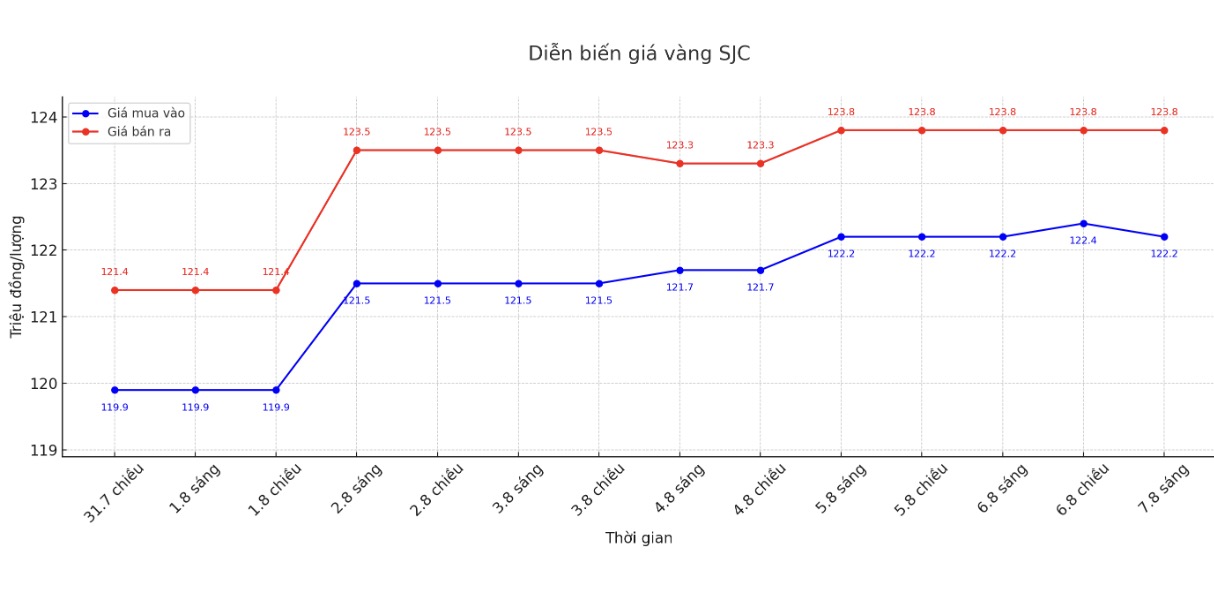

SJC gold bar price

As of 5:15 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND122.4-123.8 million/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 1.4 million VND/tael.

DOJI Group listed at 122.7-124.1 million VND/tael (buy - sell), an increase of 500,000 VND/tael for buying and an increase of 300,000 VND/tael for selling. The difference between buying and selling prices is at 1.4 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 122.4-123.8 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 1.4 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 121.2-123.8 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2.6 million VND/tael.

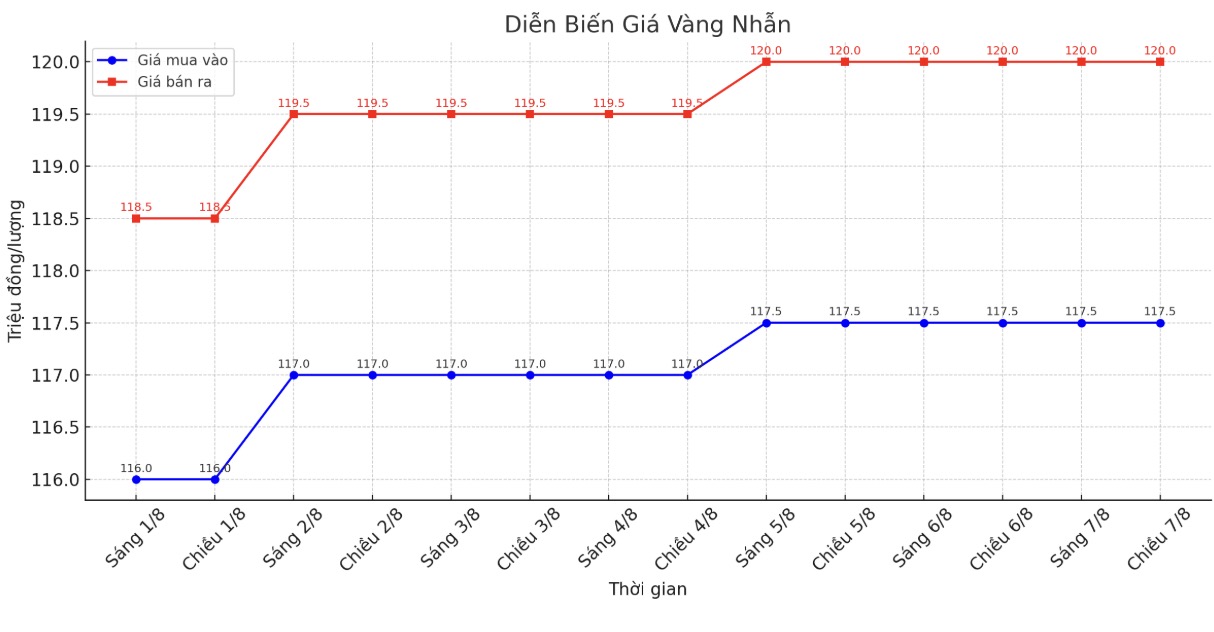

9999 gold ring price

As of 5:15 p.m., DOJI Group listed the price of gold rings at 117.5-120 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117.8-120.8 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 116.8-119 1.8 million VND/tael (buy in - sell out), an increase of 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

