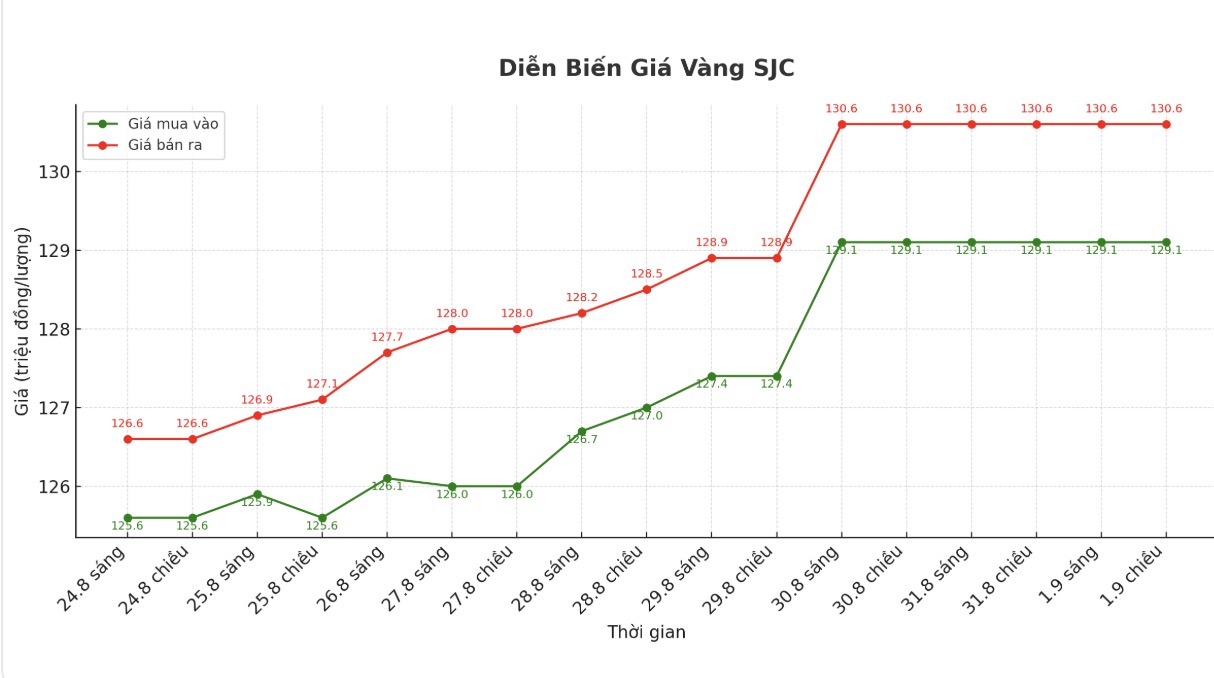

SJC gold bar price

As of 6:30 p.m., DOJI Group listed the price of SJC gold bars at 129.1-130.6 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 128.6-130.6 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 128.1-130.6 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2.5 million VND/tael.

9999 gold ring price

As of 6:30 p.m., DOJI Group listed the price of gold rings at 122.5-125.5 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 122.8-125.8 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 122.8-125.8 million VND/tael (buy - sell), an increase of 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

