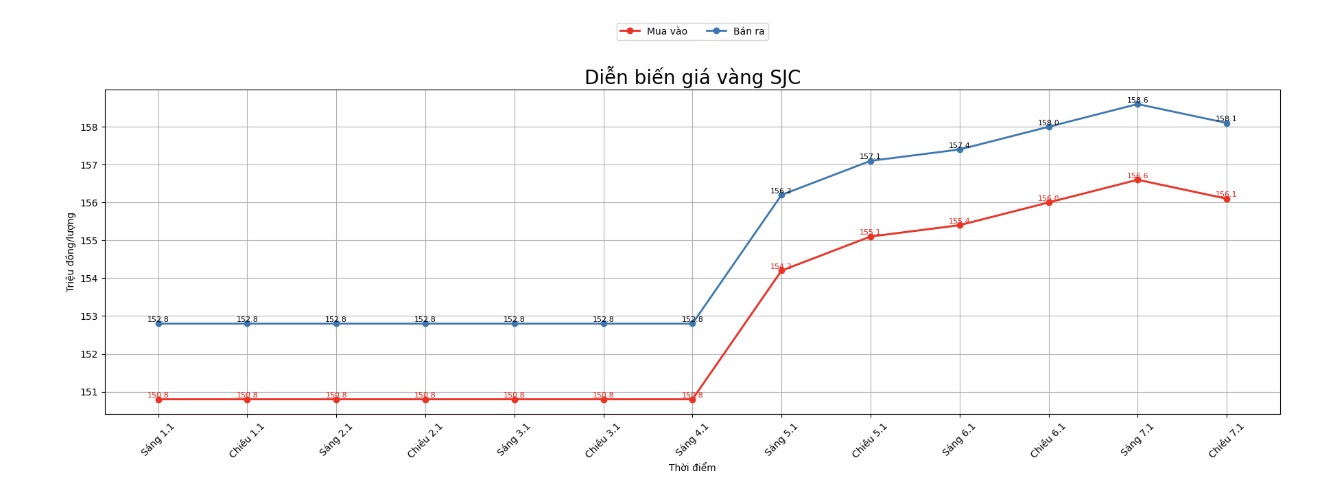

SJC gold bar price

As of 5:00 PM, SJC gold bar prices were listed by DOJI Group at the threshold of 156.1-158.1 million VND/tael (buying - selling), an increase of 100,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 156.1-158.1 million VND/tael (buying - selling), an increase of 100,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at 156.1-158.1 million VND/tael (buying - selling), an increase of 100,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

