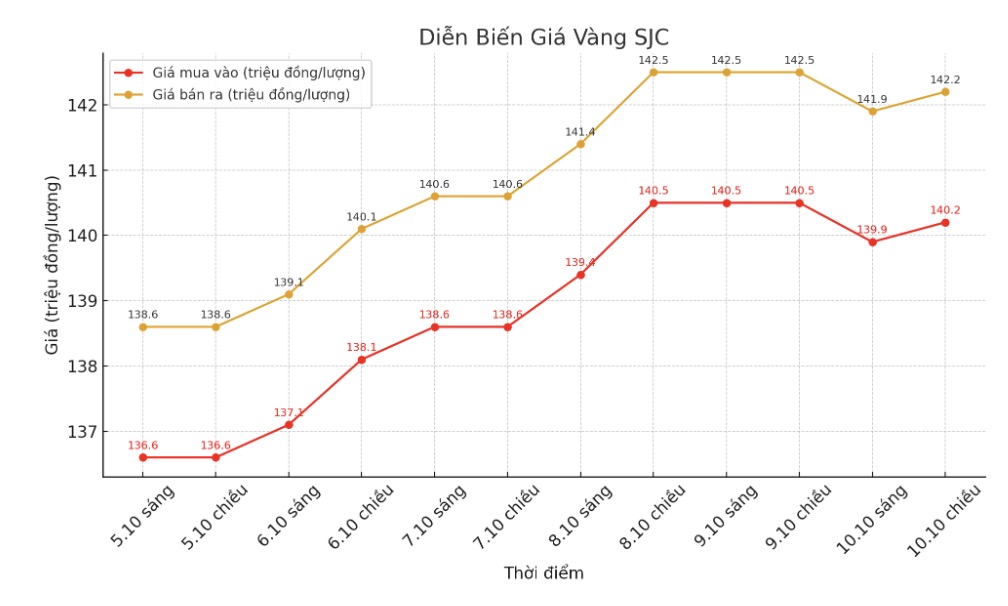

SJC gold bar price

As of 6:00 a.m. on October 11, the price of SJC gold bars was listed by DOJI Group and Bao Tin Minh Chau at VND 140.2-142.2 million/tael (buy in - sell out), down VND 300,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 139.5-142.2 million VND/tael (buy - sell), down 500,000 VND/tael for buying and down 300,000 VND/tael for selling. The difference between buying and selling prices is at 2.7 million VND/tael.

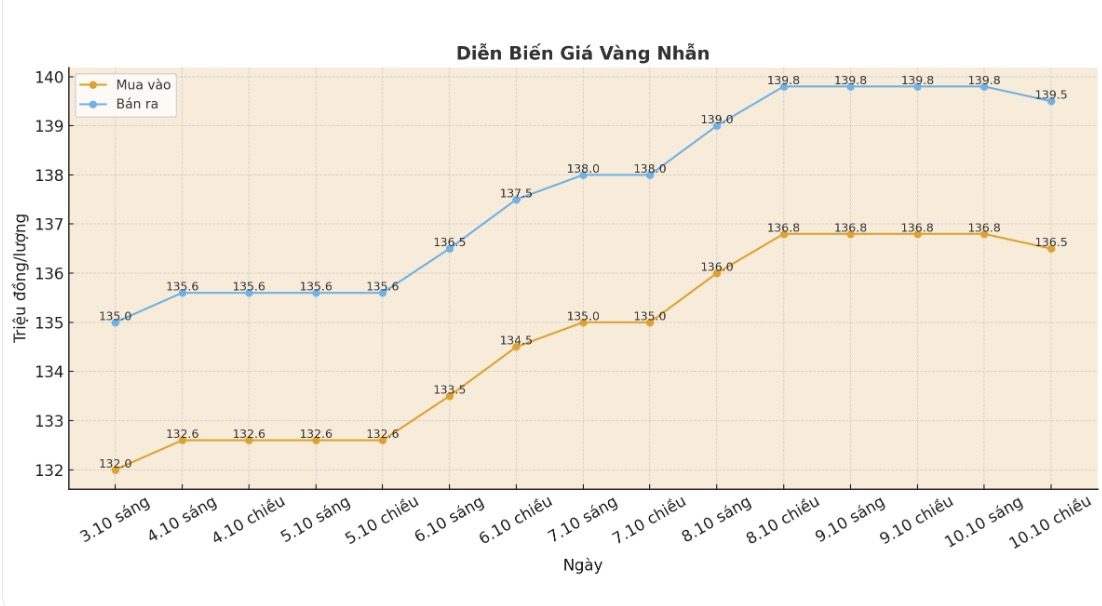

9999 gold ring price

As of 6:00 a.m. on October 11, DOJI Group listed the price of gold rings at VND 136.5-139.5 million/tael (buy in - sell out), down VND 300,000/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 138-141 million VND/tael (buy in - sell out), down 200,000 VND/tael. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 136.5-139.5 million VND/tael (buy in - sell out), down 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

