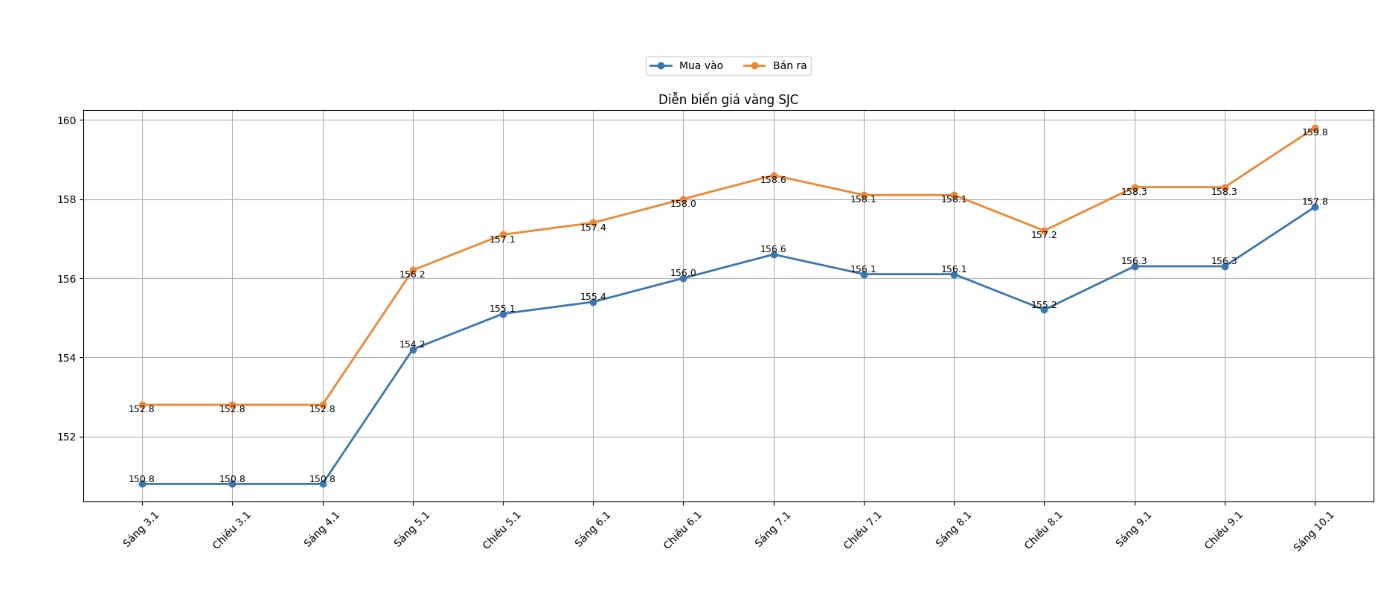

SJC gold bar price

As of 8:20 PM, SJC gold bar prices were listed by DOJI Group at the threshold of 157.8-159.8 million VND/tael (buying - selling), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 157.8-159.8 million VND/tael (buying - selling), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of SJC gold bars at 157.3-159.8 million VND/tael (buying - selling), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

