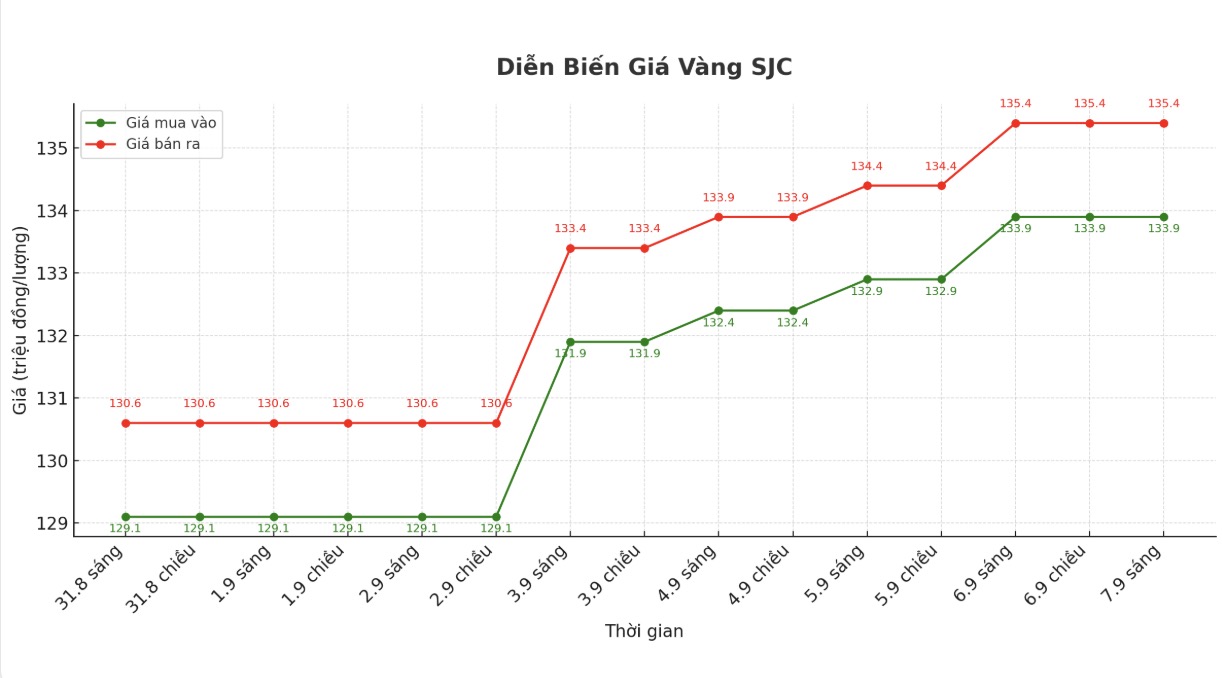

SJC gold bar price

At the end of the trading session of the week, Saigon Jewelry Company SJC listed the price of SJC gold at 133.9-135.4 million VND/tael (buy in - sell out).

Compared to the closing price of the previous trading session (August 31, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC increased by 4.8 million VND/tael in both directions. The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 133.9-135.4 million VND/tael (buy in - sell out).

Compared to a week ago, the price of SJC gold bars was increased by 5.3 million VND/tael for buying by Bao Tin Minh Chau and increased by 4.8 million VND/tael for selling. The difference between the buying and selling prices of SJC gold at Bao Tin Minh Chau is at 1.5 million VND/tael.

If buying SJC gold at Saigon Jewelry Company SJC and Bao Tin Minh Chau in the session of August 31 and selling it in today's session (September 7), the buyer will make a profit of VND 3.3 million/tael.

