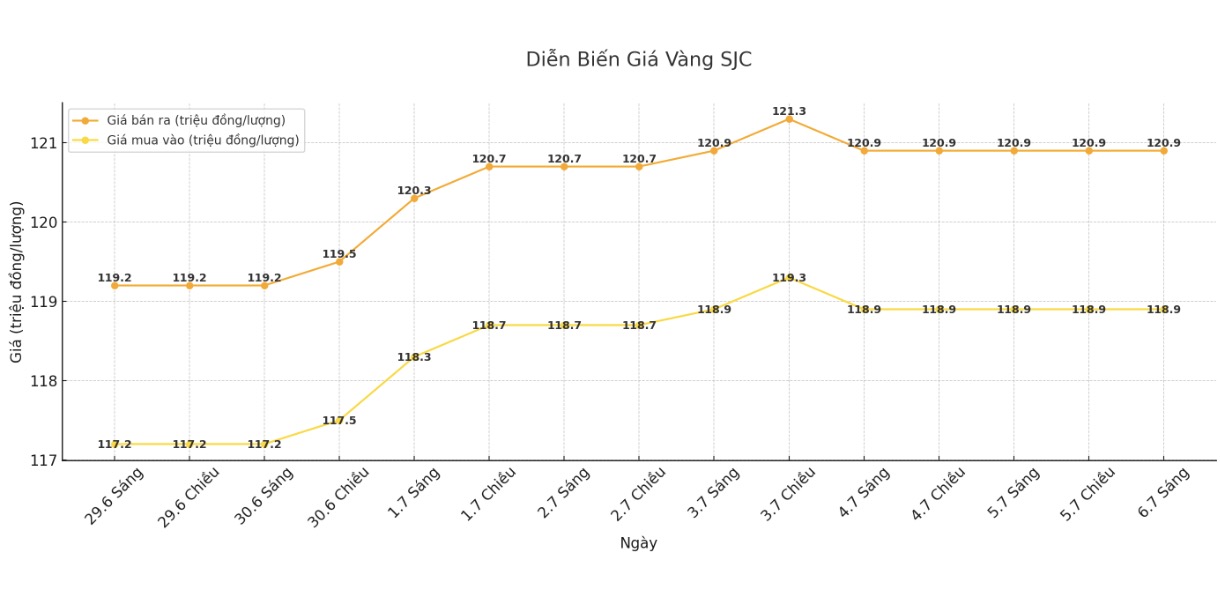

SJC gold bar price

At the end of the trading session of the week, Saigon Jewelry Company SJC listed the price of SJC gold at 118.9-120.9 million VND/tael (buy in - sell out).

Compared to the closing price of the previous trading session (June 29, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC increased by 1.7 million VND/tael in both directions.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.9-120.9 million VND/tael (buy in - sell out). Compared to a week ago, the price of SJC gold bars was adjusted by Bao Tin Minh Chau to increase by 1.7 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

If buying SJC gold at Bao Tin Minh Chau and Saigon Jewelry Company SJC on June 29 and selling it today (July 6), buyers will lose VND300,000/tael.

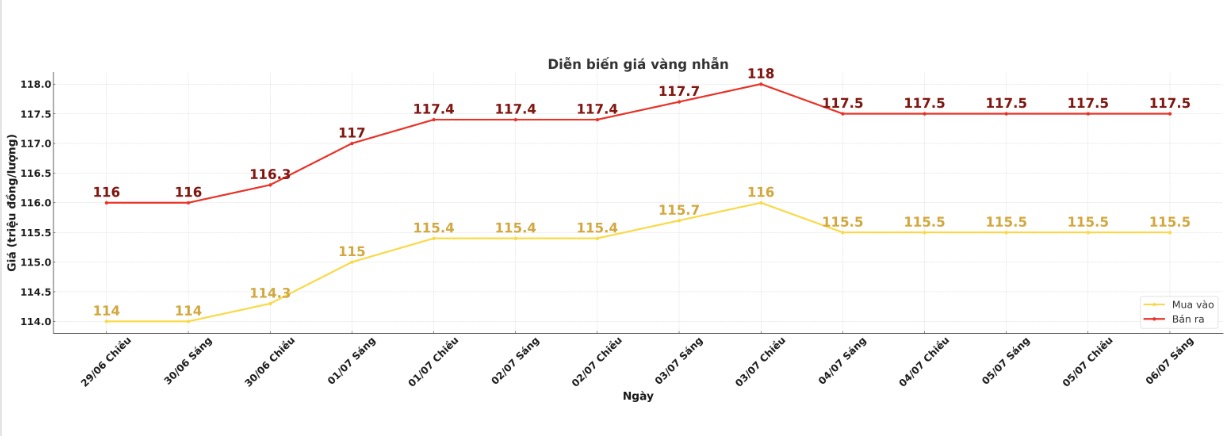

9999 gold ring price

This morning, Bao Tin Minh Chau listed the price of gold rings at 115.7-118.7 million VND/tael (buy - sell); an increase of 1.6 million VND/tael in both directions compared to a week ago. The difference between buying and selling is at 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.3-117.3 million VND/tael (buy - sell), an increase of 1.2 million VND/tael in both directions compared to a week ago. The difference between buying and selling is 3 million VND/tael.

