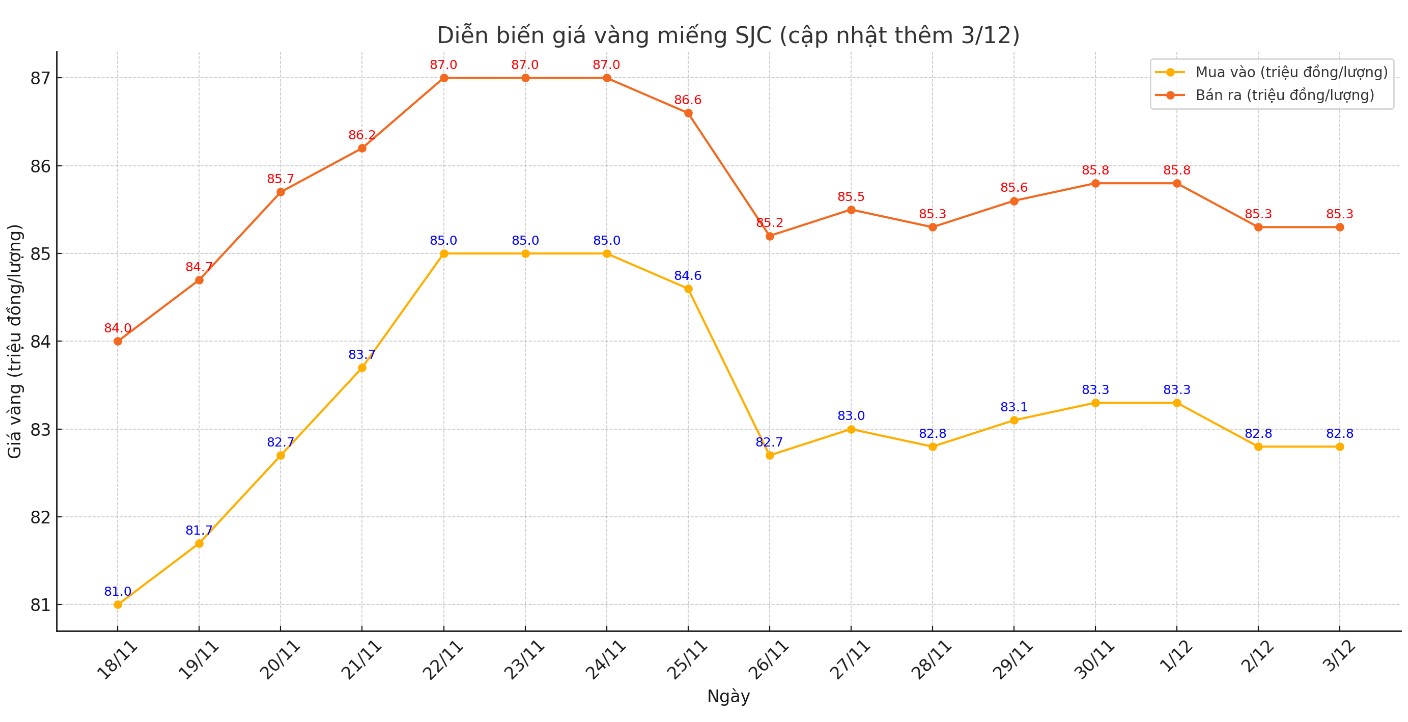

Update SJC gold price

As of 9:00 a.m., the price of SJC gold bars listed by DOJI Group was at 82.8-85.3 million VND/tael (buy - sell); unchanged from the opening price of yesterday morning's trading session.

The difference between buying and selling price of SJC gold at DOJI Group is at 2.5 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 82.8-85.3 million VND/tael (buy - sell); unchanged from the opening price of yesterday morning's trading session.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 82.8-85.3 million VND/tael (buy - sell); unchanged in both directions compared to the opening of the trading session yesterday morning.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2.5 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2.5 million VND/tael. Experts say this difference is still very high, causing investors to face the risk of losing money when buying in the short term.

This price difference is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make profits, especially in the short term.

