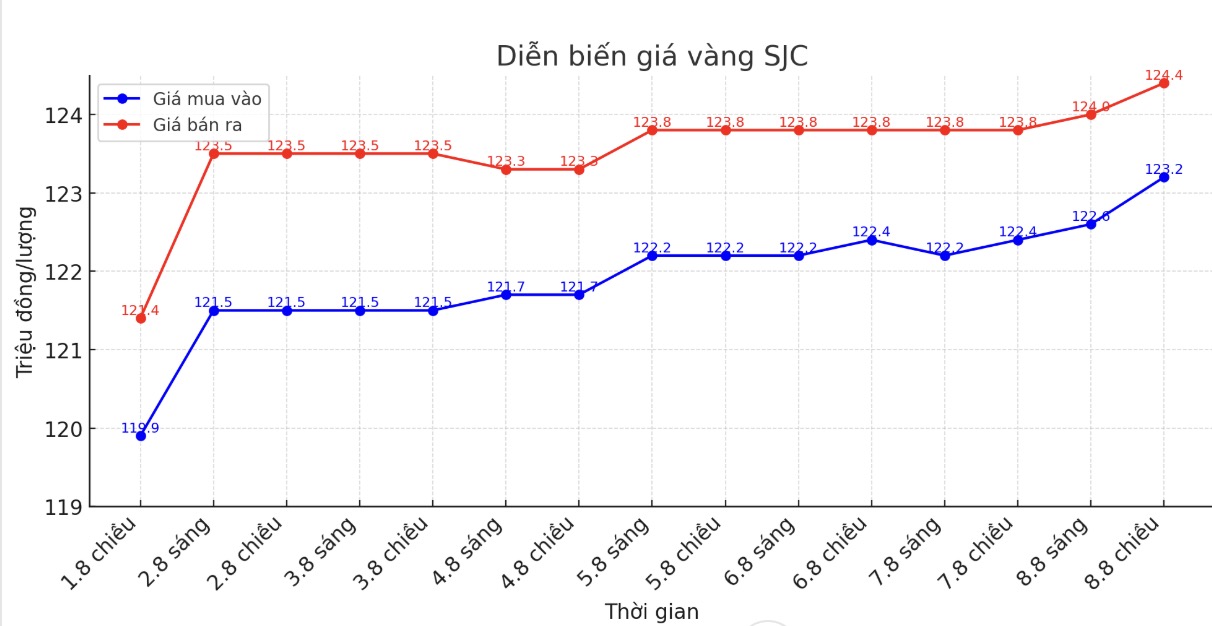

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND123.2-124.4 million/tael (buy - sell), an increase of VND800,000/tael for buying and VND600,000/tael for selling. The difference between buying and selling prices is at 1.2 million VND/tael.

DOJI Group listed at 123.2-124.4 million VND/tael (buy - sell), an increase of 800,000 VND/tael for buying and an increase of 600,000 VND/tael for selling. The difference between buying and selling prices is at 1.2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 122.6-124 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling prices is at 1.4 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 122.2-124.4 million VND/tael (buy - sell), a sharp increase of 1 million VND/tael for buying and an increase of 600,000 VND/tael for selling. The difference between buying and selling prices is at 2.2 million VND/tael.

