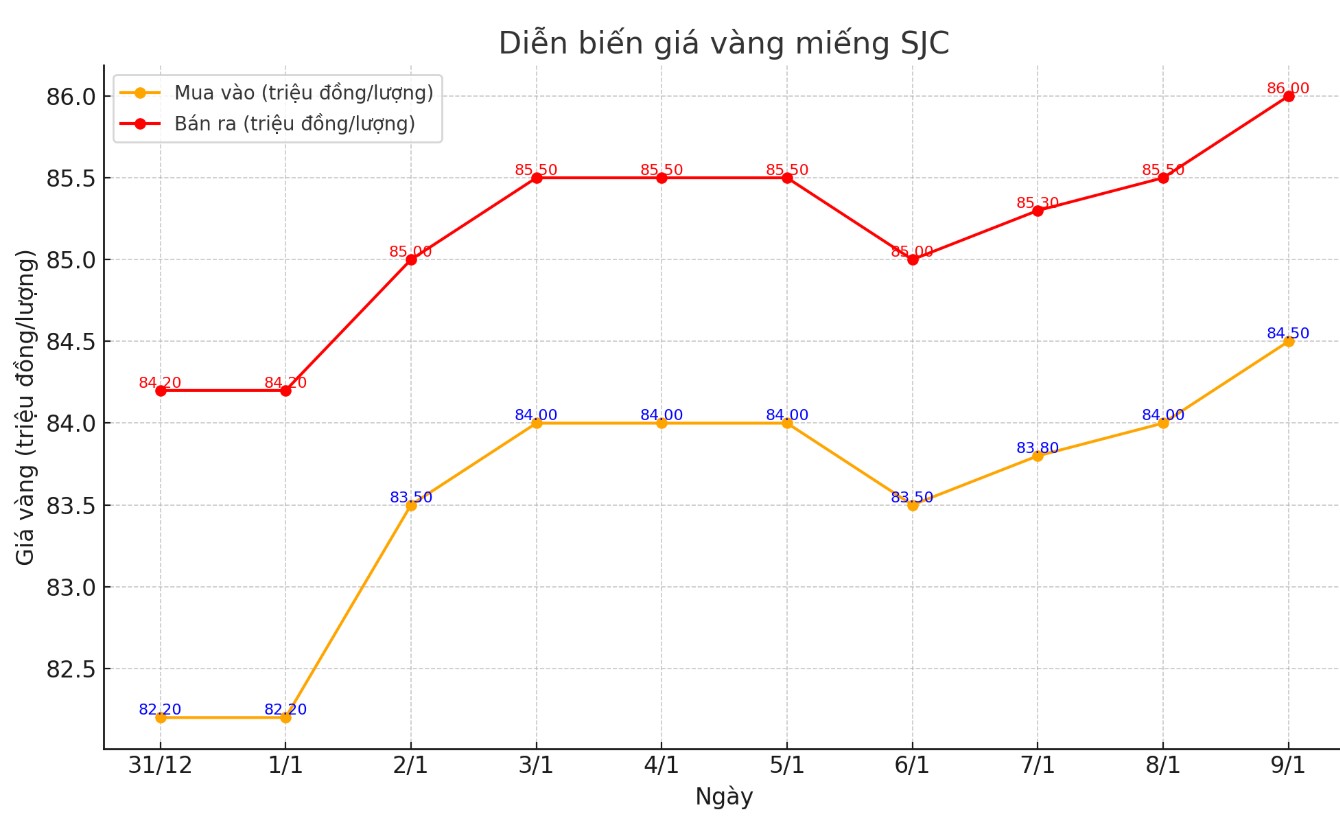

Update SJC gold price

As of 10:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND84.5-86 million/tael (buy - sell); an increase of VND500,000/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

Meanwhile, the price of SJC gold bars listed by DOJI Group is at 84.5-86 million VND/tael (buy - sell); an increase of 500,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 84.7-86 million VND/tael (buy - sell); increased 500,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.3 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say this difference is still very high. The difference between buying and selling prices is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make a profit, especially in the short term.

