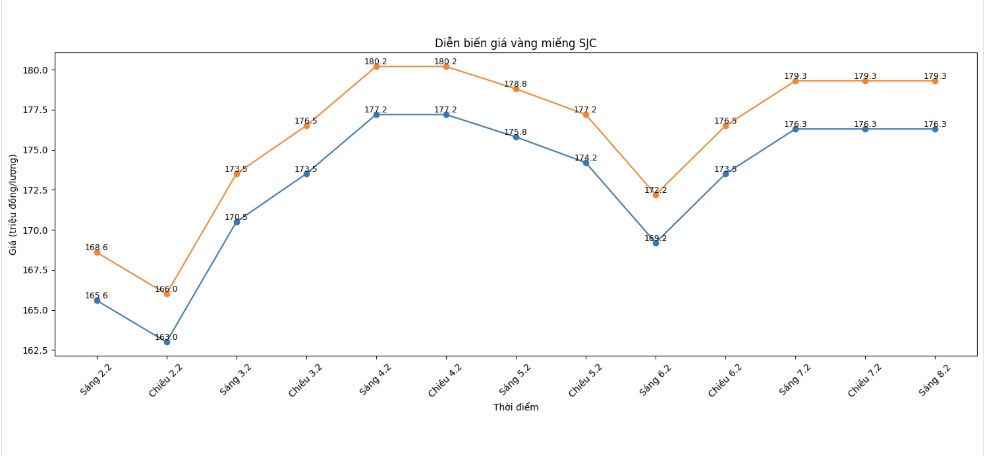

SJC gold bar price

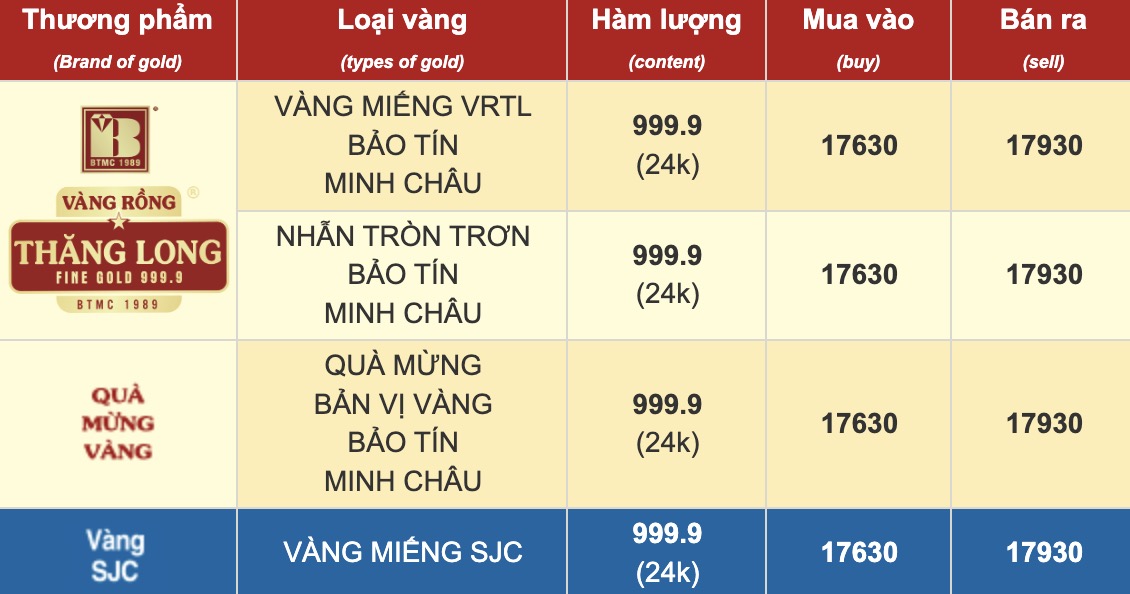

Closing the week's trading session, Saigon SJC Jewelry Company listed SJC gold price at 176.3-179.3 million VND/tael (buying - selling). The buying - selling difference is at 3 million VND/tael.

Compared to the closing session of last week (February 1), the price of SJC gold bars at Saigon SJC Jewelry Company increased by 7.3 million VND/tael in both directions.

Meanwhile, DOJI listed SJC gold price at 176.3-179.3 million VND/tael (buying - selling). The buying - selling difference is at 3 million VND/tael.

Compared to the closing session of last week (February 1), the price of SJC gold bars at DOJI increased by 7.3 million VND/tael in both directions.

Thus, if buying SJC gold bars on February 1st and selling them on today's session (February 8th), buyers at Saigon SJC Jewelry Company and the Group both make a profit of 4.3 million VND/tael.

