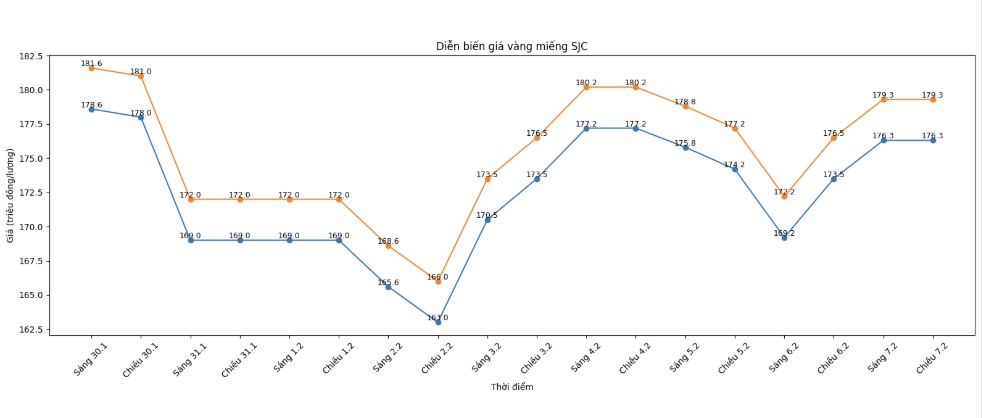

SJC gold bar price

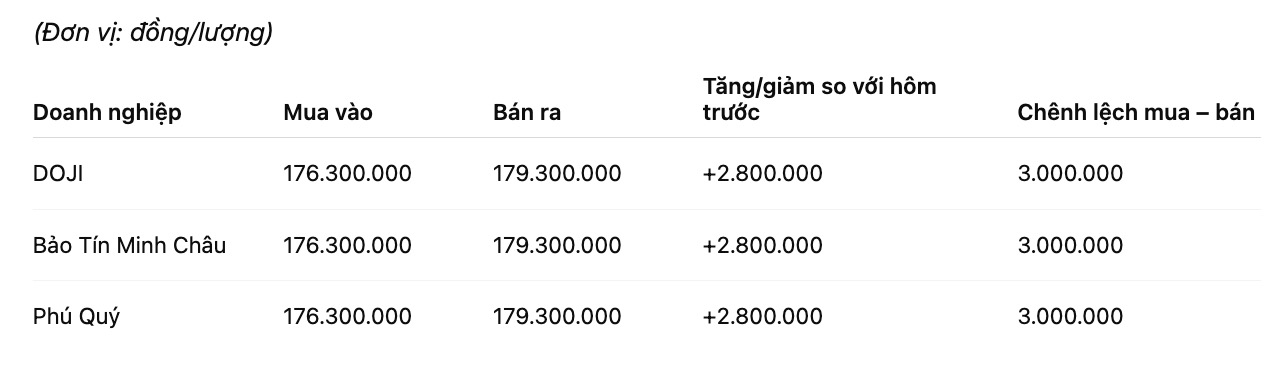

As of 7:00 PM, SJC gold bar prices were listed by DOJI Group at 176.3-179.3 million VND/tael (buying - selling); an increase of 2.8 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 176.3-179.3 million VND/tael (buying - selling); an increase of 2.8 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 176.3-179.3 million VND/tael (buying - selling); an increase of 2.8 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

