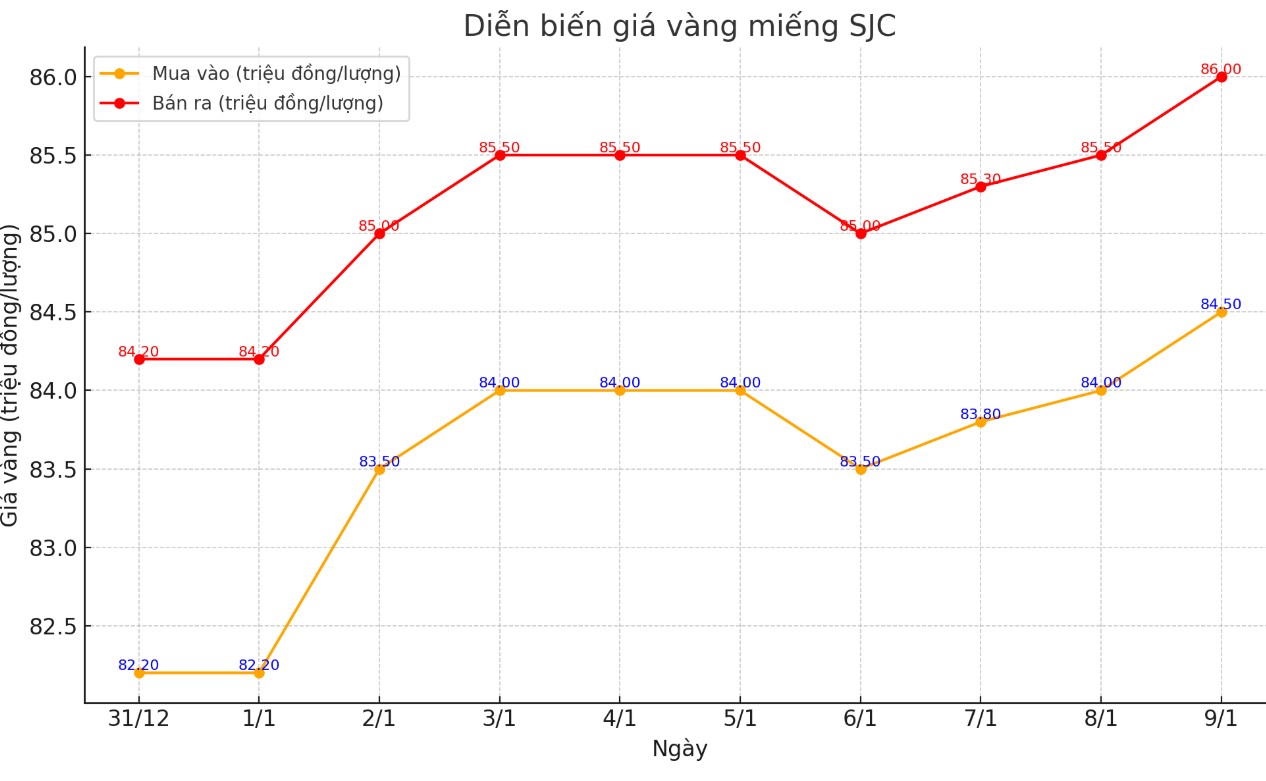

Update SJC gold price

As of 5:30 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND84.5-86 million/tael (buy - sell); an increase of VND500,000/tael in both directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 84.5-86 million VND/tael (buy - sell); an increase of 500,000 VND/tael in both directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 84.7-86 million VND/tael (buy - sell); increased 500,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.3 million VND/tael.

