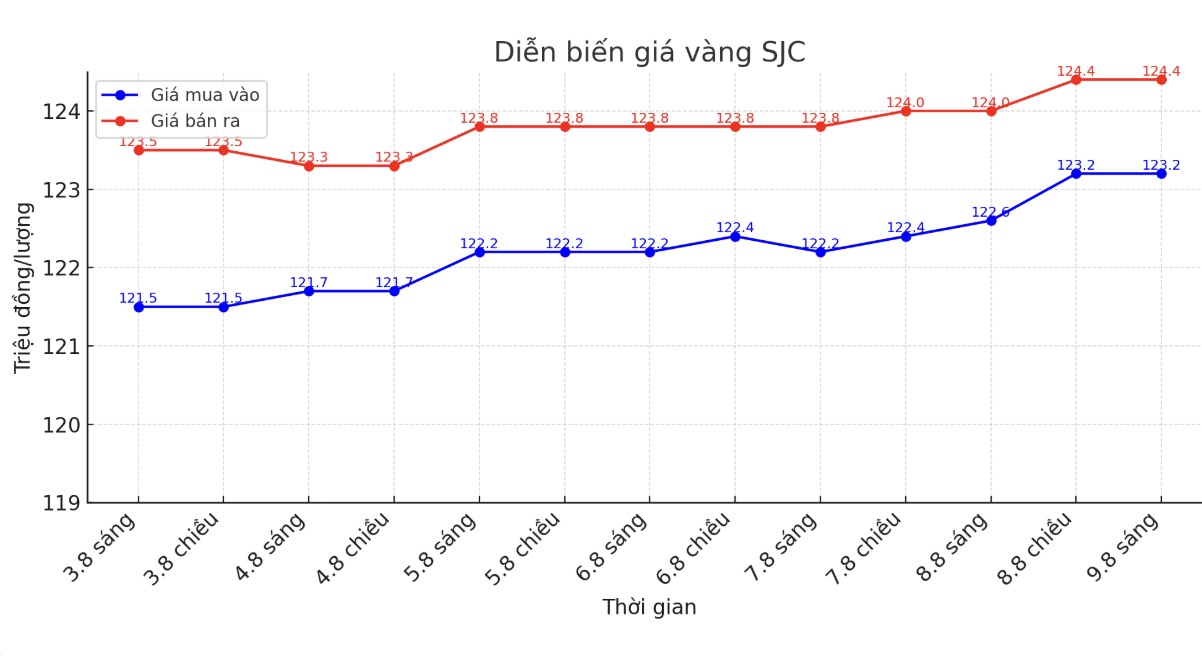

Updated SJC gold price

As of 9:30 a.m., DOJI Group listed the price of SJC gold bars at VND123.2-124.4 million/tael (buy - sell), an increase of VND600,000/tael for buying and VND400,000/tael for selling. The difference between buying and selling prices is at 1.2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 123.2-124.4 million VND/tael (buy - sell), an increase of 600,000 VND/tael for buying and an increase of 400,000 VND/tael for selling. The difference between buying and selling prices is at 1.2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 122.2-124.4 million VND/tael (buy - sell), an increase of 600,000 VND/tael for buying and an increase of 400,000 VND/tael for selling. The difference between buying and selling prices is at 2.2 million VND/tael.

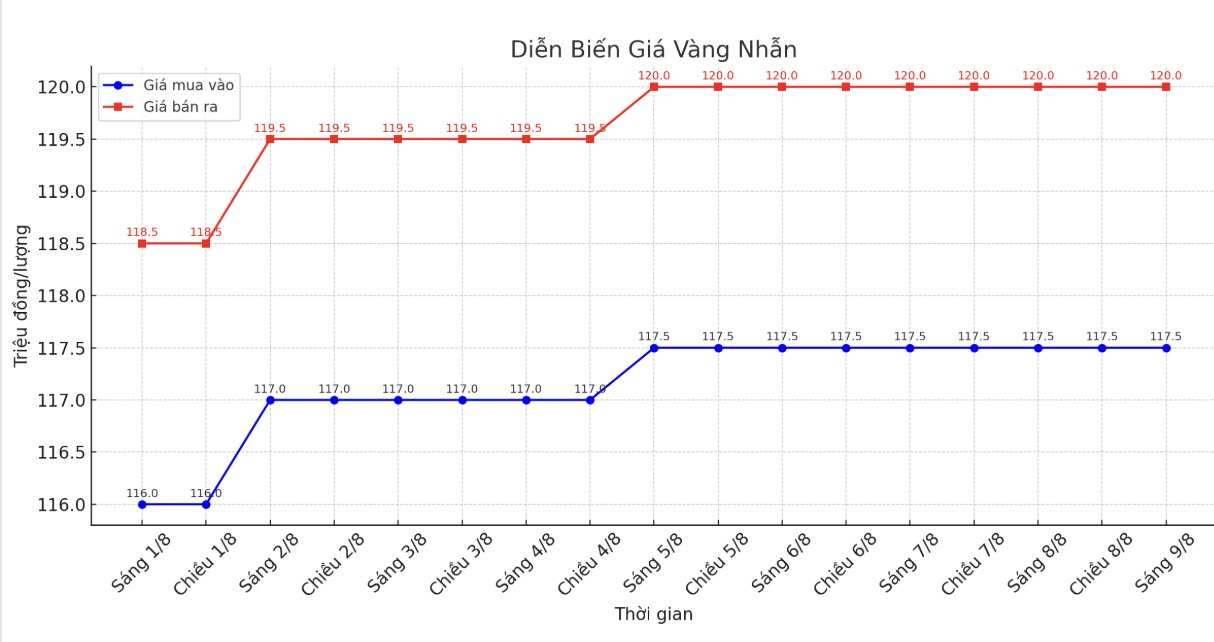

9999 round gold ring price

As of 9:30 a.m., DOJI Group listed the price of gold rings at 117.5-120 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117.8-120.8 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 117-120 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

