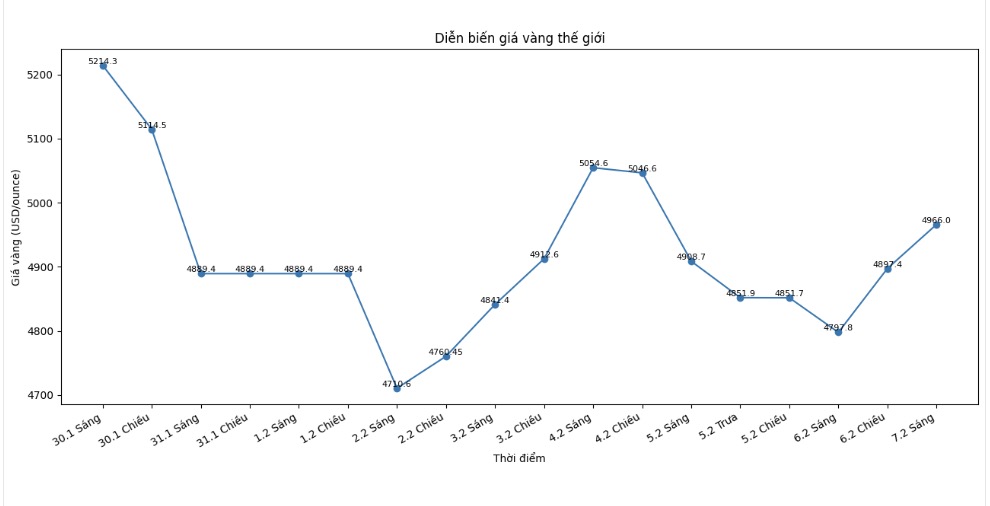

Gold prices showed remarkable resistance this week when recovering from the previous decline, increasing by a total of 175 USD (equivalent to 3.63%), bringing the price close to the important psychological threshold of 5,000 USD/ounce. However, this precious metal is still about 660 USD, or 11.82%, lower than the historical peak set last week.

In Friday's trading session, gold could not rebound to the 5,000 USD mark. However, price movements throughout the week have formed quite clear support and resistance zones, likely to dominate the fluctuation range in the short term. Comprehensive technical analysis on the daily candlestick chart shows possible price scenarios in the near future.

Ichimoku Cloud indicator - a comprehensive technical analysis tool that allows assessing market balance "only in one look" - shows a notable feature: The Ichimoku cloud still maintains green (upward trend) for 12 months shown on the chart. This confirms the market's general assessment that gold is still in a strong upward trend that has been going on for many years.

More importantly, recent corrections, including a sharp drop of 235 USD last Friday (equivalent to a 4.79% drop), have not yet damaged the technical structure of the chart.

At the beginning of the week, gold prices tested the lowest level since January 5, hitting the bottom in the session at 4,402 USD before bottom-fishing buying appeared and supported prices. Notably, even during this weakening period, the price still maintained above the Ichimoku cloud - a relationship that has been maintained for more than a year.

The fact that the price continues to "respect" the support zone of the cloud shows that gold has not entered the trend reversal phase, and at the same time the significant thickness of the cloud further strengthens the positive technical outlook for the precious metal.

On the chart, Murrey Math lines also appear - an advanced analysis framework consisting of 8 horizontal lines with many different colors. These lines represent support and resistance areas, calculated by dividing an equal cost margin of 8 parts, based on the methods of T.J. Murrey and William Gann.

Traders use these levels to predict the possibility of price reversal and identify important trading areas. The system numberes the lines from 0/8 to 8/8, in which the 4/8 line plays the role of the central balance axis, helping to determine the optimal input - ordering point.

Each line has different meanings about the level of support, resistance or reversal ability, while lines outside the boundary show the market's overbought or oversold state.

The coincidence between some Murrey Math lines and the retrograde Fibonacci levels further increases the analysis meaning, especially the 4/8 line - considered the key support/resilience zone. This level coincides with the 5,000 USD threshold and is also consistent with the Fibonacci level of 23.6%, thereby forming the first important resistance zone above.

Fibonacci analysis is applied on the range from the nearest peak of 5,602 USD to the bottom of 3,120 USD. The bottom in the first session of last week has approached, but has not reached a 50% retreat. After that, gold prices rebounded and closed above this level on February 5. Since then, the price has never seriously tested the 50% mark again, and the bottom in today's session continues to confirm that the current support zone is at Fibonacci 38.2%, equivalent to 4,654 USD.

A last noteworthy point is the strong increase in trading volume fluctuations. Although the volume of open interest contracts on the spot gold market has somewhat cooled down compared to the very high level of the previous week, it still maintains above the historical level.

This high level of participation reflects an unprecedented phenomenon: gold is attracting more investment interest than in any previous period, not only because of the price increase but also because of the increasing role of gold in the global investment portfolio.

The convergence of many technical indicators at important price levels shows that the short-term trading range of gold has been shaped quite clearly, with a solid support zone around 4.654 USD and initial resistance at the psychological threshold of 5,000 USD/ounce.

See more news related to gold prices HERE...