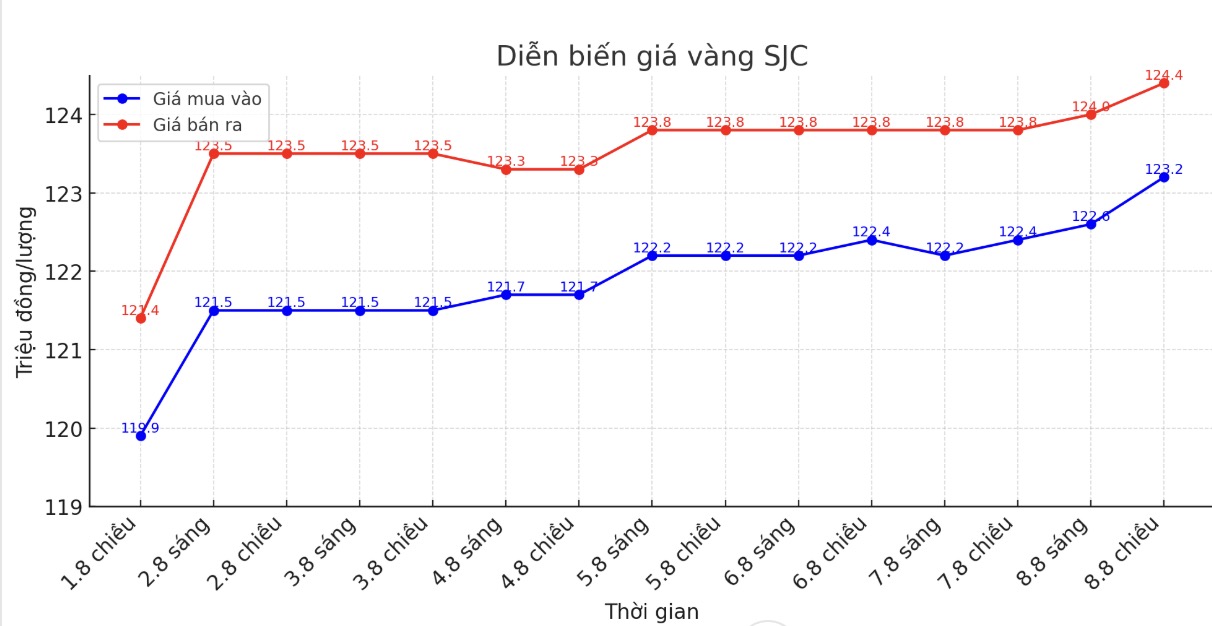

SJC gold bar price

As of 6:40 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND123.2-124.4 million/tael (buy - sell), an increase of VND800,000/tael for buying and VND600,000/tael for selling. The difference between buying and selling prices is at 1.2 million VND/tael.

DOJI Group listed at 123.2-124.4 million VND/tael (buy - sell), an increase of 800,000 VND/tael for buying and an increase of 600,000 VND/tael for selling. The difference between buying and selling prices is at 1.2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 122.6-124 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling prices is at 1.4 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 122.2-124.4 million VND/tael (buy - sell), a sharp increase of 1 million VND/tael for buying and an increase of 600,000 VND/tael for selling. The difference between buying and selling prices is at 2.2 million VND/tael.

