Despite unprecedented volatility in the metal market, a Canadian bank remains optimistic about gold and silver, while expecting prices to rise higher at the end of the year.

On Wednesday, commodity analysts at CIBC (one of Canada's largest banks) released updated gold price forecasts, according to which they believe that the average gold price this year will reach 6,000 USD/ounce, a sharp increase compared to the level of 4,500 USD/ounce that this bank offered in October.

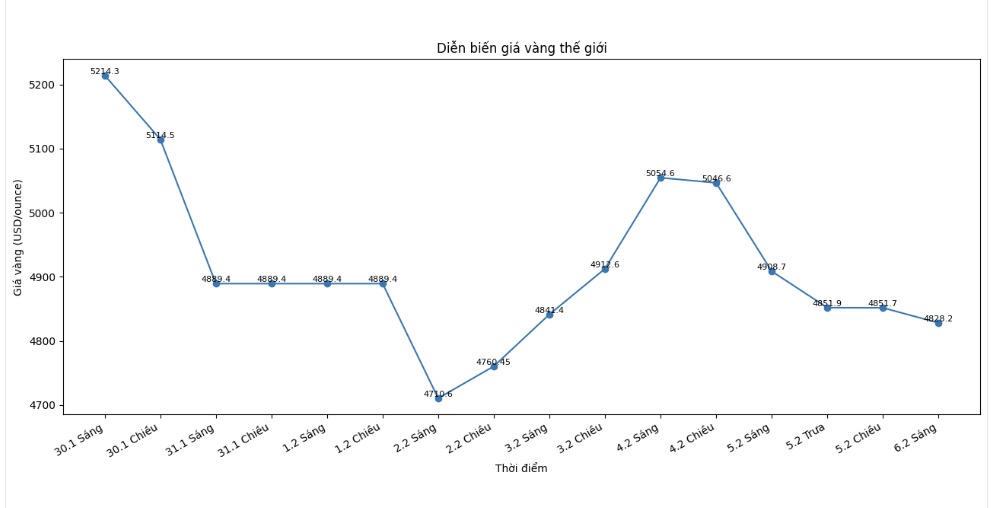

CIBC forecasts that gold prices will continue to maintain an upward trend in a wide range, with an average price reaching a peak of 6,500 USD/ounce in 2027. These optimistic assessments are made in the context that gold is facing a new resistance level around 5,000 USD/ounce and showing signs of entering a new accumulation phase. The nearest spot gold price was recorded at 4,863.1 USD/ounce, down 2% in the day.

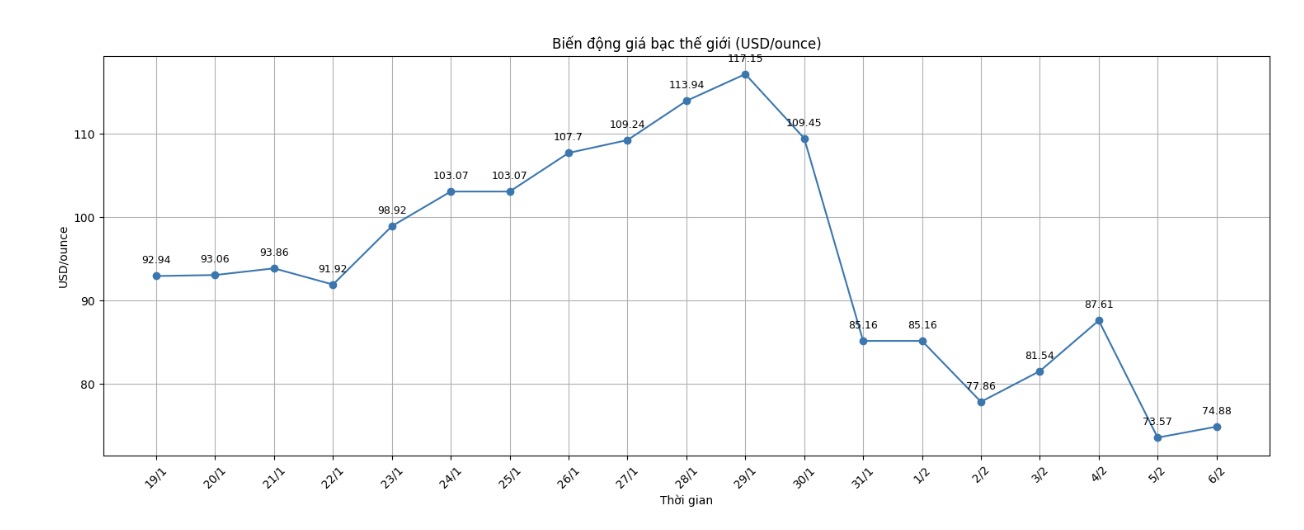

In the latest forecast, CIBC believes that silver prices will average about 105 USD/ounce this year, and increase to 120 USD/ounce next year.

Despite recent fluctuations and strong corrections, analysts say the demand momentum formed since 2025 remains intact. The Bank of Canada emphasized that geopolitical instability will continue to support safe-haven demand. At the same time, they also expect further weakening of the USD to be a key factor in supporting gold prices.

The process of weakening the value of the USD is likely to continue as central banks and investors react to the increasing level of uncertainty by quietly reducing allocations to US Treasury bonds. We believe that pressure on the USD will come from interest rate cuts and prolonged tensions between the Fed and the White House, and believe that Kevin Warsh will seek to tighten the Fed's balance sheet to lower interest rates for the real economy" - analysts said.

CIBC said that the gold sell-off from a record high last week stemmed from President Donald Trump's announcement that he would nominate Kevin Warsh to replace Jerome Powell as Chairman of the US Federal Reserve (Fed). The market expects Warsh, former Fed Governor, to maintain the political independence of the central bank.

However, although Warsh is known as a supporter of tight monetary policy, CIBC believes that Mr. Trump's choice is actually a "hawk-like dove".

Mr. Warsh seems to have a more moderate view than the negative reaction of the market last week. He once argued that tightening the Fed's balance sheet would help curb inflation and allow interest rate cuts to support the real economy. More recently, he also expressed support for the government's performance improvement program promoted by Mr. Trump, saying that this could help reduce inflation and create conditions for interest rate cuts" - analysts said - "However, we believe that it is difficult for any candidate to do otherwise than orient the Fed towards interest rate cuts in 2026.

Looking more broadly at US monetary policy, CIBC believes that the trend of weakening the value of legal currencies globally will continue to support gold demand.

When US Treasury bonds - a safe haven asset in reality for decades - are no longer considered "non-risk", investors and central banks are forced to look for alternatives.

However, these options are very limited. Most Western economies are facing a near-record public debt-to-GDP ratio, and many countries tend to choose inflation instead of tightening to solve this problem. Investor confidence in legal currencies has declined, and gold has benefited significantly from that wave of seeking safe havens" - analysts concluded.