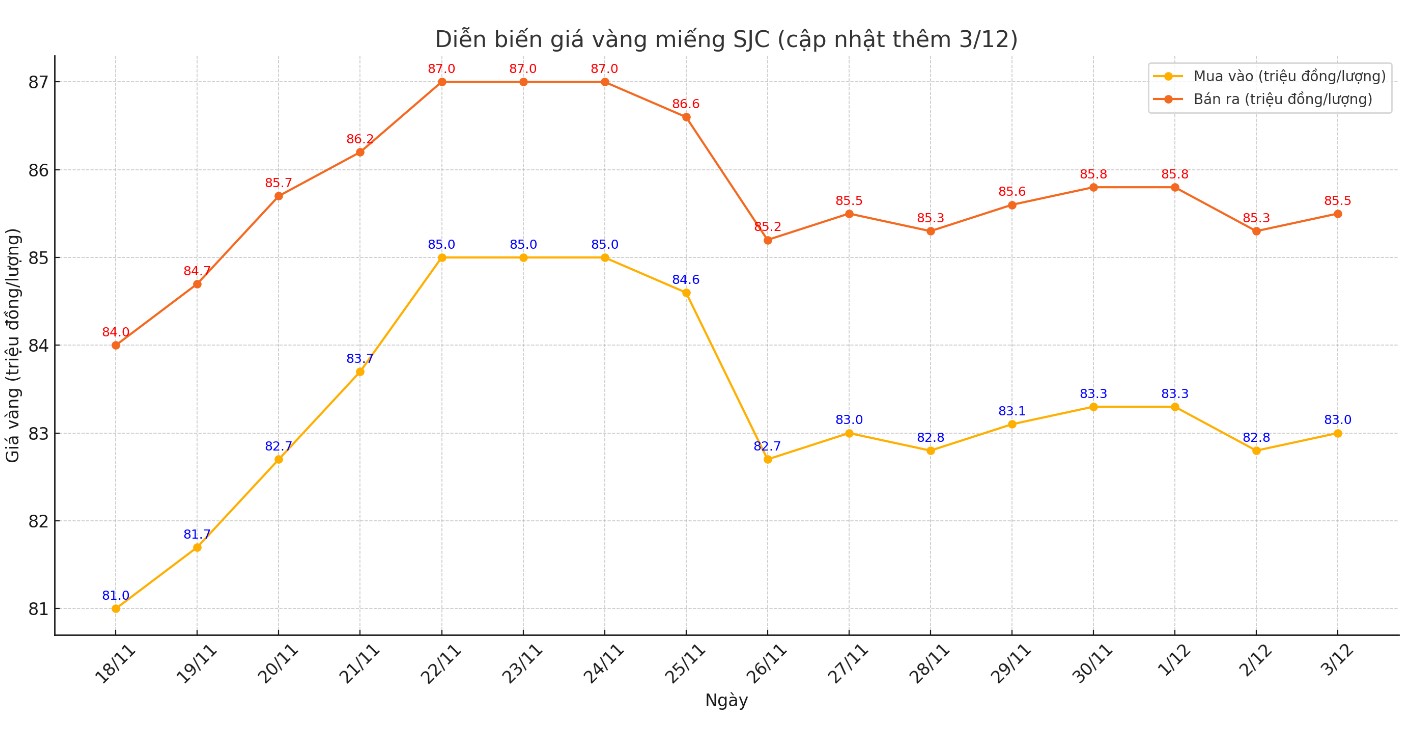

Update SJC gold price

As of 6:15 p.m., DOJI Group listed the price of SJC gold bars at 83-85.5 million VND/tael (buy - sell).

The difference between buying and selling price of SJC gold at DOJI Group is at 2.5 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 83-85.5 million VND/tael (buy - sell).

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 83-85.5 million VND/tael (buy - sell), unchanged.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2.5 million VND/tael.

The difference between buying and selling gold prices is listed at around 2 million VND/tael. Although it has decreased compared to the previous trading session, this difference is still very high.

This price difference is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make profits, especially in the short term.