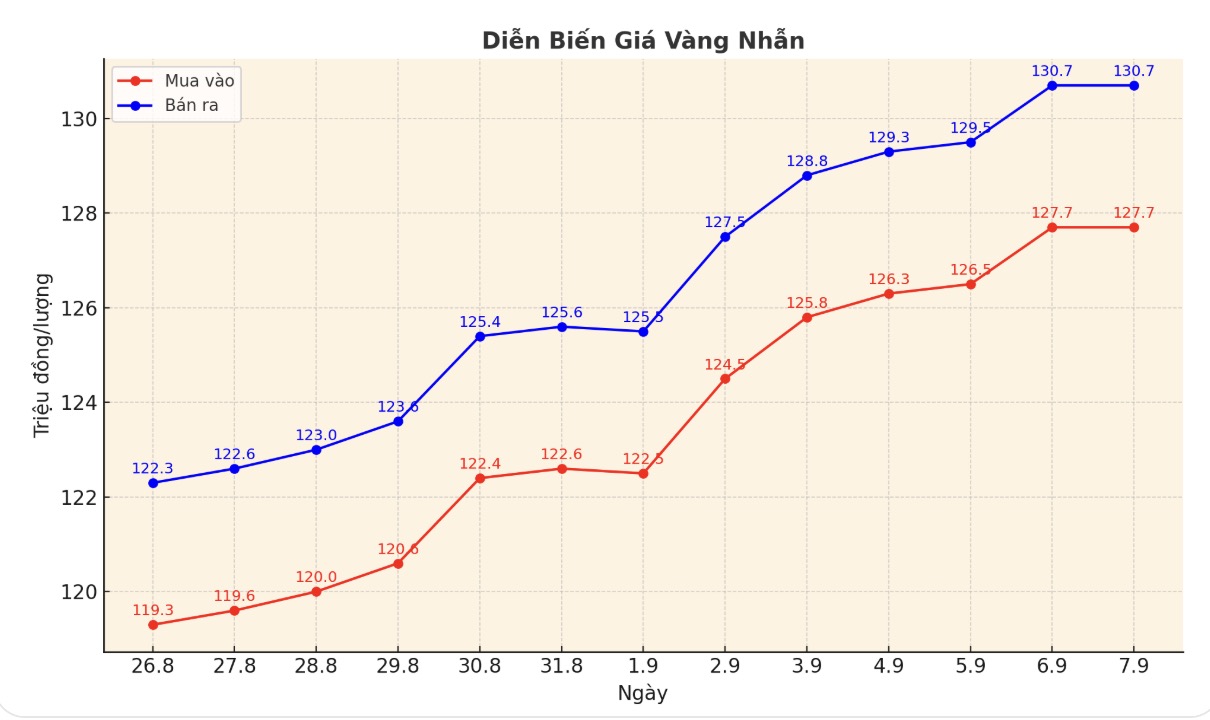

9999 gold ring price

Bao Tin Minh Chau listed the price of gold rings at 127.8-130.8 million VND/tael (buy - sell); increased by 5.2 million VND/tael in both directions. The difference between buying and selling is at 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 127.5-130.5 million VND/tael (buy - sell), an increase of 5.2 million VND/tael in both directions compared to a week ago. The difference between buying and selling is 3 million VND/tael.

If buying gold rings in the session of August 31 and selling in today's session (September 7), buyers in Phu Quy and Bao Tin Minh Chau will both make a profit of 2.2 million VND/tael.

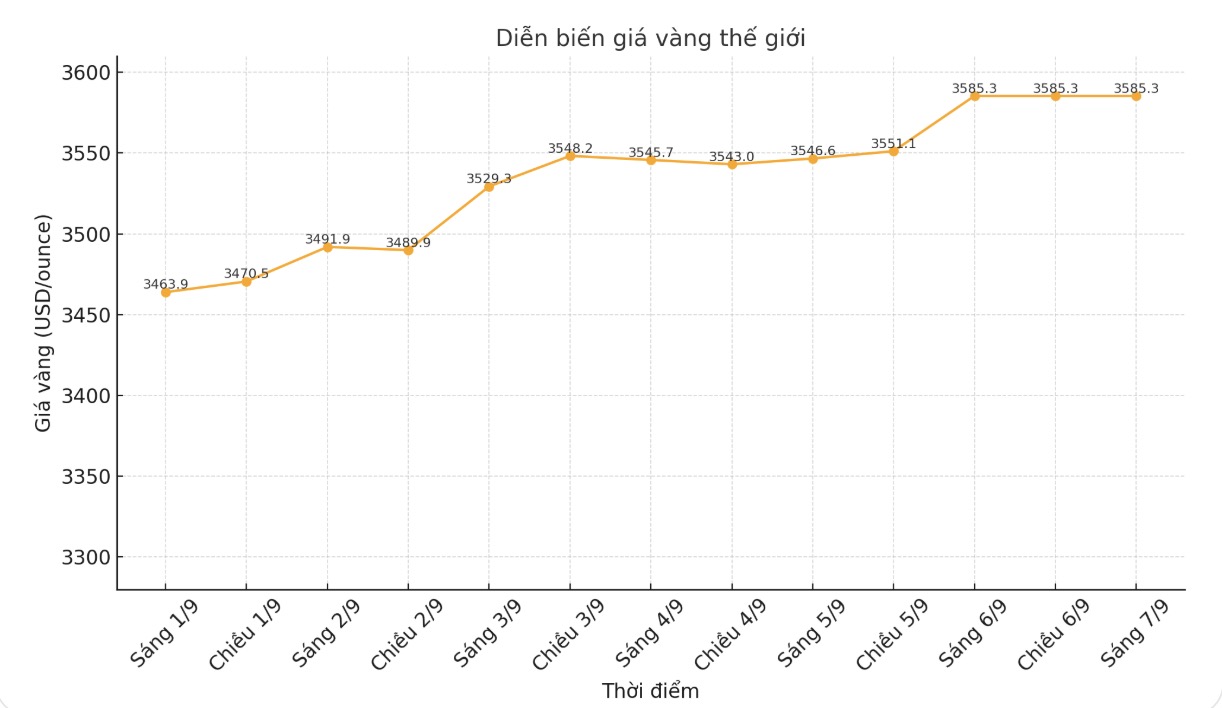

World gold price

At the end of the trading session of the week, the world gold price was listed at 3,446.5 USD/ounce, up 76.2 USD/ounce compared to the closing price of the previous trading session.

