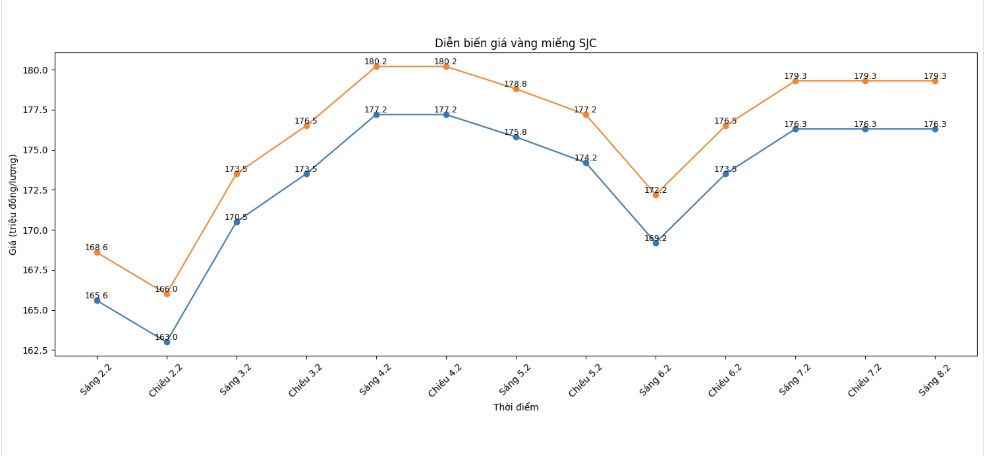

SJC gold bar price

Closing the week's trading session, Saigon SJC Jewelry Company listed SJC gold price at 176.3-179.3 million VND/tael (buying - selling). The buying - selling difference is at 3 million VND/tael.

Compared to the closing session of last week (February 1), the price of SJC gold bars at Saigon SJC Jewelry Company increased by 7.3 million VND/tael in both directions.

Meanwhile, DOJI listed SJC gold price at 176.3-179.3 million VND/tael (buying - selling). The buying - selling difference is at 3 million VND/tael.

Compared to the closing session of last week (February 1), the price of SJC gold bars at DOJI increased by 7.3 million VND/tael in both directions.

Thus, if buying SJC gold bars on February 1st and selling them on today's session (February 8th), buyers at Saigon SJC Jewelry Company and the Group both make a profit of 4.3 million VND/tael.

