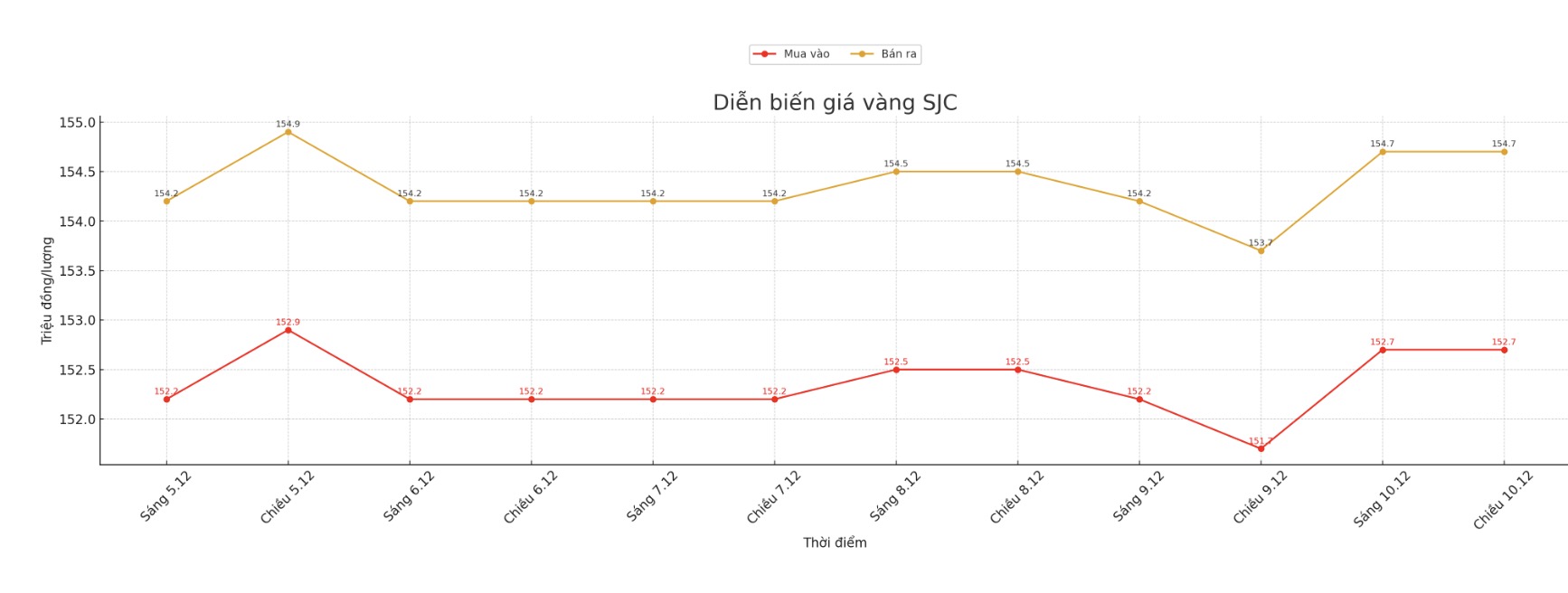

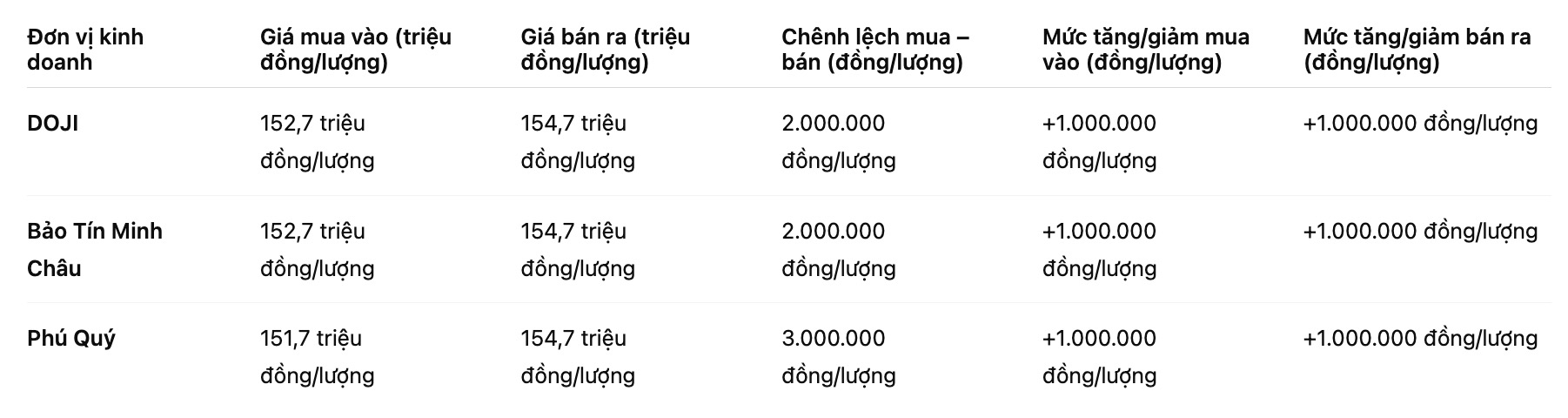

SJC gold bar price

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at VND152.7-154.7 million/tael (buy in - sell out), an increase of VND1 million/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 152.7-154.7 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 151.7-154.7 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