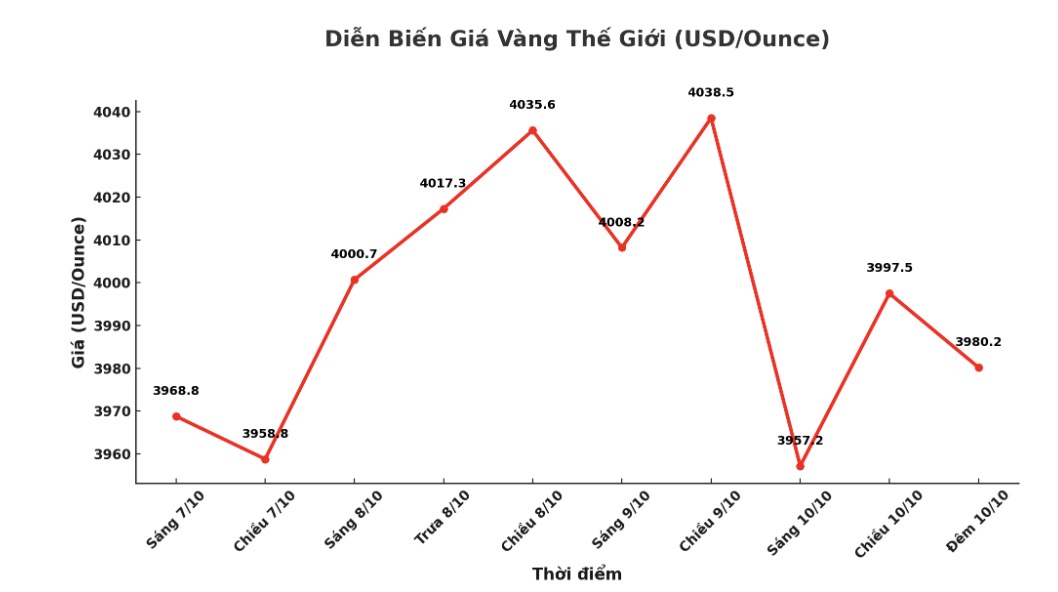

World gold price

The world gold price was listed at 11:22 on October 10 at 3,980.2 USD/ounce, up 23 USD.

Gold price forecast

The gold market increased slightly before the weekend holiday after the latest data showed that US consumer sentiment remained stable, while short-term inflation expectations increased again.

According to the University of Michigan, the preliminary consumer confidence index for October reached 55 points - higher than experts' forecast of 54.2 points, but still slightly lower than the 55.1 point in September.

Consulent confidence has been almost unchanged this month, said Joanne Hsu, director of the survey. At 55 points, consumer sentiment is almost unchanged from September.

Gold prices moved slightly higher immediately after the data was released.

In a separate report, the World Gold Council (WGC) warned of overly strong investment demand - the main factor pushing gold prices to a historical peak - causing the market to fall into a state of "overbought". Despite the rising risk of an adjustment, the organization still believes that fundamental factors will continue to support gold prices until the end of the year.

The WGC added that the US dollar is also currently overbought, but the fluctuations in the stock market in October - which was the time when many fluctuations could help gold maintain its position.

Our analysis shows that gold is still likely to stand firm, and could even be further supported if stocks correct, as a series of other positive factors are still present. Perhaps just a major liquidity tighten can pull both gold and stocks down, but there is currently no clear sign of a crack in the credit or banking system, the WGC said.

Technically, December gold futures continue to maintain a strong near-term technical advantage. The next target for buyers is to close above the strong resistance level of 4,100 USD/ounce. Meanwhile, the sellers aim to pull the price below the solid support zone of 3,850 USD/ounce.

The first resistance zone was determined to have an all-night high of $4,020.50 an ounce, followed by a record peak of $4,081/ounce. The closest support zone is Thursday's bottom at $3,957.9/ounce, followed by $3,900/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...