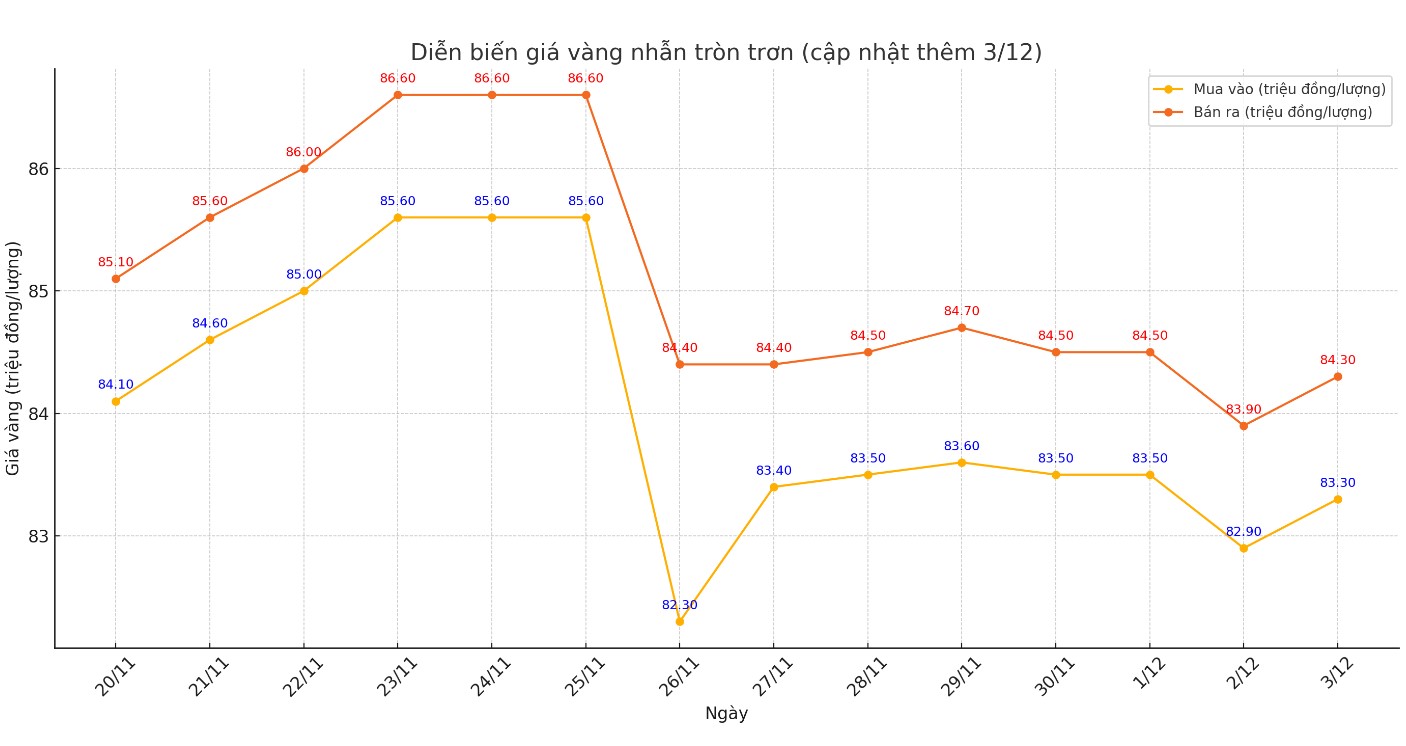

Price of round gold ring 9999

As of 6:15 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.3-84.3 million VND/tael (buy - sell); an increase of 400,000 VND/tael for both buying and selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 83.28-84.38 million VND/tael (buy - sell); increased by 200,000 VND/tael for buying and increased by 100,000 VND/tael for selling.

According to Lao Dong reporters in Hanoi, buying gold rings is still difficult because stores limit the quantity sold. At a gold shop on Tran Nhan Tong Street, many people lined up early to wait to buy gold rings. However, many customers said that buying gold rings is very difficult at this time.

An employee at a gold shop on Tran Nhan Tong Street said: “Currently, gold rings are very scarce. We cannot announce the opening date yet. However, for those who want to sell gold rings, the shop is still buying normally.”

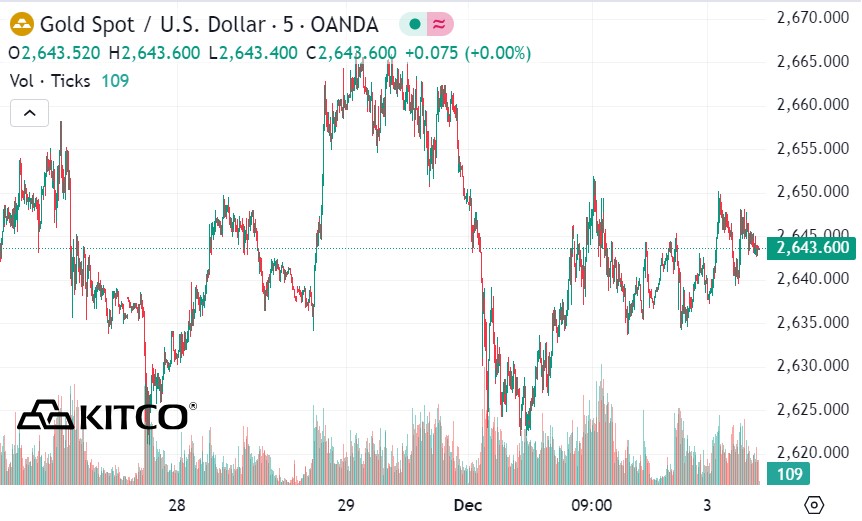

World gold price

As of 6:15 p.m., the world gold price listed on Kitco was at 2,643.6 USD/ounce, up 8.1 USD/ounce compared to the close of the previous trading session.

Gold Price Forecast

World gold prices increased in the context of the USD index decreasing. Recorded at 6:15 p.m. on December 3, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 106.235 points (down 0.18%).

Gold tends to appreciate in low interest rate environments and during times of geopolitical uncertainty.

“The next big event will be Friday’s payrolls report as it will give us a sense of whether the Federal Reserve is actually giving the green light to cut interest rates in the coming weeks,” said Kyle Rodda, a financial markets analyst at Capital.com.

FED Governor Christopher Waller has just said that with inflation forecast to remain at 2%, he is likely to support another interest rate cut later this month. The market expects a nearly 75% chance that the FED will cut interest rates at its meeting on December 17-18.

Analysts at Saxo Bank said the market is still trading in a narrow range, with expectations for fresh US economic data and more clarity on the possibility of a rate cut. The recently released US personal consumption expenditure (PCE) index for October rose 2.3% year-on-year, complicating the Fed’s decision-making process.

The CME FedWatch tool shows that market sentiment is quite interesting, with a 74.5% probability of a 25 basis point rate cut at the upcoming meeting. That's up from 52.3% last week, though down from 83% a month ago. At the same time, expectations for keeping rates unchanged have also been adjusted accordingly.

See more news related to gold prices HERE...