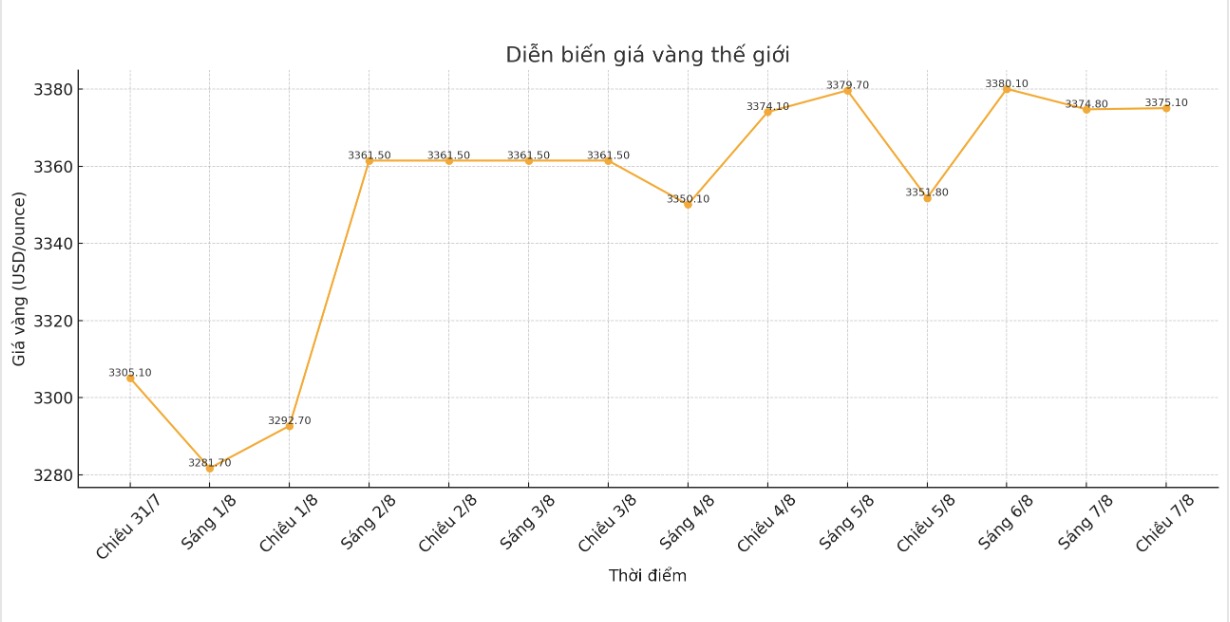

World gold price

The world gold price was listed at 5:15 p.m. at 3,375.1 USD/ounce, up 11.2 USD.

Gold price forecast

Gold prices increased slightly in the trading session on Thursday, as trade tensions escalated due to a series of new US tariffs that boosted safe-haven demand, while the weaker USD and expectations of interest rate cuts continued to support the precious metals market.

The latest tax increase by US President Donald Trump with tariffs ranging from 10% to 50%, imposed on goods from dozens of countries - officially took effect on August 7, marking a drastic step in his tough trade strategy.

Trump also announced a 100% tariff on imported semiconductors, but there will be exemptions for manufacturing companies or companies committed to manufacturing in the US.

The US dollar index (.DXY) fell 0.2%, to a 1.5-week low, making gold cheaper for holders of other currencies.

Ms. Soni Kumari - commodity strategist at ANZ - commented: "Instability has become a focus, especially after new developments related to tariffs, which is reviving safe-haven demand. In addition, macro market sentiment also supports gold, especially as the USD weakens and expectations of the US Federal Reserve (FED) to cut interest rates increase.

Soni Kumari said that tariffs are an important catalyst, but the bigger factor is still the developments of the US economy. "If the economy weakens significantly in the second half of this year, gold prices could well reach the target of $3,500/ounce in September," the expert said.

The Fed's Minneapolis branch president - Mr. Neel Kashkari - said that the US Federal Reserve may need to cut interest rates soon to cope with the economic slowdown. According to the CME FedWatch tool, the market is currently pricing in a 93% chance that the Fed will cut interest rates by 25 basis points in September.

Gold is considered a safe asset in times of economic and political instability, often benefiting from low interest rates.

We still believe that gold prices will continue to be under upward pressure until the end of 2026, NAB analysts wrote in a note, forecasting the average gold price in 2025 to $3,220/ounce and in 2026 to $3,475/ounce.

In other metals, spot silver rose 0.9% to $18.2 an ounce, platinum fell 0.7% to $1,324.4 an ounce, and gold rose 1.8% to $1,152.4 an ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...