Over the past half century, every time gold has had a strong price increase, it has often been a long period of weakness or little fluctuation. However, the current increase in percentage is only the third strong increase, significantly lower than the increase cycles in the late 1970s and the period 2000 - 2011.

The current rally began in October 2022, when spot gold prices were around $1,617 an ounce. Initially, the increase was quite small, but accelerated significantly since November 2024, after Mr. Donald Trump was re-elected President of the United States.

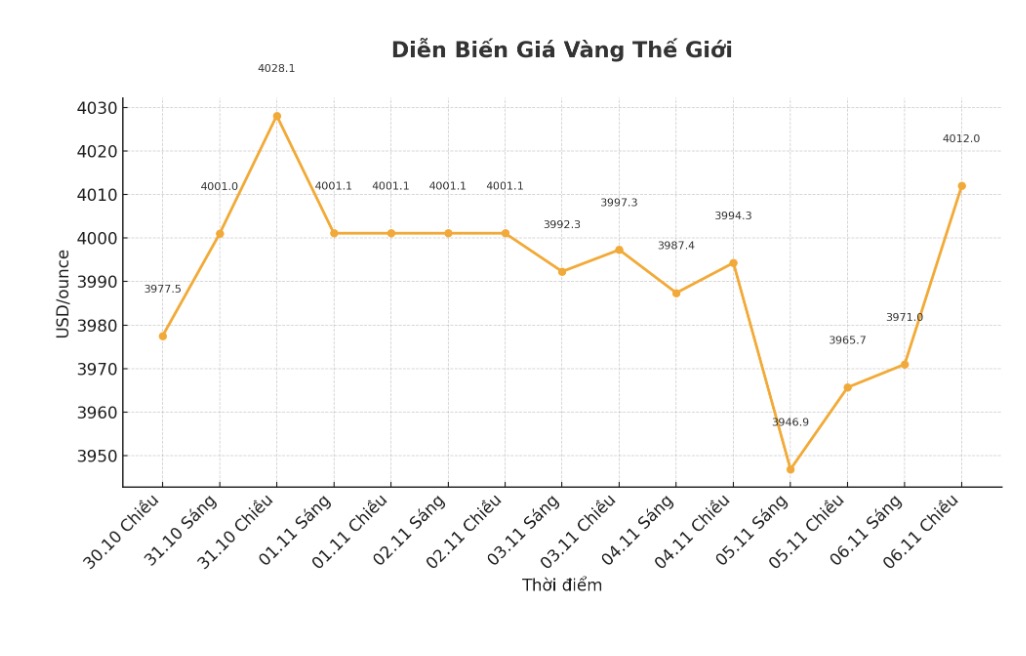

World gold prices hit a record high of $4,381.21/ounce on October 20, up 170% since October 2022. Gold then fell slightly, ending Wednesday's trading session at $3,978.63 an ounce.

The increase in the past three years, although remarkable, is still modest compared to the 518% jump from July 1976 to February 1980, and 643% from February 2001 to September 2011. After each long rally, gold has entered a bearish cycle, but the decline is not enough to erase all previous achievements.

From a peak of about 692 USD/ounce in February 1980, prices fell about 63% to 256 USD in February 2001; and from a peak of about 1,902 USD in September 2011, prices fell 44% to 1,052 USD in November 2015.

In terms of percentage, this increase is not too big, although the price in USD has increased sharply. That does not necessarily mean that the increase will last for many years, but if it does, it is not uncommon.

History shows that when the upward cycle ends, gold prices often fall back and then move sideways for a long time. Analysts often find it difficult to determine when to change direction and the present is no different from before.

There are currently many mixed forecasts for gold prices: Some believe that prices will fall around $3,000/ounce, while others predict to increase beyond $5,000/ounce within the next 1-2 years. The important issue is whether the current drivers are long-term (structural) or just temporary.

The argument shows that this is a structural increase in the fact that investors and central banks are looking for alternatives to US assets such as Treasury bonds or stocks, and gold is one of the few viable options.

The World Gold Council's Q3/2025 report shows that central banks have net bought 220 tonnes of gold in the quarter, up 28% from the previous quarter. From 2022 to now, central banks have been buying gold for over 1,000 tons per year, and 2025 is looking forward to the fourth consecutive year.

Demand for collateral, coins and exchange-traded funds (ETFs) reached 220 tons in the third quarter, up 47% over the same period last year. However, the sharp increase in prices has caused the demand for jewelry to decrease by 19%, to 371.3 tons compared to 460 tons in the same period in 2024.

However, there are still risks that could weaken gold's outlook, such as if the global stock market adjusts strongly, forcing investors to sell gold to cover losses elsewhere.

However, concerns about the US budget deficit and the risk of threatening the independence of the US Federal Reserve (FED) when Mr. Trump is said to want to control monetary policy may still be enough to keep gold in the interest of investors.