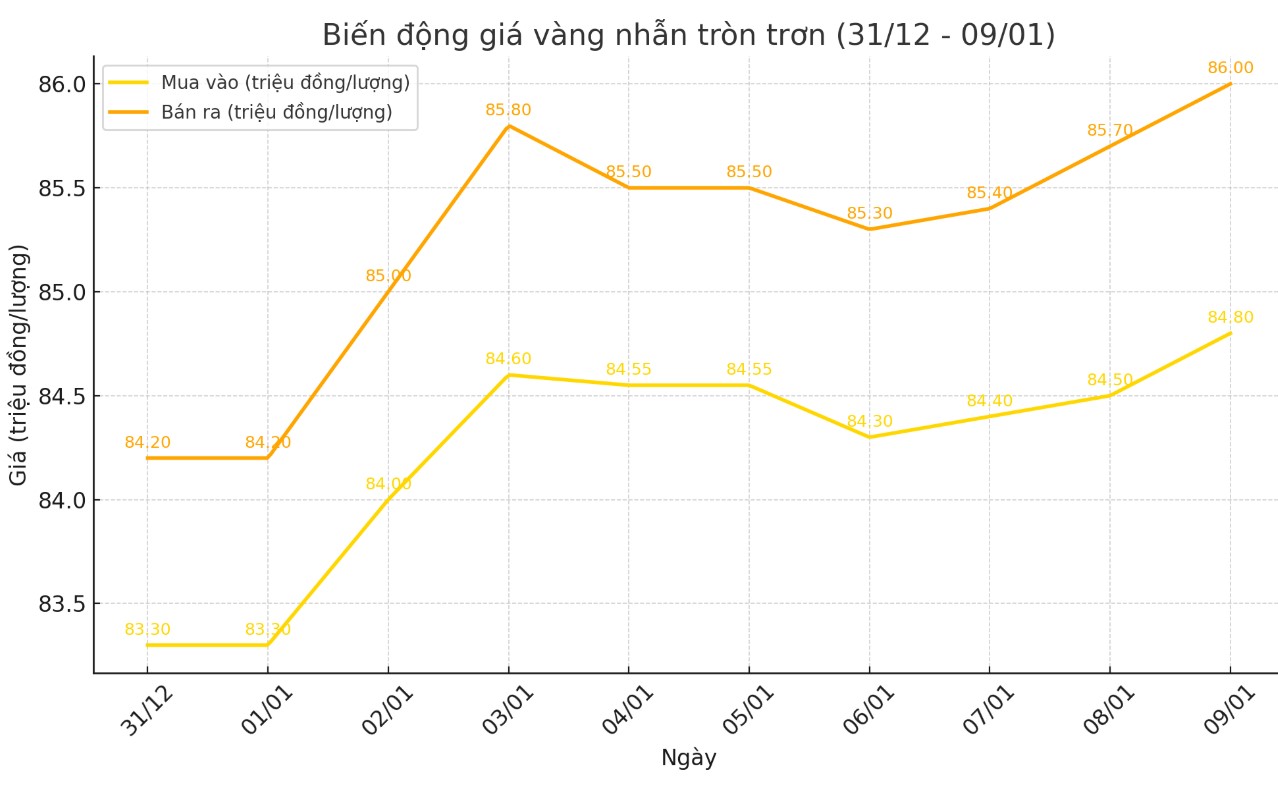

Price of round gold ring 9999

As of 5:30 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 84.8-86 million VND/tael (buy - sell); an increase of 300,000 VND/tael for both buying and selling compared to the closing price of yesterday afternoon's trading session.

Bao Tin Minh Chau listed the price of gold rings at 84.9-86.2 million VND/tael (buy - sell), an increase of 200,000 VND/tael for buying and an increase of 300,000 VND/tael for selling compared to the closing price of yesterday afternoon's trading session.

World gold price

As of 5:30 p.m., the world gold price listed on Kitco was at 2,666.4 USD/ounce, up 15.8 USD/ounce compared to the same time of the previous session.

Gold Price Forecast

World gold prices increased despite the sharp increase in the USD index. Recorded at 5:30 p.m. on January 9, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 108.980 points (up 0.05%).

Gold prices hit a nearly four-week high in recent trading, helped by a weaker-than-expected US private sector jobs report that raised expectations that the US Federal Reserve (FED) could be less cautious in adjusting interest rates this year.

According to Kitco - the gold market continued to hold firm even as the Fed took a tougher stance due to persistent inflation pressures, according to the minutes of the December monetary policy meeting.

After its last meeting of 2024, the Federal Reserve cut interest rates by another 25 basis points but said it expected only two cuts in 2025; in September, the Fed forecast four rate hikes. Although inflationary pressures have eased over the past year, the minutes showed the central bank’s committee remains concerned about prices.

Policymakers have stressed that recent higher-than-expected inflation readings, coupled with potential changes in trade and immigration policies, could lengthen the monetary policy adjustment cycle beyond previous forecasts.

In this context, gold is still seen as an effective tool to hedge against inflation, although high interest rates tend to reduce the attractiveness of this non-yielding asset.

HSBC forecasts that gold prices may maintain their upward momentum in the short term and the first months of 2025. However, the simultaneous impact of factors in the financial and physical markets may slow down the upward momentum, even pushing gold prices down slightly by the end of the year.

The market is now paying attention to the US employment report, scheduled to be released on January 10, to clarify the FED's policy in the coming time.

Mr. Ajay Kedia - Director of Kedia Commodities Company in Mumbai - commented that gold prices are in a narrow range and need a new stimulus to overcome the resistance level.

Investors are also waiting for Donald Trump to officially take office as US President on January 20. His proposed protectionist and tariff policies are likely to increase inflationary pressures.

See more news related to gold prices HERE...