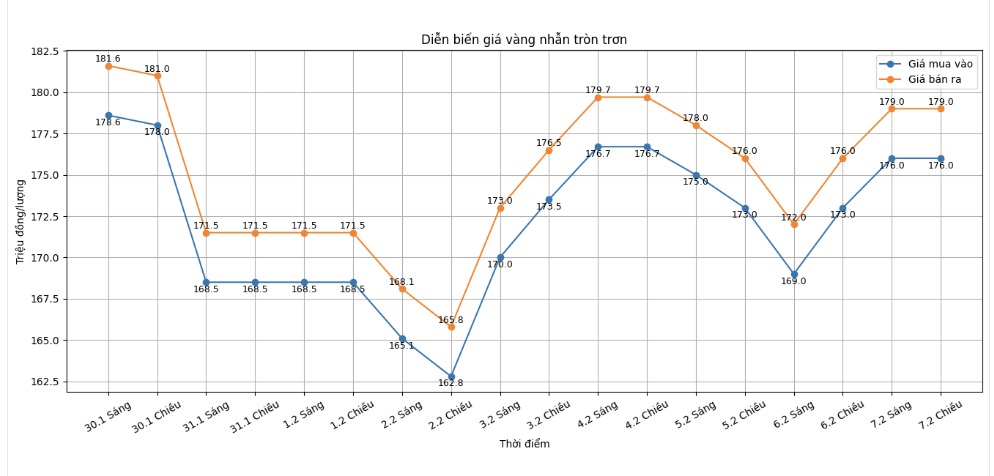

9999 gold ring price

As of 7:00 PM, DOJI Group listed the price of gold rings at 176-179 million VND/tael (buying - selling); an increase of 3 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 176.3-179.3 million VND/tael (buying - selling), an increase of 2.8 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Jewelry Group listed the price of gold rings at 176-179 million VND/tael (buying - selling), an increase of 3 million VND/tael in both buying and selling directions. The buying - selling difference is at 3 million VND/tael.

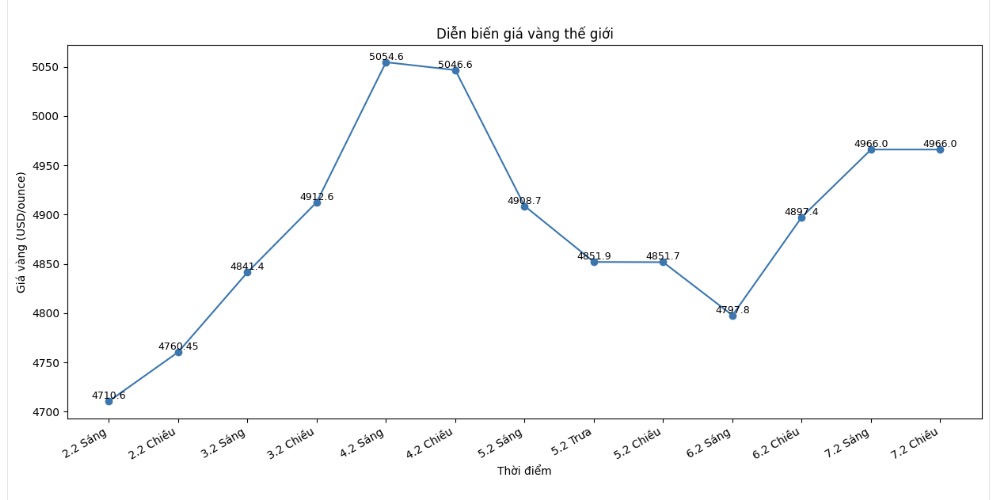

World gold price

At 7:00 PM, world gold prices were listed around the threshold of 4,966 USD/ounce; up 68.6 USD compared to the previous day.

Gold price forecast

After a period of strong fluctuations at the end of January, world gold prices are entering a more cautious state as opposite pulling forces coexist. The long-term upward momentum has not been broken, but the market needs more clear momentum to conquer important psychological price levels again.

A fundamental factor continuing to support gold is the persistent buying activity of central banks, especially China. According to newly released data, the People's Bank of China has extended its gold buying streak to the 15th consecutive month, despite world gold prices showing signs of stagnation after a hot rally. This move shows that gold still plays a key role in the reserve strategy of many major economies, especially in the context of geopolitical instability and global financial risks that have not cooled down.

The World Gold Council also noted that although the total gold purchase volume of central banks in 2025 is lower than the record level of the previous three years, demand still maintains at a high level and continues to be a structural pillar of the gold market. This is considered a factor helping gold prices limit the risk of deep decline in the medium term.

From a technical perspective, analysts believe that the long-term upward trend of gold is still preserved. Gold prices have recovered significantly after a strong correction and continue to fluctuate above important support zones. Notably, the Ichimoku indicator system still maintains positive signals as the upward trend "cloud" has not been broken, showing that the market has not entered a reversal phase.

According to assessments by some Wall Street experts, the fact that gold prices clearly form support and resistance zones in the short term may help stabilize the trading range in the coming week. The important support level is currently determined around the 4,650 USD/ounce area, while the 5,000 USD/ounce mark continues to play a major psychological barrier in the upward direction.

In the short term, gold prices are forecast to continue to fluctuate in a narrow range as investors wait for a series of upcoming US economic data, especially the jobs report and the consumer price index (CPI). This information will directly affect interest rate expectations, thereby shaping the next trend of the gold market.

Notable economic calendar for next week

Elections in Japan.

US Retail Sales.

US non-farm payroll.

US Weekly Unemployment Benefit Application; Current House Sales in the US.

US Consumer Price Index (CPI).

Gold price data is compared to the previous day.

See more news related to gold prices HERE...