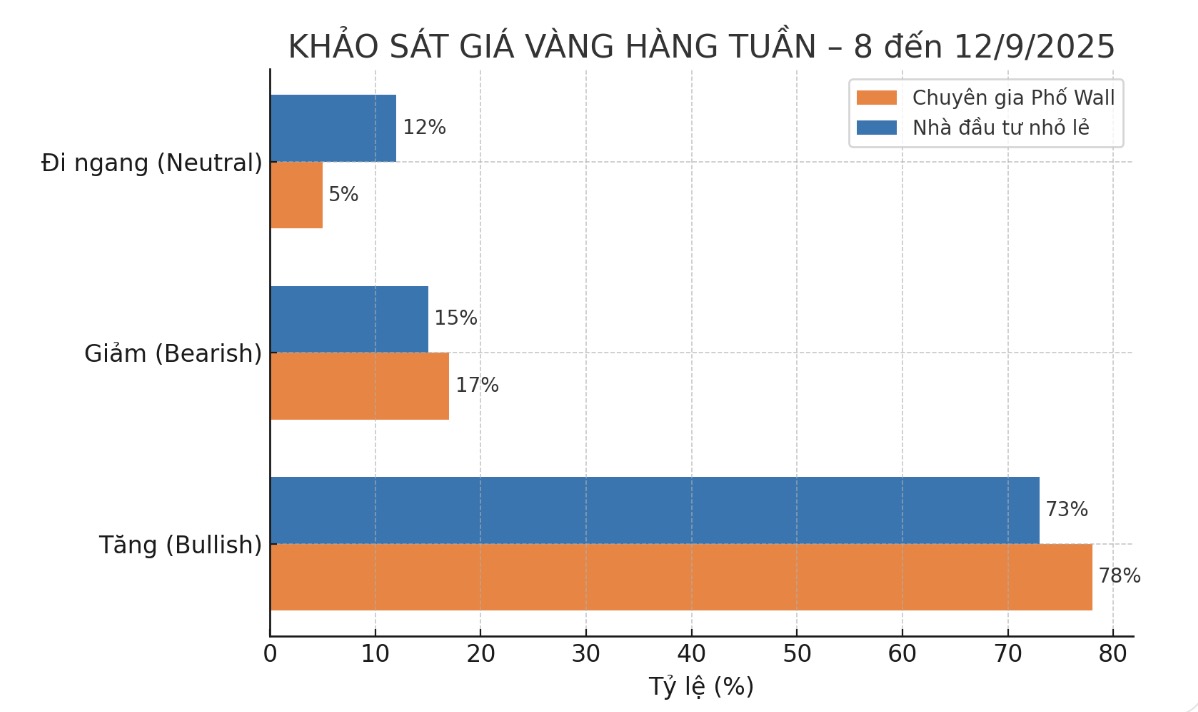

Gold price forecast

According to a survey by the international financial information platform, 18 Wall Street experts are present, of which 14 (equivalent to 78%) predict gold prices will increase next week. Only 3 experts (17%) see the price as falling, while the remaining 1 person (5%) sees gold as flat.

There were 219 votes from small investors. The results showed that 160 people (73%) believe gold prices will continue to rise, 33 (15%) predict prices will decrease, while 26 people (12%) expect gold to accumulate next week.

Colin Cieszynski - Chief Strategist at SIA Wealth Management - said that weak US labor data has created more pressure, which could force the US Federal Reserve (FED) to cut interest rates at the next meeting. Even the interest rate reduction is forecast to be up to 0.5 percentage points. This development has pushed the yields of Treasury bonds and the US dollar into weakness, paving the way for gold to continue to break out.

Adrian Day - Chairman of Adrian Day Asset Management, said that the recent increase reflects expectations of interest rate cuts, but he warned of the possibility of an adjustment if Fed Chairman Jerome Powell sends strong signals or inflation suddenly increases sharply.

However, in the medium term, Day believes that gold will continue to maintain its upward trend thanks to fundamental factors from inflation, a weak labor market, escalating US public debt and declining confidence in the financial system.

Marc Chandler - Director of Bannockburn Global Forex - noted that as gold approaches the $3,600/ounce mark, the risk of volatility increases. He predicted that the US consumer price index (CPI) to be released next week will be a decisive factor, as the market has priced too strongly into the possibility of the Fed loosening.

There will be quite a bit of economic data next week, but the reports and information released are of great significance as inflation returns to the spotlight.

On Wednesday, the market will welcome the US producer price index (PPI) in August, with both the overall and core figures forecast to fall sharply compared to July.

Then on Thursday, traders will watch the European Central Bank (ECB) monetary policy meeting - where the market has assessed the likelihood of keeping interest rates unchanged at 2.15% - and immediately after that the US consumer price index (CPI) report for August.

In addition, weekly jobless claims will also be monitored for further evidence of the weakening US labor market.

The trading week ended on Friday morning with a preliminary survey of University of Michigan consumer confidence, which also focused on inflationary factors this year.

See more news related to gold prices HERE...