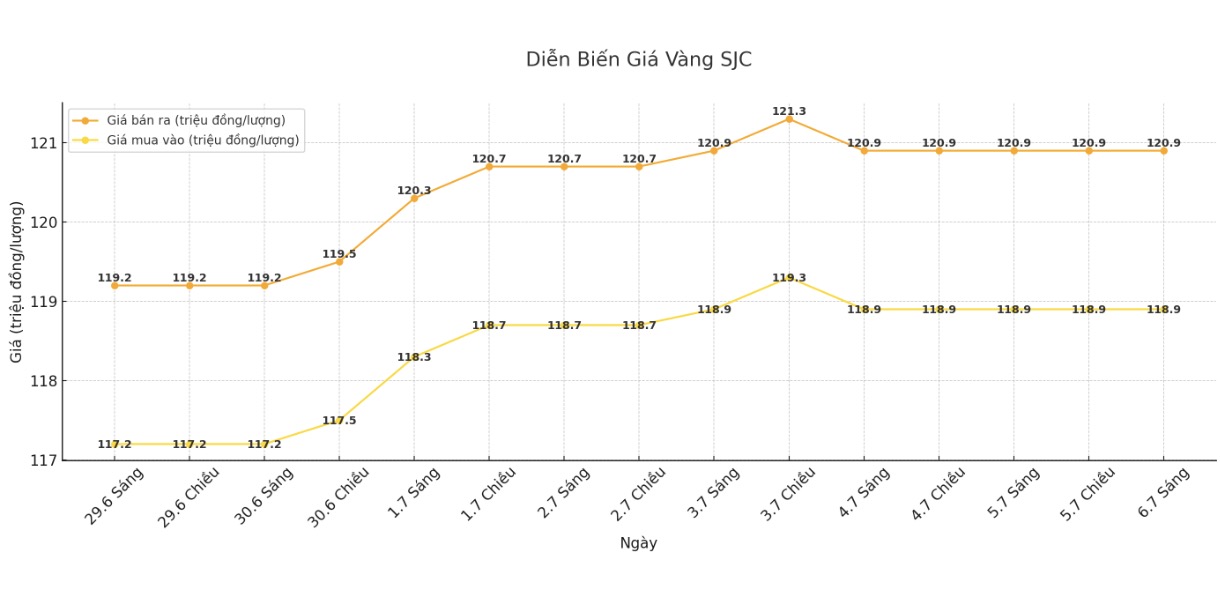

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 118.9-120.9 million VND/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 118.9-120.9 million VND/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.9-120.9 million VND/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at VND 118.2-120.9 million/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2.7 million VND/tael.

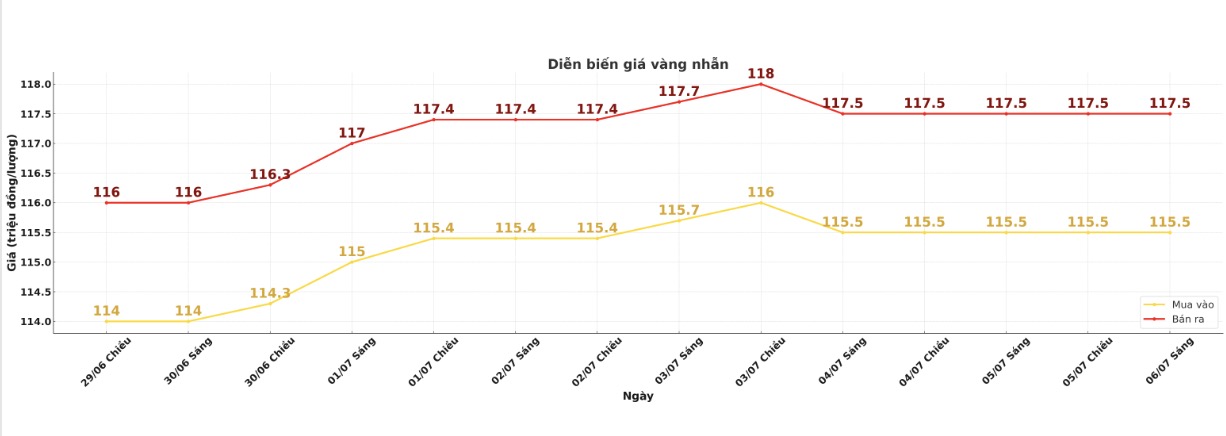

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 115.5-117.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115.7-118.7 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.3-117.3 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

When the gap between buying and selling prices is pushed up too high, the risk for individual investors increases. In particular, those who tend to "surf" should be cautious and calculate carefully before deciding to invest.

