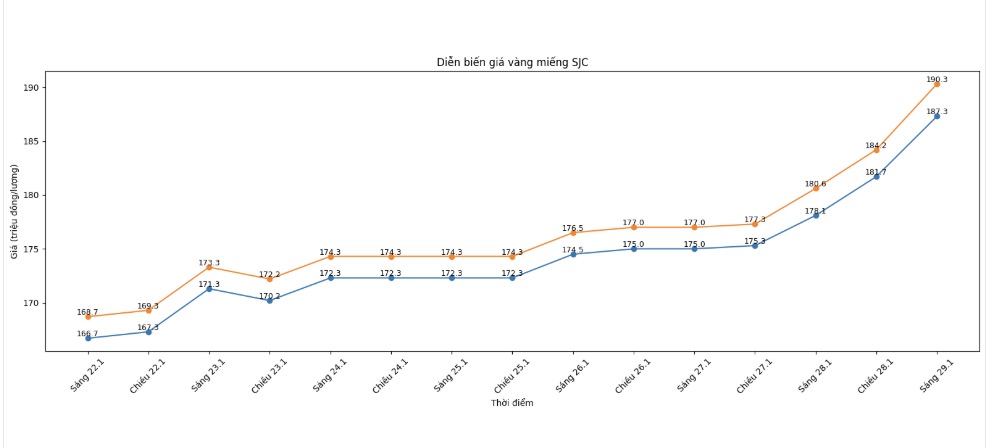

SJC gold bar price

As of 9:10 am, SJC gold bar prices were listed by DOJI Group at the threshold of 187.3-190.3 million VND/tael (buying - selling), an increase of 9.2 million VND/tael on the buying side and an increase of 9.7 million VND/tael on the selling side. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 187.2-190.2 million VND/tael (buying - selling), an increase of 9.6 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at the threshold of 187.3-190.3 million VND/tael (buying - selling), an increase of 9.8 million VND/tael on the buying side and an increase of 9.7 million VND/tael on the selling side. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

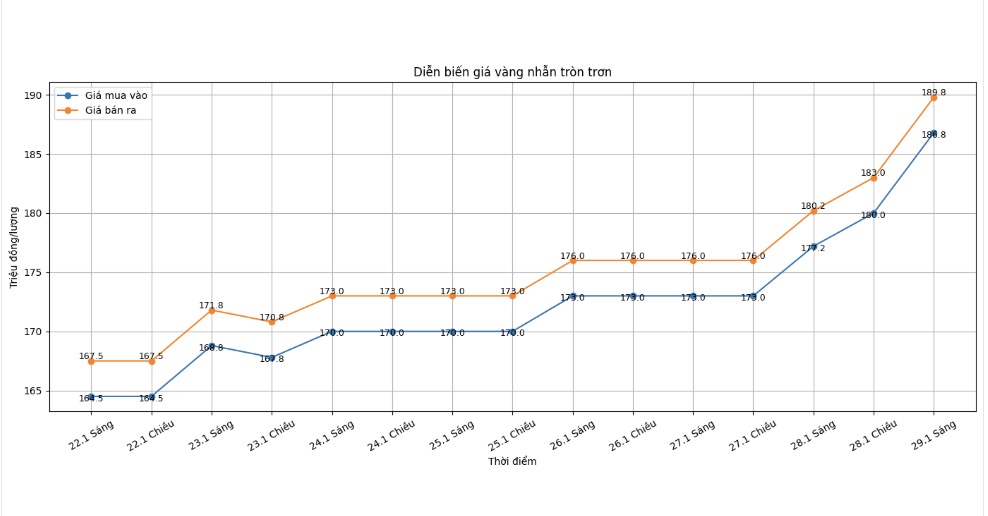

9999 gold ring price

As of 9:10 am, DOJI Group listed the price of gold rings at 186.8-189.8 million VND/tael (buying - selling), an increase of 9.6 million VND/tael in both directions compared to the previous day. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 187.2-190.2 million VND/tael (buying - selling), an increase of 9.6 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 187.3-190.3 million VND/tael (buying - selling), an increase of 10 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Currently, the buying - selling price difference of gold is at a very high level, around 2 to 3 million VND/tael, posing a risk of losses for investors.

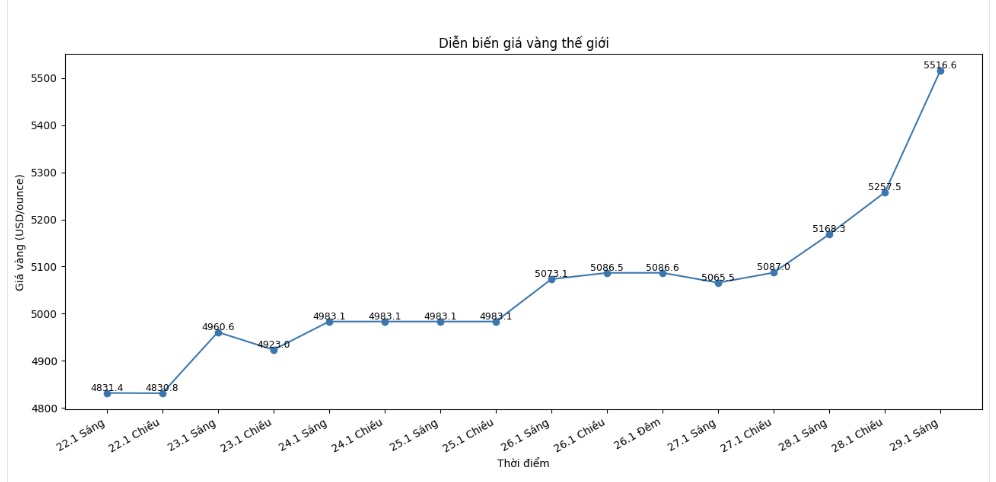

World gold price

At 9:20 am, world gold prices were listed around the threshold of 5,516.6 USD/ounce, a sharp increase of 310 USD compared to the previous day.

Gold price forecast

The sharp increase in world gold prices in recent sessions is mainly due to the prolonged weakening of the USD, along with increasing risk-prevention sentiment in the global financial market. The USD index has continuously fallen into new lows for many years, making gold – an asset valued in USD – more attractive to international investors.

Besides the exchange rate factor, a series of geopolitical and economic policy instabilities are also driving cash flow to gold. Escalating tensions in the Middle East, along with tough US trade and tariff declarations, are increasing concerns about macroeconomic risks, thereby strengthening the safe haven role of precious metals.

Another important reason is the change in the global reserve structure and investment portfolio. The process of reducing dependence on the USD is taking place clearly in many economies, leading to the demand for gold accumulation of central banks and major financial institutions. This development makes demand for gold not only short-term, but tends to be more sustainable.

Ms. Julia Khandoshko - Managing Director of Mind Money, said that the current increase in gold reflects erosion of confidence in legal tender. According to her, although gold may be under short-term correction pressure, fundamental factors such as global currency easing, US public debt risk and geopolitical instability are still supporting the long-term upward trend of the precious metal.

Meanwhile, Mr. Aaron Hill - Head of Market Analysis at FP Markets, warned that the strong weakening of the USD could lead to inflationary pressure and make the gold market fluctuate more strongly. He believes that gold is being strongly bought as a risk hedging tool, but investors need to be cautious about the possibility of correction phases when prices continuously hit new peaks.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...