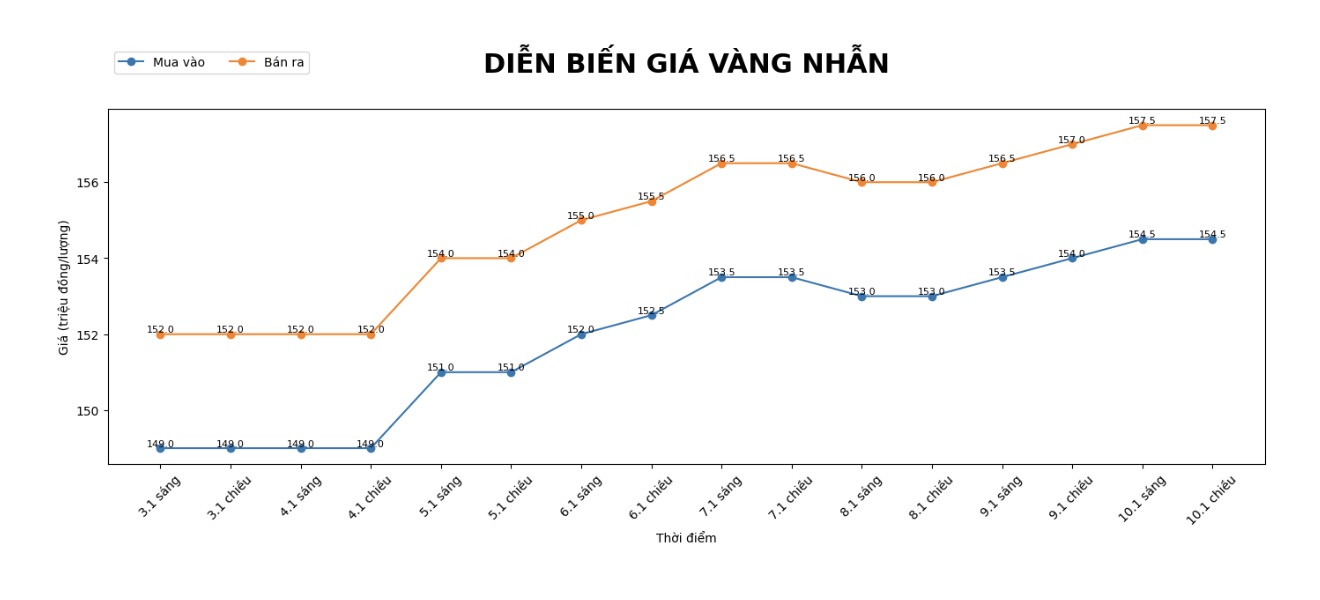

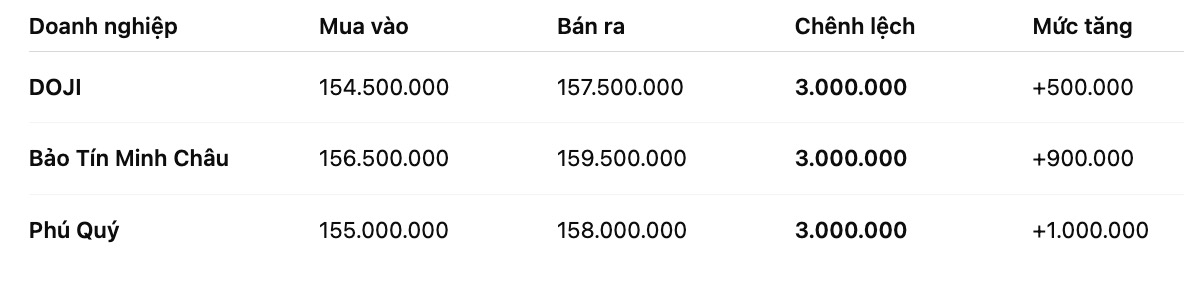

9999 gold ring price

As of 8:20 PM, DOJI Group listed the price of plain gold rings at 154.5-157.5 million VND/tael (buying - selling), an increase of 500,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 156.5-159.5 million VND/tael (buying - selling), an increase of 900,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 155-158 million VND/tael (buying - selling), an increase of 1 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

The high buying - selling gap increases the risk for individual investors. Individual investors, especially those with a "surfing" mentality, need to consider carefully before spending money.

