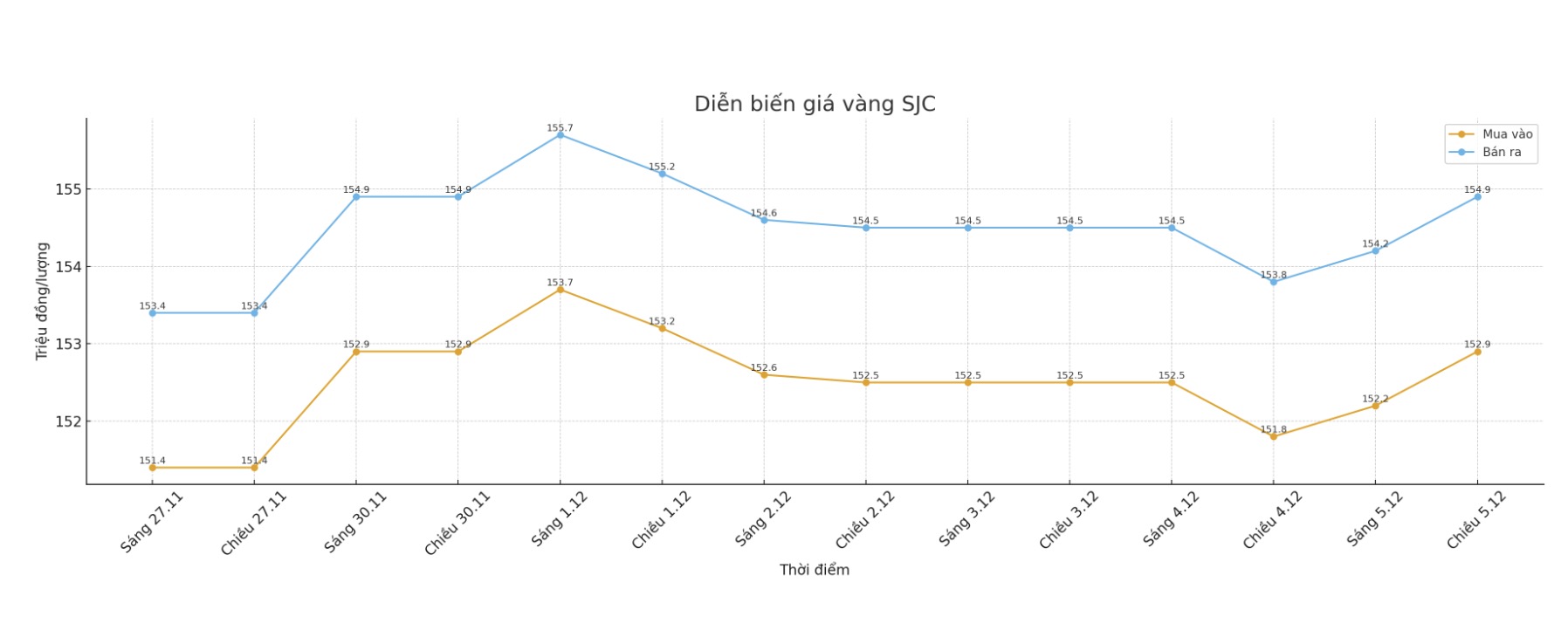

SJC gold bar price

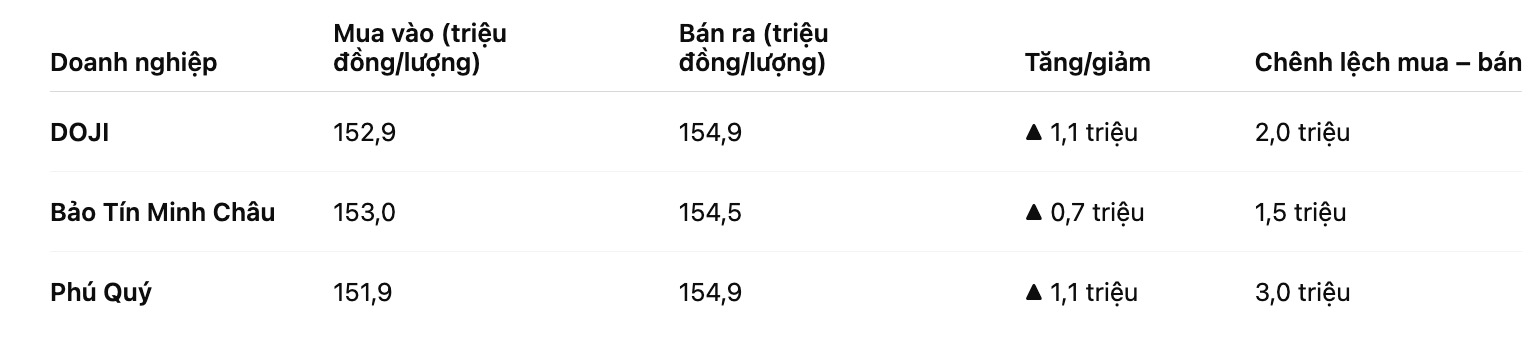

As of 6:00 p.m., DOJI Group listed the price of SJC gold bars at 152.9-154.9 million VND/tael (buy - sell), an increase of 1.1 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 153- 154.5 million VND/tael (buy - sell), an increase of 700,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 151.9-154.9 million VND/tael (buy - sell), an