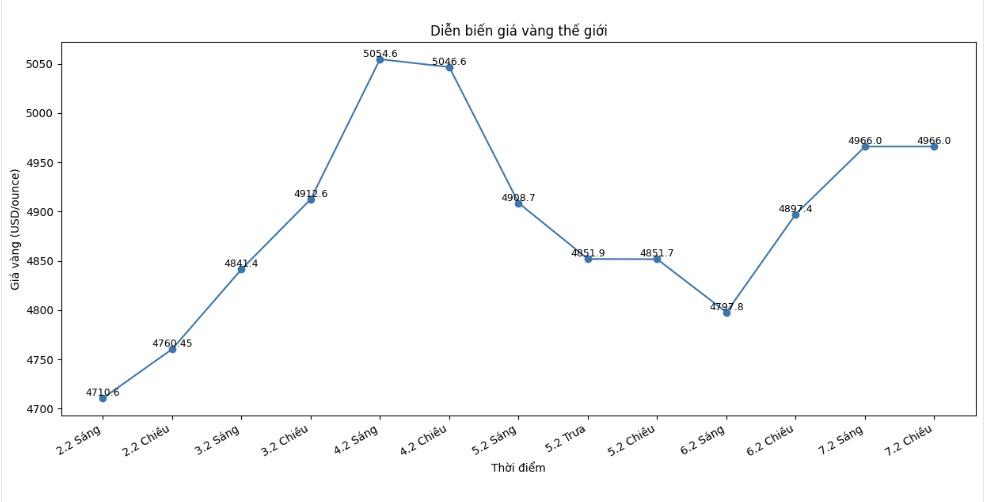

After a week of volatile trading with rare amplitudes, the gold market is entering a sensitive phase, where optimistic forecasts from Wall Street go hand in hand with increasingly clear warnings about the possibility of prolonged sideways movement or deeper technical correction.

Current developments show that gold may not be ready for another strong rally, despite the long-term foundation still being positively assessed.

Mr. Darin Newsom - senior market analyst at Barchart. com - commented that April gold futures "went all three trends" in just one week: Sharp decline at the beginning of the week, strong rebound in the middle of the week and sideways for the rest.

According to him, the price structure is leaning towards the "drop flag" model - a technical model that often appears after strong increases and signals the risk of continuing the correction trend.

From a purely technical perspective, the possibility of the market having another downtrend is entirely possible," Mr. Newsom warned. However, he also noted that if gold continues to fluctuate in the 4,423 - 5,114 USD range, the main scenario in the short term is likely still sideways accumulation, as traders are waiting for a clear breakthrough in a certain direction.

This cautious view was also shared by Mr. Daniel Pavilonis - senior commodity broker at RJO Futures. According to him, the recent sell-off did not reflect a change in fundamental factors, but mainly stemmed from distortions in the options market, where options prices increased too quickly, margin requirements were pushed up, and market regulators' risk hedging activities amplified fluctuations.

When implemented prices with high concentration are broken or due, risk hedging is also removed, creating strong fluctuations" - Mr. Pavilonis said. According to him, this process may not be completely over, making it very noteworthy that the market may continue to fluctuate in a wide range - instead of forming a clear upward trend.

While many Wall Street experts still lean towards a price increase scenario, some opinions suggest that gold is facing a major "psychological resistance" around the 5,000 USD mark.

Mr. Alex Kuptsikevich - analyst at FxPro - said that the recent sharp decline has left significant technical "scars", weakening the upward momentum that has lasted for the past three years.

According to him, even if the price can recover to over 5,000 USD, selling pressure in this area will be very strong, increasing the possibility of the market going sideways or adjusting again.

CPM Group experts also gave a more balanced view, predicting that gold may continue to fluctuate in the 4,400 - 5,200 USD wide range in the coming weeks. Although the medium-term trend still leans towards increase, this group warns of the risk of large fluctuations that could cause prices to suddenly fall deeply, especially in the context that market sentiment is still fragile after the strong correction at the beginning of the month.

Summarizing the opinions shows that, although the long-term outlook for gold is still positively assessed thanks to geopolitical instability and a downward trend depending on the USD, in the short term, the market is facing a sideways - accumulation scenario with high volatility. For investors, this is not a favorable period to expect "steady" increases, but a time to be cautious with technical risks and tighter position management.