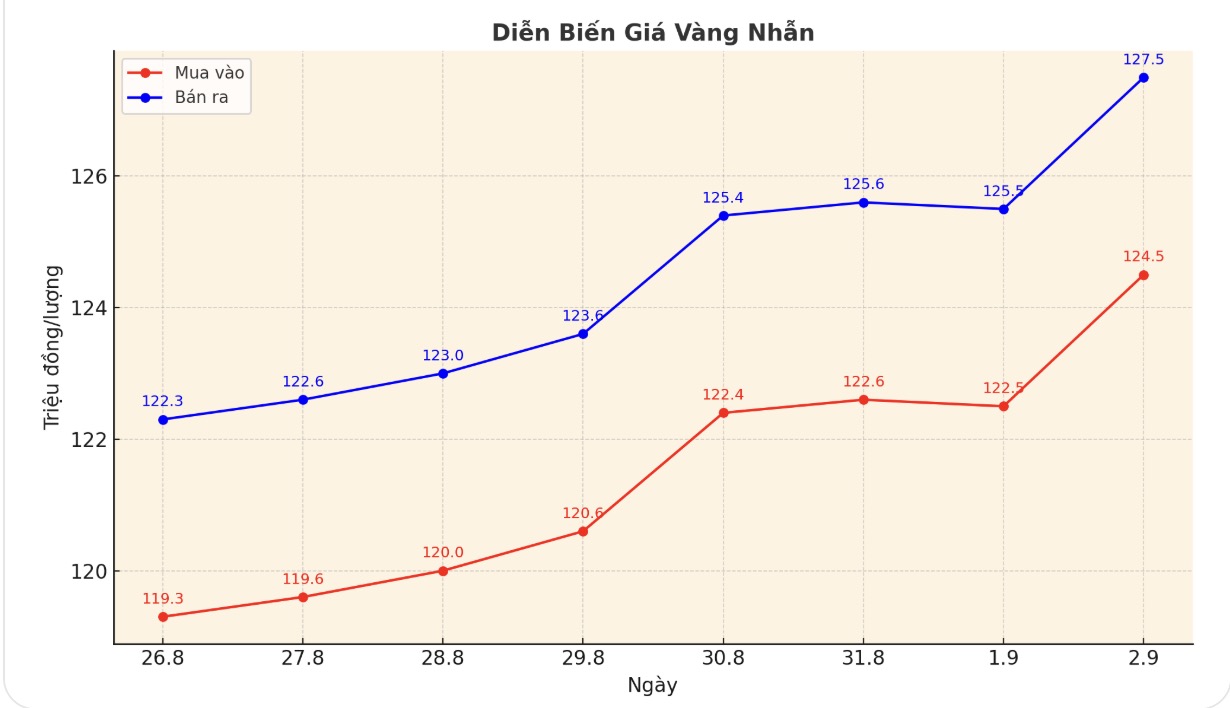

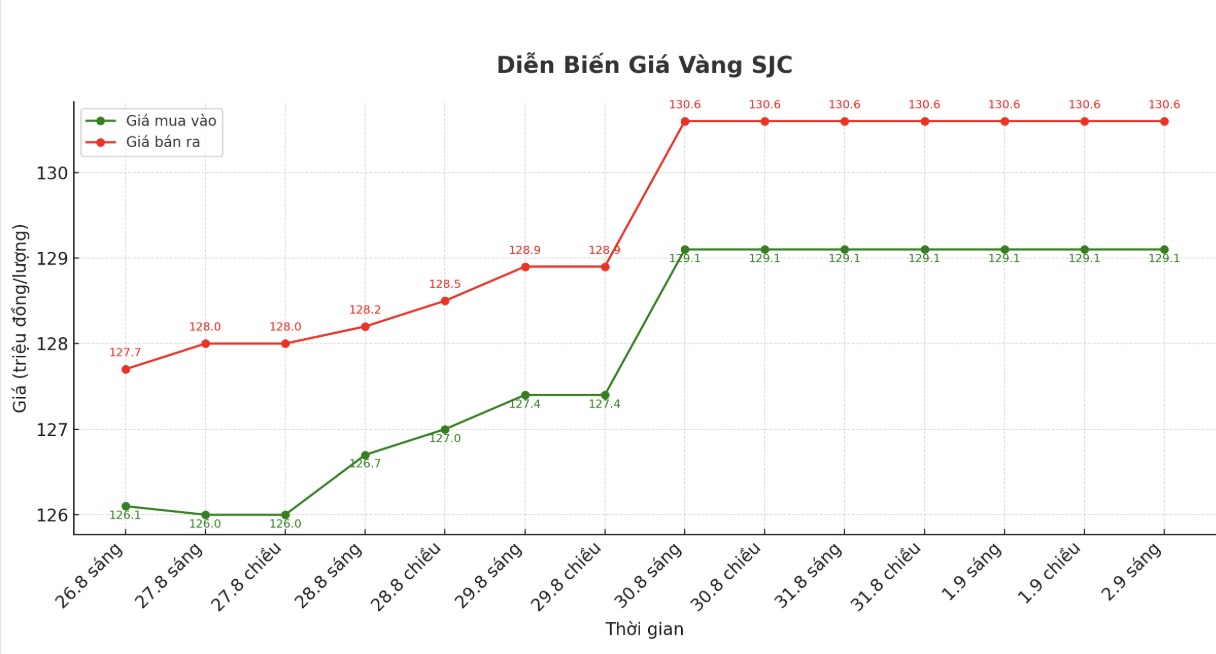

This morning, September 2, businesses simultaneously adjusted the price of gold rings to increase sharply from 1.8 to 2 million VND/tael, bringing the price level to around 124.5-127.5 million VND/tael.

In just one week, the price of gold rings at DOJI Group has increased by 5.2 million VND/tael for both buying and selling. Bao Tin Minh Chau was even stronger when adjusting the price to increase by 5.5 million VND/tael.

The reason for the soaring increase in gold rings in particular and the domestic gold market in general is due to the resonance between the upward momentum of world prices. In just 7 days, world gold has skyrocketed by 117.2 USD, from 3,374.7 USD/ounce to 3,491.9 USD/ounce. However, the domestic increase is significantly higher.

Partly due to domestic supply and demand factors. Limited supply while demand for storage increases, causing large fluctuations and prices to be pushed up rapidly.

Although the Government has issued Decree 232/2025/ND-CP, officially ending the monopoly mechanism in the production of gold bars, exporting and importing raw gold, the market is still reacting mainly according to psychology and expectations.

Mr. Nguyen Quang Huy, CEO of the Faculty of Finance - Banking (Nguyen Trai University) analyzed: "Abusing monopoly and allowing commercial banks to participate in the production of gold bars has strategic significance, contributing to creating competition, diversifying supply and moving towards a more stable market. However, these impacts have not been shown in the short term.

The licensing, building of the chain, organizing supervision and especially building social trust takes a period of time. During this period, the market sentiment of " rare gold - price will increase" is still strong, causing prices to continue to escalate and the buying - selling gap is widespread".

Plain gold rings are a familiar accumulation investment channel for many people thanks to their ability to keep prices and make transactions easier. In the context of difficulty accessing gold bars, the trend of buying gold rings is even stronger, contributing to the skyrocketing price in recent sessions.

The fact that gold prices increase too quickly in a short time poses a potential risk to investors buying at high prices. The buy-sell gap is widening, which can cause buyers to lose money right from the start of the transaction.

In addition, domestic gold prices are currently fluctuating more strongly than in the world, so if the international market has a correction, the risk of domestic price declines will be even greater.

At this time, instead of chasing the " price to increase further" mentality, investors should carefully consider their goals and financial capabilities, and should only allocate a reasonable part to gold rings to accumulate long-term. In the short term, be careful with surfing, because strong fluctuations can bring profits but can also easily cause quick losses.

See more news related to gold prices HERE...