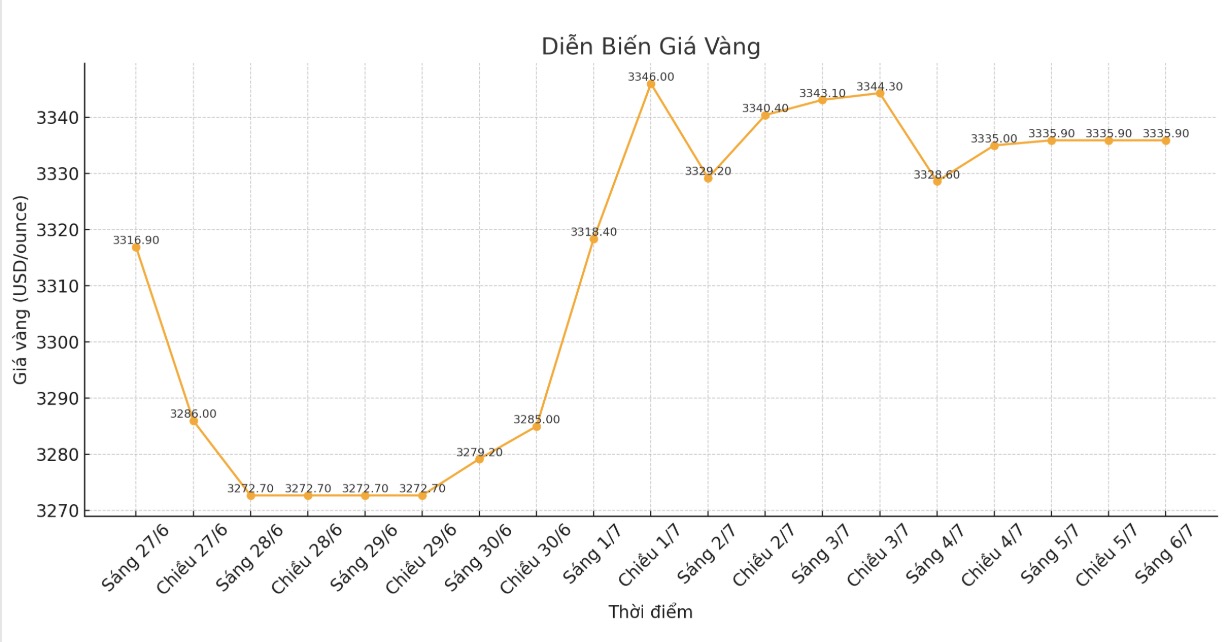

World gold price

Recorded at 6:00 a.m., spot gold was listed at $3,335.9/ounce.

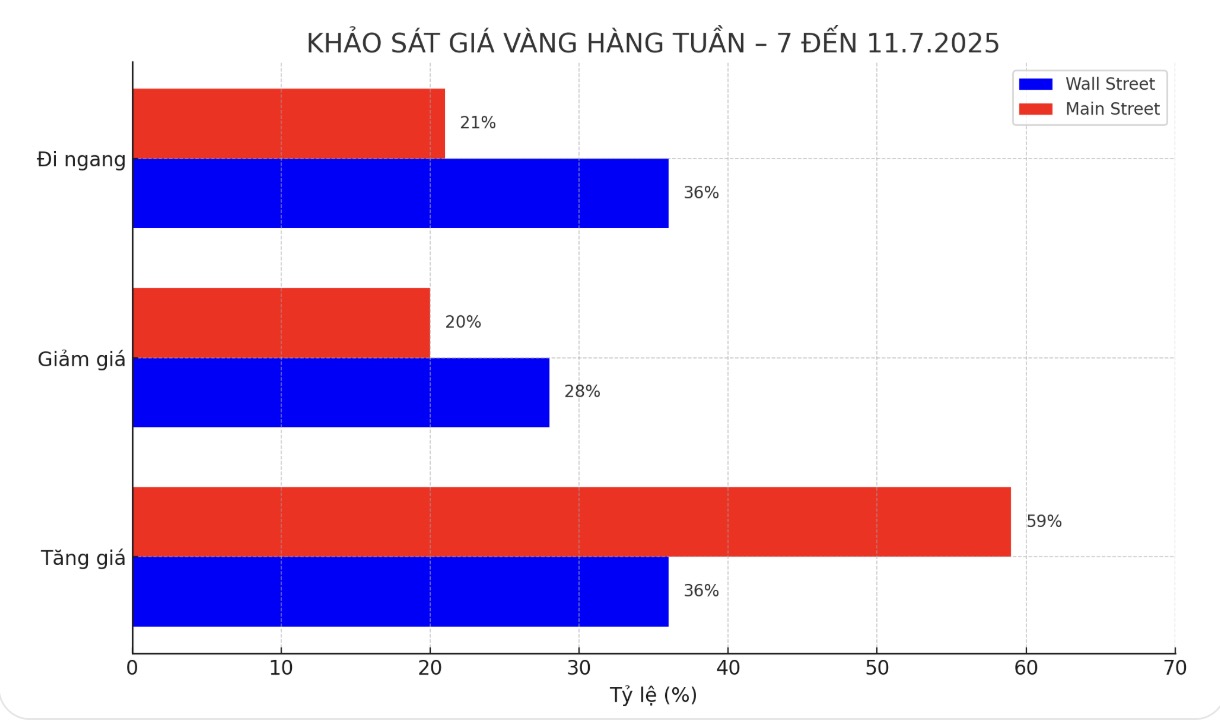

Gold price forecast

World gold prices are attracting special attention from investors as leading experts divide them into three groups of clear views: increasing, decreasing and moving sideways, in the context of a weak USD, interest rate pressure and trade instability still dominating the market.

Adam Button - Head of currency strategy at Forexlive.com, gave an optimistic view. At first, the US dollar appreciated after the non-farm payrolls report, then quickly reversed. That shows that the persistent USD selling trend has dominated the first half of the year. As this trend continues and expands, gold will benefit," he said.

Marc Chandler, managing director at Bannockburn Global Forex, also predicted that gold prices will continue to weaken after this week's economic data.

Stronger-than-expected US employment data and rising interest rates have hampered golds recovery. The spot market is likely to record an outside price decrease today, showing a negative signal. That warns that the correction period, accumulation may not be over and returning to the 3,250 USD/ounce price range is reasonable, possibly even lower, he said.

Jim Wyckoff - Kitco senior analyst, said that gold is consolidating within a narrow range. Gold prices will move sideways and fluctuate. The chart is still a bit inclined towards an uptrend, but buyers need a new fundamental boost to push prices out of the recent fluctuations," he said.

Economic data to watch next week

Tuesday: Reserve Bank of Australia monetary policy meeting.

Wednesday: Minutes of the US Federal Reserve's June FOMC meeting.

Thursday: US weekly jobless claims.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...