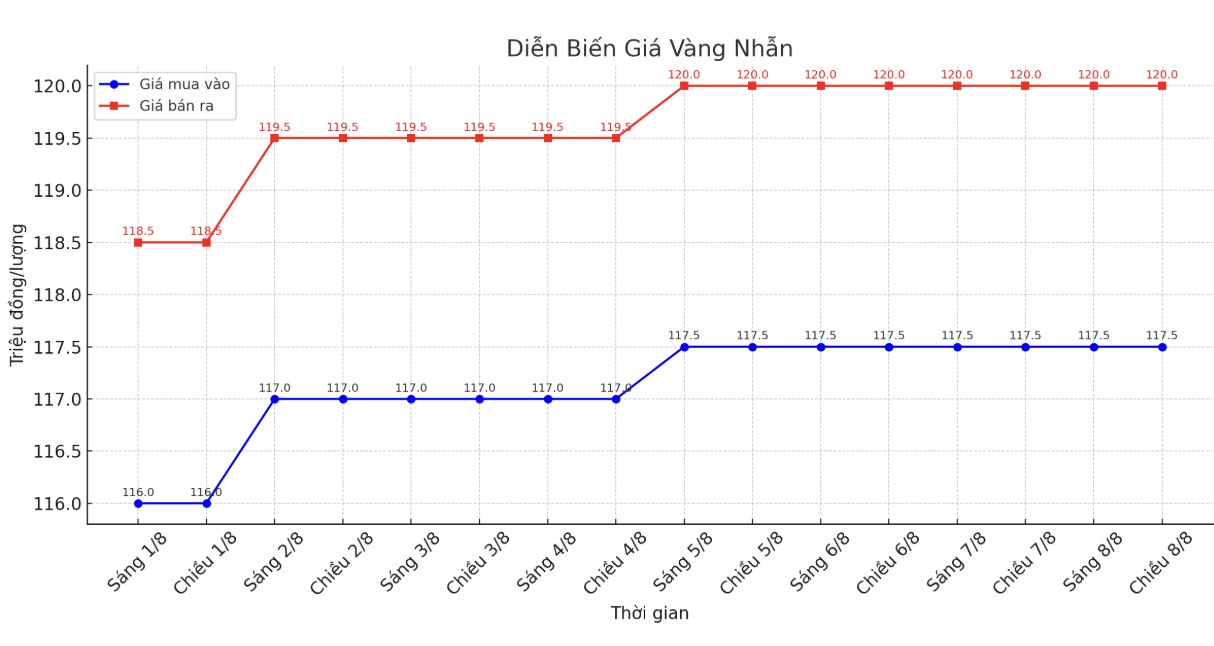

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 117.5-120 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117.8-120.8 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 117-120 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

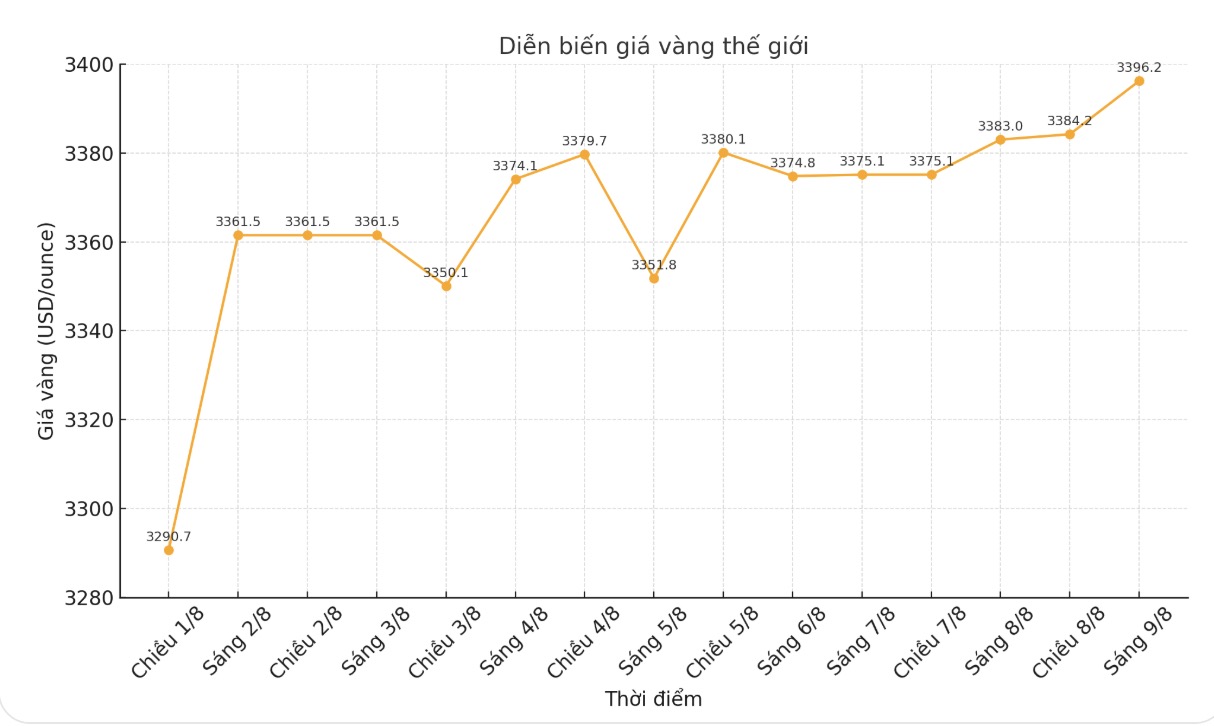

World gold price

The world gold price was listed at 0:30 at 3,396.2 USD/ounce, up 16.1 USD/ounce compared to a day ago.

Gold price forecast

Gold prices increased but were still much lower than yesterday's peak when the December gold contract reached a three-month high. December gold contract is currently up 19.3 USD to 3,473.3 USD/ounce.

The news that the US will impose import tariffs on 1 kg and 100 ounce gold bars has caused a lot of instability in the global gold market, threatening to disrupt trade from Switzerland and other major refining centers, including London and Hong Kong (China).

Traders, analysts and market observers are looking to assess the impact of this tax policy. Swiss gold exports have become a hot spot in trade negotiations with the US after a sharp increase in exports earlier this year caused the US trade deficit with Switzerland to skyrocket.

The European and Asian stock markets overnight had mixed developments. US stock indexes are expected to open slightly as the trading session in New York begins.

Technically, December gold futures still have a clear advantage for buyers in the short term. The next upside target for buyers is to close above strong resistance at $3,585.8/ounce.

In contrast, the nearest downside target for sellers is to push prices below July's low of $3,319.2/ounce.

The first resistance was seen at $3,500/ounce and then reached today's high of $3,534.1/ounce. First support was $3,450/ounce and then $3,430/ounce.

In the outside market, the US dollar index decreased slightly. Nymex crude oil prices increased, trading around 64.50 USD/barrel. The yield on the 10-year US government bond is around 4.25%.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...