SJC gold bar price

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 160-162 million VND/tael (buying - selling), an increase of 2.2 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 160-162 million VND/tael (buying - selling), an increase of 2.2 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at the threshold of 159.5-162 million VND/tael (buying - selling), an increase of 2.2 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2.5 million VND/tael.

9999 gold ring price

As of 6:00 AM, DOJI Group listed the price of plain gold rings at 156-159 million VND/tael (buying - selling), an increase of 1.5 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 158-161 million VND/tael (buying - selling), an increase of 1.5 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 157-160 million VND/tael (buying - selling), an increase of 2 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

The high buying - selling gap increases the risk for individual investors. Individual investors, especially those with a "surfing" mentality, need to consider carefully before spending money.

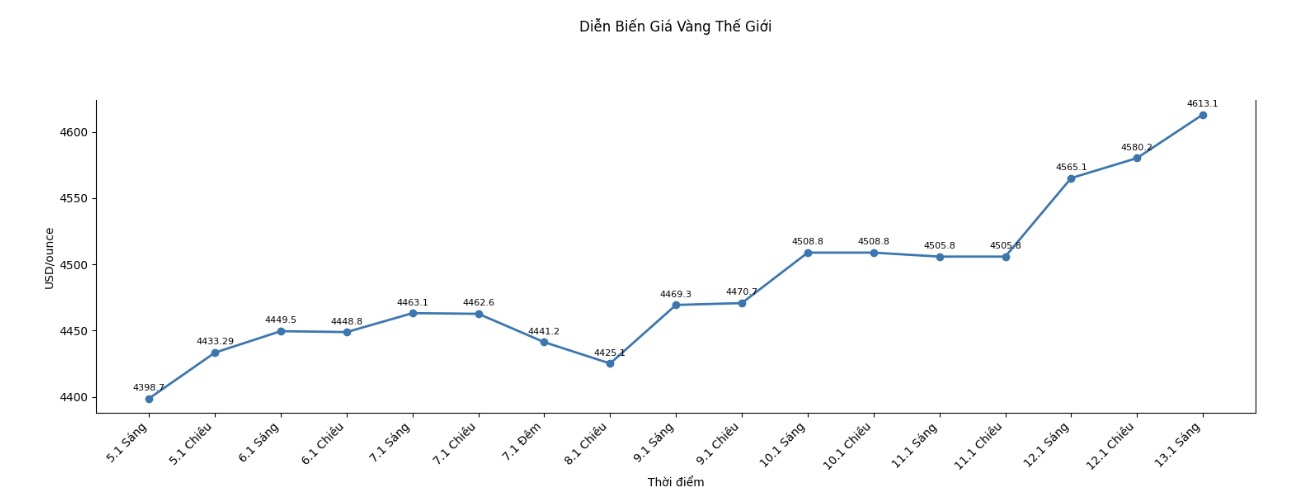

World gold price

World gold prices listed at 0:45 am were at 4,613.1 USD/ounce, up sharply by 104.3 USD/ounce.

Gold price forecast

According to Kitco, gold and silver prices rose very strongly near noon, as both precious metals set new record highs. Risk-avoidance sentiment in the global market is rising right from the beginning of the trading week, amid tense developments related to the US Federal Reserve (Fed) and the social unrest in Iran. These factors are driving cash flow to safe assets such as gold and silver.

The defensive sentiment of investors has increased after information emerged that the US Department of Justice has sent documents requesting documents to the Federal Reserve, related to the hearing of Fed Chairman Jerome Powell last summer about the agency's workplace renovation project.

According to AP news agency, this is seen as a rare escalation in tensions between President Donald Trump's administration and the Fed.

The situation in Iran continues to be tense as civil protests still take place on a large scale. The Iranian Foreign Minister said security forces are controlling the situation, and accused external forces of contributing to instability.

These complex geopolitical developments have contributed to increasing the demand for shelter in gold and precious metals.

Technically, the upward trend of gold is still clearly dominant. Buyers on the February gold futures market are aiming to conquer the strong resistance zone at 4,750 USD/ounce. In the opposite direction, sellers will need to push prices down below the important support level of 4,400 USD/ounce to weaken the current upward momentum.

In the short term, the first resistance level for gold prices was determined at a record high of 4,640.50 USD/ounce, followed by the 4,675 USD/ounce zone. On the support side, the nearest level is 4,584 USD/ounce, followed by the bottom in today's session at 4,520.8 USD/ounce.

The Wyckoff index is currently at 9.5 points, reflecting overwhelming buying power and the upward trend of the gold market is still very strong.

On the international financial market, the USD index is weakening. Crude oil prices are almost sideways around 59.25 USD/barrel. The yield of US 10-year government bonds is currently at about 4.183%.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...