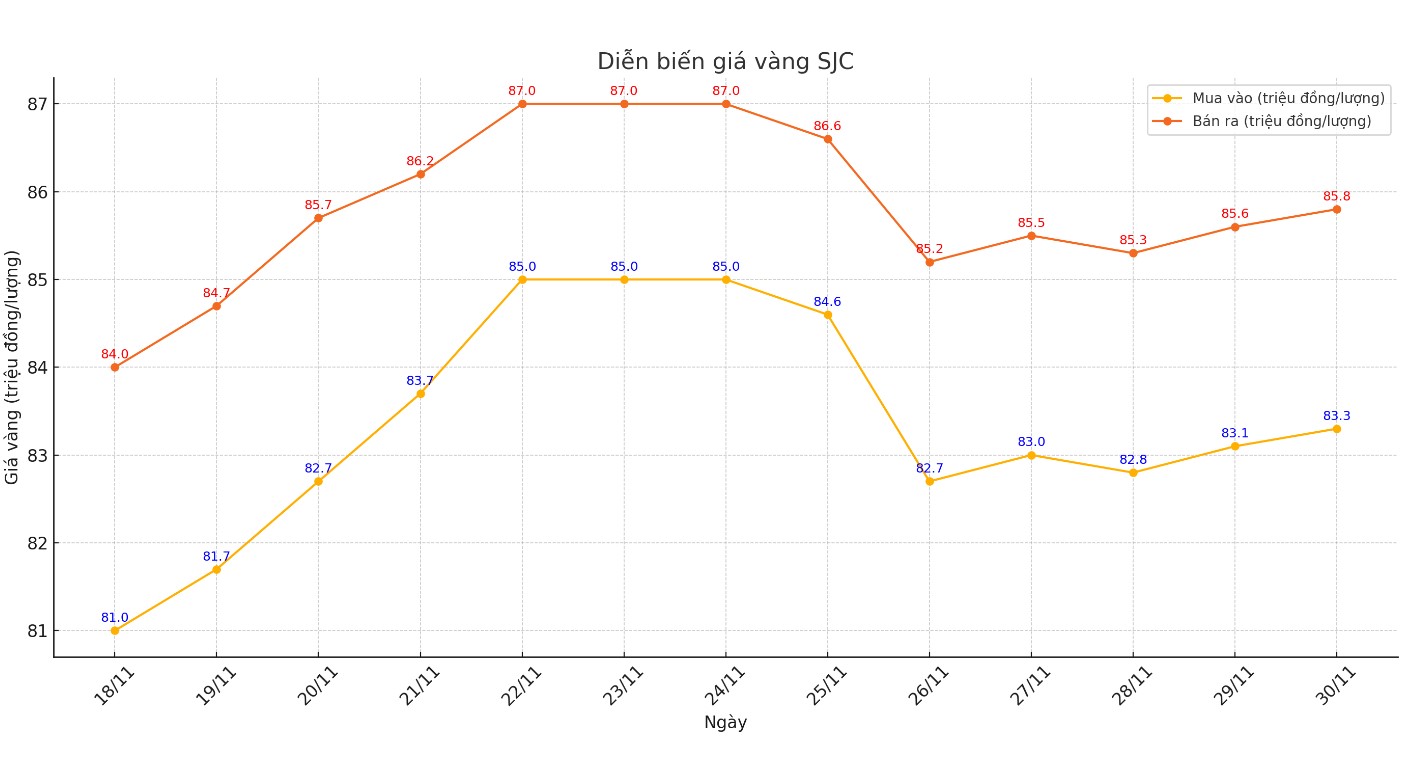

Update SJC gold price

As of 6:15 p.m., DOJI Group listed the price of SJC gold bars at 83.3-85.8 million VND/tael (buy - sell).

Compared to the close of the previous trading session, gold prices at DOJI remained unchanged in both buying and selling directions.

The difference between buying and selling price of SJC gold at DOJI Group is at 2.5 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 83.3-85.8 million VND/tael (buy - sell).

Compared to the previous trading session, the gold price at Saigon Jewelry Company SJC remained unchanged in both buying and selling directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 83.3-85.8 million VND/tael (buy - sell), unchanged.

Compared to the previous trading session, gold prices at Bao Tin Minh Chau remained unchanged in both buying and selling directions.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2.5 million VND/tael.

The difference between buying and selling gold prices is listed at around 2 million VND/tael. Although it has decreased compared to the previous trading session, this difference is still very high.

This price difference is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make profits, especially in the short term.