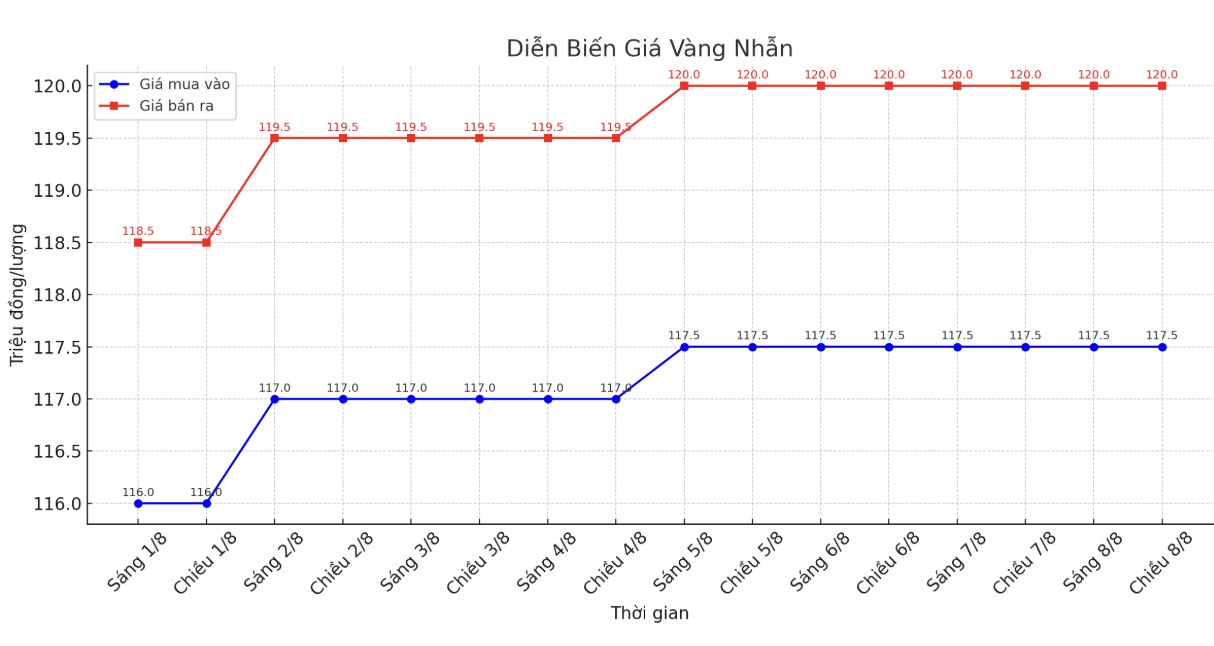

9999 gold ring price

As of 6:40 p.m., DOJI Group listed the price of gold rings at 117.5-120 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117.8-120.8 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 117-120 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

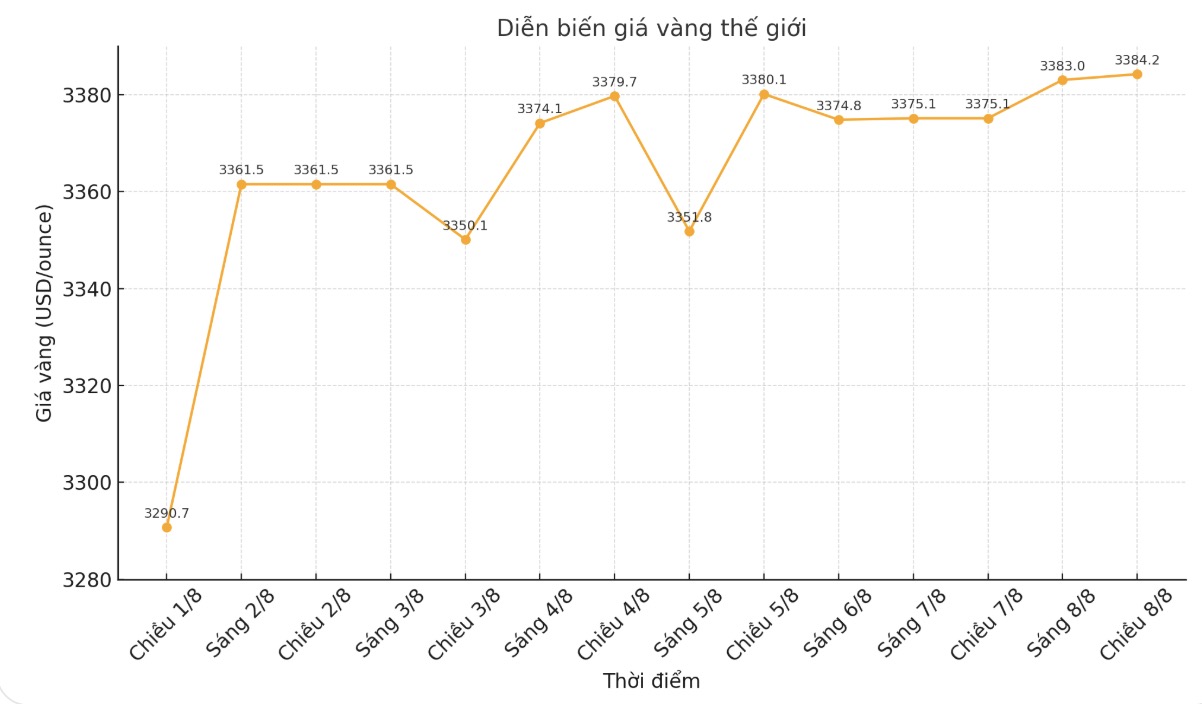

World gold price

The world gold price was listed at 6:40 p.m. at 3,384.2 USD/ounce, up 9.1 USD.

Gold price forecast

US gold futures rose to a record high on Friday after reports of a US import tax on 1 kg gold bars, while spot gold prices are still heading for a second consecutive week of increase thanks to fluctuations in tax policy and expectations of a US rate cut.

The price gap between New York futures and spot prices has widened to more than $100 after the Financial Times reported on Thursday that the US has imposed import tariffs on 1 kg gold bars, citing a letter from the US Customs and Border Protection Agency.

The letter dated July 31 said that 1-kg and 100-ounce gold bars would be classified under a higher customs code a move that could affect Switzerland, the worlds largest gold refining center.

This change will not be valid for two weeks or a month, so you cannot immediately ship more goods. However, if you deposit today, the price will be the Swiss - London gold price plus the additional tax rate, which is a new price in the US. This has led to a simple increase in the difference between US gold prices and London prices due to higher costs, said UBS commodity analyst Giovanni Staunovo.

US President Donald Trump's higher import tax rates on imports from dozens of countries took effect on Thursday, forcing major trading partners such as Switzerland, Brazil and India to rush to seek better deals.

Gold is often considered a safe haven asset in times of political and financial instability.

The unfavorable US jobs data released last week has reinforced expectations that the Federal Reserve will cut interest rates, with CME Group's FedWatch tool showing a 91% chance of the Fed cutting 25 basis points next month.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...