increase of 1.1 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

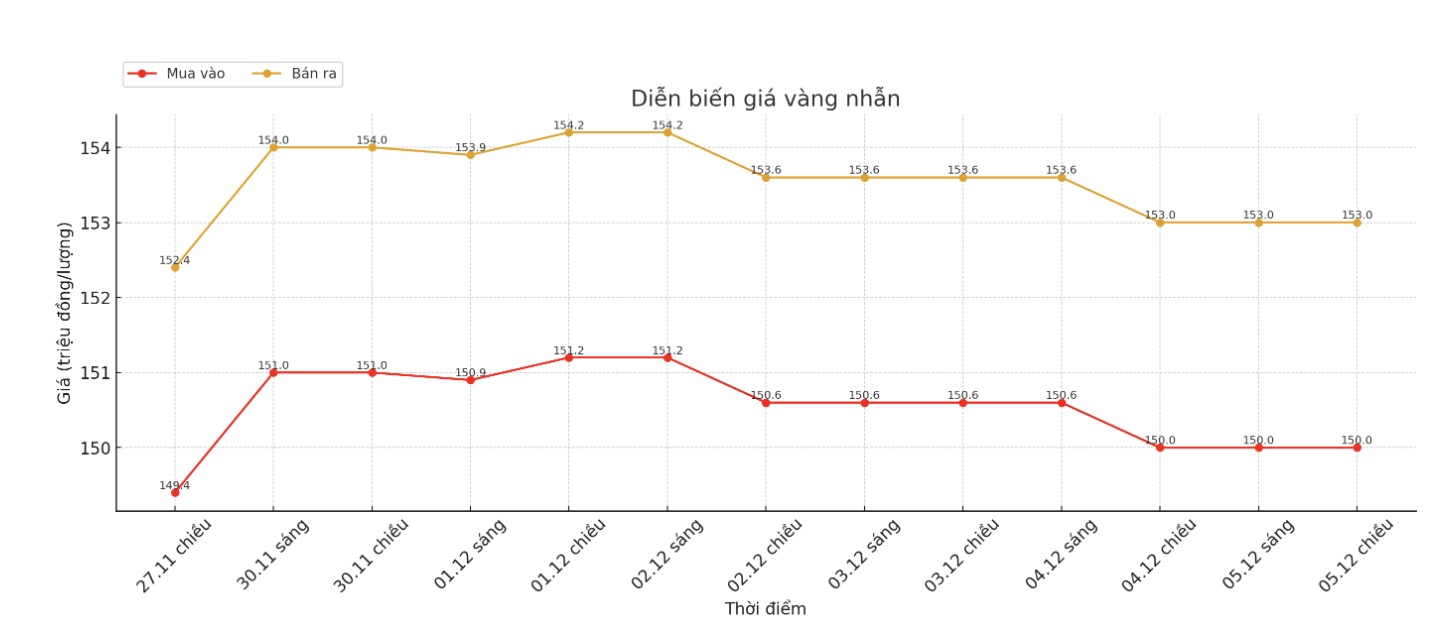

9999 gold ring price

As of 6:05 p.m., DOJI Group listed the price of gold rings at 150-153 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 151-154 million VND/tael (buy - sell), an increase of 700,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 150.3-153.3 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