If buying gold rings in the session of June 29 and selling in today's session (September 6), buyers at Bao Tin Minh Chau will lose 1.4 million VND/tael, while the loss when buying in Phu Quy is 1.8 million VND/tael.

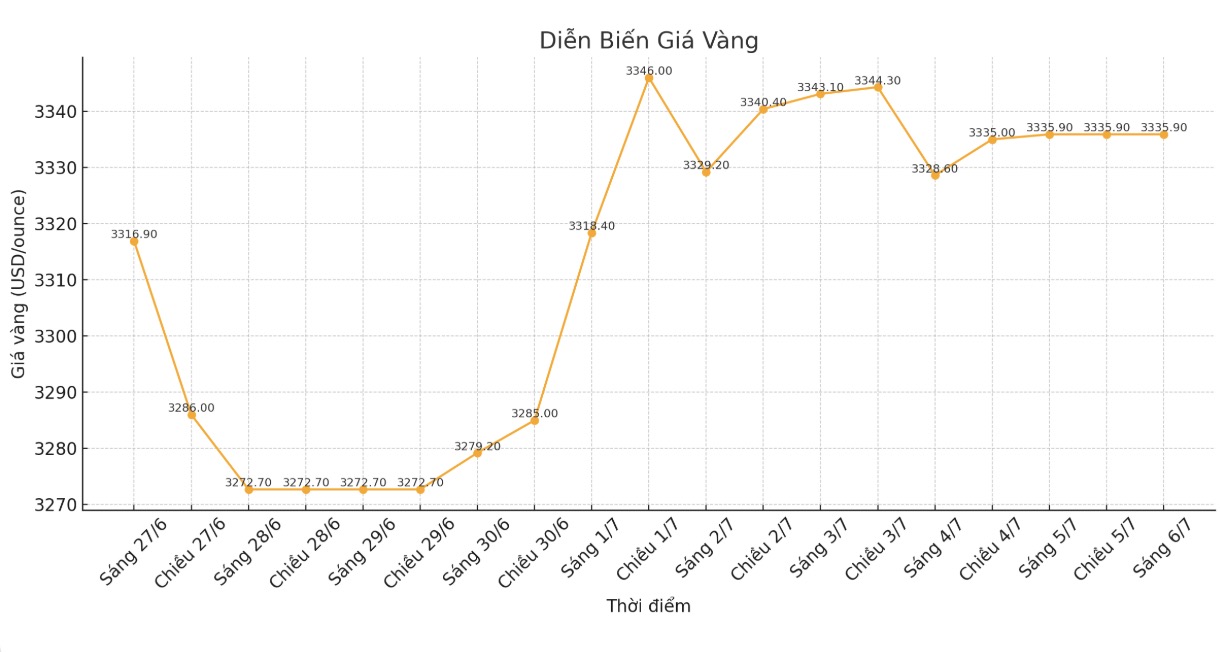

World gold price

At the end of the trading session of the week, the world gold price was listed at 3,335.9 USD/ounce USD/ounce, up 66.2 USD/ounce compared to the closing price of the previous trading session.

Gold price forecast

Marc Chandler - CEO at Bannockburn Global Forex, predicted that gold prices will continue to weaken after this week's economic data.

Stronger-than-expected US employment data and rising interest rates have hampered golds recovery. The spot market is likely to record an outside price decrease today, showing a negative signal. That warns that the correction period, accumulation may not be over and returning to the 3,250 USD/ounce price range is reasonable, possibly even lower, he said.

Jim Wyckoff - Kitco senior analyst, said that gold is consolidating within a narrow range. Gold prices will move sideways and fluctuate. The chart is still a bit inclined towards an uptrend, but buyers need a new fundamental boost to push prices out of the recent fluctuations," he said.

Rich Checkan - Chairman and CEO of Asset Strategies International, emphasized that the risk of US public debt is climbing strongly.

The stunning huge tax bill... adds $4 trillion to the US public debt over 10 years, plus an estimated debt of $2 trillion a year. By 2035, the total debt will amount to more than 50 trillion USD... not even considering the fact that the Social Security Fund will run out of money in 2033... that is the most optimistic scenario. The world is gradually realizing the problem of over spending and debt, and the solution is gold, he warned.

Adam Button - Head of currency strategy at Forexlive.com, gave an optimistic view. At first, the US dollar appreciated after the non-farm payrolls report, then quickly reversed. That shows that the persistent USD selling trend has dominated the first half of the year. As this trend continues and expands, gold will benefit," he said.

Notable US economic data next week

After a week of dominating the employment index, the market will have a bit of "rest" in economic data when entering the new week.

The Reserve Bank of Australia will announce its monetary policy decision on Tuesday. On Wednesday, the market will analyze the minutes of the US Federal Reserve's June FOMC meeting. Data on the number of weekly jobless claims will be released on Thursday morning.

See more news related to gold prices HERE...