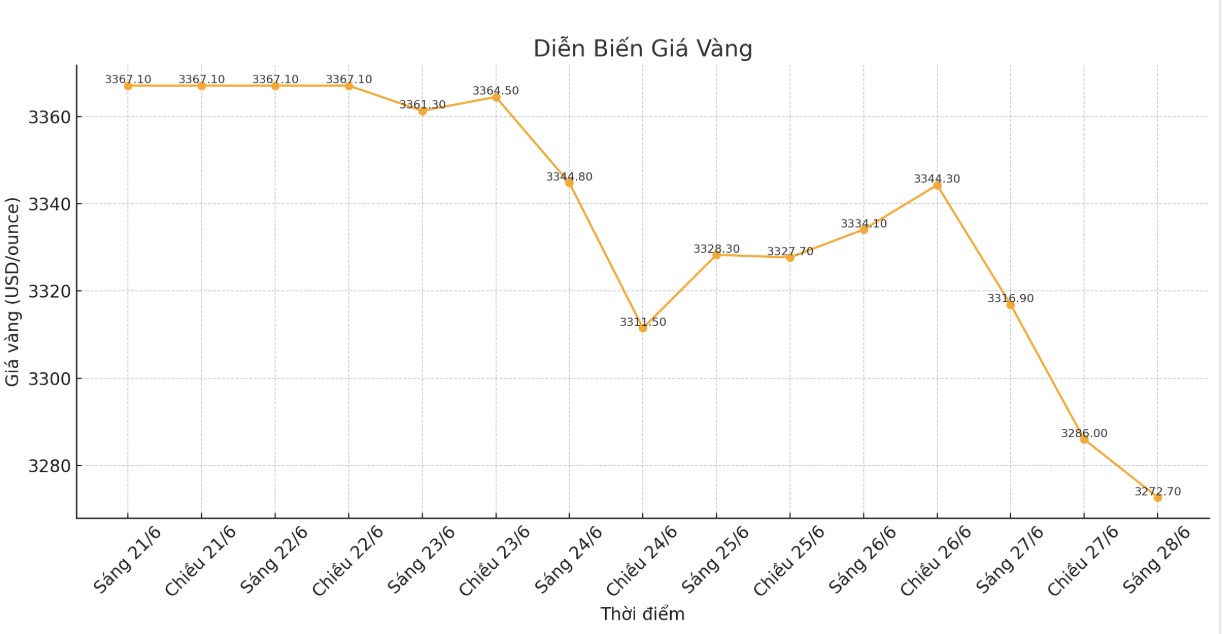

Colombo expects gold prices to remain within a wide range of $3,200 to $3,500/ounce. Gold prices have fallen nearly 3% for the week. Despite the decline, the precious metal still maintained the initial support level of 3,250 USD/ounce.

In addition to the seasonal factor, economic sentiment has improved as the US signals progress on trade agreements and a ceasefire between Israel and Iran to ease regional tensions.

With the US and China completing their trade framework and Israel/Iran respecting the ceasefire agreement, investors are rushing back on risky assets, withdrawing capital from safe havens. This market sentiment could put additional downward pressure on gold prices ahead of a new eventful week, said Lukman Otunuga, senior analyst at FXTM.

Overall, gold is getting negative, heading for the second consecutive week of decline. If it closes below $3,300/ounce for the week, prices could fall to $3,250/ounce and even the psychological mark of $3,200/ounce. Conversely, if it breaks above $3,300 an ounce again, gold could recover to $3,330 - $3,360/ounce, he added.

Despite the increased downward pressure, Colombo said gold is still supported by many factors. In addition to safe-haven demand, unsustainable increases in public debt and a return to growth in M2 money supply (total amount of money including cash, payment deposits and short-term savings in the economy) will continue to support global gold prices this summer.

Robert Minter - ETF Strategy Director at abrdn - also predicted that gold prices will continue to accumulate as the US Federal Reserve (FED) maintains a neutral monetary policy.

Last week, in a two-day hearing before the National Assembly, FED Chairman Jerome Powell stressed that the central bank was in no rush to cut interest rates due to uncertain inflation risks.

Currently, we have enough basis to wait for more information about the economic outlook before considering adjusting the policy, he said.

Minter added that the Fed will soon cut the federal funds rate, as two-year bond yields are about 80 basis points above the interest rate level.

Gold prices may still move sideways, but the next uptrend will come from traditional investment demand, as the Fed is likely to cut interest rates by at least 50 basis points before the end of the year, he said.

Despite the accumulation, Minter predicts gold will hold steady at prices above $3,000/ounce. The current price of gold is completely consistent with the scale of debt issuance, he said.

Some experts note that gold is not only attractive in the context of rising global government debt but also a protective barrier against the risk of decreasing purchasing power when the USD weakens.

The USD index is closing the week around a three-year low, testing new support at 97 points.

Naeem Aslam - Investment Director at Zaye Capital Markets - is still optimistic about gold as the USD continues to depreciate. Most investors are optimistic about the USD and expect a rate cut. If you look at the current gold price, it is clear that any other weakness is a buying opportunity. However, the return of risk-off sentiment can limit the increase, especially when there is no geopolitical tension" - he commented.

In a report released on Friday, Aaron Hill - market analyst at FP Markets - said he did not expect the USD to face significant selling pressure before the index fell to 96.5 points.

Although gold may continue to be under pressure, next week - with a shorter trading schedule - could see strong fluctuations due to major economic reports, including June non-farm payrolls data released early on Thursday, due to the National Day holiday on July 4.

Notable US economic data next week

Tuesday: ISM manufacturing PMI, JOLTS number of vacant jobs

Wednesday: ADP Employment Report

Thursday: Non-agricultural employment, weekly jobless claims, ISM service PMI