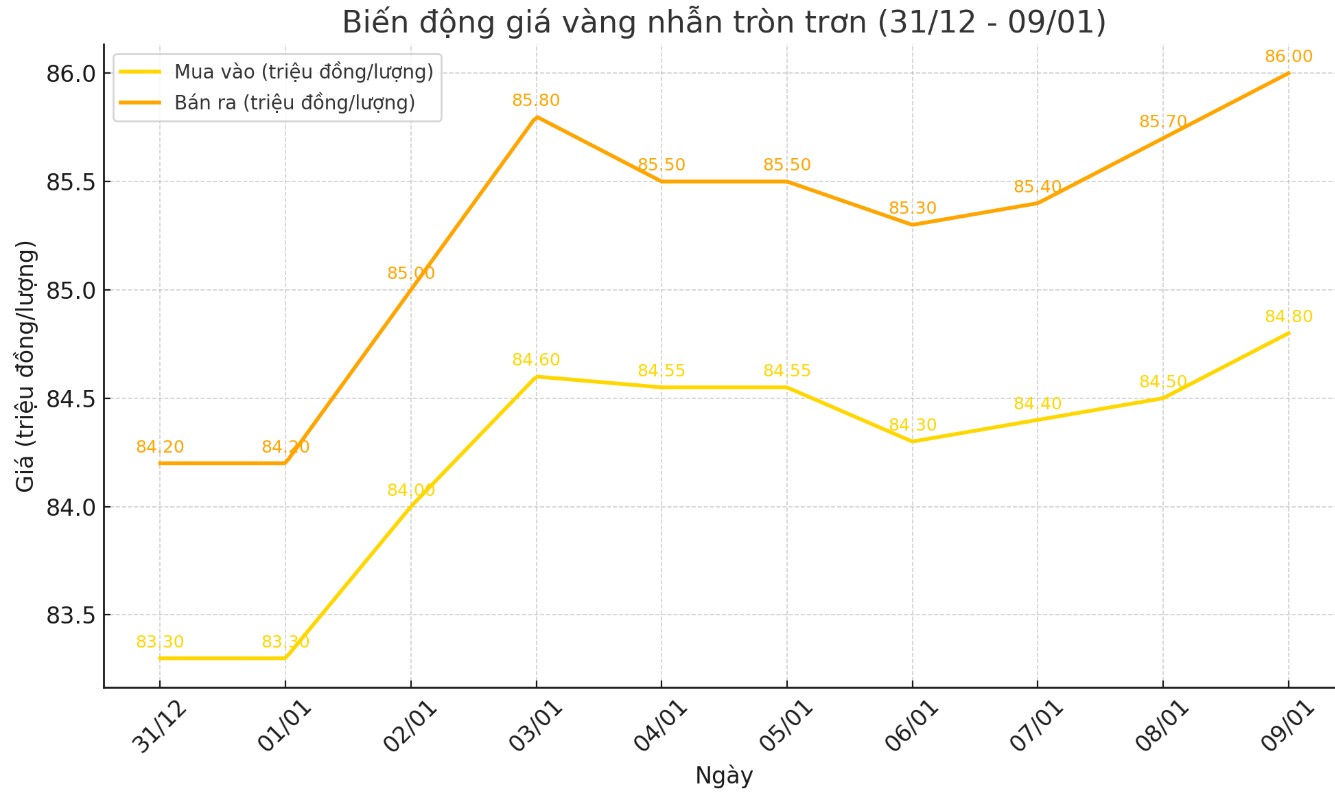

Price of round gold ring 9999

As of 10:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 84.8-86 million VND/tael (buy - sell); an increase of 100,000 VND/tael for buying and an increase of 300,000 VND/tael for selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 84.7-85.9 million VND/tael (buy - sell), an increase of 300,000 VND/tael for buying and 400,000 VND/tael for selling compared to early this morning.

World gold price

As of 10:00 a.m., the world gold price listed on Kitco was at 2,658 USD/ounce, up 9.9 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices increased amid a decline in the US dollar. Recorded at 10:00 a.m. on January 9, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 108,830 points.

Gold prices rose sharply, hitting a nearly four-week high as the US labor market slowed. This followed a report of lower-than-expected private sector growth in December, according to payroll processor ADP.

ADP reported on Wednesday that just 122,000 jobs were created last month, below expectations as consensus forecasts had expected a gain of 139,000 jobs.

“The labor economy slowed to a more modest pace of growth in the final month of 2024, with both hiring and wage growth slowing. The health care sector stood out in the second half of the year, adding more jobs than any other sector,” said Nela Richardson, chief economist at ADP.

Bart Melek, head of commodity strategy at TD Securities, said the weak jobs numbers are boosting gold prices, as they reflect a weaker-than-expected US economy.

However, Melek stressed that the more important data will be the non-farm payrolls report, due out on Friday. Economists are expecting a gain of 163,000 jobs, but if the actual figure far exceeds expectations, gold prices could face downward pressure.

In addition, the market is closely watching the minutes of the Fed's last policy meeting in 2024. Independent metals trader Tai Wong said that the minutes are unlikely to have a significant impact on gold's trend, given the current uncertainty over the new administration's policies, along with signals that the Fed has shifted to a more dovish easing phase.

Investors are also weighing the possibility that Donald Trump’s proposed tariffs could spur inflation, limiting the Fed’s room to cut interest rates, putting pressure on gold prices. However, Fed Governor Christopher Waller said inflation is expected to continue to decline in 2025, allowing the central bank to continue cutting interest rates, although the pace may not be as expected.

The precious metal is also getting a boost from central bank buying. The People’s Bank of China added 300,000 ounces to its gold reserves in December, bringing its total to 73.3 million ounces, indicating that China has resumed buying after a six-month pause last year.

See more news related to gold prices HERE...