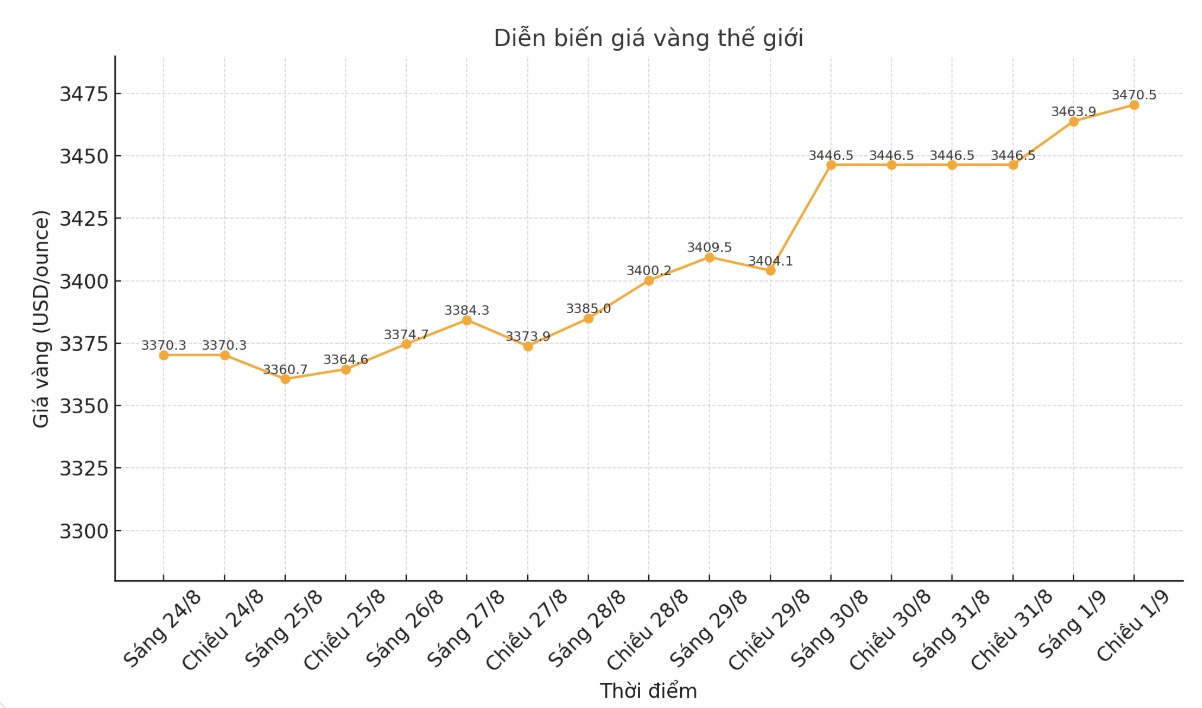

World gold price

The world gold price was listed at 6:30 p.m. at 3,470.5 USD/ounce, up 24 USD.

Gold price forecast

Michele Schneider - Strategy Director of Market Gauge said that the gold buying signal was activated after the "harmony" speech of the Chairman of the US Federal Reserve (FED) - Mr. Jerome Powell at the annual conference in Jackson Hole.

Mr. Powell acknowledged that the change in the risk balance in the economy could lead to a policy adjustment, and expressed little concern about dragging inflation back to 2%, focusing more on slowing growth and a weakening labor market.

Chris Zaccarelli - Investment Director of Northlight Asset Management commented that as long as the PPI and CPI report in early September did not suddenly increase, the FED would almost certainly cut by 0.25 percentage points.

Experts say the focus this week will be the August US jobs report, scheduled for release on September 6. A Bloomberg survey predicts that the US economy will only create 75,000 more jobs, with the unemployment rate increasing slightly - a sign that the labor market is cooling down.

FED Chairman Jerome Powell recently warned of labor risks, raising expectations that the FED will cut interest rates at the meeting on September 16-17. Lower interest rates are often beneficial for gold.

However, political instability in Washington is complicating the situation. President Donald Trump's public disclosure of a way to fire Fed Governor Lisa Cook has raised concerns about the independence of central banks. An emergency trial has been opened but a verdict has not yet been reached. Observers warn that any scenario that threatens the Fed's reputation could cause cash flow to seek gold as a safe haven.

In addition, US trade tensions continued to flare up after the federal appeal court ruled that Trump's global tariffs were "illegitimate", although it was still allowed to continue as the lawsuit continued. Previously, this tariff plan pushed gold prices closer to $3,500/ounce in April.

Although the long-term outlook remains positive thanks to expectations of monetary easing, many analysts warn that gold may adjust in the short term.

Gold prices are at a record high while the USD index is approaching the decision mark of 100 points. This is a threshold that could create a strong shake-up, said Prathamesh Mallya, head of commodity research at Indias leading financial services company Angel One.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...