Perth mint's gold sales (one of the world's most prestigious gold and silver foundries, headquartered in Perth, Western Australia - Western Australia) hit a three-year high in October, while silver sales surged 83% compared to the previous month - the highest level in the past two years, according to new data released on Wednesday.

Accordingly, sales of gold products, including coins and gold bars, reached 85,603 ounces in October, up sharply from 36,595 ounces in September - equivalent to an increase of 186% over the same period last year. Meanwhile, silver sales rose 83% month-on-month to 1.061 million ounces, the highest level since September 2023.

Mr. Neil Vance - General Director of casting products of Perth mint - said that the increase in gold prices has strongly promoted interest in the whole market, while demand for silver exploded after the launch of the 2026 Silver Kangaroo currency.

He added that global retail demand was very strong in October, with the US market recording high purchasing power for gold bars, while Europe saw good sales for gold.

Perth mint is the world's largest new gold producer and Australia's largest gold refiner. Each year, the unit processes nearly 75% of Australia's new gold reserves, playing a key role in the global gold industry.

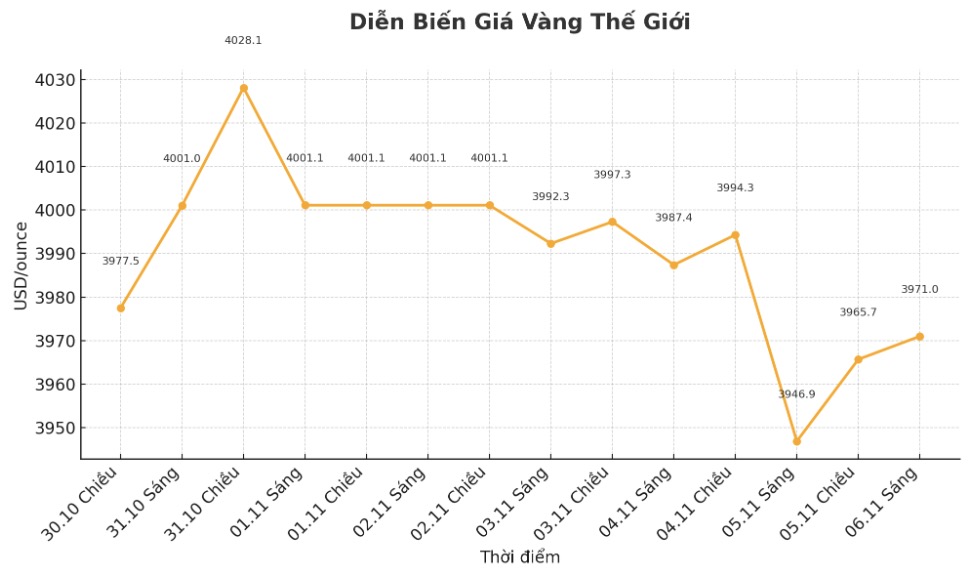

Spot gold prices hit a record $4,381.21 an ounce on October 20, while silver prices also hit a new peak of $54.47/ounce last month.

Phil Baker, former president of The Silver Institute and former CEO of Hecla Mining, shared in an interview with Kitco News in September about his visit to Perth mint, saying they have seen demand over the past five years increase than at any time in the history of the foundry.

He said the scarcity in the global market is reflected in Perth mint having to import ore from American mines to meet the demand for coins on the other side of the world.

When asked about Perth mint's silver sales falling to an 8-month low in August, Mr. Baker was not concerned. He said that monthly sales changes are normal and not too worrying in the long term, while emphasizing that Perth mint's expansion is a testament to the sustainable growth trend.

See more news related to gold prices HERE...