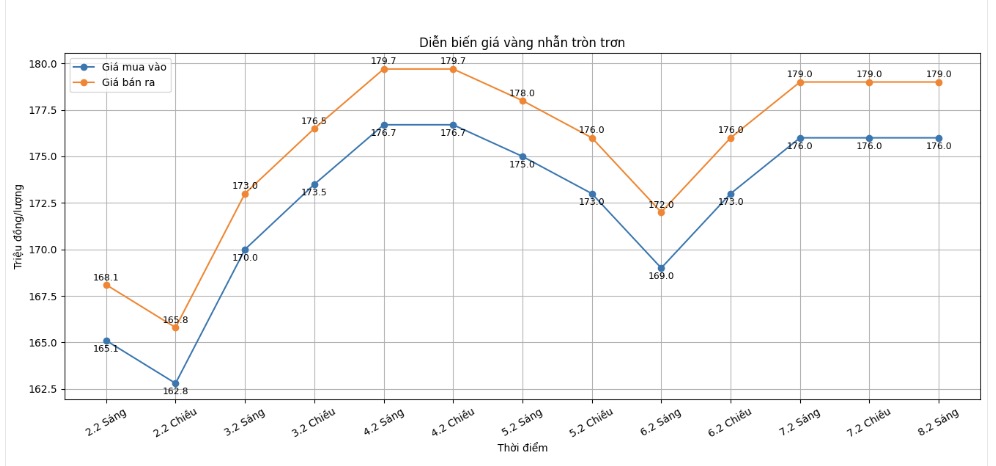

9999 gold ring price

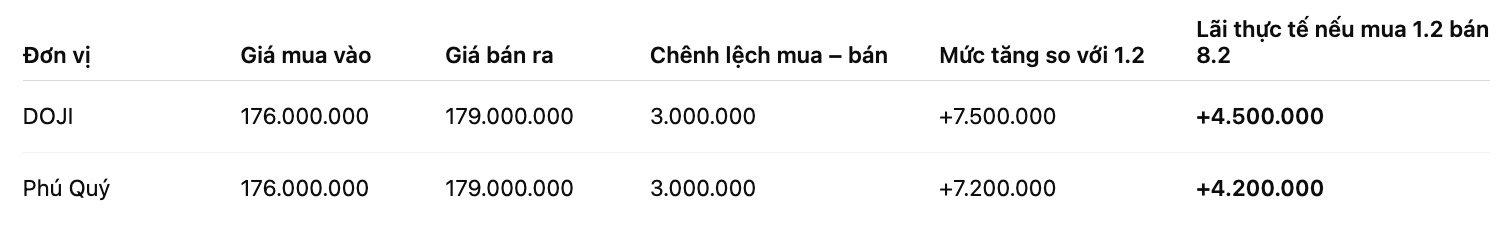

At the same time, DOJI Group listed the price of gold rings at 176-179 million VND/tael (buying - selling), an increase of 7.5 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Jewelry Group listed the price of gold rings at 176-179 million VND/tael (buying - selling), an increase of 7.2 million VND/tael in both directions compared to a week ago. The buying - selling difference is at 3 million VND/tael.

If buying gold rings in the February 1 session and selling them in today's session (February 8), buyers at DOJI make a profit of 4.5 million VND/tael, while the profit of gold ring buyers in Phu Quy is 4.2 million VND/tael.

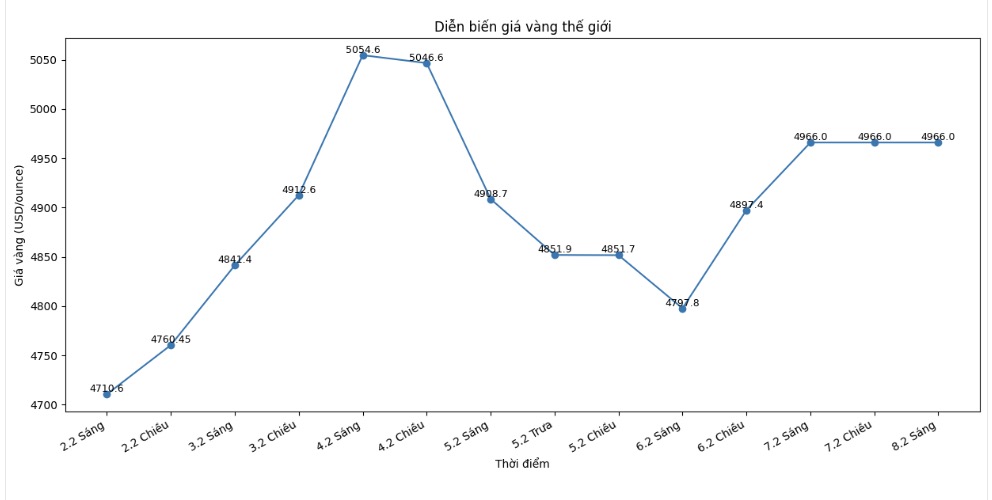

World gold price

Closing the weekly trading session, world gold prices were listed at 4,966 USD/ounce, up 76.6 USD compared to a week ago.

Gold price forecast

Kitco News' latest weekly gold survey results show that Wall Street analysts are gradually regaining confidence in the short-term outlook of gold prices, after a period of strong fluctuations and deep corrections last week. Meanwhile, individual investors still maintain a dominant optimistic view, although market sentiment is not completely stable after recent losses.