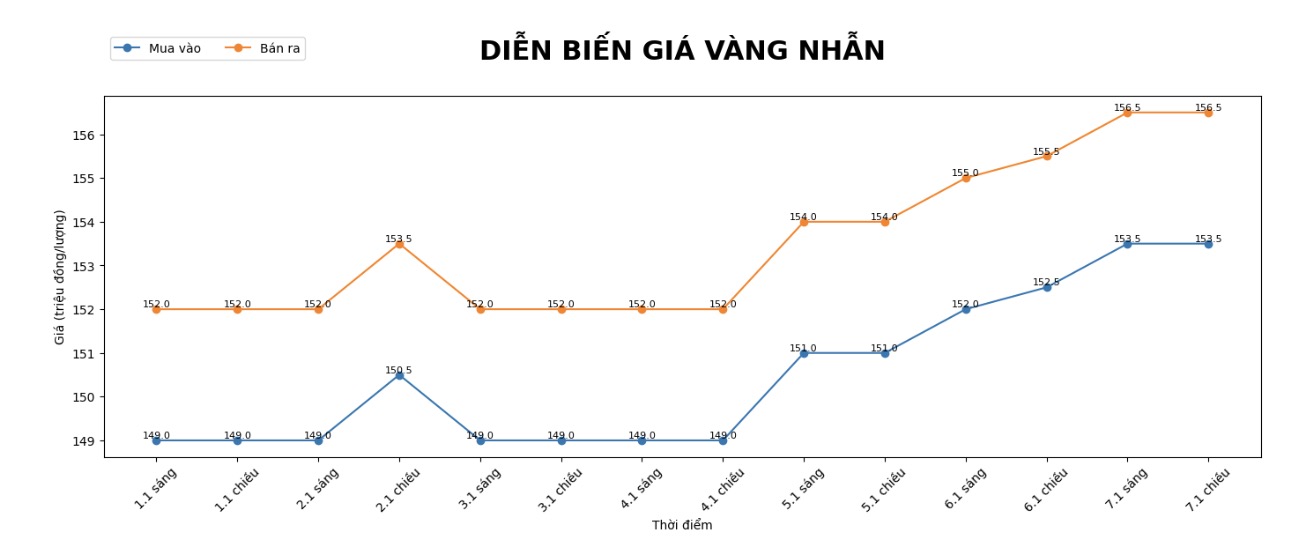

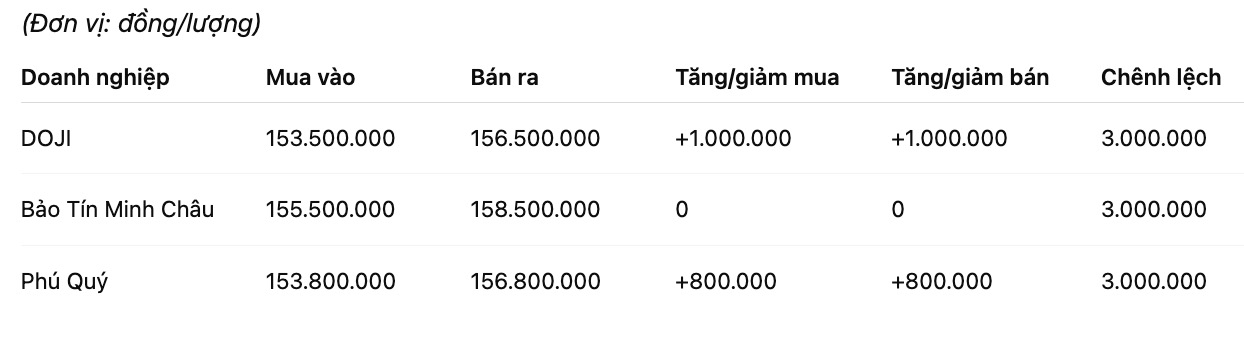

9999 gold ring price

As of 5 pm, DOJI Group listed the price of plain gold rings at 153.5-156.5 million VND/tael (buying - selling), an increase of 1 million VND/tael in both buying and selling directions. The difference between buying and selling is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 155.5-158.5 million VND/tael (buying - selling), going sideways in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 153.8-156.8 million VND/tael (buying - selling), an increase of 800,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

The high buying - selling gap increases the risk for individual investors. Individual investors, especially those with a "surfing" mentality, need to consider carefully before spending money.

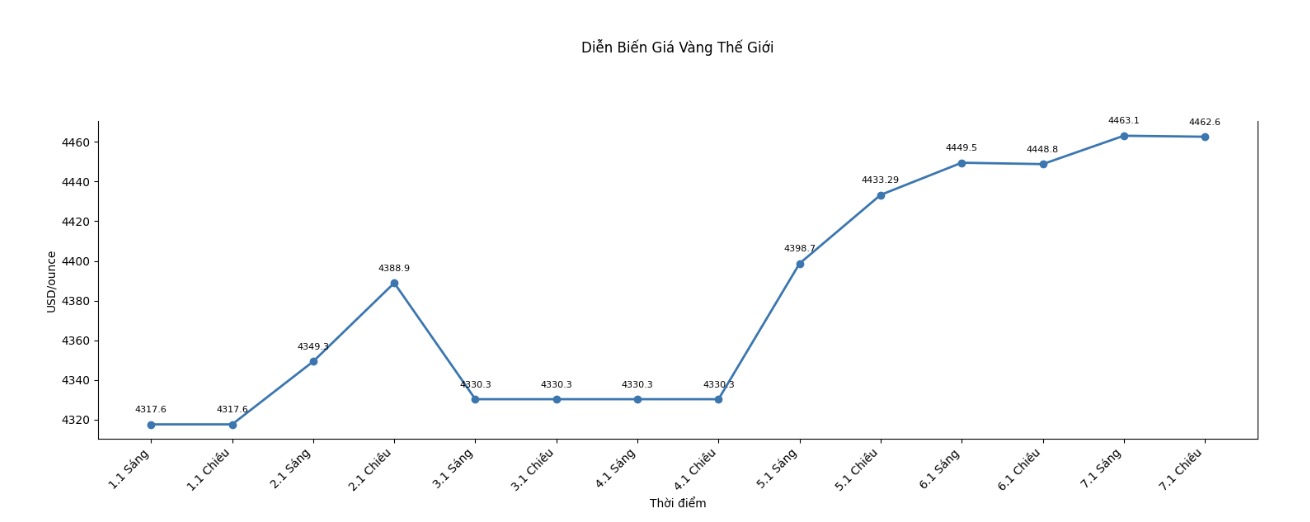

World gold price

World gold price listed at 16:53 at the threshold of 4,462.6 USD/ounce USD/ounce, up 13.8 USD compared to the previous day.

Gold price forecast

After short-term corrections due to profit-taking pressure, many international financial institutions still maintain a positive view of gold price prospects in 2026.

Foundational factors such as reduced supply, increased mining costs, loose monetary policy and prolonged geopolitical risks are assessed to continue to support the precious metals market.

According to the assessment of Mr. Michael Widmer, Head of Metal Research at Bank of America (BofA), gold still plays an important role in the defense strategy and diversification of investment portfolios. This expert believes that the gold market, although it has increased sharply in the past time, still does not fully reflect the potential investment demand.

Gold continues to stand out as an effective defensive tool, while creating added value for the portfolio in the context of global economic and financial instability" - Mr. Widmer said.

BofA forecasts that the average gold price in 2026 may exceed 4,500 USD/ounce, even approaching the 5,000 USD/ounce mark if investment demand continues to expand.

Notably, this bank believes that as long as investment capital increases at a moderate level compared to recent quarters, the market is qualified to establish a new price level.

From a similar perspective, Mr. Dominic Schnider - Head of Goods and Asia-Pacific Regional Foreign Exchange Investment Director at UBS Wealth Management, said that gold prices are benefiting from the general upward trend of the commodity market.

According to him, the persistent gold buying activity of central banks, the budget deficit in many major economies, along with the decline in real interest rates in the US will be important drivers pushing gold prices to the 5,000 USD/ounce zone in the first quarter of 2026.

However, experts also note that in the short term, gold prices may continue to experience fluctuations as investors take profits and the USD fluctuates strongly against US economic data.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...