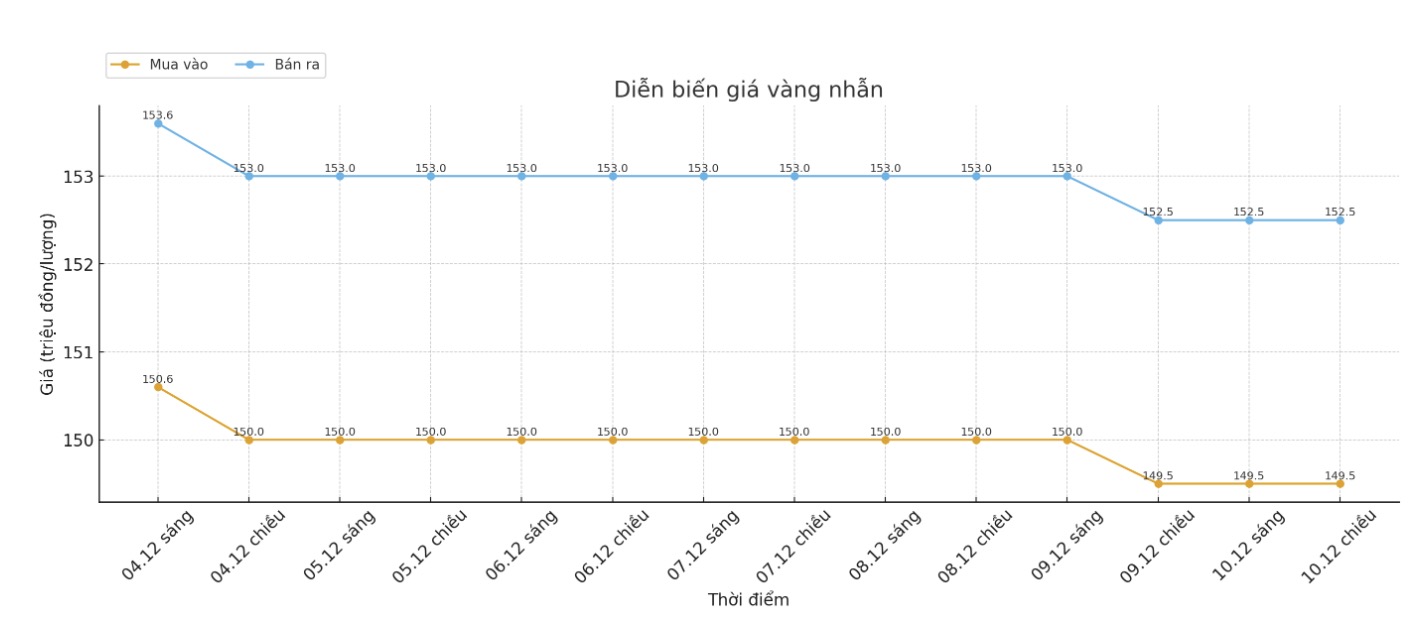

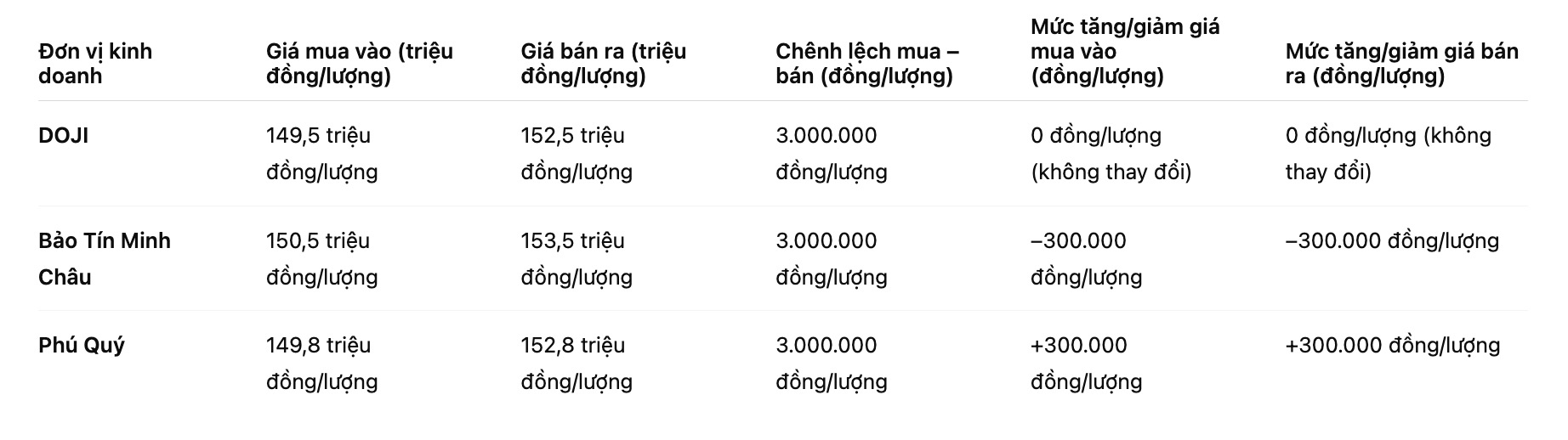

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 149.5-152.5 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 150.5-153.5 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 149.8-152.8 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

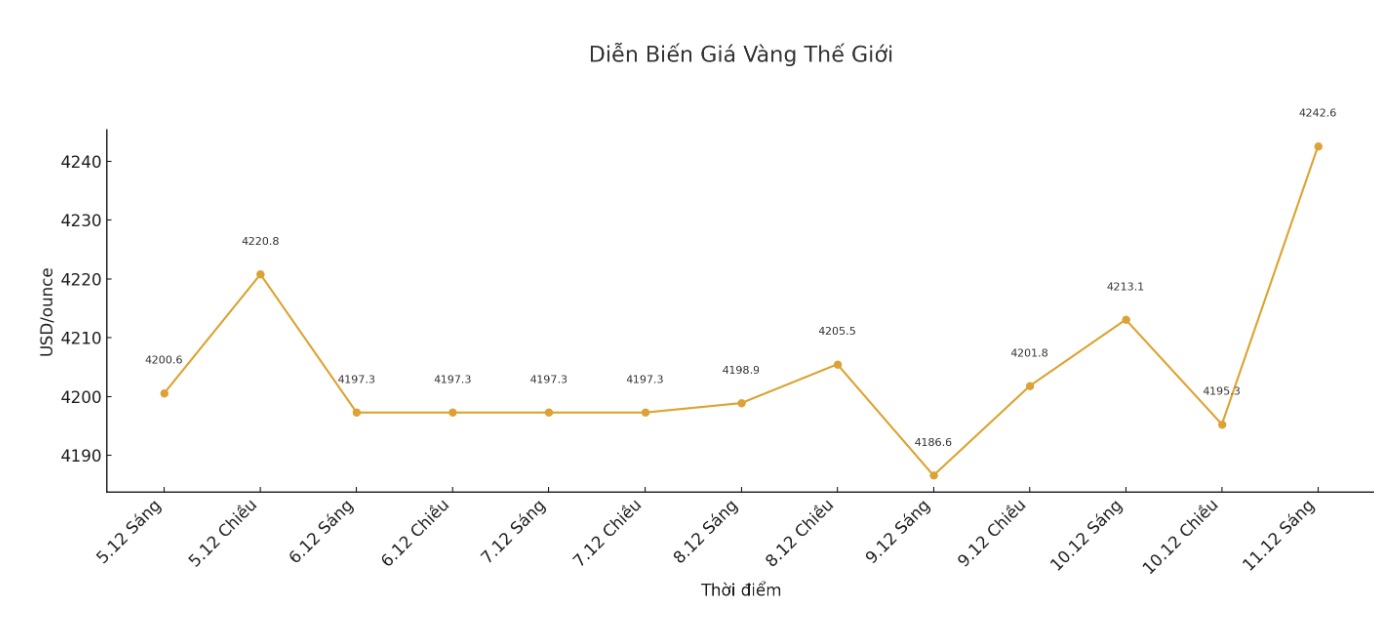

World gold price

The world gold price was listed at 7:20 a.m., at 4,242.6 USD/ounce, down 40.5 USD compared to a day ago.

Gold price forecast

Gold prices skyrocketed, right after the decision to cut interest rates was as expected by the Federal Reserve (Fed). Silver prices have largely risen but have left the previous record set for the day.

The Federal Open Market Committee (FOMC) meeting has just ended recording the Fed cutting the key interest rate range by 0.25 percentage points, down to 3.503.75%, as expected.

The FOMC statement said inflation will remain persistent and there is no chance of a new rate cut in the near term. Now, traders are paying attention to the press conference of Fed Chairman Jerome Powell.

Signs of monetary policy orientation in the coming time from the FOMC statement and from the Fed Chairman will be closely monitored by the market today.

In outside markets, the USD index decreased. Crude oil prices edged up and traded around $58.5/barrel. The yield on the 10-year US Treasury note is currently at 4.166%.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...