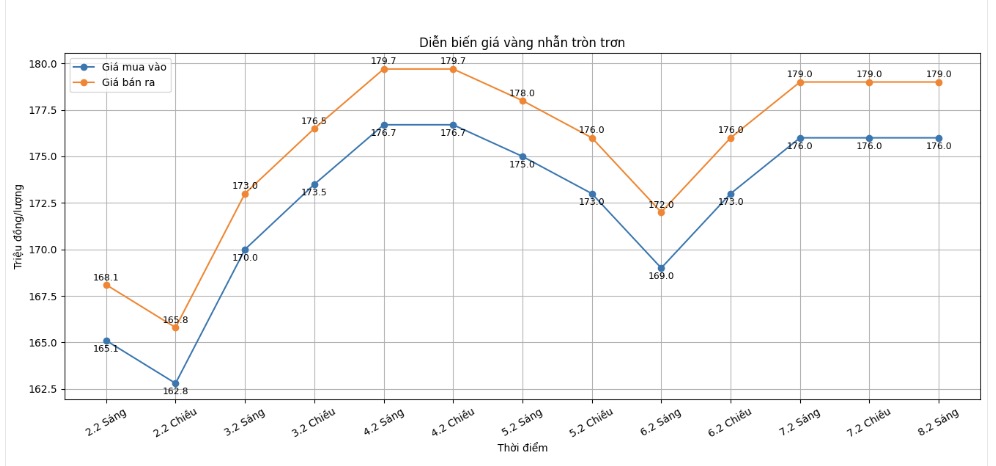

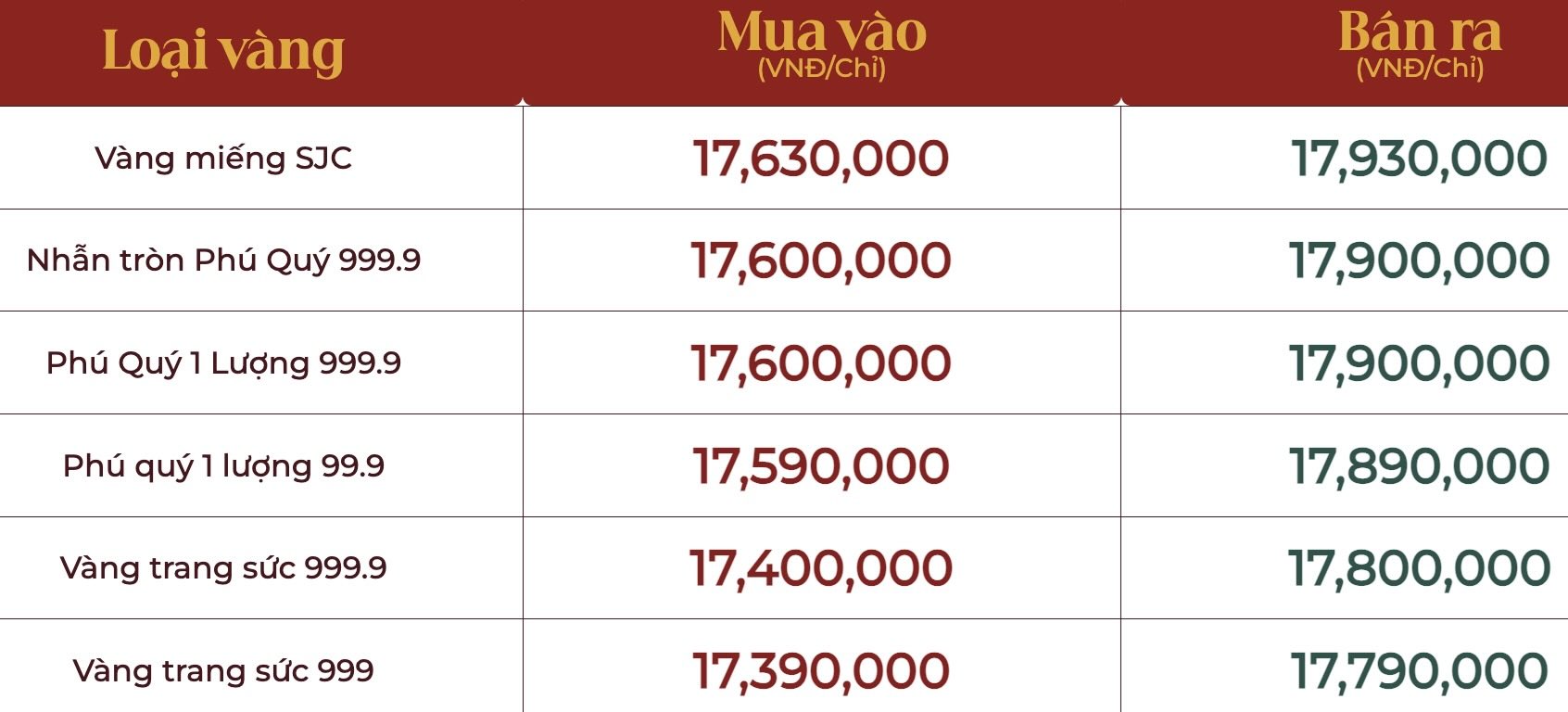

9999 gold ring price

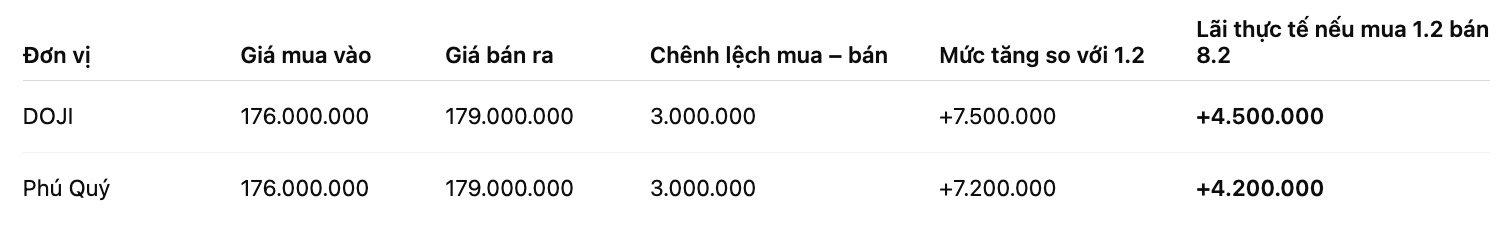

At the same time, DOJI Group listed the price of gold rings at 176-179 million VND/tael (buying - selling), an increase of 7.5 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Jewelry Group listed the price of gold rings at 176-179 million VND/tael (buying - selling), an increase of 7.2 million VND/tael in both directions compared to a week ago. The buying - selling difference is at 3 million VND/tael.

If buying gold rings in the February 1 session and selling them in today's session (February 8), buyers at DOJI make a profit of 4.5 million VND/tael, while the profit of gold ring buyers in Phu Quy is 4.2 million VND/tael.

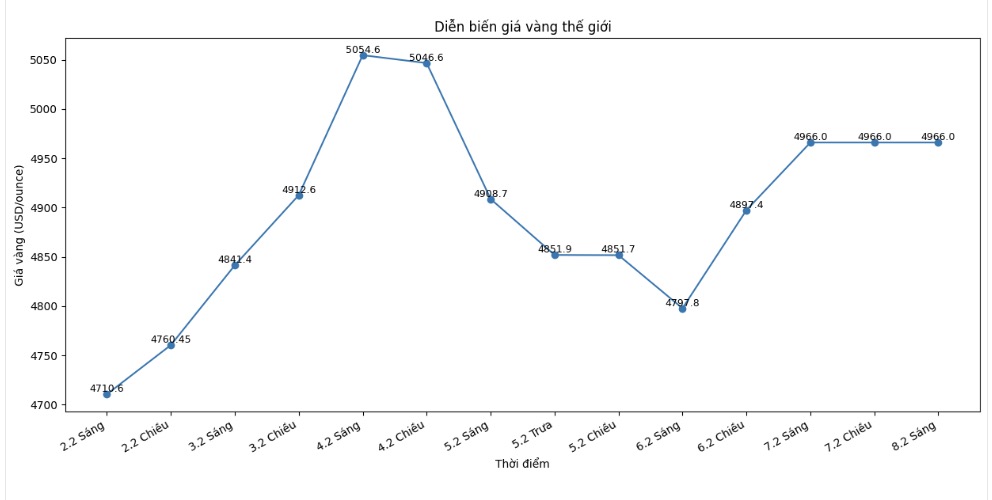

World gold price

Closing the weekly trading session, world gold prices were listed at 4,966 USD/ounce, up 76.6 USD compared to a week ago.

Gold price forecast

Mr. Aaron Hill - chief market analyst at FP Markets - said that when volatility subsides, gold prices may fluctuate in the range of 4,700 - 5,000 USD/ounce.

In the short term, the risk of a slight decrease in price is slightly higher because much positive information has been reflected in the price after the strong increase last week. For gold to return to a clear upward trend, perhaps a new boost is needed such as weaker economic data, clearer interest rate cut signals, or increased geopolitical tensions," he said.

Meanwhile, Mr. Nick Cawley - market analyst at Solomon Global, said that the current volatility is only "noise" in the short term.

I expect the 5,000 USD mark to be soon conquered again in the next few weeks, and the price may retest the decade-long peak around 5,600 USD in Q2/2026. "Removing" waves are necessary after strong gains, and technical prospects are still positive.

Supporting factors are still there. Although the USD is currently quite solid, in the coming months, interest rate cuts will weaken the greenback, or at least block further gains" - Mr. Nick Cawley said.

Ms. Rania Gule - senior market analyst at XS. com, said that the volatility of gold and silver reflects the deep level of uncertainty of investors, stemming from concerns about inflation and recession, changing expectations about monetary policy, as well as escalating geopolitical risks.

According to her, although gold prices may still remain below the 5,000 USD/ounce mark in the short term, there is still a roadmap to reach 6,000 USD/ounce by the end of the year.

The market has not exhausted its upward momentum. However, investors have become more selective and cautious, making the next waves of increase more likely to be less impulsive, interspersed with adjustment phases and more fundamental, instead of just relying on momentum or speculation.

The precious metals market is currently in a repositioning phase, not reversing the trend. The current accumulation reflects a cautious sentiment after a sharp increase, and also affirms that the price base of gold and silver is still solid," she analyzed.

Below are price updates on the websites of some business units:

See more news related to gold prices HERE...