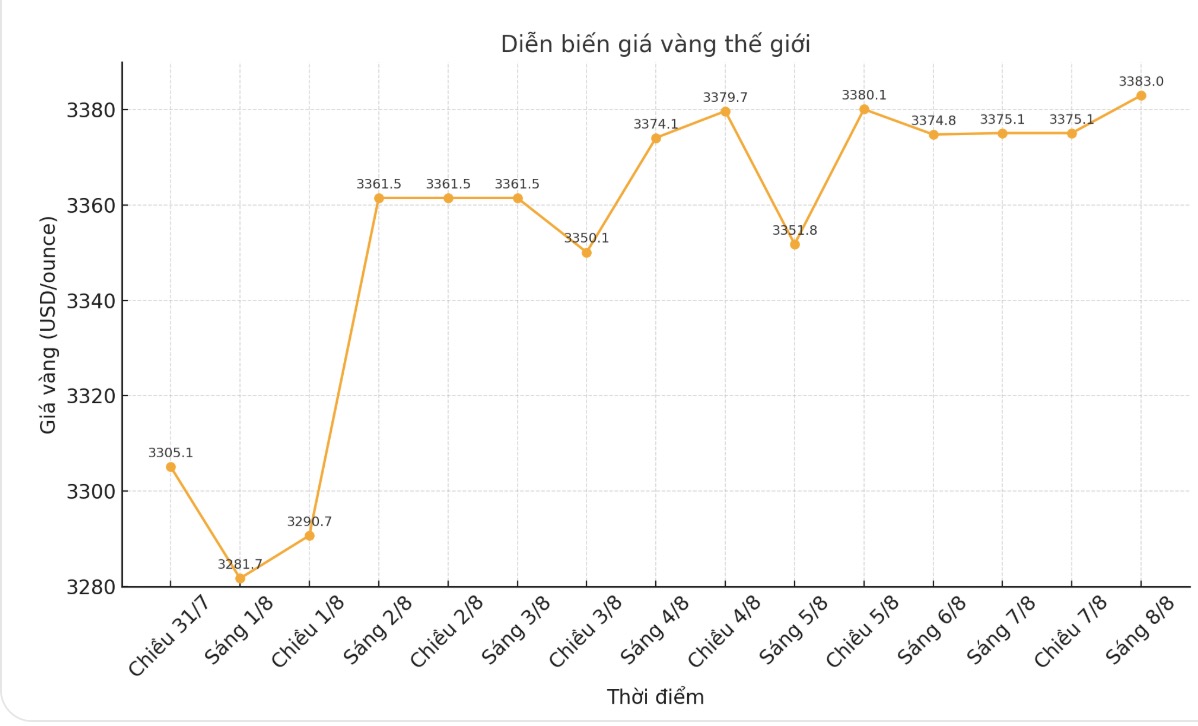

World gold price

At 9:30 a.m., the world gold price was listed around 3,397.6 USD/ounce, up 14.6 USD compared to a day ago.

Gold price forecast

Gold prices increased after the news of the US imposing import tariffs on 1kg and 100 ounce gold bars - a move that is expected to shake the global gold market and deal another heavy blow to Switzerland, the world's largest gold refining center.

According to the ruling letter dated July 31 of the US Customs and Border Protection Agency (CBP) reached by the Financial Times, the above types of gold bars will be classified as taxable customs codes, instead of codes exempted under President Donald Trump's comprehensive tax policy. The verdict is a US document used to clarify trade policy.

This decision is in complete contrast to the previous expectations of the gold industry that 1kg and 100 ounce gold bars will be classified as tax-free. Currently, 1kg gold bars are the most popular trading on the comex exchange - the world's largest gold futures market - and account for the majority of Switzerland's gold exports to the US.

Relations between Washington and Bern have deteriorated after the US imposed a 39% tariff on imports from Switzerland last week. Customs data shows that gold is one of Switzerland's largest exports to the US.

Chairman of the Swiss Association of Precious Metals Manufacturers and Traders, Mr. Christoph Wild, said the new tax was another blow to gold trade between the two countries, making it difficult to meet gold demand in the US.

Earlier this year, traders rushed to bring gold into the US ahead of released date 2.4 - Mr Trumps tax mark - leading to record inventories on comex and causing temporary shortages in London. At that time, many goods, including some types of gold bars, are exempt from tax, creating the belief that large gold bars will not be taxed.

Typically, gold trade flows are triangular: Large balls (400 ounces) move between London and New York through Switzerland, where they are cast into different sizes. The London market favours a 400-ounce bar - as big as a brick - while New York prefers a 1kg bar, the size of a smartphone.

Another important factor supporting gold prices is strong buying from central banks, especially China. In July, the People's Bank of China (PBOC) added 60,000 ounces of gold, bringing its total reserves to 73.96 million ounces. This is the 9th consecutive month that the PBOC has increased its gold purchases, aiming to diversify foreign exchange reserves and reduce dependence on the USD.

In addition, unsatisfactory US labor market data also supports the precious metal. The number of Americans filing for unemployment benefits was higher than expected, with 226,000 in the week ended August 2, compared to the forecast of 220,000 in the filing period. The labor market may be weakening, causing investors to expect the FED to soon cut interest rates to support the economy.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...