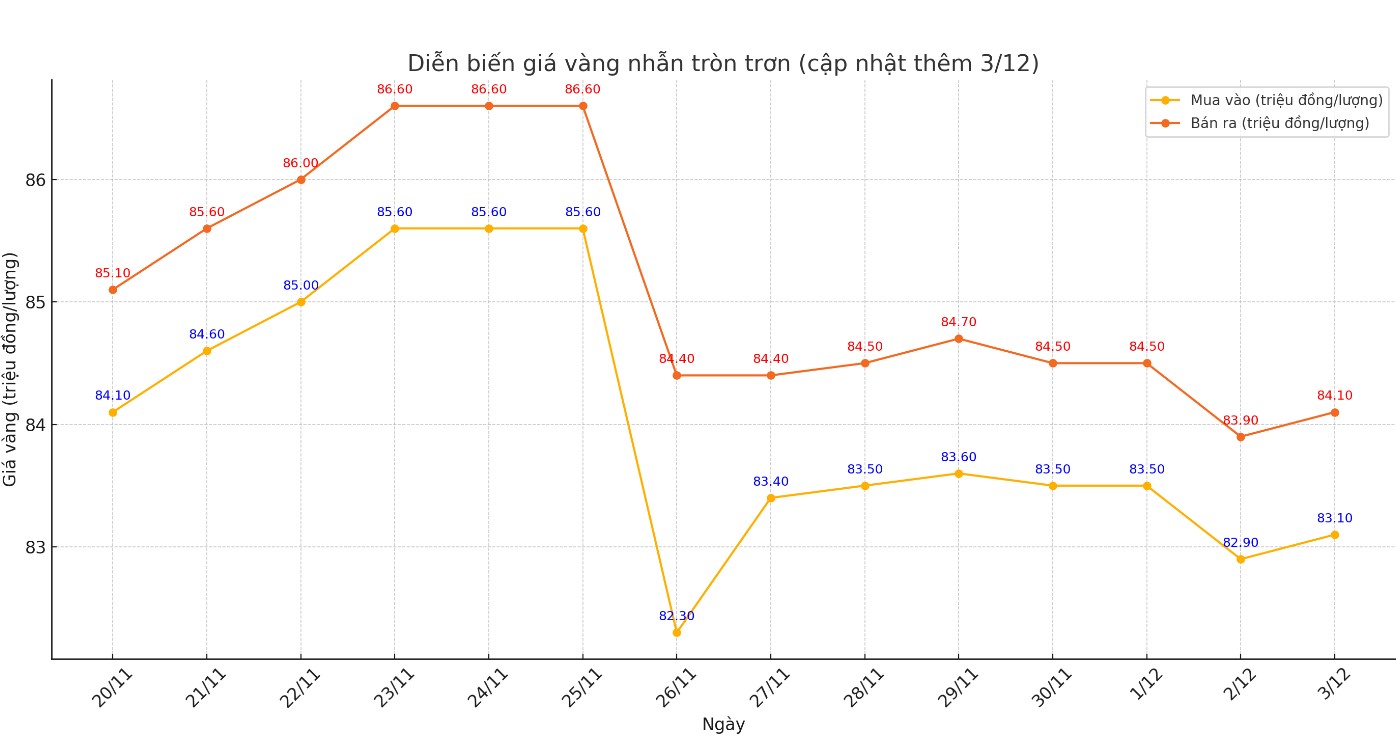

Price of round gold ring 9999

As of 9:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.1-84.1 million VND/tael (buy - sell); an increase of 200,000 VND/tael for both buying and selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 83.18-84.28 million VND/tael (buy - sell), down 500,000 VND/tael for both buying and selling compared to early this morning.

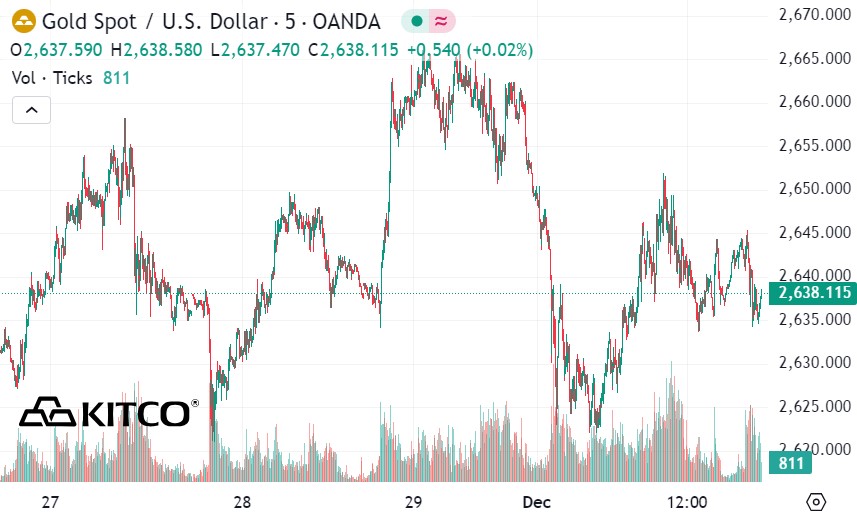

World gold price

As of 9:50 a.m., the world gold price listed on Kitco was at 2,638.1 USD/ounce, up 0.4 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices remained unchanged as the US dollar continued to strengthen. At 9:55 a.m. on December 3, the US Dollar Index, which measures the greenback's movements against six major currencies, stood at 106.484 points (up 0.09%).

According to Kitco - Gold prices are struggling with the strong rise of the US dollar. This could be reinforced by increased activity in the US manufacturing sector.

The CME FedWatch tool shows that market sentiment is quite interesting, with a 74.5% probability of a 25 basis point rate cut at the upcoming meeting. That's up from 52.3% last week, though down from 83% a month ago. At the same time, expectations for keeping rates unchanged have also been adjusted accordingly.

The Institute for Supply Management (ISM) said on Monday that its manufacturing Purchasing Managers' Index (PMI) rose to 48.4, up from 46.5 in October. While the sector remained in contraction territory, the headline figure was better than expected, with consensus forecasts expecting the index to rise to 47.7.

Analysts at Saxo Bank noted that the market is still trading in a narrow range, with expectations for fresh US economic data and more clarity on the possibility of a rate cut. The recently released US personal consumption expenditure (PCE) index for October rose 2.3% year-on-year, complicating the Fed’s decision-making process.

The CME FedWatch tool shows that market sentiment is quite interesting, with a 74.5% probability of a 25 basis point rate cut at the upcoming meeting. That's up from 52.3% last week, though down from 83% a month ago. At the same time, expectations for keeping rates unchanged have also been adjusted accordingly.

Marc Chandler - CEO of Bannockburn Global Forexs - said that gold will come under further pressure if the US labor market remains strong, reducing the Fed's interest rate cutting cycle.

Adam Button - Head of currency strategy at Forexlive.com - commented that the gold market is interested in some policies of President-elect Donald Trump related to the strength of the USD in the upcoming term.

According to Button - GDP growth of 3% and lower trade deficit during Mr. Trump's term will not be affected by tariffs and the weakening of the US dollar. A weaker greenback will benefit gold.

See more news related to gold prices HERE...