Among the 18 experts participating in the survey, up to 67% believe that gold prices will increase in the next trading week, with expectations that the precious metal may return to the important psychological milestone of 5,000 USD/ounce. Conversely, only 11% believe that prices will decrease, while the rest assess that the up-down trend is quite balanced in the short term.

Online survey results with more than 300 individual investors also showed a similar trend, when nearly 2/3 of participants expected gold prices to continue to rise. However, the rate of price forecasts to decrease and move sideways is still significant, reflecting a certain caution of the market after the recent correction.

According to Rich Checkan, the sharp declines in gold and silver last week were mainly technical and did not change the fundamental factors of the market. He believes that profit-taking and accumulation after a period of hot increase is understandable, and considers this an opportunity for investors to participate in a more attractive price range in the context that the long-term uptrend is still maintained.

Sharing the same view, James Stanley said that although the 5,000 USD/ounce mark is still a noteworthy psychological resistance and the market needs more time to adapt, the recovery response after the deep decline shows that demand is still present. According to him, the appropriate strategy in this period is to patiently wait for corrections to increase positions, instead of chasing prices.

In terms of macroeconomic information, next week there is not too much dense economic data, but some important events can still create waves for the market, especially developments from the USD and US bond yields surrounding key economic reports.

In that context, gold prices are forecast to continue to fluctuate strongly, but the main trend in the short term still leans towards the possibility of recovery if no new shocks from policy or geopolitics appear.

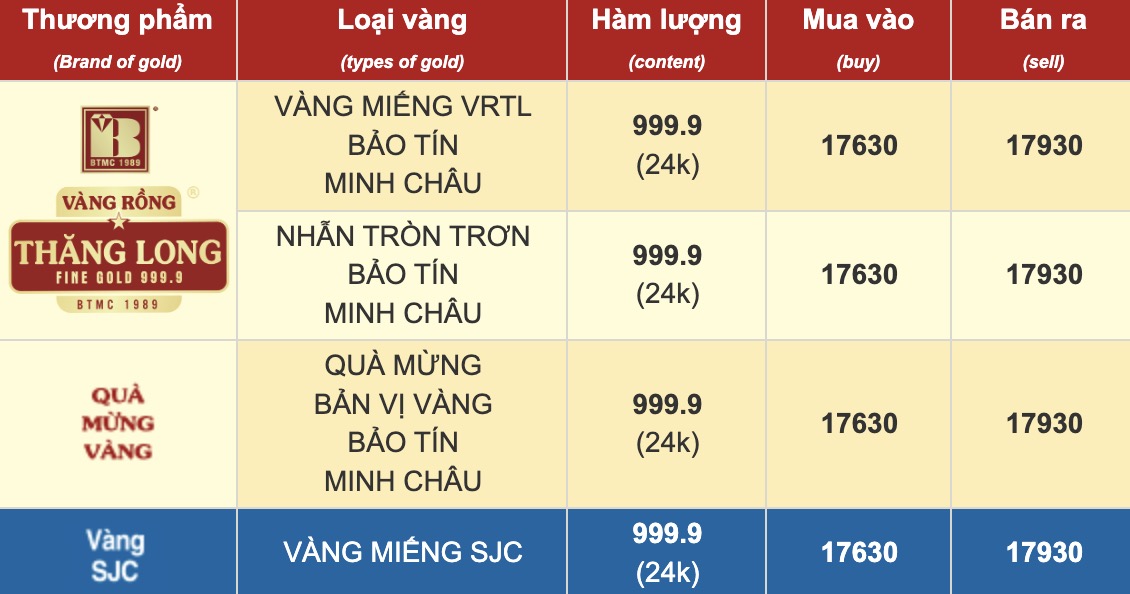

Below are price updates on the websites of some business units:

See more news related to gold prices HERE...