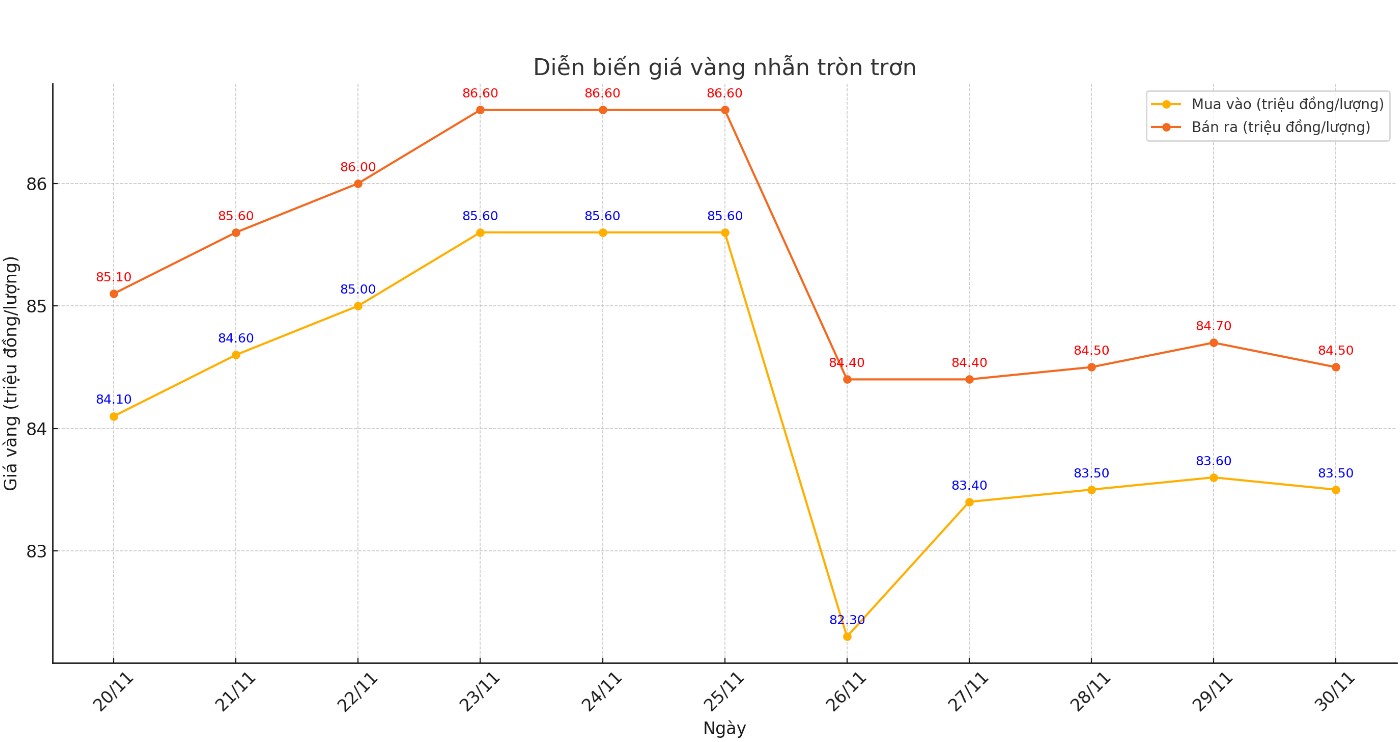

Price of round gold ring 9999

As of 6:15 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.5-84.5 million VND/tael (buy - sell), down 300,000 VND/tael for both buying and selling compared to the close of the previous trading session.

Bao Tin Minh Chau listed the price of gold rings at 83.68-84.78 million VND/tael (buy - sell); unchanged in both buying and selling directions.

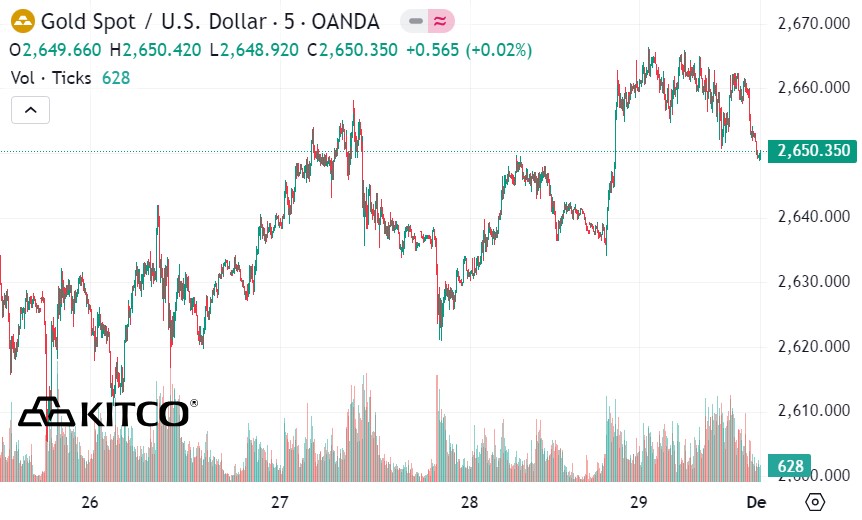

World gold price

As of 6:30 p.m., the world gold price listed on Kitco was at 2,650.3 USD/ounce, down 12.1 USD/ounce compared to the close of the previous trading session.

Gold Price Forecast

World gold prices fell despite the decline in the USD index. Recorded at 6:15 p.m. on November 30, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 105.830 points (down 0.21%).

Although the precious metal has proven resilient, holding key support at $2,600 an ounce, the market is still on edge as investors and traders await new information.

Experts say that changes in the global geopolitical landscape will be an important factor affecting gold prices. In particular, as President-elect Donald Trump continues to make policies and statements on social media, market sentiment becomes increasingly unpredictable.

The world could be just one post away from starting a new trade war on Platform X (formerly Twitter), which economists predict could lead to higher inflation and stunt economic growth, according to Kitco News analyst Neils Christensen.

The US economy is currently in a “just right” state – not too hot and not too cold. This “warm” environment does not provide much incentive for gold as a safe haven asset.

While the gold market will be difficult to navigate, analysts say the volatility could create buying opportunities for investors who missed out on this year's rally.

While many analysts have temporarily stood on the sidelines as the uncertainty subsides, the long-term sentiment remains bullish, with a growing number of analysts expecting gold prices to hit $3,000 an ounce next year.

See more news related to gold prices HERE...