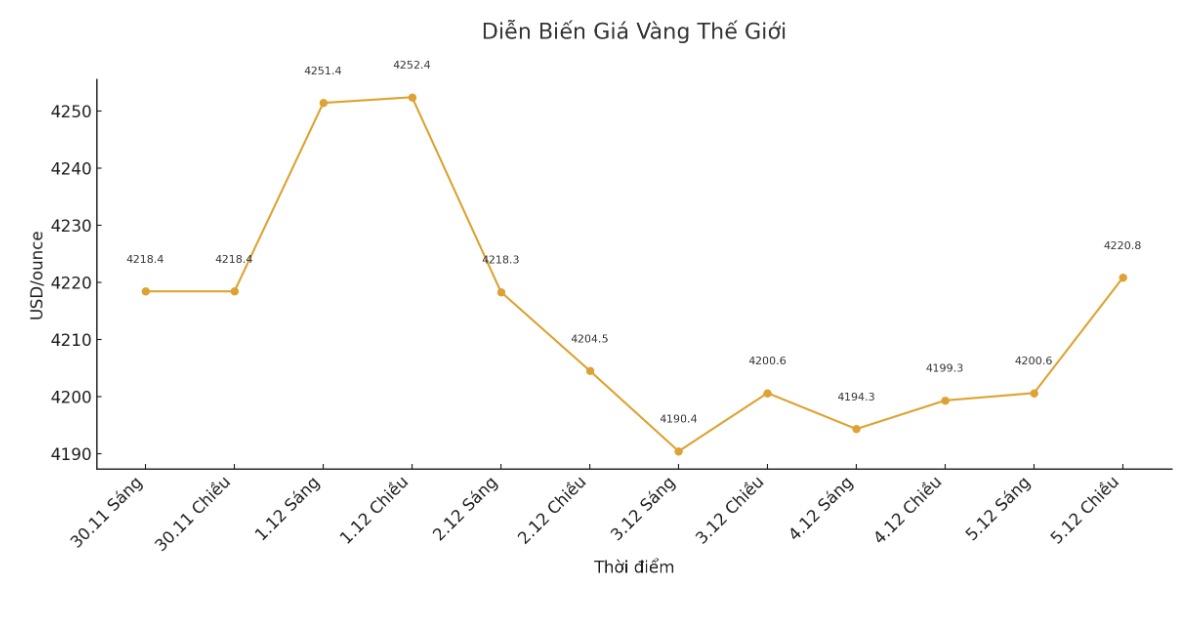

World gold price

The world gold price was listed at 6:00 p.m., at 4,220.8 USD/ounce, up 21.5 USD compared to a day ago.

Gold price forecast

Investors are waiting for the interest rate move from the US Federal Reserve (Fed) and US inflation data.

The yield on the 10-year US Treasury note has increased, while the USD index hit a one-month low, making gold more attractive to foreign investors.

According to a survey of more than 100 Reuters economists, the majority predict the Fed will cut interest rates by 0.25 percentage points at the meeting on December 9-10, to support the cooling labor market.

Mr. Edward Meir - an analyst at Marex - commented: "Increased yields are limiting gold's upward momentum, while a weaker USD is a supporting factor in the opposite direction".

The market will likely be quite quiet until the Fed meets next week. With gold, prices are likely to move sideways within a narrow range and are unlikely to return to a peak of nearly $4,400/ounce this year," Mr. Edward commented.

In the long term, TD Securities said it does not see the possibility of gold prices collapsing next year, but on the contrary, this precious metal will set new records.

The US Federal Reserve (Fed) cutting holdings costs, bond yields expected to plummet, and concerns surrounding the Feds independence make us believe that gold will set a quarterly price record of $4,400/ounce in the first 6 months of 2026.

Concerns that the Fed may no longer be determined to pursue the 2% inflation target in the future, along with the possibility of the White House putting pressure on interest rates in the context of record-high US public debt, are key factors strengthening the upward trend of gold, analysts said.

TD Securities believes that these factors will continue to promote the process of USD devaluation, de-dollarization and de- globilization, thereby supporting strong gold buying power from central banks. At the same time, investors are gradually leaving the traditional portfolio model of 60% stocks - 40% bonds, moving to allocate up to 25% to commodities, along with low interest rates, will continue to increase demand for gold.

See more news related to gold prices HERE...