Despite strong selling pressure in the last trading session of January, the first month of 2026 still had a positive start as investment demand in gold-backed exchange-traded funds (ETFs) increased sharply, according to monthly ETF data from the World Gold Council (WGC).

WGC said that gold ETFs globally recorded capital inflows of 120 tons in January, equivalent to nearly 19 billion USD - the highest level ever recorded in a month.

The report also shows that total gold holdings have reached a new record level of 4,145 tons, exceeding the peak set in 2020. At the same time, gold prices increased by 14%, pushing the total value of gold held by funds to an unprecedented high, about 669 billion USD.

Analysts emphasize that even during the period when gold prices fell the most in decades, accompanied by a continuous sell-off on Monday, investors continued to buy gold ETFs.

Demand in Asia played a leading role in the global market in the past month. ETFs in this region recorded 62 tons of capital inflows, worth nearly 10 billion USD. WGC said this is the fifth consecutive month that Asia has positive capital inflows, and also the strongest month in the region to date.

This region accounts for 51% of total global net capital inflows – a particularly noteworthy figure considering that gold holdings in Asia are only about 1/5 compared to North America" - analysts said. "China continues to lead capital inflows into the region (6 billion USD), becoming the second largest source of capital globally, second only to the US. Gold prices at high levels, prolonged geopolitical instability and strong demand from organizations have supported China's persistent interest in gold ETFs.

ETFs listed in North America also recorded strong buying activity, as investors added 43.4 tons of gold in the month, worth nearly 7 billion USD.

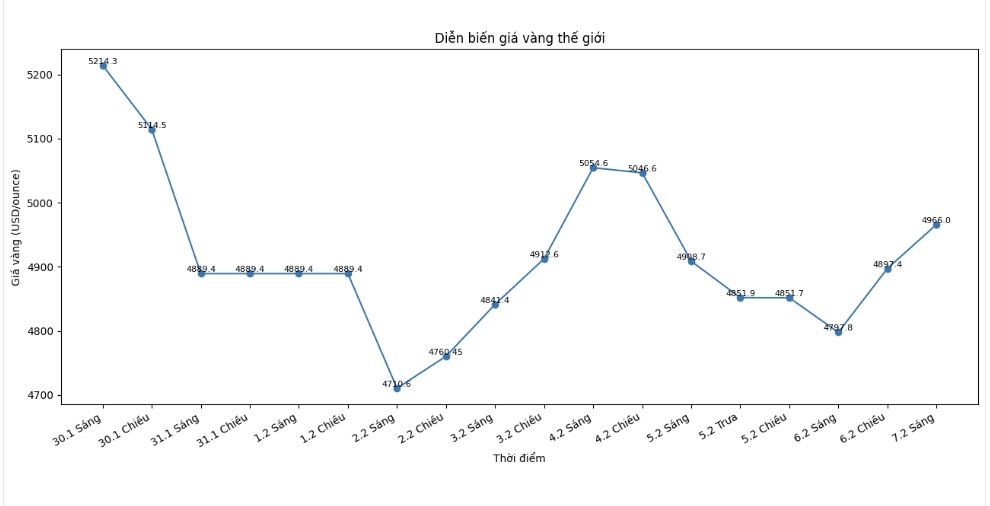

Gold prices adjusted sharply at the end of the month, after Mr. Kevin Warsh was nominated as the new Chairman of the US Federal Reserve (Fed). Prices have increased too quickly throughout January, making a correction unavoidable. However, despite the decline and increasing volatility, the region still recorded positive net capital in the last trading session of the month.

During the month, capital flows were supported by gold price increases and escalating geopolitical tensions related to the US and regions such as Iran, Greenland and some regions in Europe, thereby maintaining investor interest in gold" - analysts said.

Demand in Europe, although still positive, continues to be lower than in Asia and North America. European investors have bought nearly 13 tons of gold, equivalent to about 2 billion USD.

The region faces broader market volatility as the European Union prepares retaliatory tax measures and pressure on economies heavily dependent on exports, thereby strengthening demand for defensive assets such as gold.

In the UK - the leading capital flow in the region - inflation remains high and renewed political tensions have continued to boost investment demand in gold ETFs as a risk hedging tool both domestically and internationally," WGC said.

Although gold prices have now fallen quite far from the peak of nearly 6,000 USD/ounce in January, WGC analysts believe that investment demand will still be a key factor in the gold market. In monthly comments, WGC commented that low interest rates, persistent inflation and increased government spending make gold a more attractive safe haven than bonds.

The recent strong increase in gold prices may need a pause, but we believe that investment demand will continue to be a prominent feature in 2026.

Geopolitics is likely to remain the main driving force, while macroeconomic conditions may strengthen this trend - especially the possibility of expecting inflation to increase again in the context of fiscal support ahead of midterm elections, thereby pushing the correlation between stocks and bonds higher" - analysts concluded.