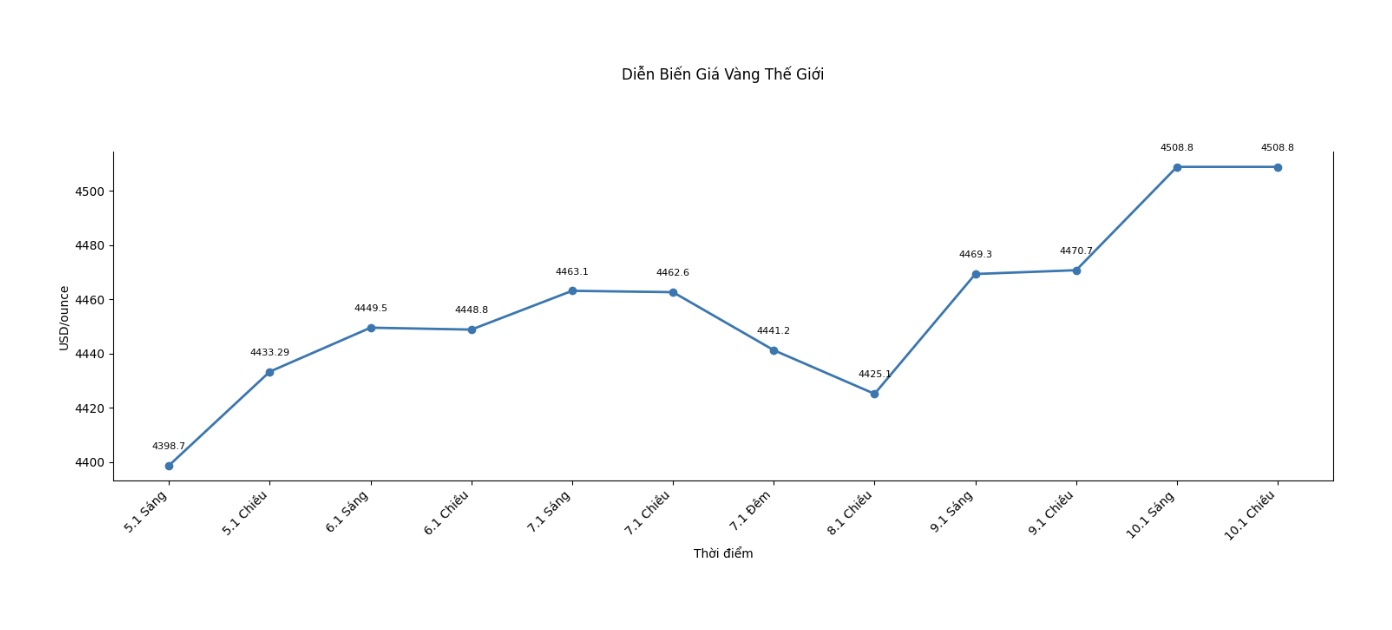

World gold price

World gold price listed at 8:20 PM at 4,508.8 USD/ounce, up 38.1 USD compared to the previous day.

Gold price forecast

Although market fluctuations are still high, both gold and silver prices started the new year quite positively, ending the week in important resistance zones.

Strong price increase momentum pushed gold prices above 4,500 USD/ounce, up nearly 4% compared to the end of last week, while silver approached the 80 USD/ounce mark and is likely to end the week with an increase of nearly 10%.

The recovery momentum of silver is particularly impressive in the context of increasing short-term correction risks in the market. This precious metal has rebounded after a sharp decline last week, when CME Group raised deposit requirements to cool down speculative activities.

Meanwhile, both gold and silver will be very sensitive to the rebalancing of annual commodity indices.

Indices such as the Bloomberg Commodity Index (BCOM) and S&P GSCI hold baskets of commodities including oil, copper, wheat, as well as gold and silver. The proportion of each commodity in the basket is determined based on factors such as liquidity and global production scale.

Currently, gold accounts for about 14% in BCOM and 3-4% in S&P GSCI; silver accounts for about 9% in BCOM and 1.5% in GSCI.

Last year, gold prices increased by more than 60%, while silver prices increased by nearly 150%, causing their proportion in indices to increase and currently funds are forced to sell off to rebalance.

According to some estimates, commodity indices will have to sell about 5 billion USD of gold and silver in this adjustment.

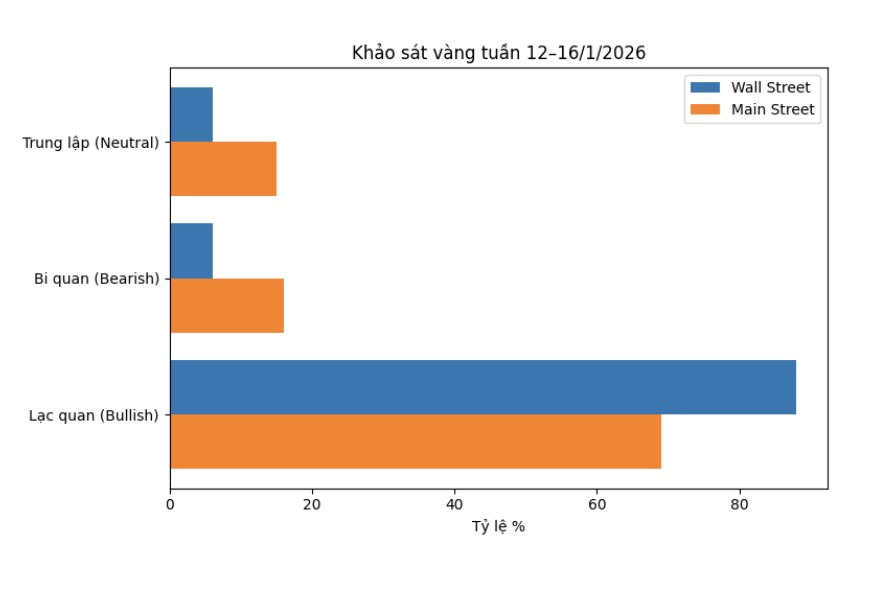

The latest weekly gold survey with Wall Street experts shows that Wall Street has almost reached absolute consensus on the prospect of gold price increases in the short term, while individual investors also maintain a majority of optimistic views.

This week, 16 experts participated in Kitco News' gold survey, in which Wall Street experts expressed an overwhelming view that gold prices will continue to rise in the near future. 14 people, equivalent to 88%, predicted gold prices would rise next week.

Only one expert, accounting for 6%, believes that prices will fall, while another predicts gold will remain unchanged next week.

Meanwhile, an online survey with individual investors recorded a total of 268 votes, with optimistic sentiment continuing to maintain at a high level.

There are 184 investors, equivalent to 69%, expecting gold prices to rise next week, while 44 people, accounting for 16%, predict this precious metal will weaken. The remaining 40 people, accounting for 15% of the total, believe that gold prices will accumulate and remain unchanged next week.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...